Is Rmhed safe?

Business

License

Is Rmhed Safe or a Scam?

Introduction

In the fast-paced world of forex trading, choosing a reliable broker is paramount for traders looking to maximize their investment potential. Rmhed, a forex broker operating under the name Romand Hedge Capital Limited, has gained attention in the trading community. However, with the increasing number of scams in the forex market, it is essential for traders to conduct thorough evaluations before committing their funds. This article aims to provide a balanced analysis of Rmheds credibility, focusing on its regulatory status, company background, trading conditions, client safety measures, and user experiences. The investigation employs a structured approach, combining qualitative insights with quantitative data to ensure a comprehensive assessment.

Regulation and Legitimacy

One of the foremost indicators of a forex broker's reliability is its regulatory status. Regulation serves as a safeguard for traders, ensuring that brokers adhere to industry standards and practices. In the case of Rmhed, the broker operates without any recognized regulatory oversight, which raises significant concerns about its legitimacy and trustworthiness.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Unregulated |

The absence of regulation poses a considerable risk for traders, as it means there is no governing body to oversee Rmheds operations or protect clients' interests. Furthermore, the lack of transparency regarding its licensing and compliance history suggests that Rmhed may not prioritize regulatory standards. This is a critical red flag, especially in an industry where unregulated brokers can engage in unethical practices, such as manipulating trades or withholding funds.

Company Background Investigation

Understanding a broker's history and ownership structure can provide valuable insights into its reliability. Rmhed, registered as Romand Hedge Capital Limited, claims to have been in operation for several years. However, detailed information about its founding, ownership, and management team remains sparse. This lack of transparency is concerning, as reputable brokers typically provide comprehensive information about their background and team.

The management team‘s professional experience is a crucial factor in assessing the broker's credibility. Unfortunately, there is limited publicly available information regarding the qualifications and backgrounds of Rmhed's executives. The absence of a well-defined corporate structure and clear leadership can lead to doubts about the broker’s operational integrity and responsiveness to client needs.

Moreover, the company‘s transparency level regarding its operations and business practices is questionable. A trustworthy broker should provide easily accessible information about its services, fees, and any potential conflicts of interest. The lack of such disclosures raises concerns about Rmhed’s commitment to ethical trading practices and client welfare.

Trading Conditions Analysis

When evaluating a forex broker, understanding its trading conditions, including fees and spreads, is essential. Rmhed presents a range of trading instruments, but the specifics regarding its fee structure are not readily available. This opacity can lead to unexpected costs for traders, making it difficult to assess the overall cost-effectiveness of trading with Rmhed.

| Fee Type | Rmhed | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1.0 - 2.0 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The absence of clear information on spreads and commissions is a significant drawback. Traders may find themselves facing higher costs than anticipated, which can erode potential profits. Moreover, if Rmhed employs unusual or hidden fees, it could undermine the trading experience and lead to dissatisfaction among clients.

Client Funds Security

The security of client funds is a paramount concern when selecting a forex broker. Rmhed's lack of regulation raises serious questions about its client fund protection measures. Reliable brokers typically segregate client funds from their operational accounts, ensuring that traders' money is safe even in the event of the broker's financial difficulties.

An in-depth analysis of Rmhed's fund security measures reveals a lack of information regarding fund segregation, investor protection schemes, and negative balance protection policies. This absence of safeguards could expose traders to significant risks, particularly if the broker encounters financial instability. Furthermore, any historical issues related to fund safety or disputes would further exacerbate concerns about Rmheds reliability.

Customer Experience and Complaints

Customer feedback is an essential component in evaluating the overall credibility of a forex broker. A review of user experiences with Rmhed reveals a mixed bag of opinions, with several traders expressing dissatisfaction regarding the broker's responsiveness and service quality.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow Response |

| Lack of Customer Support | Medium | Inconsistent |

| Misleading Information | High | Unresolved |

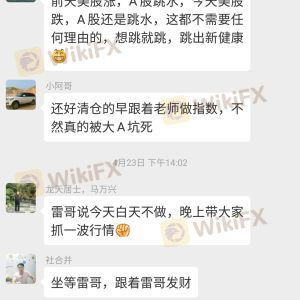

Common complaints include difficulties in withdrawing funds and a lack of timely responses from customer support. These issues are particularly concerning, as they indicate potential operational inefficiencies and a lack of commitment to client satisfaction. A few users have reported feeling misled by the broker's marketing claims, further highlighting the need for transparency and accountability.

Platform and Trade Execution

The performance of a trading platform plays a crucial role in a trader's experience. Rmhed claims to offer a user-friendly trading platform, but there is limited information available about its stability and execution quality. Traders must be able to rely on their broker to execute trades efficiently and without undue delays.

Concerns about slippage and order rejections are common in the forex market, and any signs of manipulation or unfair practices can severely impact traders' trust in a broker. Without clear evidence of Rmhed's execution quality, potential clients may find it challenging to assess the platform's reliability.

Risk Assessment

Using Rmhed as a forex broker carries inherent risks, particularly given its unregulated status and lack of transparency.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Compliance | High | No recognized regulation |

| Fund Security | High | Lack of fund segregation |

| Customer Service | Medium | Slow response times and complaints |

| Trading Conditions | High | Unclear fee structure |

To mitigate these risks, traders should approach Rmhed with caution. It is advisable to conduct thorough research and consider starting with a small investment to gauge the broker's reliability before committing significant funds.

Conclusion and Recommendations

In conclusion, the evidence suggests that Rmhed may pose significant risks for potential traders. Its lack of regulation, limited transparency, and mixed customer feedback raise serious concerns about its credibility. While some traders may still consider using Rmhed, it is crucial to remain vigilant and cautious.

Traders looking for reliable alternatives should consider brokers regulated by reputable authorities, such as the FCA or ASIC. These brokers typically offer greater transparency, better customer service, and enhanced fund protection measures. Overall, it is essential for traders to prioritize safety and reliability in their choice of forex broker, ensuring that their investments are well-protected.

Is Rmhed a scam, or is it legit?

The latest exposure and evaluation content of Rmhed brokers.

Rmhed Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Rmhed latest industry rating score is 1.57, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.57 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.