Is PLCG EXCHANGE safe?

Business

License

Is PLCG Exchange Safe or a Scam?

Introduction

PLCG Exchange, operated by Parklife Capital Group Co., Ltd., claims to be a forex broker registered in the United States, offering various trading instruments including commodities, forex, indexes, and cryptocurrencies. As the forex market continues to grow, so does the number of brokers entering this space, making it essential for traders to carefully evaluate the legitimacy and safety of these platforms. With numerous reports of scams and fraudulent activities in the industry, assessing the reliability of a broker like PLCG Exchange is crucial for protecting ones investments. This article aims to provide a comprehensive analysis of PLCG Exchange, focusing on its regulatory status, company background, trading conditions, customer security, user experiences, and overall risk assessment. The evaluation is based on a thorough review of available online resources, including user feedback and regulatory databases.

Regulation and Legitimacy

The regulatory status of a broker is a fundamental aspect that determines its legitimacy. PLCG Exchange claims to be regulated by the National Futures Association (NFA) in the United States; however, this claim has been flagged as suspicious. According to various sources, the NFA license number provided by PLCG Exchange is suspected to be a clone, raising significant red flags about its operational legitimacy. The table below summarizes the core regulatory information regarding PLCG Exchange:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| NFA | 0525014 | United States | Suspicious Clone |

The importance of regulation cannot be overstated, as it serves as a safeguard for traders, ensuring that the broker adheres to specific standards and practices. The NFA is known for its stringent requirements, and being associated with a clone license indicates potential malpractice. Furthermore, PLCG Exchange has received a low score of 1.33 out of 10 on platforms like WikiFX, which evaluates brokers based on their regulatory compliance and operational transparency. This low rating further emphasizes the need for caution when considering PLCG Exchange as a trading partner.

Company Background Investigation

PLCG Exchange, under the name Parklife Capital Group Co., Ltd., has a relatively obscure history. Information about the company's inception, ownership structure, and management team is limited, contributing to concerns regarding its transparency. The lack of publicly available data about the company's operational history raises questions about its credibility. The absence of a well-defined management team with verifiable experience in the financial sector further complicates the evaluation of PLCG Exchange's reliability. A reputable broker typically has a transparent ownership structure and a management team with a strong background in finance and trading, which is not evident in the case of PLCG Exchange. The company's website is also noted to be non-functional, which adds another layer of uncertainty regarding its operational status.

Trading Conditions Analysis

When assessing whether PLCG Exchange is safe, understanding its trading conditions is essential. The broker claims to offer various financial instruments, but there is limited information regarding its fee structure and trading conditions. A transparent broker usually provides clear details about spreads, commissions, and other costs associated with trading. However, PLCG Exchange does not disclose this information adequately, which raises concerns about potential hidden fees. The following table summarizes the core trading costs associated with PLCG Exchange, compared to industry averages:

| Cost Type | PLCG Exchange | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1.0-3.0 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | 1.5%-3.0% |

The lack of transparency in trading conditions can lead to unexpected costs for traders, making it difficult to assess the true cost of trading on this platform. This uncertainty is particularly concerning for novice traders who may not have the experience to navigate complex fee structures.

Customer Funds Security

The safety of customer funds is a critical factor in determining whether PLCG Exchange is safe. A reputable broker should implement robust security measures to protect client assets, including segregated accounts, investor protection schemes, and negative balance protection policies. However, PLCG Exchange's approach to fund security remains unclear. There are no publicly available details about how customer funds are managed or whether they are held in segregated accounts, which is a standard practice among reputable brokers.

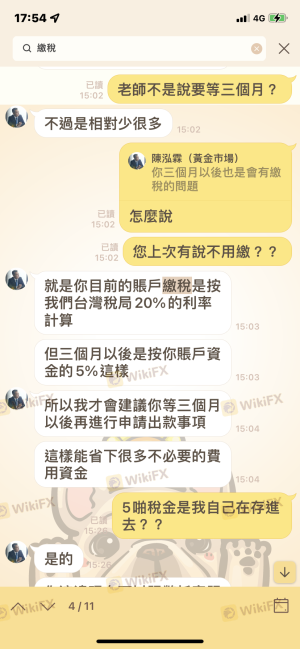

Furthermore, historical issues related to fund security have been reported, with numerous user complaints indicating difficulties in withdrawing funds. These complaints suggest a troubling trend that could indicate potential financial mismanagement or fraudulent practices. Without transparent policies regarding fund security, traders are left vulnerable to potential losses, making it imperative to approach PLCG Exchange with caution.

Customer Experience and Complaints

Analyzing customer feedback is essential for understanding the overall user experience with PLCG Exchange. Numerous reports indicate that traders have faced significant challenges when attempting to withdraw funds, with many users claiming they were unable to access their money. The following table outlines the primary types of complaints received about PLCG Exchange, along with their severity and the company's response:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Unresponsive |

| Fund Mismanagement | High | Ignored complaints |

| Poor Customer Support | Medium | Slow response time |

Typical cases reveal that users often encounter excuses when requesting withdrawals, with customer service representatives providing vague responses. This pattern of behavior raises concerns about the reliability of PLCG Exchange and indicates a lack of commitment to customer satisfaction. Such complaints are particularly alarming for potential investors, as they suggest systemic issues within the company's operations.

Platform and Trade Execution

The performance of the trading platform and the quality of trade execution are crucial factors for traders. PLCG Exchange offers a web-based trading platform known as PLCGGO, but there is limited information available regarding its performance and user experience. Traders often report issues related to order execution quality, including slippage and order rejections. These issues can significantly affect trading outcomes, especially for those employing high-frequency trading strategies.

Moreover, any signs of platform manipulation or technical glitches can further undermine traders' confidence. A reliable broker should provide a seamless trading experience with minimal disruptions. However, the lack of transparency regarding PLCG Exchange's platform performance raises concerns about its operational integrity and the safety of funds.

Risk Assessment

Using PLCG Exchange presents several risks that traders should consider before engaging with the platform. The following risk assessment summarizes key risk areas associated with PLCG Exchange:

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Suspicious regulatory status raises concerns. |

| Fund Security Risk | High | Lack of transparency regarding fund management. |

| Customer Service Risk | Medium | Poor response to complaints and withdrawal issues. |

Given these risks, potential traders should exercise extreme caution. It is advisable to conduct thorough research and consider alternative, more reputable brokers that offer transparent operations and robust regulatory oversight.

Conclusion and Recommendations

In conclusion, the evidence suggests that PLCG Exchange raises several red flags that warrant caution. The suspicious regulatory status, lack of transparency in trading conditions, and numerous customer complaints indicate that this broker may not be safe for trading. Traders should be particularly wary of the potential for withdrawal issues and fund mismanagement.

For those considering engaging with PLCG Exchange, it is essential to weigh the risks carefully. For novice traders or those seeking a reliable trading environment, it may be prudent to explore alternative brokers with strong regulatory oversight and positive user feedback. Reputable options include brokers regulated by top-tier authorities, such as the FCA or ASIC, which provide better investor protection and a more transparent trading experience.

In summary, is PLCG Exchange safe? The weight of the evidence suggests that it is not, and traders should proceed with caution or seek safer alternatives.

Is PLCG EXCHANGE a scam, or is it legit?

The latest exposure and evaluation content of PLCG EXCHANGE brokers.

PLCG EXCHANGE Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

PLCG EXCHANGE latest industry rating score is 1.52, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.52 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.