Is TradeIFX safe?

Business

License

Is TradeIFX Safe or a Scam?

Introduction

TradeIFX positions itself as a Forex broker, aiming to attract both novice and experienced traders by offering a range of trading instruments and appealing trading conditions. However, the Forex market is notorious for its potential pitfalls, and traders must exercise caution when evaluating brokers. The importance of regulatory compliance, transparent operations, and customer feedback cannot be overstated in this volatile environment. This article aims to investigate the legitimacy of TradeIFX by examining its regulatory status, company background, trading conditions, customer experiences, and overall risk profile. Our assessment is based on a thorough review of online resources, expert opinions, and user testimonials, providing a comprehensive overview of whether TradeIFX is safe for trading.

Regulation and Legitimacy

The regulatory framework within which a broker operates is crucial for ensuring the safety of traders' funds. TradeIFX claims to operate out of the UK; however, it lacks proper licensing from recognized regulatory bodies. The absence of regulatory oversight raises significant concerns regarding the security of client funds and the broker's operational integrity.

| Regulatory Body | License Number | Regulated Area | Verification Status |

|---|---|---|---|

| FCA | N/A | UK | Unregulated |

The Financial Conduct Authority (FCA) is one of the most stringent regulators globally, demanding high standards of transparency and financial stability from brokers. For instance, FCA-regulated brokers must maintain segregated accounts and meet minimum capital requirements. TradeIFX's failure to comply with these regulations not only indicates a lack of legitimacy but also puts clients at risk, as there are no guarantees for fund recovery in the event of insolvency.

Moreover, TradeIFX advertises leverage of up to 1:400, which exceeds the FCA's maximum limit of 1:30 for retail traders. This discrepancy is a red flag, suggesting that TradeIFX may be operating outside the bounds of established regulatory practices. With no licensing or oversight, it is prudent for traders to question if TradeIFX is safe for their investments.

Company Background Investigation

TradeIFX's company history and ownership structure are essential factors in assessing its credibility. Unfortunately, detailed information about the company is scarce. The lack of transparency regarding its ownership and management team raises concerns about its legitimacy and operational practices. A reputable broker typically provides comprehensive information about its founders, management team, and corporate structure, allowing potential clients to evaluate their expertise and experience.

The absence of such information from TradeIFX's website is troubling. Furthermore, the company does not disclose its physical address, which is a standard practice among legitimate brokers. This lack of transparency may indicate an attempt to obscure its operations and avoid scrutiny from regulatory authorities.

In summary, the limited information available about TradeIFX's background, combined with its unregulated status, strongly suggests that TradeIFX is not safe for traders seeking a reliable and trustworthy Forex broker.

Trading Conditions Analysis

When evaluating a broker, understanding its trading conditions is critical. TradeIFX claims to offer competitive trading conditions, including a low minimum deposit of $250 and high leverage. However, the actual trading fees and conditions may not align with industry standards.

| Fee Type | TradeIFX | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 0.1 - 2 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | 0.5% - 2% |

The absence of clear information regarding spreads, commissions, and overnight fees raises questions about the broker's transparency and fairness. Legitimate brokers typically provide detailed information about their fee structures, allowing traders to make informed decisions. The lack of such information from TradeIFX suggests that traders may encounter hidden fees or unfavorable trading conditions.

Moreover, the promise of unrealistic returns, such as doubling investments within a month, is a common tactic used by fraudulent brokers to lure unsuspecting clients. Such claims should be approached with skepticism, as they often indicate a high risk of loss. Therefore, it is essential for traders to consider whether TradeIFX is safe before committing any funds.

Client Funds Safety

The safety of client funds is paramount when choosing a Forex broker. TradeIFX's lack of regulatory oversight raises significant concerns about its fund security measures. Reputable brokers typically maintain segregated accounts, ensuring that client funds are protected and not used for operational expenses.

