Is SPTORO safe?

Business

License

Is SPTORO Safe or a Scam?

Introduction

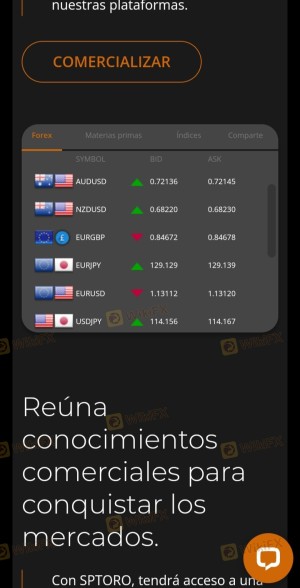

SPTORO is an online broker that positions itself within the forex, cryptocurrency, and CFD trading markets. Operating from Saint Vincent and the Grenadines, SPTORO claims to offer a modern trading platform with low initial deposits. However, the rise of unregulated brokers has made it essential for traders to carefully evaluate the legitimacy and safety of such platforms. This article aims to investigate whether SPTORO is a safe trading option or a potential scam. To achieve this, we will analyze various aspects of the broker, including its regulatory status, company background, trading conditions, client fund security, customer feedback, platform performance, and overall risk assessment.

Regulation and Legitimacy

The regulatory status of a broker is one of the most critical factors in determining its safety. Regulation serves as a safeguard for traders, ensuring that brokers adhere to specific standards and practices. In the case of SPTORO, it is crucial to note that the broker does not mention any regulatory oversight from recognized financial authorities.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

SPTORO operates without any regulatory framework, which is a significant red flag. The absence of regulation means that traders are not afforded any legal protections, increasing the risk of potential fraud. Additionally, the Spanish financial authority, CNMV, has flagged SPTORO as a fraudulent entity, further raising concerns about its legitimacy. The lack of regulatory compliance and the negative scrutiny from financial authorities suggest that SPTORO is not a safe trading option.

Company Background Investigation

Understanding a broker's history, ownership structure, and transparency is vital in assessing its reliability. SPTORO is owned by SPT Media LLC and is based in Saint Vincent and the Grenadines, a jurisdiction known for its lax regulatory environment. The company's lack of transparency regarding its ownership and management team raises concerns about its credibility.

Information about the management team is scarce, which is troubling for prospective traders. A reputable broker typically provides detailed information about its leadership, including their professional backgrounds and experiences. The absence of such information can be interpreted as a lack of accountability, making it difficult for traders to trust the broker. Furthermore, the limited disclosure of operational details suggests that SPTORO may not prioritize transparency, which is essential for building trust with clients.

Trading Conditions Analysis

The trading conditions offered by a broker can significantly impact a trader's experience. SPTORO claims to provide competitive trading conditions, but a closer examination reveals potential issues. The broker does not provide clear information regarding its fee structure, which can lead to unexpected costs for traders.

| Fee Type | SPTORO | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 2.6 pips (approx.) | 1.0-1.5 pips |

| Commission Model | N/A | Varies (0-10 USD per lot) |

| Overnight Interest Range | N/A | Varies by broker |

The spreads offered by SPTORO seem to be higher than the industry average, which could affect profitability for traders. Additionally, the lack of clarity regarding commissions and overnight interest raises concerns about hidden fees. Traders should be wary of brokers that do not provide transparent fee structures, as this can lead to unexpected expenses that diminish trading profits.

Client Fund Security

Client fund security is paramount when evaluating a broker's safety. SPTORO's website lacks detailed information about its fund protection measures. It is unclear whether the broker employs segregated accounts to protect client funds or if it has any investor protection policies in place.

The lack of transparency regarding fund security measures is alarming. Traders should always seek brokers that provide clear information about how they protect client funds, including details about account segregation and negative balance protection. The absence of such policies can expose traders to significant financial risks, especially in volatile market conditions.

Customer Experience and Complaints

Customer feedback is a valuable resource for assessing a broker's reliability. A review of user experiences with SPTORO reveals a pattern of complaints, particularly regarding withdrawal issues and poor customer service. Many users have reported difficulties in withdrawing their funds, which is a common red flag for unregulated brokers.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service | Medium | Inadequate |

Several users have shared their experiences of being unable to withdraw their money after making deposits, with some claiming that their requests were ignored or delayed for months. These complaints highlight a troubling trend that is often associated with scam brokers. The quality of customer service is also a concern, as many users report receiving inadequate support when addressing their issues.

Platform and Trade Execution

The trading platform's performance is crucial for a smooth trading experience. SPTORO offers a proprietary platform, but reviews indicate mixed experiences regarding its stability and execution quality. Users have reported instances of slippage and order rejections, which can significantly impact trading outcomes.

A reliable trading platform should ensure quick execution and minimal slippage. However, reports of execution issues at SPTORO raise concerns about the platform's reliability. Traders should be cautious when dealing with platforms that do not meet industry standards for execution quality, as this can lead to losses.

Risk Assessment

Using SPTORO comes with several risks that potential traders should consider. The lack of regulation, transparency, and poor customer feedback collectively contribute to a high-risk profile for the broker.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated broker with no oversight. |

| Fund Security Risk | High | Lack of clear fund protection measures. |

| Execution Risk | Medium | Reports of slippage and order rejections. |

| Customer Service Risk | High | Poor response to customer complaints. |

To mitigate these risks, traders should conduct thorough research, consider using regulated brokers, and avoid depositing large sums until they have confirmed the broker's reliability.

Conclusion and Recommendations

In conclusion, the evidence suggests that SPTORO is not a safe trading option. The lack of regulation, transparency issues, negative customer feedback, and high-risk profile indicate that traders should exercise caution. If you are considering trading with SPTORO, it is advisable to look for regulated alternatives that offer better security and customer support.

For safer trading options, consider brokers that are regulated by reputable authorities such as the FCA or ASIC. These brokers typically provide better protection for client funds, clearer fee structures, and more reliable customer service. Always prioritize safety and conduct thorough due diligence before committing to any trading platform.

Is SPTORO a scam, or is it legit?

The latest exposure and evaluation content of SPTORO brokers.

SPTORO Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

SPTORO latest industry rating score is 1.51, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.51 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.