Is Tmgnfx safe?

Business

License

Is TMGMFX A Scam?

Introduction

TMGMFX, known as TradeMax Global Markets, is an online forex and CFD broker that has been operating since 2013. With its headquarters in Sydney, Australia, TMGMFX positions itself as a versatile trading platform, offering a wide array of trading instruments, including forex, indices, commodities, and cryptocurrencies. As the forex market continues to grow, traders must exercise caution when selecting a broker, given the prevalence of scams and fraudulent operations. Evaluating a broker's legitimacy is crucial to ensure the safety of funds and the integrity of trading conditions. This article employs a comprehensive assessment framework, analyzing TMGMFX through various lenses, including regulatory compliance, company background, trading conditions, and customer experience.

Regulation and Legitimacy

One of the fundamental indicators of a broker's legitimacy is its regulatory status. TMGMFX is regulated by several authorities, including the Australian Securities and Investments Commission (ASIC) and the Financial Markets Authority (FMA) in New Zealand, which are considered tier-1 regulators. Additionally, TMGMFX operates under the Vanutu Financial Services Commission (VFSC) and the Mauritius Financial Services Commission (FSC), which are tier-3 regulators. The following table summarizes the regulatory information for TMGMFX:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | 436416 | Australia | Verified |

| FMA | 569807 | New Zealand | Verified |

| VFSC | 40356 | Vanuatu | Verified |

| FSC | GB 22201012 | Mauritius | Verified |

The presence of two tier-1 licenses indicates that TMGMFX adheres to stringent financial standards, ensuring a higher level of protection for traders. The broker has maintained a good compliance history, which further enhances its credibility. However, it is essential to note that while the regulation by ASIC and FMA provides a solid foundation for trust, the existence of offshore licenses raises some concerns regarding the overall safety of funds.

Company Background Investigation

TMGMFX was founded in 2013 by a group of experienced traders with the goal of improving existing trading platforms. The company has since grown to serve traders in over 150 countries, establishing a solid reputation in the forex community. The ownership structure of TMGMFX is transparent, with its main entity, TradeMax Australia Limited, being publicly listed and regulated by ASIC. This transparency extends to its management team, which comprises industry veterans with extensive experience in finance and trading.

The company's commitment to transparency is evident in its detailed disclosure of trading conditions, fees, and regulatory compliance. However, the level of information provided on its website regarding the management team and corporate structure could be further improved to enhance trust among potential clients.

Trading Conditions Analysis

TMGMFX offers a competitive trading environment with low fees and tight spreads. The broker provides two main account types: the Classic account and the Edge account. The Classic account features spreads starting from 1.0 pips with no commission, while the Edge account offers spreads from 0.0 pips with a commission of $7 per round turn. Below is a comparison of core trading costs:

| Fee Type | TMGMFX | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.0 pips | 1.2 pips |

| Commission Model | $7.00 | $6.00 |

| Overnight Interest Range | Varies | Varies |

While the spread rates are competitive, the commission structure may deter some traders, particularly those who prefer commission-free trading. Furthermore, the broker imposes a $30 inactivity fee for accounts that remain dormant for six months, which is a common practice but may be viewed negatively by some users.

Client Funds Security

TMGMFX places significant emphasis on the safety of client funds. The broker employs strict measures, including segregated accounts, to ensure that client funds are kept separate from its operational funds. This is a critical safety measure that protects traders' investments in the event of financial discrepancies or insolvency. Additionally, TMGMFX offers negative balance protection, ensuring that clients cannot lose more money than they deposit.

Despite these safety measures, there have been historical concerns regarding the security of funds with offshore brokers. TMGMFX's offshore licenses, while legitimate, can sometimes raise red flags for traders accustomed to stricter regulatory environments. It is essential for potential clients to weigh these risks when deciding whether to open an account with TMGMFX.

