Is skyoption safe?

Software Index

License

Is Skyoption A Scam?

Introduction

Skyoption has emerged as a prominent name in the foreign exchange (forex) market, attracting attention from both novice and seasoned traders. However, as the online trading landscape becomes increasingly populated with brokers, it is crucial for traders to exercise caution and conduct thorough evaluations before engaging with any trading platform. The potential for scams and fraudulent activities in the forex industry necessitates a careful assessment of brokers like Skyoption to ensure the safety of funds and the legitimacy of trading practices. This article aims to investigate the credibility of Skyoption by examining its regulatory status, company background, trading conditions, customer experiences, and overall risk profile.

To conduct this investigation, we analyzed various sources, including regulatory alerts, user reviews, and expert assessments. By synthesizing this information, we aim to provide a comprehensive evaluation of whether Skyoption is safe or if it raises red flags that potential investors should consider.

Regulation and Legitimacy

The regulatory landscape for forex brokers is critical in ensuring that traders' interests are protected. Regulation provides oversight, ensuring that brokers adhere to specific standards of conduct and financial practices. Unfortunately, Skyoption is not regulated by any recognized financial authority, which raises significant concerns regarding its legitimacy. The absence of regulation often indicates a higher risk for traders, as there are no governing bodies to oversee the broker's operations or protect investors' funds.

| Regulatory Body | License Number | Regulatory Area | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Regulated |

The lack of a valid regulatory license is a major warning sign. Regulatory agencies such as the Financial Conduct Authority (FCA) or the Securities and Exchange Commission (SEC) provide a safety net for traders, ensuring that brokers operate transparently and ethically. Skyoption's unregulated status suggests that it may not be subject to the same scrutiny as legitimate brokers, increasing the likelihood of potential scams or fraudulent activities. Traders must be cautious and consider the implications of trading with an unregulated entity, as this significantly heightens the risk of losing funds without any recourse for recovery.

Company Background Investigation

Understanding the background of a broker is essential in assessing its credibility. Skyoption's history, ownership structure, and management team play a vital role in determining whether it is a trustworthy entity. However, information about Skyoption's establishment and operational history is limited and somewhat opaque. The company claims to operate from New York, but its actual physical presence and legitimacy remain questionable.

Furthermore, the management team behind Skyoption appears to lack transparency. A credible broker typically provides detailed information about its leadership, including their professional backgrounds and expertise. In Skyoption's case, there is a noticeable absence of such information, which can lead to skepticism regarding the broker's intentions and overall reliability. Without a clear understanding of who manages the company, traders may find it challenging to trust that their funds are in safe hands.

The overall transparency of Skyoption is lacking, which is a critical factor for any financial institution. Legitimate brokers should openly disclose their financial status, business model, and management team to build trust with potential investors. The absence of such information raises concerns about the brokers operations and whether it is indeed a safe platform for trading.

Trading Conditions Analysis

When evaluating a broker, it is essential to analyze its trading conditions, including fees, spreads, and overall cost structure. Skyoption's trading conditions have been a point of contention among users, with many reporting high fees and unfavorable trading terms. A clear understanding of the costs associated with trading on the platform is crucial for traders looking to maximize their investments.

| Fee Type | Skyoption | Industry Average |

|---|---|---|

| Major Currency Pair Spread | High (e.g., 3 pips) | Low (e.g., 1-2 pips) |

| Commission Model | Varies | Standard (e.g., $5 per lot) |

| Overnight Interest Range | High | Competitive |

The fees associated with trading on Skyoption are notably higher than the industry average, which could significantly impact traders' profitability. High spreads and commissions can erode potential gains, making it essential for traders to consider the overall cost of trading before committing to this broker. Furthermore, reports of hidden fees and unfavorable withdrawal conditions have surfaced, further complicating the trading experience. These factors contribute to the overall perception that Skyoption may not be safe, as traders may find themselves facing unexpected costs that diminish their investment returns.

Customer Funds Security

The security of customer funds is paramount when evaluating a forex broker. Traders need to know that their investments are protected and that the broker has measures in place to safeguard their funds. Unfortunately, Skyoption's approach to fund security raises several concerns. The broker does not appear to implement robust security measures, such as segregating client funds or providing investor protection schemes.

Traders should expect brokers to maintain strict protocols for fund security, including the separation of client funds from the broker's operational funds. Additionally, reputable brokers often offer negative balance protection, ensuring that traders cannot lose more than their initial investments. However, Skyoption's lack of transparency regarding its fund security measures raises significant concerns about the safety of traders' investments.

