Pure Market 2025 Review: Everything You Need to Know

Executive Summary

Pure Market shows a mixed picture in the forex world. This pure market review finds a broker that gets both strong support and criticism from clients, with 66% of users giving five-star ratings while 24% provided one-star reviews.

The broker's main attractions include spreads starting from 0.0 pips and full platform support through both MT4 and MT5 trading environments. Pure Market calls itself a real STP and DMA broker. It targets traders who want fast execution speeds and competitive trading conditions, operating from London, United Kingdom, and working in financial services since 1999 with access to over 70 trading instruments across various asset classes.

The broker works best for traders who value rapid order execution, low spreads, and strong customer service. However, potential clients should know about the mixed user feedback and do thorough research before using the platform.

Important Disclaimers

This review uses available user feedback, trading conditions analysis, and public information about Pure Market. Traders should note that specific regulatory information was not detailed in available sources, which may present additional considerations for risk assessment.

Different regional entities may offer varying services and protections. Prospective clients should verify regulatory status in their area before opening accounts, and the assessment uses user testimonials, trading condition analysis, and market research.

Due to limited regulatory background information in available sources, traders should conduct independent verification of licensing and regulatory compliance before engaging with the broker.

Rating Framework

Broker Overview

Pure Market has worked in the forex industry since 1999. It operates from its London headquarters with a focus on providing efficient trading services to global clients, positioning itself as a technology-driven broker that emphasizes its real STP and DMA business model to deliver fast execution speeds typically under 200 milliseconds and access to deep market liquidity.

This approach aims to provide traders with direct market access while maintaining transparency in order processing. The broker's infrastructure supports comprehensive trading through industry-standard MT4 and MT5 platforms, enabling access to over 70 trading instruments spanning currency pairs, indices, stocks, and cryptocurrency markets.

Pure Market operates under the business name "Pure M Global Limited" and has maintained its presence in the competitive forex brokerage sector for over two decades. The company emphasizes technological advancement and market transparency as core components of its service delivery model.

Regulatory Status: Specific regulatory information was not detailed in available sources. Prospective clients need independent verification.

