Regarding the legitimacy of Rely Group forex brokers, it provides ASIC, FCA, FSCA and WikiBit, .

Is Rely Group safe?

Business

License

Is Rely Group markets regulated?

The regulatory license is the strongest proof.

ASIC Market Making License (MM)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

UnverifiedLicense Type:

Market Making License (MM)

Licensed Entity:

STRATOS TRADING PTY. LIMITED

Effective Date: Change Record

2007-05-15Email Address of Licensed Institution:

compliance@fxcm.comSharing Status:

No SharingWebsite of Licensed Institution:

https://www.fxcm.com/au/Expiration Time:

--Address of Licensed Institution:

STRATOS TRADING PTY. LIMITED 'PART' SE 2 L 12 530 COLLINS ST MELBOURNE VIC 3000Phone Number of Licensed Institution:

1800109751Licensed Institution Certified Documents:

FCA Market Making License (MM)

Financial Conduct Authority

Financial Conduct Authority

Current Status:

UnverifiedLicense Type:

Market Making License (MM)

Licensed Entity:

Stratos Markets Limited

Effective Date:

2003-05-27Email Address of Licensed Institution:

compliance@fxcm.comSharing Status:

No SharingWebsite of Licensed Institution:

www.fxcm.com/uk/, www.tradu.com/ukExpiration Time:

--Address of Licensed Institution:

125 Old Broad Street Ninth Floor London EC2N 1AR UNITED KINGDOMPhone Number of Licensed Institution:

+44 02073984050Licensed Institution Certified Documents:

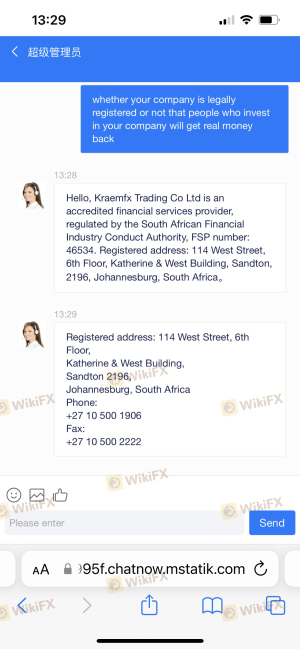

FSCA Derivatives Trading License (EP)

Financial Sector Conduct Authority

Financial Sector Conduct Authority

Current Status:

UnverifiedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

STRATOS SOUTH AFRICA (PTY) LTD

Effective Date:

2016-02-09Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

61 KATHERINE STREET 9TH FLOOR SANDTON JOHANNESBURG 2196Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is Rely Group Safe or Scam?

Introduction

Rely Group is a forex broker that positions itself primarily within the Chinese market, offering trading services that include a variety of financial instruments. As the forex market continues to grow, it becomes increasingly important for traders to evaluate the credibility and safety of brokers before committing their funds. The potential for scams and fraudulent practices in the industry necessitates a careful approach to selecting a trading partner. In this article, we will conduct a thorough investigation into Rely Group, assessing its legitimacy, regulatory status, trading conditions, and customer experiences. Our evaluation will be based on a comprehensive review of available online resources, including regulatory databases, user reviews, and expert opinions.

Regulation and Legitimacy

The regulatory framework surrounding forex brokers is critical to ensuring the safety of traders' funds and the integrity of trading practices. Rely Group's regulatory status raises significant concerns. According to various sources, Rely Group operates without proper licensing, which is a red flag for potential investors. The lack of regulation means that there are no authoritative bodies overseeing the company's operations, leaving traders vulnerable to potential fraud.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unlicensed |

The absence of regulatory oversight is alarming, as it suggests that Rely Group may not adhere to industry standards and practices designed to protect traders. Additionally, warnings from financial authorities indicate that Rely Group may be classified as an unlicensed entity, further solidifying concerns about its legitimacy. Without a regulatory framework to ensure compliance, traders must exercise extreme caution when considering Rely Group as a potential broker.

Company Background Investigation

Rely Group's history and ownership structure provide further insight into its operations. The company appears to operate primarily in China, but details regarding its founding, ownership, and management team are scarce. This lack of transparency raises questions about the broker's credibility and operational integrity. A thorough analysis of the management team's background is essential, as experienced professionals typically lead reputable firms. However, the limited information available on Rely Group's leadership suggests a potential lack of expertise and accountability.

