Is PipsForex safe?

Business

License

Is PipsForex A Scam?

Introduction

PipsForex is an online forex broker that positions itself as a global trading platform, offering a wide range of financial instruments including forex, commodities, indices, and cryptocurrencies. Established in 2020, the broker claims to provide traders with access to advanced trading tools and features. However, the forex market is notorious for its risks, and traders must exercise caution when selecting a broker. With numerous reports of scams and fraudulent activities in the industry, it is crucial to thoroughly evaluate the legitimacy of any trading platform before investing hard-earned money. This article aims to assess whether PipsForex is a safe trading option or a potential scam by examining its regulatory status, company background, trading conditions, customer fund safety, user experiences, and overall risk factors.

Regulation and Legitimacy

The regulatory status of a brokerage is a vital aspect for traders to consider, as it often indicates the level of protection afforded to clients. PipsForex claims to operate under several licenses, but a closer investigation reveals a lack of credible regulatory oversight. The following table summarizes the core regulatory information:

| Regulatory Authority | License Number | Regulated Area | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Regulated |

PipsForex has not been verified by any recognized financial authority, raising significant concerns about its legitimacy. Regulatory bodies such as the FCA (UK), ASIC (Australia), or CySEC (Cyprus) provide essential protections for traders, including mechanisms for fund recovery in case of disputes. The absence of such oversight for PipsForex indicates a potential risk for traders, as unregulated brokers can operate with little accountability. Reports from users and financial watchdogs highlight the lack of transparency and compliance with industry standards, further suggesting that PipsForex may not be a safe trading platform.

Company Background Investigation

PipsForex claims to have a presence in multiple countries, including India and Mauritius, but the actual ownership and management structure remain obscure. The company was founded in 2020, but there is limited information regarding its founders or executive team. This lack of transparency can be concerning for potential clients, as a reputable broker typically discloses information about its management and operational history.

Furthermore, the broker's website does not provide adequate information about its location or regulatory compliance, making it difficult for traders to ascertain the legitimacy of its claims. The absence of a clear ownership structure and the lack of transparency in its operations raise red flags about the broker's reliability. Given these factors, it is prudent for traders to question the integrity of PipsForex and whether it can be trusted with their investments.

Trading Conditions Analysis

PipsForex offers various trading conditions that may initially appear attractive to potential clients. However, a detailed examination of its fee structure reveals several concerning aspects. The broker provides a range of account types, each with different minimum deposit requirements and varying trading conditions. Below is a summary of the core trading costs:

| Fee Type | PipsForex | Industry Average |

|---|---|---|

| Major Currency Pair Spread | From 0.0 pips | 1.0 - 1.5 pips |

| Commission Structure | Not Disclosed | Varies by broker |

| Overnight Interest Range | Not Specified | Varies by broker |

While the prospect of low spreads may attract traders, the lack of transparency regarding commissions and overnight interest raises concerns about hidden fees. Many traders have reported difficulties in withdrawing funds, which may indicate the presence of unfavorable terms and conditions that could affect their trading experience.

Additionally, the high leverage offered by PipsForex, up to 1:500, may appeal to traders looking to amplify their profits, but it also significantly increases the risk of substantial losses. Overall, the trading conditions presented by PipsForex warrant careful scrutiny, as they may not align with industry best practices.

Customer Fund Safety

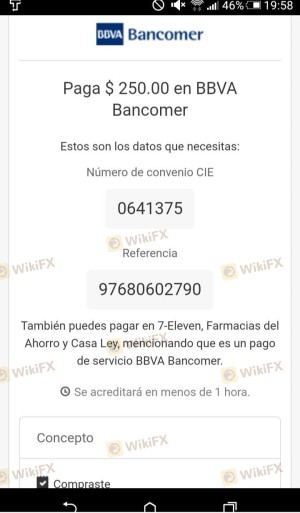

When evaluating whether PipsForex is safe, it is essential to consider the measures in place for protecting customer funds. The broker claims to implement several safety protocols, including negative balance protection, which ensures that clients cannot lose more than their initial investment. However, the effectiveness of these measures is questionable given the broker's unregulated status.

