Regarding the legitimacy of PURE MARKET forex brokers, it provides VFSC, FCA and WikiBit, (also has a graphic survey regarding security).

Is PURE MARKET safe?

Pros

Cons

Is PURE MARKET markets regulated?

The regulatory license is the strongest proof.

VFSC Forex Trading License (EP)

Vanuatu Financial Services Commission

Vanuatu Financial Services Commission

Current Status:

Offshore RegulatedLicense Type:

Forex Trading License (EP)

Licensed Entity:

Pure M Global Limited

Effective Date: Change Record

2024-03-25Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

--Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

FCA Forex Execution License (STP)

Financial Conduct Authority

Financial Conduct Authority

Current Status:

Clone FirmLicense Type:

Forex Execution License (STP)

Licensed Entity:

Price Markets UK Ltd

Effective Date:

2016-10-03Email Address of Licensed Institution:

compliance@pricemarkets.comSharing Status:

No SharingWebsite of Licensed Institution:

https://pricemarkets.comExpiration Time:

2023-04-06Address of Licensed Institution:

Westlink House 981 Great West Road Brentford TW8 9DN UNITED KINGDOMPhone Number of Licensed Institution:

4402088175269Licensed Institution Certified Documents:

Is Pure Market Safe or a Scam?

Introduction

Pure Market is an online forex broker that has positioned itself as a provider of low-cost trading solutions, catering to a diverse clientele across the globe. Established in 2016, it offers a range of trading instruments, including forex, CFDs, and cryptocurrencies, through popular platforms like MetaTrader 4 and MetaTrader 5. However, as with any financial trading platform, it is crucial for traders to conduct thorough due diligence before committing their funds. The forex market is rife with potential risks, including scams and unregulated brokers, which can lead to significant financial losses. This article aims to provide a comprehensive evaluation of Pure Market, focusing on its regulatory status, company background, trading conditions, customer safety, and user experiences. The analysis is based on various online reviews, regulatory records, and user feedback to determine whether Pure Market is safe or a potential scam.

Regulation and Legitimacy

The regulatory status of a broker is one of the most critical factors for traders when assessing its legitimacy. Pure Market claims to be regulated by the Vanuatu Financial Services Commission (VFSC), which is known for its relatively lax regulatory standards. While the broker is registered and has a license number (14801), the VFSC is classified as a tier-3 regulator, which raises concerns about the level of investor protection it offers.

| Regulatory Authority | License Number | Regulated Area | Verification Status |

|---|---|---|---|

| Vanuatu Financial Services Commission | 14801 | Vanuatu | Verified |

The VFSC imposes minimal capital requirements and does not enforce strict compliance measures, which can lead to higher risks for traders. Additionally, Pure Market's parent company, Pure M Global Ltd., has been associated with other brokers that have received warnings from regulatory bodies. This history of regulatory scrutiny further complicates the broker's reputation. Therefore, while Pure Market is technically regulated, the quality of that regulation is questionable and may not offer adequate protection for traders.

Company Background Investigation

Pure Market is owned by Pure M Global Ltd., a company that operates out of Vanuatu. Since its inception in 2016, the firm has aimed to provide a transparent trading environment by offering low spreads and a variety of trading instruments. However, the lack of detailed information regarding the management team raises concerns about the broker's transparency.

The available data suggests that the management team has some experience in trading, but specific qualifications or backgrounds are not disclosed publicly. This lack of information may indicate a lower level of transparency, which is essential for building trust with clients. Furthermore, the company's website does not provide substantial details about its operational practices or compliance measures, which can be a red flag for potential investors.

Trading Conditions Analysis

When evaluating whether Pure Market is safe, it is essential to analyze its trading conditions, including fees, spreads, and commissions. The broker offers two main account types: the MT4 account and the MT5 account, each with different minimum deposit requirements and fee structures.

| Fee Type | Pure Market | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.2 pips | 1.0 pips |

| Commission Model | $30 per million traded (MT4) / $6.5 per lot (MT5) | $5 per lot |

| Overnight Interest Range | Varies by position | Varies by position |

While the spreads offered by Pure Market appear competitive, the commission structure could be considered high compared to industry standards. Additionally, the broker imposes withdrawal fees that can vary significantly depending on the method chosen, which could impact traders' overall profitability. These fee structures may deter some traders, especially those who are cost-sensitive.

