Regarding the legitimacy of SUNWAH KINGSWAY forex brokers, it provides SFC and WikiBit, (also has a graphic survey regarding security).

Is SUNWAH KINGSWAY safe?

Risk Control

Software Index

Is SUNWAH KINGSWAY markets regulated?

The regulatory license is the strongest proof.

SFC Derivatives Trading License (AGN)

Securities and Futures Commission of Hong Kong

Securities and Futures Commission of Hong Kong

Current Status:

RegulatedLicense Type:

Derivatives Trading License (AGN)

Licensed Entity:

Kingsway Financial Services Group Limited

Effective Date:

2004-05-31Email Address of Licensed Institution:

lnc@sunwahkingsway.comSharing Status:

No SharingWebsite of Licensed Institution:

www.sunwahkingsway.comExpiration Time:

--Address of Licensed Institution:

香港金鐘道89號力寶中心第1座7樓Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is Sunwah Kingsway Safe or Scam?

Introduction

Sunwah Kingsway is a financial services provider based in Hong Kong, primarily known for its brokerage services in the forex and CFD markets. As traders increasingly seek opportunities in the foreign exchange market, it becomes essential to evaluate the safety and legitimacy of brokers like Sunwah Kingsway. The forex market, while lucrative, is also rife with potential scams and fraudulent activities. Therefore, traders must conduct thorough research before entrusting their funds to any broker. This article aims to provide an objective analysis of Sunwah Kingsway, focusing on its regulatory status, company background, trading conditions, client fund security, customer experiences, and overall risk assessment. Our investigation is based on multiple reputable online sources, reviews, and regulatory data to ensure a comprehensive evaluation of whether Sunwah Kingsway is safe or potentially a scam.

Regulation and Legitimacy

A broker's regulatory status is a crucial factor in determining its safety. Sunwah Kingsway operates under the supervision of the Securities and Futures Commission (SFC) in Hong Kong, which is known for its stringent regulatory framework. However, the broker's operations are primarily focused on futures contracts rather than forex trading, raising questions about its legitimacy in the forex market.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Securities and Futures Commission (SFC) | ADF 346 | Hong Kong | Regulated |

The SFC's oversight provides a layer of security for traders, as it enforces compliance with industry standards. However, it is important to note that while Sunwah Kingsway is regulated, there are reports indicating that clients have faced difficulties in withdrawing funds. This raises concerns about the quality of the broker's compliance and operational practices. A broker that operates in a regulated environment should ideally have a solid track record of client fund protection and transparent operations. Therefore, while Sunwah Kingsway is technically regulated, its operational practices warrant further scrutiny to determine if it is truly safe for traders.

Company Background Investigation

Sunwah Kingsway Capital Holdings Ltd. was founded in 1990 and has since established itself as a significant player in the financial services sector in Hong Kong. The company operates various segments, including brokerage, asset management, and corporate finance. Its ownership structure is primarily linked to the Sunwah Group, a well-known conglomerate in Asia. The management team comprises experienced professionals with backgrounds in finance and investment, contributing to the firm's credibility.

Despite its long-standing presence in the market, the transparency of Sunwah Kingsway's operations has been questioned. The company's website lacks detailed information about its services and regulatory compliance, which could be a red flag for potential clients. Furthermore, the absence of a clear communication channel regarding client concerns can affect the overall trustworthiness of the broker. In evaluating whether Sunwah Kingsway is safe, it is essential to consider not only its regulatory status but also its operational transparency and willingness to address client issues.

Trading Conditions Analysis

When assessing a broker's trading conditions, it is vital to evaluate its fee structure and any unusual costs that may impact profitability. Sunwah Kingsway offers a range of services, but its fee structure has been a point of contention among clients. Reports suggest that some users have encountered unexpected charges, particularly concerning withdrawal fees and inactivity fees.

| Fee Type | Sunwah Kingsway | Industry Average |

|---|---|---|

| Major Currency Pair Spreads | Varies | 1-2 pips |

| Commission Structure | 0.25% on transactions | 0.1%-0.5% |

| Overnight Interest Range | Varies | Varies |

While the spreads for major currency pairs may be competitive, the commission structure appears to be on the higher end compared to industry averages. Additionally, the lack of clarity regarding overnight interest charges can lead to unexpected costs for traders. Such fee structures can significantly affect a trader's bottom line, leading to dissatisfaction and complaints. Therefore, potential clients should carefully review Sunwah Kingsway's fee structure and consider whether these costs align with their trading strategies. This analysis is crucial in determining if Sunwah Kingsway is safe or if its fee practices could be indicative of larger issues.

