ProfitLevel 2025 In-Depth Review: Opportunity or Trap?

Executive Summary

ProfitLevel, a Cyprus-based brokerage, has made a name for itself among traders with its broad suite of trading instruments including forex and CFDs. While it provides opportunities for intermediate to advanced traders, the brokers questionable regulatory practices and high fees present significant risks that potential investors should consider. Whether it's the conflicting reports about its regulatory status or numerous user complaints regarding fund withdrawals, aspiring investors may find themselves navigating a landscape fraught with uncertainty. Thus, ProfitLevel appeals mainly to those who appreciate diverse trading options and low initial deposits but poses considerable risks for less experienced or risk-averse investors.

⚠️ Important Risk Advisory & Verification Steps

- Risk Statement: Engaging with ProfitLevel may involve significant financial risks due to their ambiguous regulatory status and high fee structure.

- Potential Harms: Investors could face difficulties in fund withdrawals, misleading fee structures, and a lack of transparent communication from the broker.

- How to Self-Verify:

- Visit the official Cyprus Securities and Exchange Commission (CySEC) website.

- Use the NFA BASIC Database to check for any regulatory changes or disciplinary actions.

- Verify the current standing of ProfitLevel against official registries to confirm legitimacy.

- Search online reviews and testimonies for real-user experiences.

- Consider consulting with independent financial advisors to discuss your findings.

Rating Framework

Broker Overview

Company Background and Positioning

Founded in 2015, ProfitLevel operates as a trading brand under BCM Begin Capital Markets CY Ltd and is based in Limassol, Cyprus. Although it markets itself as a regulated broker, numerous reports suggest that the company has associations with other poorly-rated entities. The infusion of potentially false regulatory claims raises alarm bells for would-be investors, directly impacting its credibility and market positioning.