The lack of information regarding fund segregation and investor protection schemes is concerning. Reputable brokers typically maintain client funds in separate accounts to prevent misuse and ensure that they are available for withdrawals at all times. Without such measures, clients may be at risk of losing their investments in the event of the broker's insolvency. Historical complaints about withdrawal issues further exacerbate these concerns, as they suggest that clients may have difficulty accessing their funds when needed.

Customer Experience and Complaints

Customer feedback is a critical factor in assessing whether PipsForex is a scam. A review of user experiences reveals a pattern of complaints, particularly regarding withdrawal difficulties and poor customer support. The following table summarizes the primary complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Unresponsive |

| Poor Customer Service | Medium | Slow Response |

| Transparency Concerns | High | No Clarification |

Many users have reported being unable to withdraw their funds, with some claiming that the broker imposes unreasonable conditions or delays processing requests. Additionally, the quality of customer support has been criticized, with numerous accounts of unresponsive representatives when clients sought assistance. These issues highlight significant red flags and suggest that PipsForex may not prioritize customer satisfaction or transparency.

Platform and Execution

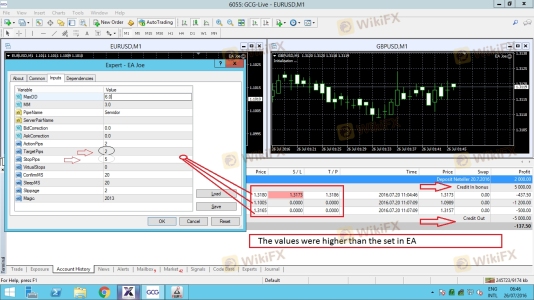

The trading platform offered by PipsForex is the widely used MetaTrader 5 (MT5), which is known for its advanced features and user-friendly interface. However, the overall performance, stability, and execution quality of the platform are critical factors to consider. Users have raised concerns about order execution quality, including instances of slippage and rejected orders, which can significantly impact trading outcomes.

Moreover, there are allegations of potential platform manipulation, where the broker may not honor market prices, leading to unfavorable trading conditions for clients. Such practices are often indicative of a broker lacking integrity and can severely undermine trust in the trading environment.

Risk Assessment

Using PipsForex comes with various risks that traders should be aware of. The following risk assessment summarizes key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight, increasing the risk of fraud. |

| Fund Safety Risk | High | Lack of transparency regarding fund protection measures. |

| Withdrawal Risk | High | Numerous complaints about withdrawal issues and delays. |

| Execution Risk | Medium | Concerns about order execution quality and potential manipulation. |

To mitigate these risks, traders are advised to conduct thorough due diligence, avoid investing more than they can afford to lose, and consider using regulated brokers with a proven track record.

Conclusion and Recommendations

In conclusion, the evidence suggests that PipsForex may not be a safe trading platform. The lack of regulatory oversight, coupled with numerous complaints about withdrawal issues and poor customer service, raises significant concerns about the broker's legitimacy. Traders should exercise extreme caution when considering PipsForex, as the potential risks outweigh the benefits.

For those seeking reliable alternatives, it is advisable to consider brokers that are well-regulated and have a positive reputation in the industry. Recommended options include brokers regulated by authorities such as the FCA, ASIC, or CySEC, which provide greater security and transparency for traders.

In summary, while PipsForex may offer some appealing trading conditions, the overall assessment indicates that it is not a safe choice for traders. It is essential to prioritize safety and regulatory compliance when selecting a forex broker to protect your investments.

Is PipsForex a scam, or is it legit?

The latest exposure and evaluation content of PipsForex brokers.

PipsForex Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

PipsForex latest industry rating score is 1.49, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.49 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.