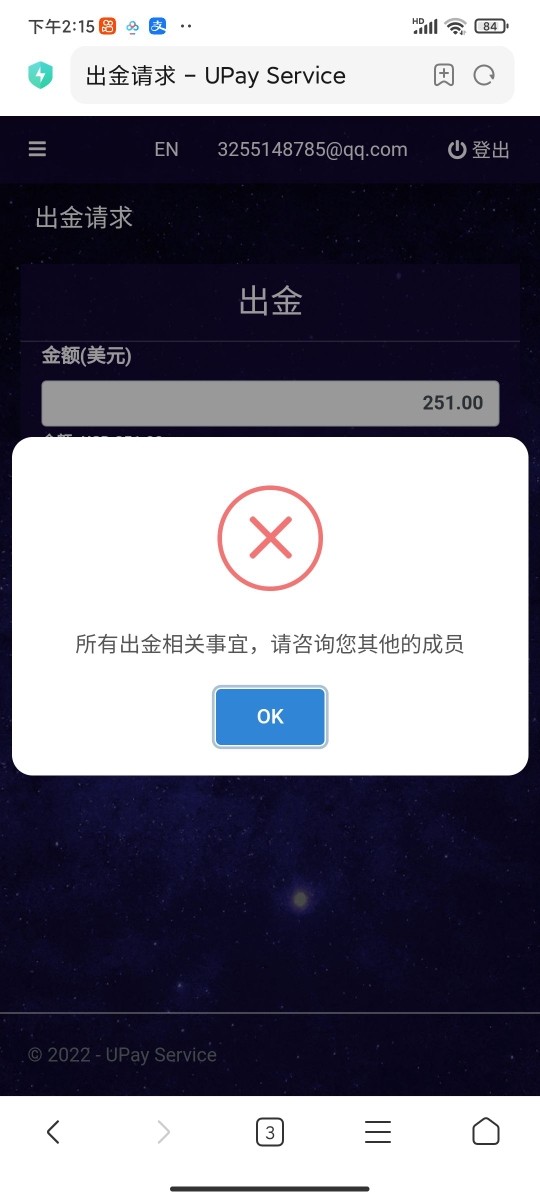

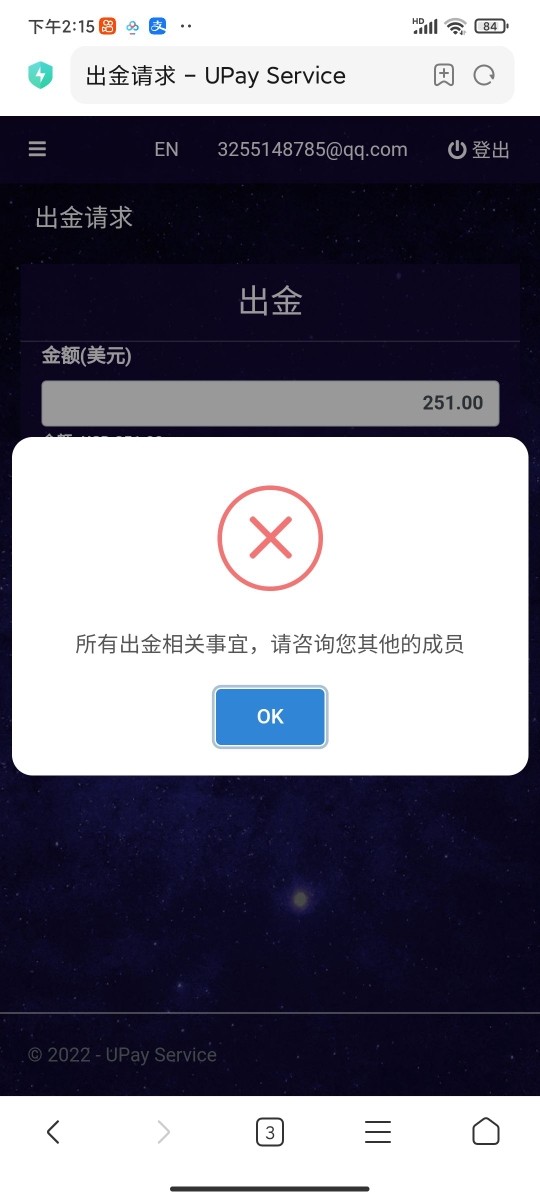

Deposit and Withdrawal Methods: Detailed information about payment processing methods was not specified in available materials.

Minimum Deposit Requirements: Specific minimum deposit thresholds were not mentioned in accessible sources.

Bonus and Promotions: Current promotional offerings were not detailed in available information.

Tradeable Assets: The broker provides access to over 70 instruments including currency pairs, indices, stocks, and cryptocurrency markets. This offers diverse trading opportunities across multiple asset classes.

Cost Structure: Pure Market advertises spreads starting from 0.0 pips with competitive commission structures. However, detailed fee schedules were not comprehensively outlined in available sources.

Leverage Ratios: Specific leverage information was not detailed in accessible materials.

Platform Options: The broker supports both MT4 and MT5 trading platforms. This provides traders with established and widely-used trading environments.

Geographic Restrictions: Regional limitations were not specified in available information.

Customer Support Languages: Supported languages for customer service were not detailed in accessible sources.

This pure market review shows that while the broker offers competitive trading conditions, several important operational details require direct verification with the company.

Detailed Rating Analysis

Account Conditions Analysis (6/10)

Pure Market's account conditions present a mixed picture of competitive advantages alongside transparency concerns. The broker's primary strength lies in its advertised spreads starting from 0.0 pips, which positions it competitively within the industry for cost-conscious traders, and the commission structure is described as competitive though specific details about commission rates across different account types were not comprehensively outlined in available sources.