Core Business Overview

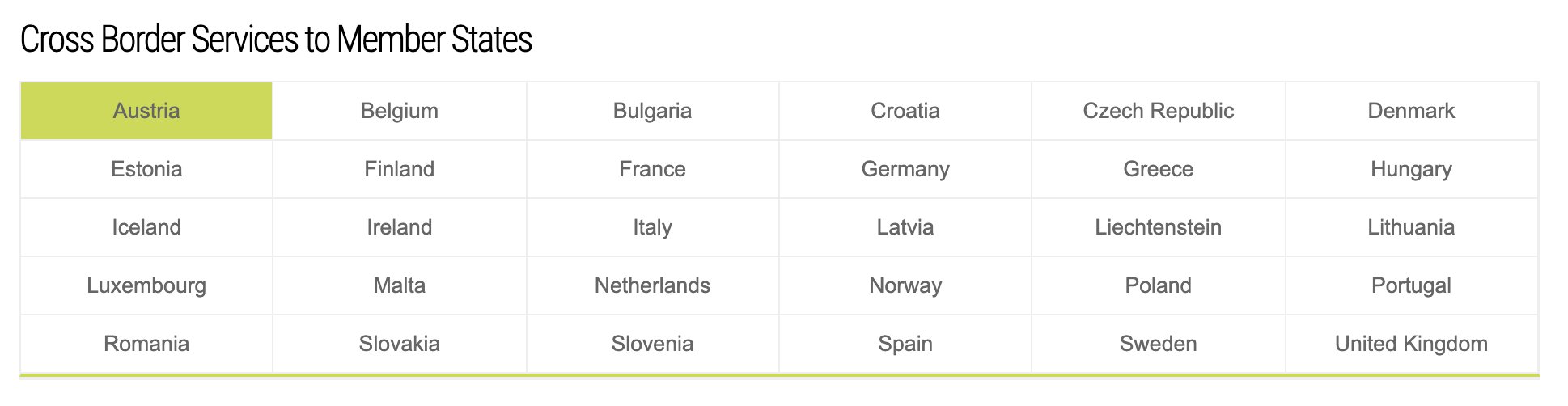

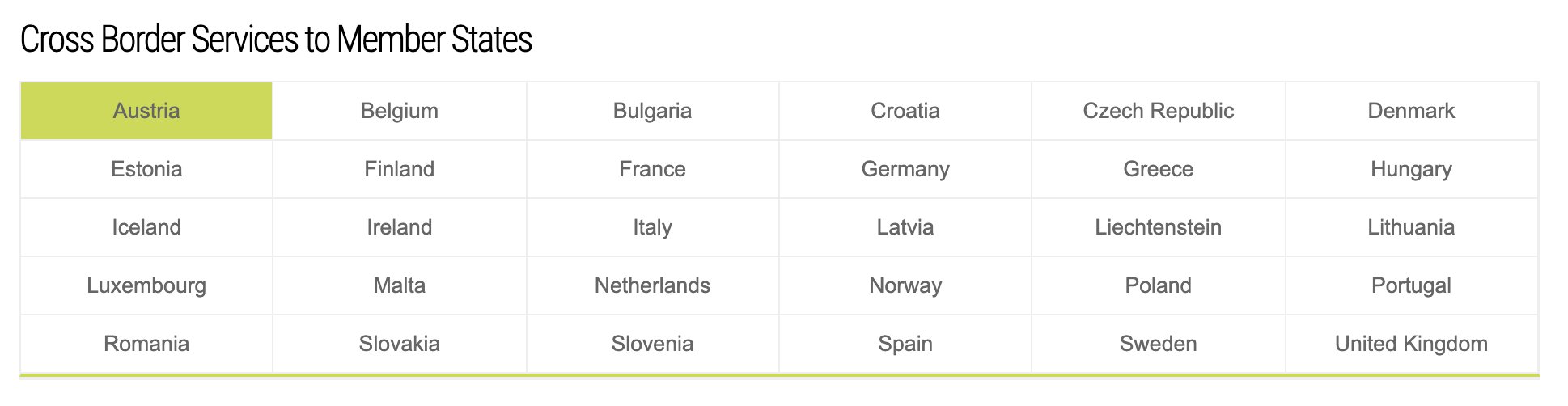

ProfitLevel specializes in a wide array of trading instruments, focusing predominantly on forex and CFDs. It claims to offer access to over 60 currency pairs, multiple indices, stocks, and various commodities. The platform's sole trading interface, the MetaTrader 5 (MT5), allows advanced trading strategies and tools, but the claims about regulatory oversight must be scrutinized closely.

Quick-Look Details Table

In-depth Analysis of Each Dimension

Trustworthiness Analysis

ProfitLevel's trustworthiness comes under scrutiny due to contradictions surrounding its regulatory claims. Confusion often arises from the association with BCM Begin Capital Markets, a firm that has faced regulatory issues in the past.

Analysis of Regulatory Information Conflicts: ProfitLevels representation as a regulated entity conflicts with reports indicating it may not be fully compliant with regulatory standards. As numerous user complaints pile up—particularly regarding withdrawal difficulties—the inherent risk for customers grows.

User Self-Verification Guide:

Visit the CySEC website directly.

Navigate to the registration section and check for ProfitLevels licensure details.

Research any recent disciplinary actions against BCM or associated entities.

Check user experiences and reviews via reputable trading forums.

Use tools like the NFA BASIC Database to assess overall reputation.

Industry Reputation and Summary: The broker suffers from a poor reputation characterized by numerous negative reviews highlighting concerns over fund safety and access.

"Many users have reported issues with fund withdrawals, making it hard to trust ProfitLevel as a reliable broker."

Trading Costs Analysis

ProfitLevel markets itself as a low-cost trading option; however, it presents a double-edged sword.

Advantages in Commissions: The broker showcases competitive commission rates with a starting fee of 0.75%. These rates can be appealing, especially for seasoned traders accustomed to lower fees.

The "Traps" of Non-Trading Fees: Beyond the allure of low commission, ProfitLevel imposes significant withdrawal fees—reportedly $30 per withdrawal—alongside a mandatory $89 maintenance fee charged every three months for inactive accounts.

"Users have documented their frustrations regarding the $30 withdrawal fee, calling it 'excessive and discouraging for investors.'"

- Cost Structure Summary: While some traders may find the structure appealing, others, especially beginners, may balk at the high non-trading fees, creating a mixed appeal.

The broker employs the highly respected MT5 platform, offering decent breadth in tools; however, usability concerns are prevalent.

Platform Diversity: ProfitLevel presents only the MT5 platform, but its integration remains questionable since some users reported MT5 accessed through competitor interfaces leading to confusion.

Quality of Tools and Resources: Even though MT5 is known for its charting capabilities and algorithmic trading, the platform's guide section provided by ProfitLevel lacks the depth and clarity traditionally expected.

Platform Experience Summary: Users have reported a mixed experience with the platform. Some appreciated the comprehensive nature of MT5, while others pointed to the interface linked to another broker, raising suspicions about the platform's reliability.

"I found it frustrating that the MT5 interface says 'Top Forex' on it, often leading me to question whether ProfitLevel is legitimate."

User Experience Analysis

Navigating the user journey with ProfitLevel presents both ease of registration yet complexity in account functionality.

Account Registration Process: The registration process is straightforward, with essential fields like name and email. However, transitioning to a live account requires a detailed submission, which can be cumbersome.

User Interface and Experience: Users share sentiments that while the platform is theoretically sound, it suffers from a chaotic site navigation structure which complicates the user experience.

Feedback from Users: Overall user feedback indicates dissatisfaction regarding account handling and information clarity.

"The navigation is so confusing that often I find myself struggling to find basic account management tools."

Customer Support Analysis

Customer support is available, but reviews highlight inconsistency in its effectiveness.

Support Channels Available: ProfitLevel offers multiple channels such as phone, email, and chat, attempting to cater to a diverse clientele.

Response Times and Quality: Feedback reveals mixed results. While some users enjoyed timely assistance, others lamented long wait times.

User Feedback on Support: Several reviews mention that while support exists, it is often not very helpful or informative.

"I reached out for help, but responses felt generic and unsatisfactory."

Account Conditions Analysis

ProfitLevel's account structure can be prohibitive, especially for beginners.

Account Types and Features: The platform offers a tiered account system, with minimum deposit requirements ranging from $1,000 to $1,000,000, making it financially inaccessible for many small investors.

Minimum Deposits and Leverage: While leverage options up to 1:200 are enticing, the high minimum deposit may alienate a segment of potential users.

Overall Account Conditions Summary: The account conditions present a mixed bag; while substantial leverage is advantageous, the overall structure is complex and potentially off-putting for new traders.

Conclusion

ProfitLevel presents a diverse trading platform that could attract experienced traders, yet it is shrouded in varying degrees of regulatory ambiguity and high fees, which can deter potential investors. In this landscape, while opportunities abound, the associated risks necessitate meticulous consideration and caution from any potential user. Therefore, before proceeding, prospective clients should judiciously evaluate the information available and perform due diligence to protect their investments should temptation overshadow risk.