Unfortunately, TradeIFX does not provide any information regarding its fund safety protocols. Without segregated accounts and investor protection mechanisms, clients risk losing their investments in the event of a broker's insolvency. Additionally, the absence of negative balance protection means that traders could potentially lose more than their initial deposit, further highlighting the risks associated with trading with TradeIFX.

In light of these factors, it is difficult to ascertain whether TradeIFX is safe for clients seeking to protect their investments. The lack of transparency and regulatory oversight suggests that traders should exercise extreme caution.

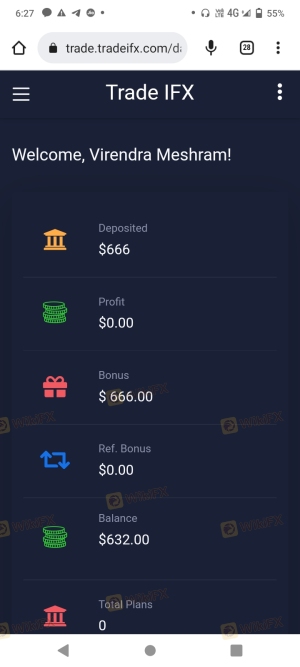

Customer Experience and Complaints

Analyzing customer feedback is crucial in assessing a broker's reliability. A significant number of online reviews and testimonials about TradeIFX indicate a pattern of complaints from dissatisfied clients. Common issues reported include difficulties in withdrawing funds, unresponsive customer support, and misleading promotional offers.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support | Medium | Poor |

| Misleading Promotions | High | Poor |

For example, several users have reported being unable to withdraw their funds after multiple requests, with some claiming that their accounts were frozen without explanation. Additionally, the company's customer support has been criticized for being unresponsive and ineffective in addressing client concerns. Such complaints are serious red flags for potential traders.

In conclusion, the overwhelming negative feedback from clients raises significant doubts about whether TradeIFX is safe. The lack of effective customer support and persistent withdrawal issues suggest that traders may face considerable challenges when dealing with this broker.

Platform and Trade Execution

The trading platform is a critical component of a broker's offering, impacting the overall trading experience. While TradeIFX claims to provide access to popular trading platforms like MetaTrader 5, there is limited information available about the actual performance and reliability of these platforms.

Users have reported issues related to order execution, including slippage and rejected orders, which can severely impact trading outcomes. The lack of transparency regarding platform performance raises concerns about potential manipulation and the overall integrity of the trading environment.

Given these factors, it is essential for traders to carefully evaluate whether TradeIFX is safe for their trading needs. The potential for execution issues and the lack of reliable information about the trading platform suggest that there may be better alternatives available.

Risk Assessment

Engaging with TradeIFX poses several risks that traders should carefully consider before proceeding. The lack of regulatory oversight, transparency, and negative customer experiences contribute to a high-risk profile for this broker.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated status raises concerns |

| Fund Safety Risk | High | No segregation or investor protection |

| Execution Risk | Medium | Reports of slippage and rejected orders |

To mitigate these risks, traders should conduct thorough research and consider alternative brokers with established regulatory oversight and positive customer feedback. It is advisable to prioritize brokers that demonstrate transparency, effective customer support, and a solid reputation within the trading community.

Conclusion and Recommendations

In light of the evidence presented, it is clear that TradeIFX exhibits several characteristics commonly associated with fraudulent brokers. The lack of regulatory oversight, transparency regarding company operations, negative customer feedback, and questionable trading conditions all point to significant risks for potential traders.

As such, it is crucial for traders to approach TradeIFX with extreme caution. Those seeking a reliable trading experience should consider alternative brokers that are properly regulated and have a proven track record of positive customer experiences. Some reputable alternatives include brokers regulated by the FCA or other recognized financial authorities, which ensure a higher level of safety and security for traders.

In summary, the overwhelming evidence suggests that TradeIFX is not safe for trading, and potential clients should seek out more trustworthy options to protect their investments.

Is TradeIFX a scam, or is it legit?

The latest exposure and evaluation content of TradeIFX brokers.

TradeIFX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

TradeIFX latest industry rating score is 1.49, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.49 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.