Regarding the legitimacy of Tradelink forex brokers, it provides FCA and WikiBit, (also has a graphic survey regarding security).

Is Tradelink safe?

Pros

Cons

Is Tradelink markets regulated?

The regulatory license is the strongest proof.

FCA Forex Execution License (STP)

Financial Conduct Authority

Financial Conduct Authority

Current Status:

Clone FirmLicense Type:

Forex Execution License (STP)

Licensed Entity:

RESI CAPITAL MANAGEMENT LIMITED

Effective Date:

2012-01-31Email Address of Licensed Institution:

g.lambert@greshamhouse.comSharing Status:

No SharingWebsite of Licensed Institution:

https://greshamhouse.com/real-assets/uk-housing/residential-secure-income-plc/Expiration Time:

2024-07-23Address of Licensed Institution:

5th Floor 80 Cheapside London EC2V 6EEE C 2 V 6 E E UNITED KINGDOMPhone Number of Licensed Institution:

4402073820910Licensed Institution Certified Documents:

Is TradeLink Safe or a Scam?

Introduction

TradeLink is a forex broker that has gained attention in the trading community, particularly for its claims of providing competitive trading conditions and a diverse range of financial instruments. As the forex market continues to attract both novice and experienced traders, it becomes increasingly important for individuals to carefully assess the legitimacy and safety of trading platforms. This is particularly crucial given the prevalence of scams in the online trading space, where unregulated brokers can pose significant risks to investors. In this article, we will conduct a thorough investigation into TradeLink's regulatory status, company background, trading conditions, customer experiences, and overall safety. Our assessment will be based on data gathered from various reputable sources, providing a balanced view of whether TradeLink is a safe trading option or a potential scam.

Regulation and Legitimacy

The regulatory status of a broker is one of the most critical factors in determining its legitimacy and safety. A regulated broker is subject to oversight by financial authorities, which helps ensure that they adhere to strict standards designed to protect traders. Unfortunately, TradeLink has been flagged as an unregulated platform, raising significant concerns about its operations.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Financial Conduct Authority (FCA) | N/A | United Kingdom | Unregulated |

The absence of a valid license from a reputable regulatory body such as the FCA is alarming. The FCA has issued warnings about TradeLink, categorizing it as a potential scam. This lack of oversight means that clients may have limited recourse in the event of disputes or issues related to fund withdrawals. The regulatory quality is vital, as it not only ensures compliance with financial standards but also fosters trust among investors. Given TradeLink's unregulated status, potential clients should exercise extreme caution and consider the risks involved before proceeding with trading activities.

Company Background Investigation

Understanding a broker's history and ownership structure can provide valuable insights into its reliability. TradeLink claims to have been operational since 1979, but there is limited verifiable information about its development and ownership. The company's management team lacks transparency, with little information available regarding their professional backgrounds and relevant experience in the financial sector.

The absence of detailed disclosures raises concerns about the company's transparency and accountability. Legitimate brokers typically provide comprehensive information about their management teams and operational history, which helps build trust with clients. In contrast, TradeLink's vague information makes it difficult for potential investors to assess the company's credibility. As a result, this lack of transparency is a significant red flag that could indicate underlying issues with the broker.

Trading Conditions Analysis

When evaluating a broker, it is essential to analyze their trading conditions, including fees and commissions. TradeLink advertises competitive trading conditions, but potential traders must scrutinize the fee structure to ensure there are no hidden charges or unfavorable policies.

| Fee Type | TradeLink | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | N/A | 1-2 pips |

| Commission Structure | N/A | Varies by broker |

| Overnight Interest Range | N/A | Varies by broker |

While specific figures for TradeLink's fees are not readily available, the lack of transparency in this area is concerning. Unusual or excessive fees can significantly impact a trader's profitability, and brokers that do not disclose their fee structures may be attempting to hide unfavorable terms. Therefore, it is crucial for traders to conduct thorough research and seek clarity on any potential costs before engaging with TradeLink.

Customer Fund Security

The security of customer funds is a paramount concern for any trading platform. TradeLink's lack of regulatory oversight raises questions about its safety measures for protecting client funds. Reputable brokers typically implement strict protocols, such as segregating client accounts and providing negative balance protection, to safeguard investors' assets.

Unfortunately, there is little information available regarding TradeLink's fund security measures. This absence of clarity can be a significant cause for concern, as it leaves traders vulnerable to potential financial losses. Historical issues related to fund security can further exacerbate these risks, and without a clear understanding of how TradeLink manages client funds, potential investors should approach this broker with caution.

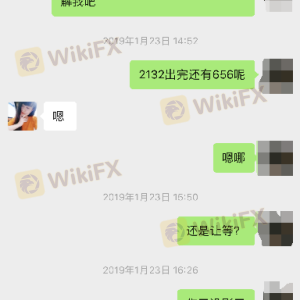

Customer Experience and Complaints

Customer feedback is a vital indicator of a broker's reliability and service quality. Reviews and testimonials about TradeLink reveal a mixed bag of experiences, with a notable number of complaints regarding fund withdrawals and customer service responsiveness.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Customer Support Issues | Medium | Inconsistent |

Common complaints include delays in processing withdrawals and difficulties in reaching customer support. Such issues can be indicative of a broker's operational inefficiencies or, in worse cases, a sign of potential fraudulent activity. For instance, several users have reported that their withdrawal requests were either ignored or faced unreasonable delays, raising alarms about the broker's practices. These patterns of complaints suggest that TradeLink may not prioritize customer satisfaction, which is a significant concern for potential traders.

Platform and Execution

The performance of a trading platform is crucial for a trader's success. TradeLink's platform has been described as functional, but there are concerns regarding its stability and execution quality. Reports of slippage and order rejections have surfaced, which can negatively impact trading outcomes.

A reliable trading platform should provide seamless trade execution and minimal slippage. However, if users experience frequent issues with order execution, it can lead to frustration and financial losses. Moreover, any signs of platform manipulation should be taken seriously, as they can indicate unethical practices. Therefore, potential traders must carefully evaluate TradeLink's platform performance before committing their funds.

Risk Assessment

Using TradeLink for trading carries inherent risks that potential clients must consider. The lack of regulation, transparency issues, and customer complaints collectively contribute to a high-risk profile for this broker.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated status poses significant risks. |

| Transparency Risk | High | Lack of information raises concerns about legitimacy. |

| Fund Security Risk | Medium | Insufficient details on fund protection measures. |

| Customer Service Risk | Medium | Frequent complaints about withdrawal issues. |

Given these high-risk factors, it is essential for potential traders to weigh their options carefully. Engaging with an unregulated broker like TradeLink may expose them to financial losses and disputes without adequate protections in place. To mitigate these risks, traders should consider using regulated brokers with proven track records and transparent practices.

Conclusion and Recommendations

In conclusion, the investigation into TradeLink raises several red flags that warrant caution. The broker's unregulated status, lack of transparency, and numerous customer complaints suggest that it may not be a safe trading option. Potential traders should be wary of engaging with TradeLink, as the risks associated with unregulated brokers can lead to significant financial losses.

For those seeking safer alternatives, it is advisable to choose brokers that are well-regulated and have positive reviews from clients. Regulatory oversight, transparent fee structures, and strong customer support are essential factors to consider when selecting a trading platform. Ultimately, protecting ones investments should be the top priority, and opting for a reputable broker is the best way to ensure a secure trading experience.

Is Tradelink a scam, or is it legit?

The latest exposure and evaluation content of Tradelink brokers.

Tradelink Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Tradelink latest industry rating score is 1.59, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.59 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.