Moreover, the company's information disclosure practices are questionable. A transparent broker should provide comprehensive details about its operations, management, and financial standing. The absence of such information may indicate an unwillingness to be held accountable for its practices, which is a significant concern for potential traders. In conclusion, the lack of transparency and regulatory oversight raises serious doubts about whether Rely Group is safe for traders.

Trading Conditions Analysis

When evaluating a forex broker, understanding its trading conditions is crucial. Rely Group's fee structure and trading costs must be analyzed to determine whether they align with industry standards. Reports suggest that Rely Group's trading conditions may not be competitive, with potentially hidden fees that could impact traders' profitability.

| Fee Type | Rely Group | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1.0 - 2.0 pips |

| Commission Structure | N/A | Varies |

| Overnight Interest Range | N/A | 1.5% - 3.0% |

The lack of specific details regarding spreads, commissions, and overnight interest rates is concerning. Traders should expect transparency in these areas, as unclear or unusual fee structures can often indicate potential scams. Furthermore, if Rely Group employs a commission model that is not clearly defined, it may lead to unexpected costs for traders, further questioning the broker's safety.

Client Fund Safety

The safety of client funds is paramount when selecting a forex broker. Rely Group's measures for protecting client funds are critical to consider. Reports indicate that Rely Group does not have robust fund segregation practices, which means that client funds may not be kept in separate accounts from the company's operational funds. This lack of protection poses a significant risk to traders, as it increases the likelihood of losing funds in the event of financial difficulties faced by the broker.

Additionally, the absence of investor protection schemes, such as negative balance protection, raises further concerns. Traders should be aware that without these safeguards, they could potentially lose more than their initial investment. Historical incidents of fund security issues associated with unregulated brokers further highlight the risks involved. Therefore, it is essential to question whether Rely Group is safe for traders when it comes to the protection of their investments.

Customer Experience and Complaints

Analyzing customer feedback and experiences is vital in assessing a broker's reliability. User reviews of Rely Group reveal a pattern of complaints regarding withdrawal issues and unresponsive customer service. Many traders have reported difficulties in accessing their funds, which is a significant red flag in evaluating whether Rely Group is safe.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service | Medium | Poor |

| Transparency | High | None |

Typical cases involve traders attempting to withdraw their funds only to face delays or complete denial of access. Such experiences indicate a lack of accountability and responsiveness from the broker, which is alarming for potential clients. The absence of effective complaint resolution mechanisms further exacerbates concerns about Rely Group's reliability.

Platform and Trade Execution

The performance of the trading platform is another critical factor in assessing a broker's credibility. Rely Group's trading platform has been described as lacking stability, with reports of frequent outages and execution issues. Traders have expressed frustration with slippage and order rejections, which can severely impact trading outcomes.

The potential for manipulation on the platform is also a concern. If a broker's platform is not functioning correctly or is subject to irregularities, it can lead to significant financial losses for traders. Therefore, it is crucial to question whether Rely Group is safe in terms of its trading platform and execution quality.

Risk Assessment

Using Rely Group as a forex broker presents several inherent risks. A comprehensive risk assessment reveals multiple areas of concern that potential traders should consider before engaging with the broker.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unlicensed broker with no oversight. |

| Fund Safety | High | Lack of fund segregation and protection. |

| Customer Service | Medium | Poor response to complaints and issues. |

| Trading Conditions | High | Unclear fees and potential hidden costs. |

To mitigate these risks, traders should conduct thorough research and consider alternative brokers with a proven track record of regulatory compliance and customer satisfaction. Engaging with well-regulated brokers can significantly reduce the risks associated with trading.

Conclusion and Recommendations

In conclusion, the evidence suggests that Rely Group raises significant concerns regarding its safety and legitimacy as a forex broker. The lack of regulatory oversight, transparency, and customer service responsiveness indicates that traders should approach with caution. The potential for fund security issues and poor trading conditions further solidifies the notion that Rely Group may not be a safe choice for traders.

For those seeking reliable alternatives, consider brokers that are well-regulated, offer transparent trading conditions, and have a history of positive customer experiences. Options such as FXCM or other reputable brokers may provide a safer trading environment. Ultimately, the decision to trade with Rely Group should be made with careful consideration of the associated risks and potential pitfalls.

Is Rely Group a scam, or is it legit?

The latest exposure and evaluation content of Rely Group brokers.

Rely Group Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Rely Group latest industry rating score is 1.50, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.50 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.