Is ROYAL TRADES safe?

Business

License

Is Royal Trades Safe or Scam?

Introduction

Royal Trades is a forex and CFD broker that has emerged in the competitive landscape of online trading. It claims to offer a variety of accounts and trading instruments, aiming to attract both novice and experienced traders. However, the importance of thoroughly evaluating forex brokers cannot be overstated. Traders need to ensure that they are engaging with a legitimate entity to protect their investments and avoid potential scams. This article investigates the safety and legitimacy of Royal Trades, employing a comprehensive framework that includes regulatory status, company background, trading conditions, client experiences, and risk assessment.

Regulation and Legitimacy

The regulatory status of a broker is one of the most critical factors that determine its legitimacy. Royal Trades claims to operate out of the UK; however, it lacks regulation by any recognized authority such as the Financial Conduct Authority (FCA). This absence of oversight raises significant concerns regarding the safety of client funds and adherence to industry standards. Below is a summary of the regulatory information regarding Royal Trades:

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The lack of regulation means that Royal Trades is not subject to any strict compliance requirements, which typically protect investors. Moreover, the broker has been flagged by the Comisión Nacional del Mercado de Valores (CNMV) in Spain as a fraudulent entity. This warning highlights the potential risks associated with trading through Royal Trades and emphasizes the need for extreme caution. In summary, Royal Trades is not a safe broker, and the absence of regulatory oversight is a major red flag.

Company Background Investigation

Understanding the history and ownership structure of a broker can provide valuable insights into its legitimacy. Unfortunately, there is limited information available regarding Royal Trades. The company does not disclose its ownership details or the identities of its management team on its website, which is a significant transparency issue. A lack of information about the individuals behind the brokerage raises concerns about accountability and reliability.

Additionally, the company's website mentions that it is based in London, but this claim is questionable given its unregulated status. The absence of a clear corporate structure and the anonymity of its management team further contribute to the skepticism surrounding the broker. In conclusion, Royal Trades lacks transparency, which is essential for establishing trust in the financial industry.

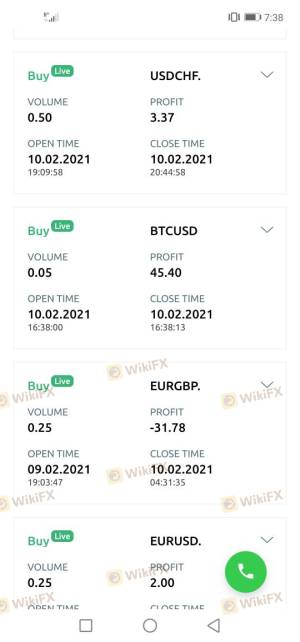

Trading Conditions Analysis

Royal Trades offers several account types, each with varying minimum deposit requirements and trading conditions. However, the overall fee structure raises concerns. The broker claims to provide competitive spreads and leverage options, but these can often be misleading. Below is a comparison of the core trading costs associated with Royal Trades:

| Fee Type | Royal Trades | Industry Average |

|---|---|---|

| Major Currency Pair Spread | From 1.8 pips | From 1.5 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The spreads offered by Royal Trades are significantly higher than the industry average, indicating that traders may incur higher costs compared to more reputable brokers. Furthermore, the lack of clarity regarding commission structures and overnight interest rates adds to the uncertainty. Traders should be cautious, as high trading costs can erode potential profits and lead to unfavorable trading experiences. Therefore, Royal Trades may not offer the best trading conditions, making it essential for traders to consider alternatives.

Client Fund Security

The safety of client funds is paramount when evaluating a broker. Royal Trades does not provide clear information about its security measures or whether client funds are held in segregated accounts. Without proper segregation of funds, there is a risk that client deposits could be misused or lost in the event of the broker's insolvency.

Additionally, the absence of investor protection schemes is concerning. Legitimate brokers typically offer measures such as negative balance protection and compensation schemes in case of financial disputes. Royal Trades' lack of these protections raises alarms about the safety of client investments. Historical controversies surrounding the broker, particularly its classification as a fraudulent entity by regulatory authorities, further compound these concerns. In conclusion, Royal Trades does not prioritize client fund security, making it a risky choice for traders.

Customer Experience and Complaints

Customer feedback is a crucial aspect of assessing a broker's reliability. Reviews of Royal Trades reveal a pattern of negative experiences from users, with many reporting issues related to withdrawal difficulties and poor customer service. Below is a summary of common complaints and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow or Non-responsive |

| Customer Service | Medium | Inconsistent Support |

| Misleading Information | High | Lack of Transparency |

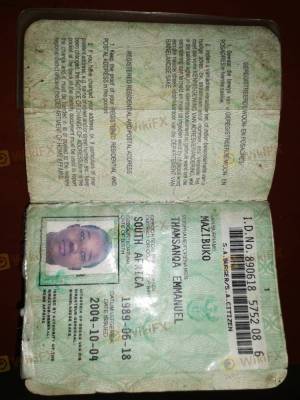

One notable case involves a trader who reported being unable to withdraw funds after multiple requests, leading to frustration and a sense of being scammed. Such experiences are alarming and indicate that Royal Trades may not provide adequate support or transparency, further diminishing its credibility.

Platform and Trade Execution

The trading platform offered by Royal Trades is based on MetaTrader 4, a widely used platform in the industry. However, the performance and stability of the platform are critical for a successful trading experience. Users have reported issues such as slippage and order rejections, which can severely impact trading outcomes. Furthermore, there are no indications of platform manipulation, but the overall user experience remains questionable.

In summary, while the platform itself may be functional, the execution quality and reliability of Royal Trades are not guaranteed. Traders should be aware that using Royal Trades may expose them to execution risks, which can lead to financial losses.

Risk Assessment

Trading with Royal Trades involves several inherent risks. The lack of regulation, high trading costs, and poor customer service contribute to an overall negative risk profile. Below is a risk scorecard summarizing the key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated broker with a history of fraud |

| Financial Risk | High | High trading costs and lack of fund protection |

| Customer Service Risk | Medium | Poor response to complaints and support issues |

To mitigate these risks, traders are advised to conduct thorough research before opening an account. Additionally, it is recommended to consider brokers with robust regulatory oversight and transparent practices.

Conclusion and Recommendations

After a comprehensive analysis, it is evident that Royal Trades is not a safe broker. The absence of regulation, lack of transparency, high trading costs, and negative customer experiences all point to significant risks for potential investors. Traders should exercise extreme caution and consider alternative options that offer better security and reliability.

For those still interested in trading, it is advisable to look for brokers that are regulated by top-tier authorities such as the FCA or ASIC. These brokers typically provide better protection for client funds and a more transparent trading environment. In conclusion, potential investors should prioritize their safety and consider more reputable alternatives to avoid the pitfalls associated with unregulated brokers like Royal Trades.

Is ROYAL TRADES a scam, or is it legit?

The latest exposure and evaluation content of ROYAL TRADES brokers.

ROYAL TRADES Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

ROYAL TRADES latest industry rating score is 1.51, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.51 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.