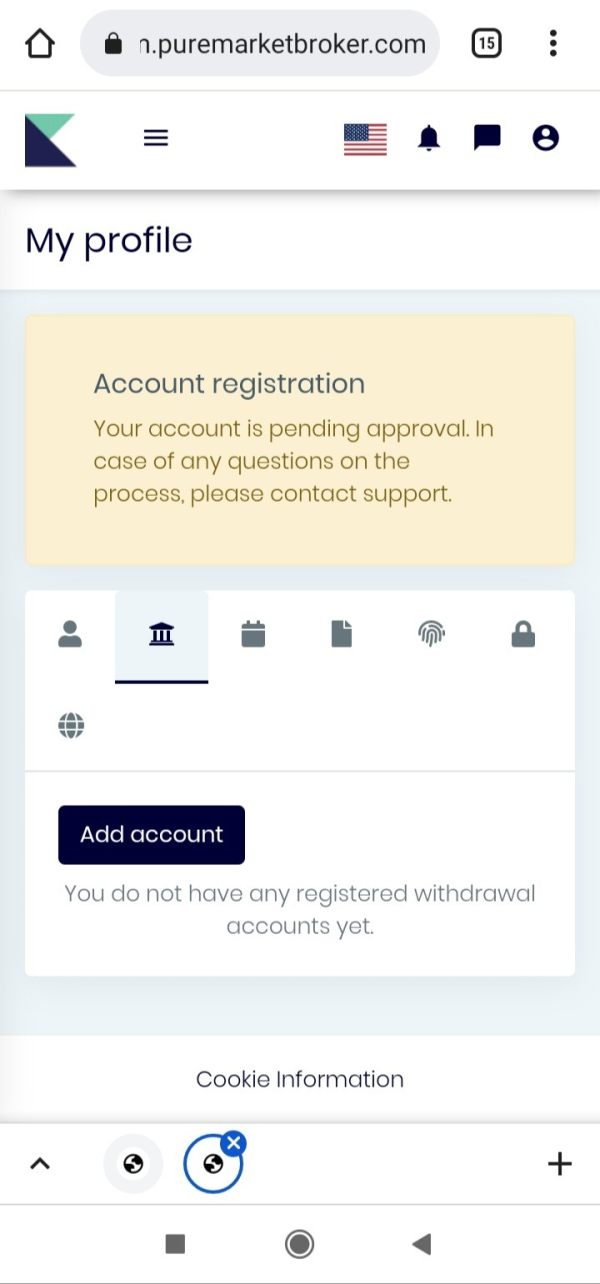

The absence of clearly stated minimum deposit requirements and account type specifications in accessible materials impacts the transparency assessment. This lack of detailed account information makes it challenging for potential clients to make fully informed decisions about account selection and initial funding requirements, while the broker's operational model emphasizes STP and DMA execution which typically benefits serious traders seeking institutional-quality execution.

However, the limited availability of specific account features reduces the overall assessment. User feedback suggests varying experiences with account opening processes, though specific procedural details were not extensively documented, and the pure market review process reveals that while trading conditions appear competitive, enhanced transparency in account specifications would strengthen the overall offering.

