Is Proact finance Limited safe?

Business

License

Is Proact Finance Limited Safe or Scam?

Introduction

Proact Finance Limited is a relatively new player in the forex market, having been established in 2022. As a forex broker, it aims to provide trading services across various asset classes, including forex, oil, and cryptocurrencies. In an industry rife with both legitimate firms and scams, it is crucial for traders to carefully evaluate brokers before committing their funds. The stakes are high, and without proper due diligence, traders risk losing their investments. This article aims to investigate whether Proact Finance Limited is a safe trading option or a potential scam. Our evaluation will be based on regulatory status, company background, trading conditions, client experiences, and overall risk assessment.

Regulatory and Legitimacy

The regulatory environment in which a broker operates is one of the most significant indicators of its legitimacy. Proact Finance Limited claims to be regulated by the National Futures Association (NFA), a self-regulatory organization in the U.S. However, when the NFA license number provided by Proact Finance Limited was searched, no results were found, raising serious doubts about the broker's regulatory claims.

| Regulatory Body | License Number | Regulatory Area | Verification Status |

|---|---|---|---|

| NFA | Not Found | United States | Suspicious |

The lack of valid regulatory oversight is alarming. A broker's regulatory status is essential for protecting client funds and ensuring fair trading practices. Without a reputable regulator, traders have little recourse in case of disputes or fraudulent activities. Furthermore, Proact Finance Limited has been reported to have a suspicious regulatory license and a high potential risk rating, which raises significant concerns about its operational integrity.

Company Background Investigation

Proact Finance Limited was incorporated in February 2022, and it operates from the United Kingdom. However, the company lacks transparency regarding its ownership structure and management team. There is limited information available about the individuals behind the company, which is often a red flag in the financial services industry. Transparency is critical for building trust, and the absence of information about the management team raises concerns about accountability.

Additionally, the company's official website has been reported as inaccessible during our investigation, further complicating the ability to assess the broker's credibility. A lack of accessible information can be indicative of a company that may not be committed to operating in a transparent manner, which is essential for any financial institution.

Trading Conditions Analysis

Proact Finance Limited offers trading services with a minimum deposit requirement of $5,000, which is considerably higher than the industry average. The broker claims to offer leverage of up to 1:1000, a feature that can attract traders looking for high-risk, high-reward opportunities. However, the lack of transparency regarding spreads and commissions is concerning.

| Fee Type | Proact Finance Limited | Industry Average |

|---|---|---|

| Spread for Major Pairs | Not Disclosed | 1-3 pips |

| Commission Model | Not Disclosed | $0-$10 per lot |

| Overnight Interest Range | Not Disclosed | 0.5%-1.5% |

The absence of clear information on trading costs can lead to unexpected expenses, making it difficult for traders to calculate the true cost of trading. Moreover, the high minimum deposit requirement may deter many potential clients, limiting the broker's accessibility.

Client Fund Security

The safety of client funds is paramount when evaluating any broker. Proact Finance Limited does not provide clear information regarding its fund security measures. There is no mention of segregated accounts, which are crucial for protecting client funds in the event of the broker's insolvency. Additionally, the absence of investor protection schemes or negative balance protection policies is concerning.

Historically, brokers without proper fund security measures have faced issues where clients lost their entire deposits due to mismanagement or fraud. Therefore, the lack of information on these fronts raises significant red flags regarding the safety of funds held with Proact Finance Limited.

Customer Experience and Complaints

Customer feedback is a valuable resource for assessing a broker's reliability. Unfortunately, reviews of Proact Finance Limited on various platforms indicate a pattern of complaints, particularly regarding withdrawal issues. Many users have reported difficulties in accessing their funds, which is a serious concern for any potential trader.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Unresponsive |

| Lack of Customer Support | Medium | Limited to Email |

| Transparency Concerns | High | No Clear Answers |

A notable case involved a trader who was unable to withdraw funds for several months. The lack of timely responses from customer support exacerbated the situation, leading to frustration and financial loss. Such complaints highlight the potential risks associated with trading through Proact Finance Limited.

Platform and Trade Execution

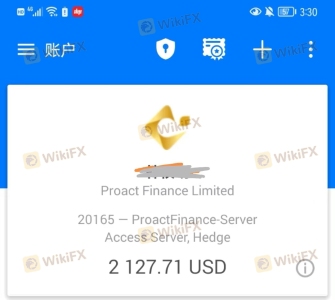

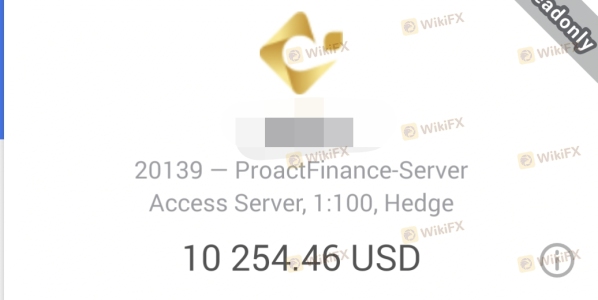

The trading platform offered by Proact Finance Limited is reportedly a mobile application, which may not meet the expectations of traders accustomed to more robust desktop platforms. User reviews indicate that the platform lacks advanced features such as technical analysis tools and copy trading options.

Moreover, concerns have been raised about order execution quality, including slippage and order rejections. If traders experience frequent slippage or rejections, it can significantly impact their trading performance and profitability. The absence of a well-supported trading platform is another factor that raises questions about whether Proact Finance Limited is a safe option for traders.

Risk Assessment

Using Proact Finance Limited carries several risks that traders should be aware of. These risks include:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Compliance | High | No valid regulatory oversight |

| Fund Security | High | Lack of transparency on fund protection |

| Customer Support | Medium | Limited to email with slow response times |

| Trading Conditions | High | High minimum deposit and undisclosed fees |

To mitigate these risks, traders are advised to conduct thorough research before engaging with Proact Finance Limited. It may also be wise to consider alternative brokers with better regulatory standing and customer reviews.

Conclusion and Recommendations

In conclusion, the investigation into Proact Finance Limited raises significant concerns regarding its safety and legitimacy. The lack of valid regulatory oversight, combined with numerous customer complaints and transparency issues, suggests that this broker may not be a safe choice for traders.

For those considering trading with Proact Finance Limited, it is essential to weigh the risks carefully and consider alternative brokers that offer better regulatory protection and customer service. Some reputable alternatives include brokers regulated by top-tier authorities like the FCA or ASIC.

Ultimately, the question "Is Proact Finance Limited safe?" leans towards a cautious "no," and traders should proceed with extreme caution if they choose to engage with this broker.

Is Proact finance Limited a scam, or is it legit?

The latest exposure and evaluation content of Proact finance Limited brokers.

Proact finance Limited Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Proact finance Limited latest industry rating score is 1.46, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.46 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.