Is Securedoptionbase safe?

Business

License

Is Securedoptionbase Safe or Scam?

Introduction

Securedoptionbase is a forex broker that has emerged in the competitive landscape of online trading, claiming to offer a range of services for both novice and experienced traders. However, the importance of thoroughly assessing the credibility of forex brokers cannot be overstated. Traders invest their hard-earned money, and it is crucial to ensure that they are dealing with a trustworthy platform. In this article, we will investigate the safety and legitimacy of Securedoptionbase by examining its regulatory status, company background, trading conditions, customer feedback, and overall risk profile. Our research methodology includes analyzing user reviews, regulatory databases, and expert opinions to provide a comprehensive evaluation.

Regulation and Legitimacy

The regulatory status of a forex broker is a critical factor in determining its safety. Securedoptionbase has been flagged as an unregulated broker, which raises significant concerns about the security of traders' funds. Without oversight from a reputable financial authority, there is no guarantee that the broker adheres to industry standards for transparency and ethical practices.

| Regulatory Authority | License Number | Regulated Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Not Regulated |

The absence of regulation means that traders' funds are not protected by any legal framework, making it easy for unscrupulous brokers to operate without accountability. The lack of a verified regulatory license is a red flag, as it indicates that Securedoptionbase does not meet the necessary criteria to operate as a legitimate broker. This raises the question: Is Securedoptionbase safe? The overwhelming consensus from various reviews and reports suggests that it is not.

Company Background Investigation

Securedoptionbase's company background reveals a concerning lack of transparency. The broker does not provide adequate information regarding its ownership structure or the qualifications of its management team. This absence of information is alarming, as reputable brokers typically disclose their operational history, team expertise, and corporate governance practices.

The company's history appears to be relatively short, with limited information available about its establishment and growth trajectory. This lack of transparency can hinder potential traders from making informed decisions. Furthermore, the absence of a clear regulatory framework raises questions about the broker's legitimacy and long-term viability. Overall, the opaque nature of Securedoptionbase's operations significantly contributes to the skepticism surrounding its safety.

Trading Conditions Analysis

The trading conditions offered by Securedoptionbase reflect a mix of standard and concerning practices. While the broker claims to provide competitive spreads and trading options, the overall fee structure remains ambiguous. Traders should be wary of hidden fees that could significantly impact their profitability.

| Fee Type | Securedoptionbase | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1.0 - 1.5 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | 0.5% - 1.5% |

The lack of clarity regarding spreads, commissions, and overnight interest rates raises concerns about the broker's fee structure. Hidden fees can erode trading profits and lead to unexpected losses. Consequently, potential traders should exercise caution and conduct thorough research before engaging with Securedoptionbase.

Customer Funds Safety

The safety of customer funds is a paramount concern for any trader. Securedoptionbase has not provided sufficient information regarding its fund security measures. The lack of details about fund segregation, investor protection, and negative balance protection policies raises significant red flags.

Traders should be particularly cautious when dealing with brokers that do not implement strict security measures. The absence of fund segregation means that client funds may not be kept separate from the broker's operational funds, increasing the risk of loss in case of financial instability. Furthermore, without investor protection mechanisms, traders have little recourse in the event of fraud or mismanagement.

Customer Experience and Complaints

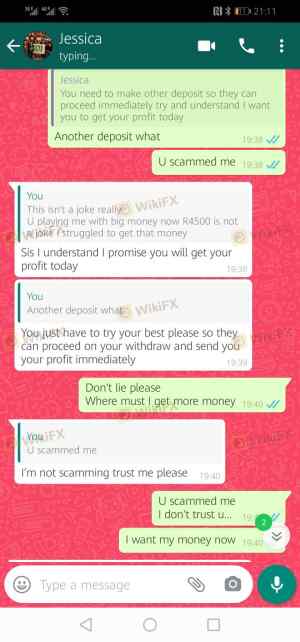

Customer feedback regarding Securedoptionbase paints a troubling picture. Many users have reported negative experiences, including difficulties in withdrawing funds, poor customer service, and misleading marketing practices. Common complaints include:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support | Medium | Poor |

| Misleading Information | High | Poor |

One notable case involved a trader who reported that their withdrawal requests were consistently denied, leading to frustration and financial loss. Such complaints indicate a pattern of untrustworthy behavior, further questioning the broker's legitimacy. This leads us to ask again: Is Securedoptionbase safe? The evidence suggests it is not.

Platform and Execution

The trading platform offered by Securedoptionbase is another critical aspect to consider. While the platform may appear user-friendly, the overall performance, stability, and execution quality remain questionable. Reports of slippage and rejected orders have been cited by users, which can significantly impact trading outcomes.

Additionally, any signs of platform manipulation should be taken seriously. If traders experience frequent technical issues or irregularities in order execution, it raises concerns about the broker's integrity. In this regard, potential users should approach Securedoptionbase with caution.

Risk Assessment

Using Securedoptionbase presents an array of risks that potential traders should be aware of. The lack of regulation, unclear trading conditions, and poor customer feedback contribute to a high-risk profile for this broker.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Financial Risk | High | Potential loss of funds |

| Operational Risk | Medium | Issues with platform stability |

To mitigate these risks, traders should conduct thorough due diligence, consider using regulated brokers, and refrain from investing more than they can afford to lose.

Conclusion and Recommendations

In conclusion, the evidence gathered raises significant concerns regarding the safety of Securedoptionbase. The lack of regulation, transparency issues, and negative customer feedback suggest that this broker may not be trustworthy. It is crucial for traders to exercise caution and consider alternative options with verified regulatory oversight.

For those seeking reliable trading platforms, we recommend exploring brokers that are well-regulated and have a proven track record of customer satisfaction. Overall, the question remains: Is Securedoptionbase safe? Based on the available information, it appears to be a risky choice for traders.

Is Securedoptionbase a scam, or is it legit?

The latest exposure and evaluation content of Securedoptionbase brokers.

Securedoptionbase Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Securedoptionbase latest industry rating score is 1.52, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.52 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.