Is IREN safe?

Pros

Cons

Is Iren Safe or Scam?

Introduction

Iren is a forex brokerage that has gained attention in the trading community since its establishment in 2019. Based in Italy, it offers various trading services, including forex, commodities, and contracts for difference (CFDs). As the forex market continues to grow, traders are increasingly faced with a plethora of options when selecting a broker. However, the absence of proper regulation in this space raises significant concerns about the safety and credibility of many brokers, including Iren. This article aims to provide a comprehensive assessment of Iren by examining its regulatory status, company background, trading conditions, customer safety measures, user experiences, and overall risks. Through this structured analysis, we aim to answer the crucial question: Is Iren safe?

Regulation and Legitimacy

The regulatory status of a brokerage is one of the most critical factors in determining its safety and reliability. Iren is currently unregulated, which poses a significant risk for potential traders. Without oversight from a recognized financial authority, traders may face challenges in recovering their funds in the event of disputes or insolvency. To illustrate the regulatory landscape, we present the following table:

| Regulatory Authority | License Number | Regulatory Area | Verification Status |

|---|---|---|---|

| None | N/A | Italy | Unregulated |

The lack of regulation means that Iren does not adhere to the stringent requirements that licensed brokers must follow, such as maintaining adequate capital reserves and implementing investor protection measures. This absence of oversight can lead to increased risks for traders, including potential fraud or mismanagement of funds. Historically, unregulated brokers tend to have higher instances of customer complaints, often related to withdrawal issues and lack of transparency. Thus, it is crucial for traders to exercise caution and conduct thorough research before engaging with Iren.

Company Background Investigation

Iren was established in 2019 and operates out of Torino, Italy. Although relatively new to the forex market, the company has positioned itself to attract traders primarily in Italy. However, the limited operational history raises questions about its stability and long-term viability. The management team behind Iren lacks publicly available information, which further complicates the assessment of its credibility. Transparency is a vital aspect of a trustworthy brokerage; therefore, the lack of detailed information about the ownership structure and the qualifications of the management team is concerning.

The absence of regulatory oversight compounds these issues. Without a governing body to ensure compliance with industry standards, traders may find it challenging to trust Iren's operational practices. Transparency in terms of company history, management experience, and ownership is essential for assessing the integrity of any brokerage. In this case, the lack of such information raises red flags regarding Iren's legitimacy.

Trading Conditions Analysis

Understanding the trading conditions offered by Iren is essential for evaluating its overall appeal to traders. Iren's fee structure appears to be competitive, but the unregulated nature of the brokerage raises concerns about hidden fees or unfavorable trading conditions. The following table summarizes the core trading costs associated with Iren:

| Fee Type | Iren | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable (not disclosed) | 1.0 - 2.0 pips |

| Commission Model | Not specified | Varies widely |

| Overnight Interest Range | Not disclosed | 0.5% - 2.0% |

The lack of transparency regarding spreads and commissions is alarming. Traders should be aware that unregulated brokers may impose unexpected fees that can erode profits. Additionally, the absence of clear information on overnight interest rates may indicate a lack of standard practices that regulated brokers typically adhere to. In the absence of a clear fee structure, potential clients are left to wonder about the true cost of trading with Iren, further complicating the question of Is Iren safe?

Customer Funds Security

The safety of client funds is paramount when considering a forex broker. Iren's lack of regulation raises significant concerns about its fund security measures. Regulated brokers are typically required to implement strict policies for fund segregation, ensuring that client funds are held separately from the company's operational funds. Unfortunately, there is no publicly available information regarding Iren's policies on fund segregation or investor protection.

Without these protective measures, traders could face substantial risks, particularly in scenarios where the broker faces financial difficulties. Moreover, the absence of a negative balance protection policy further exacerbates the risks, as traders could potentially lose more than their initial investment. Historical complaints against Iren, such as issues related to withdrawal difficulties, indicate a troubling trend that potential clients should consider seriously. The lack of a robust framework for fund security leads to the conclusion that Iren may not be a safe choice for traders.

Customer Experience and Complaints

Understanding customer experiences is essential in evaluating the credibility of any broker. Feedback from Iren's clients has been mixed, with several complaints surfacing regarding withdrawal issues and customer service responsiveness. The following table summarizes the primary complaint types and their severity:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Poor Customer Service | Medium | Inconsistent |

| Lack of Transparency | High | No clear answers |

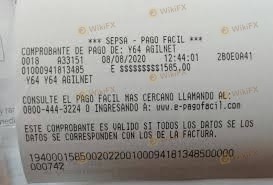

One notable complaint involved a trader who deposited $1,585 but faced difficulties when attempting to withdraw their funds. Such complaints highlight the potential risks associated with trading with Iren. The company's slow response to these issues raises further concerns about its customer support infrastructure. A brokerage that is unresponsive to client inquiries is often a red flag for potential fraud or mismanagement.

Platform and Trade Execution

The trading platform offered by Iren is another critical aspect to consider. While there is limited information available regarding the platform's performance, traders have reported issues with execution quality, including slippage and order rejections. A reliable trading platform should provide quick and efficient order execution, especially during volatile market conditions. If traders experience frequent slippage or rejected orders, it can significantly impact their trading outcomes.

Moreover, the lack of a demo account option for potential clients to test the platform raises concerns about transparency and user experience. Traders should have the opportunity to familiarize themselves with the trading environment before committing real funds. Without this option, the question of Is Iren safe? becomes increasingly pertinent, as traders are left in the dark regarding the platform's capabilities.

Risk Assessment

Using Iren as a forex broker presents several risks that potential traders must consider. The following risk assessment summarizes the key risk areas associated with Iren:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated status |

| Fund Security Risk | High | Lack of fund segregation |

| Customer Service Risk | Medium | Complaints about responsiveness |

| Trading Conditions Risk | High | Lack of transparency in fees |

The high regulatory risk associated with Iren is the most concerning. Traders must be cautious when dealing with unregulated brokers, as they may not have recourse in the event of disputes. Additionally, the lack of fund security and transparency around trading conditions further compounds these risks. To mitigate potential issues, traders should consider using regulated brokers that offer clear fee structures, robust customer support, and strong fund protection measures.

Conclusion and Recommendations

In conclusion, the evidence suggests that Iren poses several risks for potential traders, leading to the conclusion that Iren is not safe. The unregulated status, lack of transparency in fees, and numerous customer complaints indicate that traders should exercise extreme caution when considering this broker. While trading with Iren may seem appealing due to its offerings, the potential risks outweigh the benefits.

For traders seeking safer alternatives, it is advisable to consider regulated brokers with a proven track record of customer satisfaction and transparent business practices. Brokers that are regulated by recognized authorities provide a level of security and accountability that unregulated brokers like Iren cannot offer. By prioritizing safety and reliability, traders can better protect their investments and enhance their trading experiences.

Is IREN a scam, or is it legit?

The latest exposure and evaluation content of IREN brokers.

IREN Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

IREN latest industry rating score is 1.57, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.57 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.