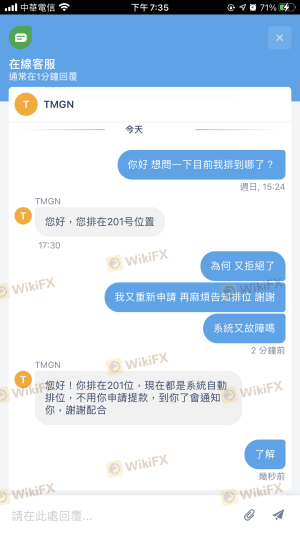

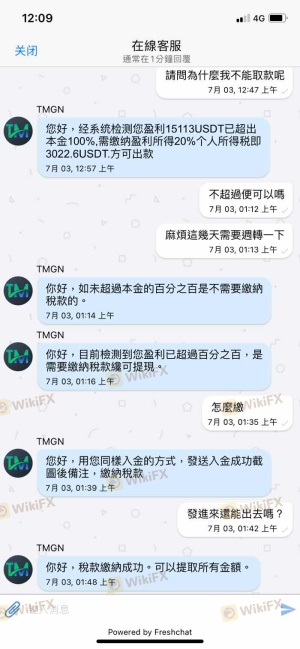

Customer Experience and Complaints

Customer feedback is a vital component in assessing the credibility of any broker. TMGMFX has received a mix of reviews from users, with many praising its user-friendly interface and responsive customer support. However, some common complaints have emerged, particularly regarding withdrawal processes and execution quality. Below is a summary of major complaint types and their severity assessment:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response |

| Slippage Issues | Medium | Addressed |

| Customer Service Accessibility | Medium | Varies |

For instance, one user reported significant delays in the withdrawal process, leading to frustration and a loss of confidence in the broker. Another trader experienced slippage during volatile market conditions, which raised concerns about execution quality. While TMGMFX has taken steps to address these issues, the frequency of such complaints highlights the need for continuous improvement in customer service and operational efficiency.

Platform and Execution

TMGMFX offers a robust trading platform, primarily utilizing MetaTrader 4 (MT4) and MetaTrader 5 (MT5). These platforms are renowned for their stability, extensive features, and user-friendly interfaces. However, some users have reported issues with order execution, particularly during high volatility periods.

The broker claims average execution speeds of under 30 milliseconds, which is competitive in the industry. However, instances of slippage have been noted, particularly during major economic announcements. Traders should remain vigilant regarding execution quality and consider using the demo account to assess the platform's performance before committing significant capital.

Risk Assessment

When evaluating the overall risk of trading with TMGMFX, several factors must be considered. Below is a concise risk scorecard summarizing key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | Medium | Offshore licenses present concerns. |

| Execution Risk | Medium | Reports of slippage during volatility. |

| Fund Security | Low | Segregated accounts and negative balance protection. |

While TMGMFX is regulated by reputable authorities, the existence of offshore licenses introduces additional risk. Traders are advised to employ strict risk management practices, especially when utilizing high leverage, which can amplify both gains and losses.

Conclusion and Recommendations

In conclusion, TMGMFX presents itself as a legitimate broker with strong regulatory oversight and a commitment to client safety. However, potential traders should exercise caution and conduct thorough research before opening an account. While the broker offers competitive trading conditions and a variety of instruments, the presence of offshore licenses and reports of execution issues warrant careful consideration.

For traders seeking a reliable and secure trading environment, it is advisable to explore alternative options that provide similar trading conditions with more robust regulatory frameworks. Brokers such as IG, OANDA, and Pepperstone may offer more transparency and a proven track record in client satisfaction. Ultimately, the decision to trade with TMGMFX should be based on individual risk tolerance and trading goals.

In summary, is TMGMFX safe? While it is regulated and offers several protective measures, the potential risks associated with offshore operations and execution issues necessitate a cautious approach.

Is Tmgnfx a scam, or is it legit?

The latest exposure and evaluation content of Tmgnfx brokers.

Tmgnfx Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Tmgnfx latest industry rating score is 1.50, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.50 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.