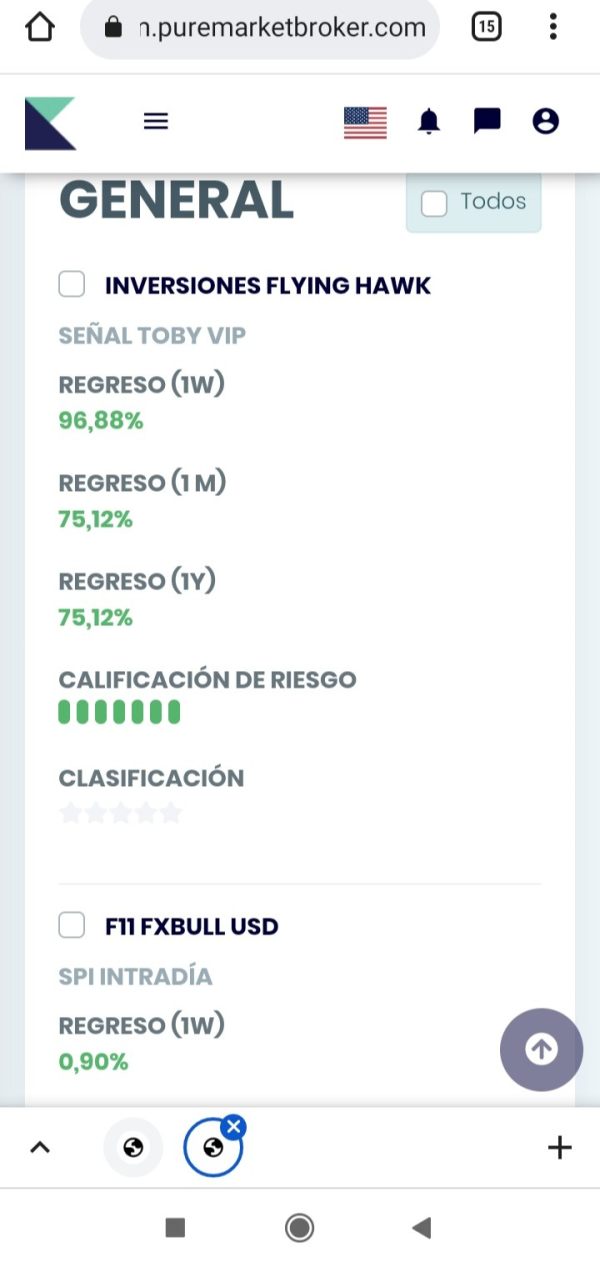

Pure Market shows strong performance in tools and resources provision. It earns recognition for its comprehensive platform support and trading instrument diversity, with the broker's commitment to providing both MT4 and MT5 platforms ensuring traders have access to industry-standard trading environments with robust functionality and widespread market acceptance.

These platforms support advanced charting, automated trading capabilities, and extensive technical analysis tools. The broker's instrument offering exceeds 70 tradeable assets across multiple categories including forex pairs, indices, stocks, and cryptocurrencies, enabling traders to implement varied strategies and access different market sectors within a single trading environment.

The range of available instruments suggests adequate liquidity provision and market coverage for most trading approaches. Advanced trading tools are mentioned in available information, though specific details about proprietary tools, research resources, or educational materials were not extensively documented, and the technological infrastructure supporting sub-200ms execution speeds indicates investment in quality trading technology.

However, the assessment is limited by the absence of detailed information about research capabilities, market analysis resources, and educational support materials that many traders value for strategy development and market understanding.

Customer Service and Support Analysis (7/10)

Customer service represents an area of generally positive performance with notable areas for improvement based on user feedback patterns. Available user testimonials indicate that many clients appreciate the responsiveness and helpfulness of Pure Market's support team, with particular recognition for problem-solving capabilities and professional communication standards.

However, the significant percentage of one-star reviews suggests that customer service experiences vary considerably among users. Some clients have reported challenges with support interactions, though specific details about response times, available communication channels, or service hour coverage were not comprehensively outlined in accessible sources, and the polarized feedback pattern indicates inconsistent service delivery that affects overall customer satisfaction.

The absence of detailed information about multilingual support capabilities, 24-hour availability, or specialized support for different account types limits the comprehensive assessment of service quality. User feedback suggests that while many clients receive satisfactory support, the variation in service experiences creates uncertainty about service consistency, and improvement in service standardization could significantly enhance the overall customer experience and reduce the negative feedback percentage.

Trading Experience Analysis (7/10)

Pure Market's trading experience centers on its STP and DMA execution model. This provides direct market access and typically results in faster order processing and reduced conflicts of interest, with user feedback indicating general satisfaction with execution speeds and the broker advertising sub-200ms processing times that align with institutional-quality execution standards.

This technological capability supports scalping strategies and high-frequency trading approaches. The platform stability appears adequate based on user testimonials, though specific uptime statistics or performance benchmarks were not detailed in available sources, and the availability of both MT4 and MT5 platforms provides traders with familiar environments and extensive functionality for analysis and execution.