Client Fund Security

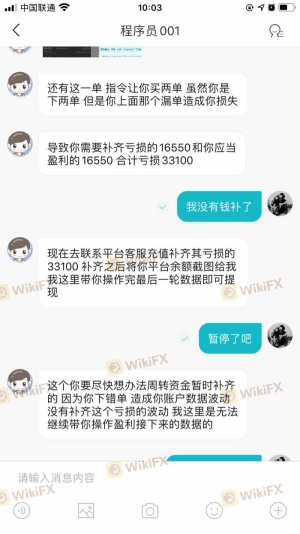

The security of client funds is paramount in any financial service, especially in forex trading. Sunwah Kingsway claims to implement various measures to protect client funds, including segregated accounts and adherence to SFC regulations. However, the effectiveness of these measures has been questioned, particularly in light of reports from clients who have struggled to withdraw their funds.

The absence of comprehensive investor protection policies, such as negative balance protection, further complicates the safety assessment. Traders should be aware that if a broker does not guarantee the return of their funds, they may be at risk of losing their entire investment in the event of adverse market movements or broker insolvency. Historical issues surrounding fund security and withdrawal complaints raise significant concerns about whether Sunwah Kingsway is safe for traders. Prospective clients should exercise caution and consider these factors when deciding whether to engage with this broker.

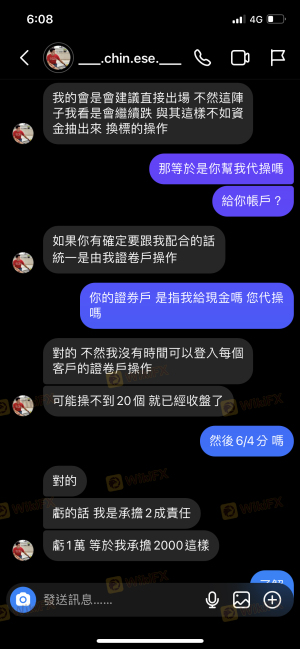

Customer Experience and Complaints

Analyzing customer feedback is essential in evaluating a broker's reliability. Reviews of Sunwah Kingsway indicate a mixed bag of experiences, with many users praising the brokerage's platform and trading conditions, while others express frustration over withdrawal issues and customer service responsiveness.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response, unresolved |

| Customer Support | Medium | Delayed replies, unclear information |

| Fee Transparency | Medium | Mixed reviews, some clarity |

Common complaints revolve around the inability to withdraw funds in a timely manner, which is a critical issue for any trading platform. Some users report that their withdrawal requests were met with unnecessary delays or additional requests for documentation, leading to frustration and loss of trust. The company's response to these complaints has been inconsistent, with some clients feeling ignored or inadequately supported.

Two notable case studies highlight these issues: one trader reported a six-week delay in withdrawing funds, while another faced repeated requests for additional fees before their withdrawal could be processed. These experiences raise significant concerns about whether Sunwah Kingsway is safe for traders, as timely access to funds is a fundamental expectation in the trading community.

Platform and Trade Execution

A broker's trading platform is the primary interface through which clients interact with the market. Sunwah Kingsway provides a proprietary trading platform that has received mixed reviews regarding its performance and reliability. Users have reported occasional stability issues, which can lead to missed trading opportunities and increased stress during volatile market conditions.

Additionally, the quality of order execution is paramount. Reports indicate that some traders have experienced slippage and rejections during high volatility, which can significantly impact trading outcomes. The absence of clear data regarding the broker's order execution policies can create uncertainty among traders about whether they are receiving fair treatment in the market.

Risk Assessment

Evaluating the overall risk associated with trading with Sunwah Kingsway is crucial for prospective clients. The following risk assessment summarizes key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | Medium | Regulated but with compliance issues reported |

| Fund Security | High | Historical withdrawal issues and lack of investor protection |

| Customer Support | Medium | Mixed reviews on responsiveness and support quality |

| Fee Transparency | Medium | Unclear fee structures leading to dissatisfaction |

Given these risks, it is advisable for traders to approach Sunwah Kingsway with caution. Potential clients should consider utilizing risk management strategies, such as limiting their initial investment and thoroughly reviewing all terms and conditions before proceeding.

Conclusion and Recommendations

After a thorough investigation into Sunwah Kingsway, it is clear that while the broker has a long-standing presence in the market and is regulated by the SFC, significant concerns remain regarding its operational practices and client experiences. The reports of withdrawal difficulties, mixed customer feedback, and unclear fee structures suggest that traders should exercise caution when considering this broker.

In conclusion, while Sunwah Kingsway is not outright labeled as a scam, the risks associated with trading through this broker cannot be ignored. Traders seeking reliability and transparency may want to consider alternative options with a better reputation for customer service and fund security. Recommended alternatives include brokers that are well-regulated, have clear fee structures, and demonstrate a commitment to client support. Ultimately, thorough due diligence is essential for traders to ensure they are engaging with a broker that prioritizes their safety and financial well-being.

Is SUNWAH KINGSWAY a scam, or is it legit?

The latest exposure and evaluation content of SUNWAH KINGSWAY brokers.

SUNWAH KINGSWAY Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

SUNWAH KINGSWAY latest industry rating score is 6.95, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 6.95 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.