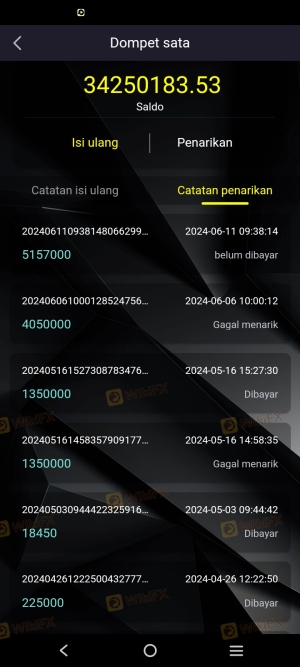

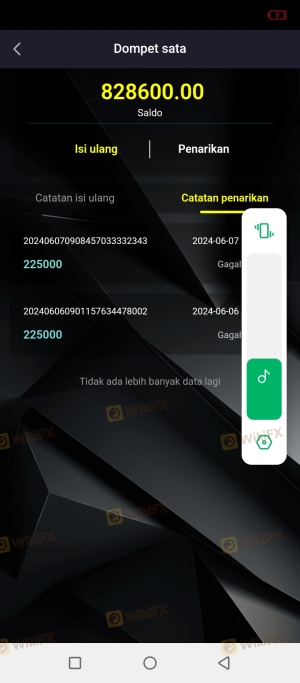

Historically, there have been reports of issues related to fund withdrawals and access to funds on the Skyoption platform. These incidents further underscore the importance of evaluating a broker's fund security practices, as the inability to withdraw funds can lead to significant financial losses for traders. Overall, the lack of clear information about Skyoption's fund security measures suggests that potential investors should approach this broker with caution.

Customer Experience and Complaints

Customer feedback is a valuable resource for assessing a broker's reliability and overall performance. In the case of Skyoption, user reviews indicate a pattern of dissatisfaction, with many clients reporting issues related to customer service, withdrawal difficulties, and manipulative trading practices.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service | Medium | Average |

| Manipulative Practices | High | Unresponsive |

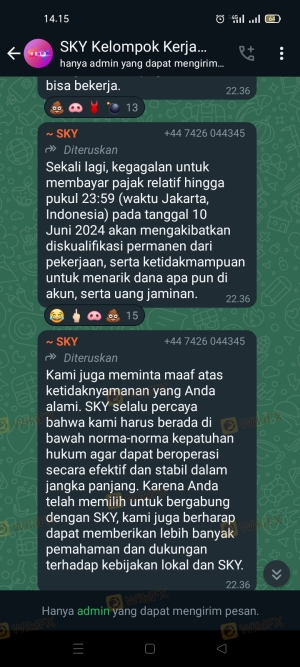

Common complaints revolve around the inability to withdraw funds, with users reporting delays and unexpected fees during the withdrawal process. Additionally, many clients have expressed frustration over unresponsive customer service, which can exacerbate their issues and leave them feeling unsupported. The combination of these complaints paints a concerning picture of Skyoption's operational practices, implying that Skyoption may not be safe for traders seeking a reliable and supportive trading environment.

Two notable cases highlight these concerns. In one instance, a trader reported being unable to withdraw their funds for several weeks, leading to significant financial distress. In another case, a user alleged that their trades were manipulated, resulting in losses that could have been avoided had the broker acted transparently. These experiences reflect a broader trend of dissatisfaction among Skyoption's clientele, further questioning the broker's credibility and safety.

Platform and Trade Execution

The performance of a trading platform is critical for traders, influencing their overall experience and ability to execute trades effectively. Skyoption's platform has faced criticism for its stability and execution quality. Users have reported instances of slippage, where orders are executed at unfavorable prices, as well as occasional outages that hinder trading activities.

The quality of order execution is a vital aspect of a broker's service, as delays or errors can lead to significant financial losses for traders. Reports of high slippage and rejected orders raise concerns about the platform's reliability and whether it is designed to prioritize the broker's interests over those of its clients. This lack of confidence in the platform's performance further amplifies the skepticism surrounding Skyoption's legitimacy and raises questions about whether it is indeed a safe trading environment.

Risk Assessment

Every trading platform carries inherent risks, and it is essential for traders to understand these risks before committing their funds. In the case of Skyoption, several risk factors have been identified that could impact traders' experiences and financial outcomes.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated broker, lack of oversight. |

| Fund Security Risk | High | No clear fund protection measures. |

| Customer Service Risk | Medium | Poor response to complaints and issues. |

The overall risk profile of Skyoption indicates a high level of concern for potential investors. The lack of regulation, combined with inadequate fund security measures and poor customer service, suggests that traders may face significant challenges when dealing with this broker. To mitigate these risks, investors should consider starting with a small investment, thoroughly researching the broker's practices, and seeking independent financial advice before proceeding.

Conclusion and Recommendations

In conclusion, the evidence gathered raises substantial concerns regarding the legitimacy and safety of Skyoption. The broker's lack of regulation, transparency issues, high trading costs, and negative customer experiences suggest that it may not be a trustworthy platform for forex trading. Therefore, potential investors should approach Skyoption with caution and consider alternative brokers that offer better regulatory oversight and customer support.

For traders seeking reliable options, consider reputable brokers that are regulated by recognized authorities, provide transparent fee structures, and demonstrate a commitment to customer service. By prioritizing safety and due diligence, traders can protect their investments and enhance their trading experiences. Ultimately, the findings suggest that Skyoption may not be safe, and it is advisable to explore other, more trustworthy trading platforms.

Is skyoption a scam, or is it legit?

The latest exposure and evaluation content of skyoption brokers.

skyoption Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

skyoption latest industry rating score is 2.03, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 2.03 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.