Is Sen Hui safe?

Business

License

Is Sen Hui Safe or Scam?

Introduction

Sen Hui is a forex broker that has positioned itself within the volatile realm of foreign exchange trading. As with any financial service, particularly in the forex market, traders must exercise caution and conduct thorough research before engaging with a broker. The forex market is notorious for its risks, and the presence of unregulated or poorly regulated brokers can lead to significant financial losses for unsuspecting traders. In this article, we aim to evaluate the safety and legitimacy of Sen Hui, focusing on its regulatory status, company background, trading conditions, customer experiences, and overall risk assessment. Our investigation draws on various credible sources, including regulatory databases, user reviews, and expert analyses, to provide a comprehensive overview of whether Sen Hui is safe or potentially a scam.

Regulation and Legitimacy

The regulatory landscape of forex brokers is crucial for establishing their legitimacy and trustworthiness. Brokers that operate under the oversight of recognized regulatory authorities are generally deemed safer, as these organizations enforce strict compliance standards to protect investors. Unfortunately, Sen Hui appears to lack adequate regulatory oversight. According to various sources, including WikiFX, Sen Hui operates without valid regulatory information, raising red flags regarding its legitimacy.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | Vanuatu | Not Verified |

The absence of a regulatory license from a reputable authority such as the Financial Conduct Authority (FCA) or the Australian Securities and Investments Commission (ASIC) is concerning. This lack of oversight can expose traders to higher risks, including potential fraud or mismanagement of funds. Furthermore, the information available suggests that Sen Hui does not have a history of compliance with regulatory standards, which is a critical factor in assessing whether Sen Hui is safe for trading.

Company Background Investigation

Sen Hui Limited, the entity behind the trading platform, has a murky history with limited publicly available information. The company is registered in Vanuatu, an offshore jurisdiction known for its lenient regulatory framework. This raises questions about the company's operational transparency and accountability. The management team behind Sen Hui has not been extensively documented, making it difficult for potential clients to evaluate their qualifications and experience in the financial sector.

A lack of transparency regarding the ownership structure and management team is a significant concern for potential investors. In a market where trust is paramount, the inability to ascertain who is behind the broker can deter traders from engaging with the platform. Furthermore, the absence of detailed information on the companys history and development trajectory adds to the skepticism surrounding whether Sen Hui is safe for trading activities.

Trading Conditions Analysis

When evaluating a forex broker, understanding the trading conditions they offer is essential for determining their overall value and potential risks. Sen Hui's fee structure has been described as opaque, with various sources indicating that traders may encounter hidden fees that are not clearly disclosed upfront. This lack of transparency can lead to unexpected costs, which is a common complaint among users of unregulated brokers.

| Fee Type | Sen Hui | Industry Average |

|---|---|---|

| Major Currency Pair Spreads | TBD | 1-2 pips |

| Commission Model | TBD | Varies |

| Overnight Interest Range | TBD | Varies |

The absence of clear information about spreads, commissions, and overnight fees can create confusion and distrust among traders. If Sen Hui imposes significantly higher fees than the industry average, this could further diminish its attractiveness as a trading platform. In summary, the lack of transparency in trading conditions raises concerns about whether Sen Hui is safe for traders looking for a reliable and cost-effective trading environment.

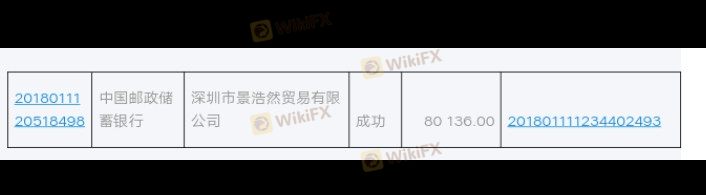

Customer Funds Security

The safety of customer funds is a paramount concern when selecting a forex broker. Reliable brokers typically implement robust security measures, including segregated accounts, investor protection schemes, and negative balance protection policies. However, there is little information available regarding Sen Hui's security measures for client funds. The absence of documented policies on fund segregation or investor protection raises alarms about the safety of traders' investments.

If Sen Hui does not offer adequate protection for customer funds, traders could face significant risks, particularly in the event of the broker's insolvency. Historical data on any previous security breaches or fund mismanagement incidents would provide further insight into the brokers reliability. Given the current lack of information, it is crucial for potential clients to consider whether Sen Hui is safe before committing any capital.

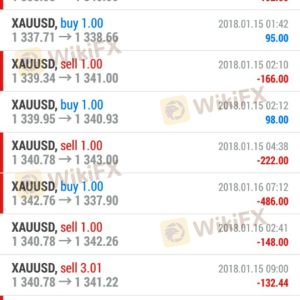

Customer Experience and Complaints

Analyzing customer feedback is vital for understanding the overall experience with a broker. Unfortunately, reviews of Sen Hui reveal a mixed bag of experiences, with numerous complaints regarding withdrawal issues and poor customer service. Many users have reported difficulty in accessing their funds, which is a significant red flag when evaluating the trustworthiness of a broker.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service Delays | Medium | Inconsistent |

Case studies from users indicate that some traders have faced long delays in fund withdrawals, which can be a sign of financial instability or operational inefficiency. Additionally, the quality of customer service appears to be lacking, with many users expressing frustration over unresponsive support channels. These issues collectively contribute to the growing concerns over whether Sen Hui is safe for trading.

Platform and Execution

The performance of a trading platform is crucial for a seamless trading experience. Sen Hui's platform reportedly suffers from stability issues, leading to frequent downtimes and execution delays. Traders have expressed concerns over slippage and rejected orders, which can severely impact trading outcomes.

The potential for platform manipulation is another serious concern, particularly if traders experience significant discrepancies between quoted prices and executed trades. Such issues can lead to financial losses and erode trust in the broker. Therefore, it is essential to consider the platform's reliability when assessing whether Sen Hui is safe for trading.

Risk Assessment

Using Sen Hui as a trading platform presents several risks that potential clients should consider. The lack of regulation, transparency, and customer support, combined with the numerous complaints regarding fund withdrawals and platform stability, contribute to a high-risk environment for traders.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No valid regulation |

| Operational Risk | Medium | Poor customer service |

| Financial Risk | High | Withdrawal issues |

To mitigate these risks, traders should conduct thorough due diligence before engaging with Sen Hui. It is advisable to start with a minimal investment or demo account, if available, to assess the platforms reliability and customer service firsthand.

Conclusion and Recommendations

In conclusion, the evidence suggests that Sen Hui may not be a safe trading option for forex traders. The lack of regulatory oversight, transparency in trading conditions, and numerous complaints regarding customer service and fund withdrawals raise significant concerns.

For traders seeking reliable alternatives, we recommend considering brokers that are regulated by reputable authorities, such as the FCA or ASIC, and have a proven track record of customer satisfaction and transparent trading practices. Always prioritize brokers that demonstrate strong security measures for client funds and provide clear information about their services.

In summary, while some traders may still choose to explore opportunities with Sen Hui, it is crucial to proceed with caution and remain aware of the potential risks involved.

Is Sen Hui a scam, or is it legit?

The latest exposure and evaluation content of Sen Hui brokers.

Sen Hui Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Sen Hui latest industry rating score is 1.61, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.61 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.