The spread stability from 0.0 pips offers competitive trading costs for active traders. However, the pure market review process reveals limited information about mobile trading capabilities, platform customization options, or additional trading features that enhance the overall experience, with user feedback suggesting satisfactory performance for basic trading needs though advanced features and specialized trading tools were not extensively documented.

The trading environment appears suitable for straightforward forex and CFD trading, with room for enhancement in specialized features and mobile optimization.

Trust and Safety Analysis (5/10)

Trust and safety represent the most concerning aspect of Pure Market's offering. This is primarily due to limited regulatory information in available sources, with the absence of clearly stated regulatory oversight, licensing details, or compliance frameworks creating uncertainty about client protection standards and operational oversight.

This regulatory opacity significantly impacts the trust assessment and requires independent verification by prospective clients. User feedback regarding safety and security shows mixed patterns, with some clients expressing confidence in the broker's operations while others raise concerns about various operational aspects, and the lack of detailed information about fund segregation, investor protection schemes, or regulatory compliance measures limits the ability to assess actual safety standards comprehensively.

The broker's longevity since 1999 provides some operational credibility. It suggests sustained business operations over more than two decades, but without clear regulatory backing or detailed safety protocols, the trust assessment remains limited.

The significant variation in user ratings may partly reflect concerns about transparency and regulatory clarity that affect client confidence levels.

User Experience Analysis (6/10)

