Is Rexmark safe?

Pros

Cons

Is Rexmark Safe or Scam?

Introduction

Rexmark is a forex broker that has emerged in the competitive landscape of the foreign exchange market since its establishment in 2018. Based in Hong Kong, it positions itself as a platform for traders looking to engage in forex trading. However, the question that looms large for potential users is whether Rexmark is safe or a scam. In an industry rife with unregulated brokers and scams, it is crucial for traders to conduct thorough evaluations before committing their funds. This article aims to objectively analyze Rexmarks credibility by examining its regulatory status, company background, trading conditions, and customer experiences. Our investigation is based on a review of multiple sources, including user testimonials and industry evaluations, to provide a comprehensive view of Rexmark's standing in the forex market.

Regulation and Legitimacy

A broker's regulatory status is a critical factor in assessing its safety. Regulation ensures that brokers adhere to specific standards that protect traders from fraud and malpractice. Unfortunately, Rexmark currently lacks regulation from any recognized financial authority. This absence of oversight raises significant concerns regarding investor protection.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Regulated |

The lack of a regulatory framework means that Rexmark does not have to comply with the stringent requirements that regulated brokers must follow. This includes rules about fund segregation, regular audits, and transparency in operations. In the forex industry, brokers that operate without regulation are often viewed with suspicion, as they can potentially engage in unethical practices without fear of repercussions. The absence of any regulatory history or compliance records further compounds the risks associated with trading through Rexmark.

Company Background Investigation

Rexmark was founded in 2018, making it a relatively new entrant in the forex brokerage space. While its establishment might suggest a fresh approach to trading, the lack of a substantial track record raises questions about its reliability. The ownership structure of Rexmark is not transparently disclosed, which is a red flag for potential investors.

The management team‘s background is crucial in assessing the broker's credibility. However, there is limited information available regarding the qualifications and experience of Rexmark's executives. Without clear insights into the management’s expertise, it is difficult to ascertain the broker's operational integrity.

Furthermore, the level of transparency in information disclosure is concerning. Potential clients should be able to access comprehensive information about the broker's operations, including its financial health and business practices. The absence of such disclosures can lead to doubts about Rexmark's legitimacy and overall safety.

Trading Conditions Analysis

When evaluating whether Rexmark is safe, understanding its trading conditions is essential. The broker claims to offer competitive spreads and trading fees; however, the specifics remain vague.

| Fee Type | Rexmark | Industry Average |

|---|---|---|

| Major Currency Pair Spread | TBD | TBD |

| Commission Model | TBD | TBD |

| Overnight Interest Range | TBD | TBD |

The lack of clear information on trading costs can be problematic for traders. Hidden fees or unusual cost structures can significantly impact trading profitability. Furthermore, the absence of a commission model can lead to confusion, as traders might be unaware of the potential costs associated with their trades. This lack of clarity in trading conditions raises concerns about the overall fairness and transparency of Rexmark's fee structure.

Client Fund Security

One of the most critical aspects of trading with any broker is the security of client funds. Rexmark's approach to fund safety is unclear, especially considering its lack of regulation. Typically, regulated brokers are required to segregate client funds from their operational funds, ensuring that traders' money is protected even if the broker faces financial difficulties.

Rexmark's failure to provide information about its fund segregation practices and investor protection policies is alarming. Additionally, there are no indications of negative balance protection, which can leave traders vulnerable to losing more than their initial investments. Historical issues regarding fund security or disputes have not been documented, but the absence of a regulatory framework heightens the risk of potential fund mismanagement.

Customer Experience and Complaints

Customer feedback is a valuable resource for assessing the reliability of a broker. In the case of Rexmark, user experiences have been mixed, with several complaints surfacing regarding withdrawal issues and customer service responsiveness.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Difficulty with Withdrawals | High | Poor |

| Customer Service Delays | Medium | Average |

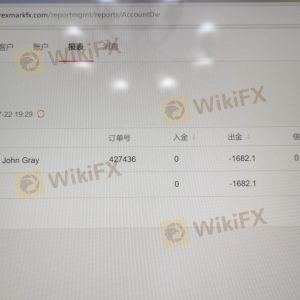

Common complaints include difficulties in withdrawing funds, with some users reporting prolonged waiting times and unresponsive customer service. These issues indicate a lack of support for traders who may encounter problems while using the platform.

For instance, one user reported being unable to access their account for an extended period, while another highlighted issues with fund withdrawals that took longer than expected. Such complaints are serious as they can significantly affect a trader's confidence in the broker's ability to manage their funds securely and efficiently.

Platform and Execution

The performance of a trading platform is vital for a successful trading experience. Rexmark's platform has been described as user-friendly, but there are concerns regarding its stability and execution quality.

Traders have reported instances of slippage and order rejections, which can adversely affect trading outcomes. Any signs of platform manipulation, such as unusual delays in order execution, can further erode trust in the broker. Users expect a seamless trading experience, and any disruptions can lead to significant financial losses.

Risk Assessment

Using Rexmark presents several risks that potential traders should consider.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight. |

| Fund Safety Risk | High | Lack of fund segregation and protection policies. |

| Customer Service Risk | Medium | Complaints regarding responsiveness and withdrawal issues. |

Given these risks, it is essential for traders to approach Rexmark with caution. To mitigate these risks, potential users should consider starting with a minimal investment, thoroughly reviewing the terms and conditions, and monitoring their trading experience closely.

Conclusion and Recommendations

In conclusion, the evidence suggests that Rexmark is not a safe option for forex trading. The lack of regulation, transparency issues, and numerous customer complaints raise significant red flags. Traders should be particularly wary of the potential for withdrawal difficulties and inadequate customer support.

For those seeking reliable trading options, it is advisable to consider brokers that are well-regulated and have a proven track record of client satisfaction. Alternatives such as brokers regulated by the FCA, ASIC, or NFA offer a higher level of security and reliability. Ultimately, conducting thorough due diligence is crucial for traders to ensure the safety of their investments in the forex market.

Is Rexmark a scam, or is it legit?

The latest exposure and evaluation content of Rexmark brokers.

Rexmark Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Rexmark latest industry rating score is 1.57, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.57 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.