Is RLHK safe?

Business

License

Is RLHK Safe or Scam?

Introduction

In the ever-evolving world of forex trading, the broker you choose plays a pivotal role in your trading success. RLHK, a broker based in Hong Kong, has emerged as a point of interest for many traders. However, with the rise of online trading, the potential for scams has also increased, making it crucial for traders to carefully assess the legitimacy of their chosen brokers. This article aims to provide a comprehensive evaluation of RLHK, examining its regulatory status, company background, trading conditions, and customer experiences, to determine whether RLHK is safe or a potential scam.

Our investigation is based on a thorough analysis of multiple sources, including user reviews, regulatory information, and expert opinions. The evaluation framework focuses on key aspects such as regulatory compliance, company history, trading conditions, customer feedback, and risk assessment.

Regulation and Legitimacy

Understanding the regulatory framework within which a broker operates is essential for assessing its safety. RLHK claims to be regulated by the Hong Kong Securities and Futures Commission (SFC). Regulatory oversight is crucial, as it ensures that brokers adhere to strict operational standards and protects traders' interests.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Hong Kong SFC | Not disclosed | Hong Kong | Verified |

The SFC is known for its stringent regulatory requirements, which include maintaining sufficient capital reserves and conducting regular audits. However, the lack of a disclosed license number raises questions about the transparency of RLHK's operations. Furthermore, while the SFC is a reputable regulatory authority, the absence of any historical compliance issues or sanctions against RLHK is a positive indicator. Nonetheless, traders should remain vigilant and conduct their own due diligence before engaging with this broker.

Company Background Investigation

RLHK was established in 2021, positioning itself as a player in the competitive forex market. The companys ownership structure and management team are critical to understanding its legitimacy. Unfortunately, detailed information about the management team and their professional backgrounds is scarce, which could be a red flag for potential investors.

Transparency is a vital component of trust in the financial sector. RLHK's limited disclosure of its operational history and management experience may deter some traders. A broker with a well-documented history and a competent management team typically instills more confidence among potential clients. Without this information, it becomes challenging to fully assess whether RLHK is safe for trading or if it poses a risk to investors.

Trading Conditions Analysis

When evaluating a broker, understanding its trading conditions is essential. RLHK offers various trading instruments, but the specifics regarding spreads, commissions, and overnight interest rates are not clearly laid out.

| Fee Type | RLHK | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Not disclosed | 1.0 - 2.0 pips |

| Commission Model | Not disclosed | Varies |

| Overnight Interest Range | Not disclosed | 1.0 - 3.0% |

The lack of transparency in fee structures can be concerning. Traders often rely on clear information regarding costs to make informed decisions. If RLHK does not provide competitive spreads and commissions comparable to industry averages, it may not be the best choice. Furthermore, any unusual fees or hidden charges could indicate potential scams. Therefore, it is imperative to clarify these details with the broker before proceeding.

Client Fund Safety

The safety of client funds is a paramount concern for any trader. RLHK claims to implement measures to protect client funds, including segregated accounts and investor protection policies. However, the specifics of these measures are not well-documented.

Segregated accounts are essential as they ensure that client funds are kept separate from the broker's operational funds, reducing the risk of loss in case of insolvency. Additionally, investor protection schemes can provide a safety net for traders in the event of a broker's failure. However, without clear documentation or evidence of these protections, one must question whether RLHK is safe for managing investments.

Historically, there have been no reported incidents of fund mismanagement or security breaches associated with RLHK, which is a positive sign. Nevertheless, traders should remain cautious and consider the potential risks involved.

Customer Experience and Complaints

Customer feedback is invaluable in assessing a broker's reliability. Reviews of RLHK reveal a mixed bag of experiences. Some users report smooth trading experiences, while others have raised concerns regarding withdrawal issues and customer service responsiveness.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Customer Service Quality | Medium | Mixed reviews |

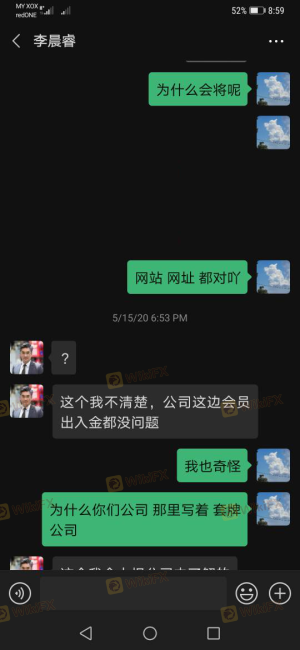

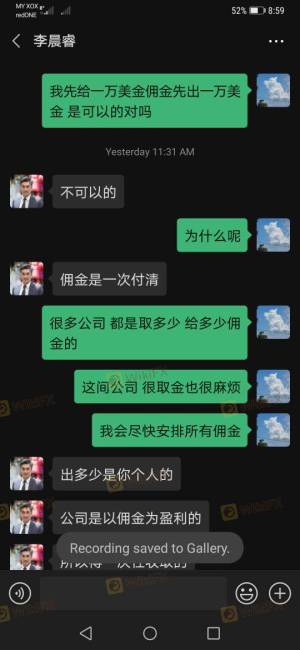

Common complaints include difficulties in withdrawing funds and lack of timely responses from customer support. Such issues can significantly impact a trader's experience and raise concerns about the broker's integrity. For instance, one user reported being unable to withdraw profits due to unspecified "processing fees," which raises red flags about the broker's practices.

While RLHK has responded to some complaints, the overall sentiment suggests that their customer service may not be adequately equipped to handle issues efficiently. This could indicate that RLHK is not entirely safe, especially for traders who may require immediate assistance.

Platform and Execution

The trading platform offered by RLHK is another critical aspect to consider. A reliable trading platform should provide stability, ease of use, and efficient order execution. RLHK utilizes the popular MetaTrader 4 platform, which is known for its robustness and user-friendly interface.

However, reports of slippage and order rejections have surfaced among users. Such issues can affect trading performance and lead to significant losses. If traders experience frequent execution problems, it may signal potential manipulation or inefficiencies within the trading environment. Therefore, assessing whether RLHK is safe involves scrutinizing the platform's performance and reliability closely.

Risk Assessment

Using RLHK as a trading platform comes with inherent risks. The overall risk profile can be summarized as follows:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | Medium | Lack of clear regulatory status |

| Financial Risk | High | Unclear fee structures |

| Operational Risk | Medium | Customer service complaints |

| Security Risk | Medium | Limited information on fund protection |

To mitigate these risks, traders should conduct thorough research and consider diversifying their trading activities across multiple brokers. Staying informed about market regulations and best practices can also help safeguard investments.

Conclusion and Recommendations

In conclusion, while RLHK presents itself as a legitimate forex broker, several factors raise concerns regarding its safety. The lack of transparency in regulatory status, unclear fee structures, and mixed customer feedback suggest that traders should exercise caution.

For those considering trading with RLHK, it is advisable to start with a small investment and closely monitor the trading experience. If significant issues arise, it may be prudent to withdraw funds and seek alternative brokers with a stronger reputation for reliability and customer service.

In summary, while RLHK is operational, the question remains: Is RLHK safe? Given the current information, potential traders should approach with caution and consider more established alternatives in the forex market.

Is RLHK a scam, or is it legit?

The latest exposure and evaluation content of RLHK brokers.

RLHK Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

RLHK latest industry rating score is 1.54, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.54 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.