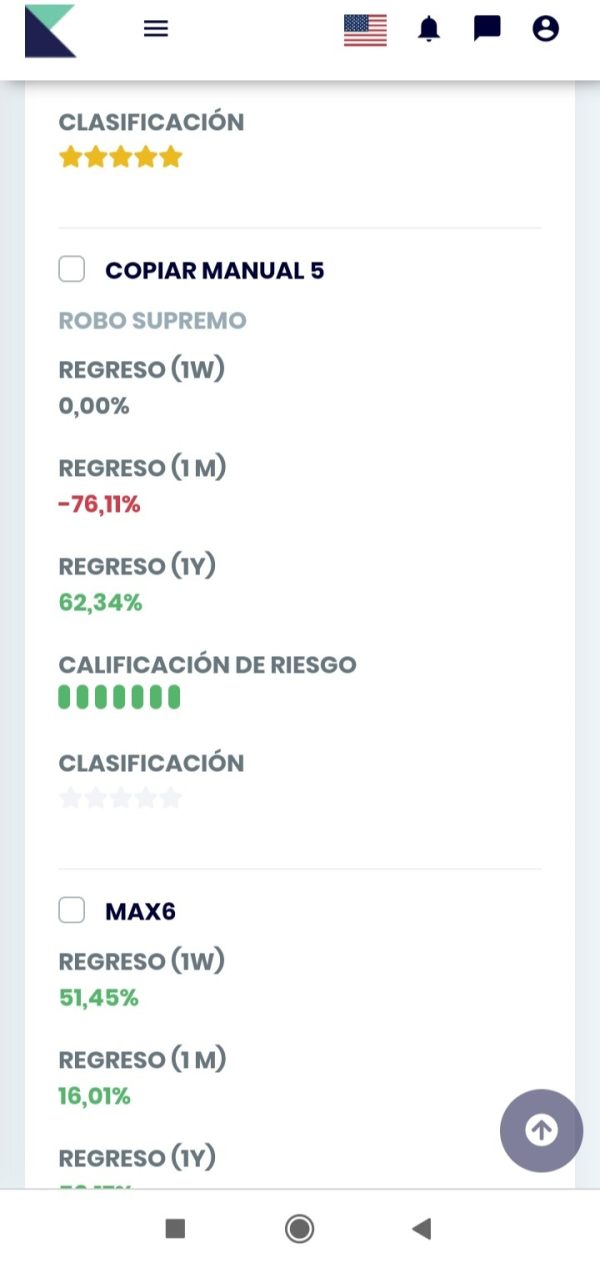

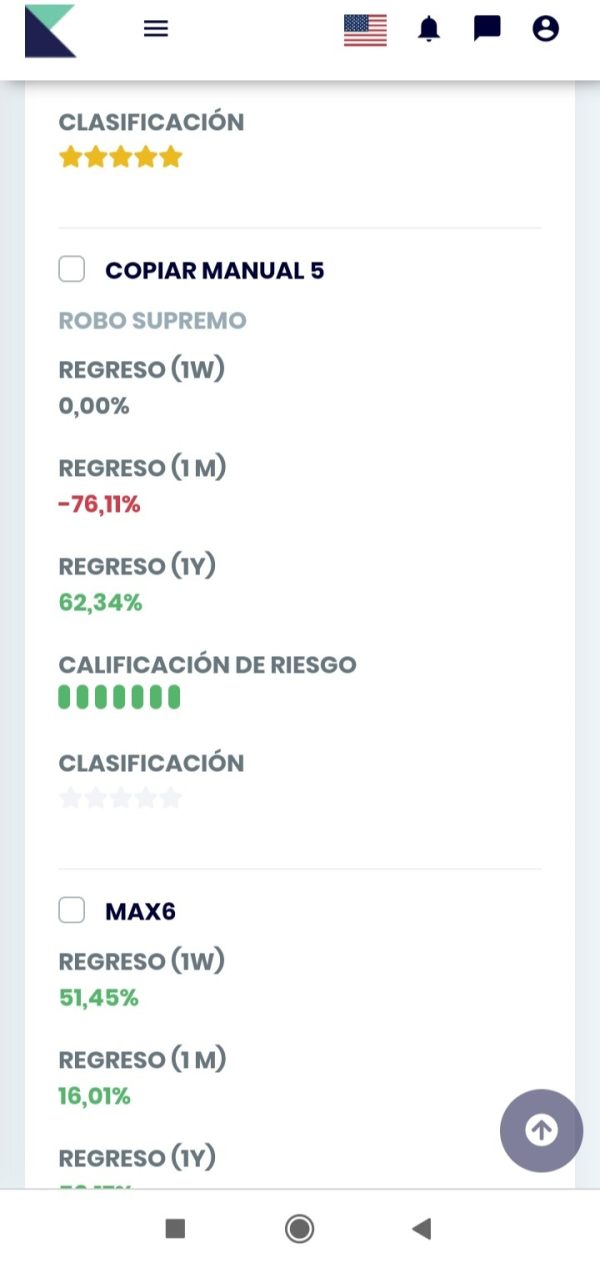

User experience at Pure Market shows significant polarization. The stark contrast between 66% five-star ratings and 24% one-star reviews indicates substantial variation in client satisfaction levels, suggesting that while many users find the service satisfactory or excellent, a significant minority encounters notable problems that severely impact their experience.

Positive user feedback typically centers on execution speed, competitive spreads, and responsive customer service when functioning effectively. Users who prioritize fast execution and cost-effective trading conditions appear more likely to report satisfaction with the service, with the broker's technological infrastructure and platform reliability receiving generally positive mentions from satisfied clients.

Negative feedback patterns appear to relate to service consistency issues and potentially regulatory or transparency concerns. The high percentage of one-star reviews suggests that when problems occur, they significantly impact user satisfaction, and interface design, registration processes, and fund operation experiences were not comprehensively documented in available materials, limiting detailed user experience assessment.

The broker would benefit from addressing the factors contributing to negative experiences to improve overall user satisfaction consistency.

Conclusion

This comprehensive pure market review reveals a broker with competitive trading conditions but mixed user satisfaction levels. Pure Market's strengths include attractive spreads starting from 0.0 pips, STP/DMA execution model, and generally responsive customer service, appearing most suitable for traders who prioritize fast execution speeds, competitive costs, and direct market access capabilities.

However, significant concerns include limited regulatory transparency, inconsistent user experiences, and substantial variation in client satisfaction levels. The 24% one-star rating percentage alongside 66% five-star ratings indicates polarized experiences that potential clients should carefully consider.

Traders seeking regulatory clarity and consistent service delivery may need to conduct additional due diligence before engaging with this broker.