Customer Funds Safety

The safety of customer funds is paramount when assessing a broker's reliability. Pure Market claims to maintain client funds in segregated accounts, which is a standard practice aimed at protecting traders' investments. However, the broker does not provide clear information regarding the banks where these funds are held, nor does it offer any investor protection schemes that are common among more reputable brokers.

Moreover, the absence of negative balance protection—an essential feature that prevents traders from losing more than their initial investment—raises additional concerns. Historical records indicate that Pure Market has faced scrutiny regarding its fund management practices, although specific incidents have not been publicly documented. This lack of transparency regarding fund safety measures may lead traders to question whether Pure Market is genuinely safe.

Customer Experience and Complaints

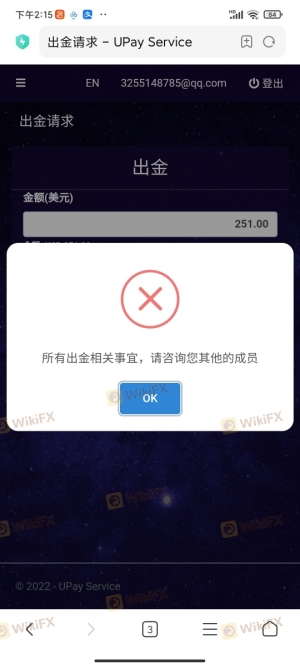

Customer feedback provides valuable insights into a broker's operational integrity. Reviews of Pure Market reveal a mixed bag of experiences, with some users praising the broker's trading conditions and customer service, while others have reported issues with withdrawals and account management.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| High Fees | Medium | Average |

| Customer Support Issues | Medium | Average |

Notably, several users have reported delays in processing withdrawals, which is a significant concern for traders who prioritize access to their funds. Complaints about high fees and inadequate customer support have also surfaced, indicating a trend of dissatisfaction among users. For instance, one trader noted that their account was suspended without adequate explanation, leading to frustration and mistrust. Such experiences highlight the importance of considering user feedback when evaluating whether Pure Market is safe.

Platform and Execution

The trading platform's performance is critical for a smooth trading experience. Pure Market utilizes MetaTrader 4 and MetaTrader 5, both of which are widely regarded as industry standards. However, user reviews suggest that there may be issues with order execution, including slippage and delays during high volatility periods.

While the platforms themselves are stable, the reported instances of rejected orders and inconsistent execution quality raise questions about the broker's reliability in critical trading situations. Traders should be cautious, as these factors can significantly impact trading outcomes and overall satisfaction.

Risk Assessment

Using Pure Market carries several inherent risks that traders should be aware of. The regulatory environment, combined with customer feedback and the broker's operational practices, suggests a medium to high-risk profile.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Lax oversight from a tier-3 regulator. |

| Fund Safety | Medium | Lack of investor protection and negative balance protection. |

| Customer Service | Medium | Mixed reviews on responsiveness and effectiveness. |

To mitigate these risks, traders should consider diversifying their investments across multiple brokers, ensuring they do not allocate all their funds to a single platform. Additionally, it is advisable to start with a demo account to familiarize oneself with the trading environment before committing real capital.

Conclusion and Recommendations

In conclusion, while Pure Market is a legally registered broker with some appealing trading conditions, several factors lead to concerns about its overall safety. The lax regulatory environment, combined with mixed customer experiences and inadequate transparency in fund management, suggests that traders should exercise caution.

For traders considering using Pure Market, it is essential to weigh the potential benefits against the risks involved. Those with a lower risk tolerance or who prioritize strong regulatory oversight may want to explore alternative brokers with more robust regulatory frameworks and better customer feedback. Reliable alternatives include brokers regulated by tier-1 authorities, such as the FCA or ASIC, which offer enhanced protections and a more transparent trading environment.

Ultimately, the question remains: Is Pure Market safe? The answer leans toward caution, and potential traders should conduct thorough research and consider their risk appetite before engaging with this broker.

Is PURE MARKET a scam, or is it legit?

The latest exposure and evaluation content of PURE MARKET brokers.

PURE MARKET Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

PURE MARKET latest industry rating score is 2.38, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 2.38 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.