PipsForex 2025 Review: Everything You Need to Know

Executive Summary

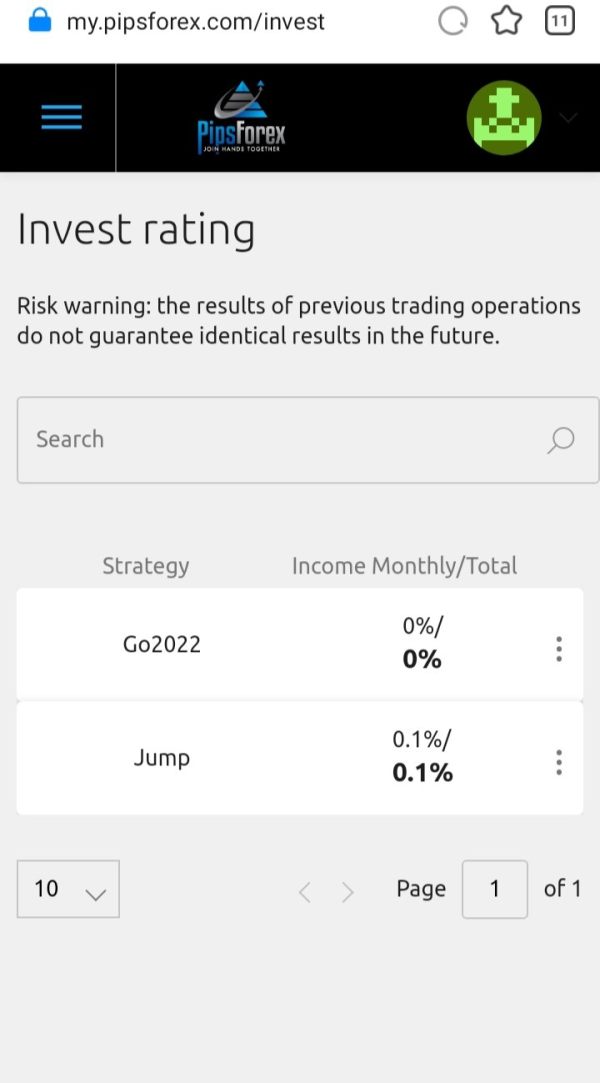

PipsForex is an emerging forex broker that has been operating since 2020. It presents itself as a platform for traders seeking diverse trading opportunities, but this pipsforex review reveals significant concerns regarding the broker's regulatory transparency and overall trustworthiness. The platform offers high leverage trading up to 500:1 and supports multiple asset classes including forex, commodities, indices, and cryptocurrencies through the MT5 trading platform.

Based on available information and user feedback, PipsForex shows a moderate trust score of 58. This indicates medium-level reliability concerns within the trading community, and the broker appears to target traders looking for high leverage opportunities and diversified asset portfolios. However, potential clients should exercise considerable caution due to reported withdrawal difficulties and limited regulatory oversight.

The minimum deposit requirement of $100 makes the platform accessible to retail traders. The MT5 platform provides familiar trading environment for experienced users, but the lack of comprehensive regulatory information and user complaints about withdrawal processes raise red flags that cannot be ignored in this evaluation.

Important Disclaimers

PipsForex operates from Mauritius with reported branches in multiple countries. The available information lacks clarity regarding specific regulatory oversight from recognized financial authorities, and this pipsforex review is based on publicly available information and user feedback collected up to 2025. It may not cover all possible trading scenarios or recent developments.

Potential traders should be aware that regulatory frameworks vary significantly across different jurisdictions. The broker's regulatory status may differ depending on the client's location, and this review aims to provide an objective assessment based on available data. Traders are strongly advised to conduct their own due diligence before making any investment decisions.

Rating Framework

Broker Overview

PipsForex established its operations in 2020. It positions itself as a comprehensive online forex broker headquartered in Mauritius, and the company focuses on providing retail and institutional clients access to global financial markets through its proprietary trading infrastructure. The broker's business model centers around offering multi-asset trading opportunities, encompassing traditional forex pairs alongside modern financial instruments including cryptocurrencies and CFDs.

The platform operates primarily through the MetaTrader 5 trading environment. This provides users with advanced charting capabilities, automated trading options, and comprehensive market analysis tools, while PipsForex supports trading across multiple asset classes including major and minor currency pairs, precious metals, energy commodities, stock indices, and digital currencies. However, specific information regarding regulatory oversight remains unclear in available documentation, which raises questions about the broker's compliance framework and client protection measures.

Regulatory Status: Available information indicates that PipsForex lacks oversight from any recognized financial regulatory authority. This represents a significant concern for potential clients seeking regulated trading environments.

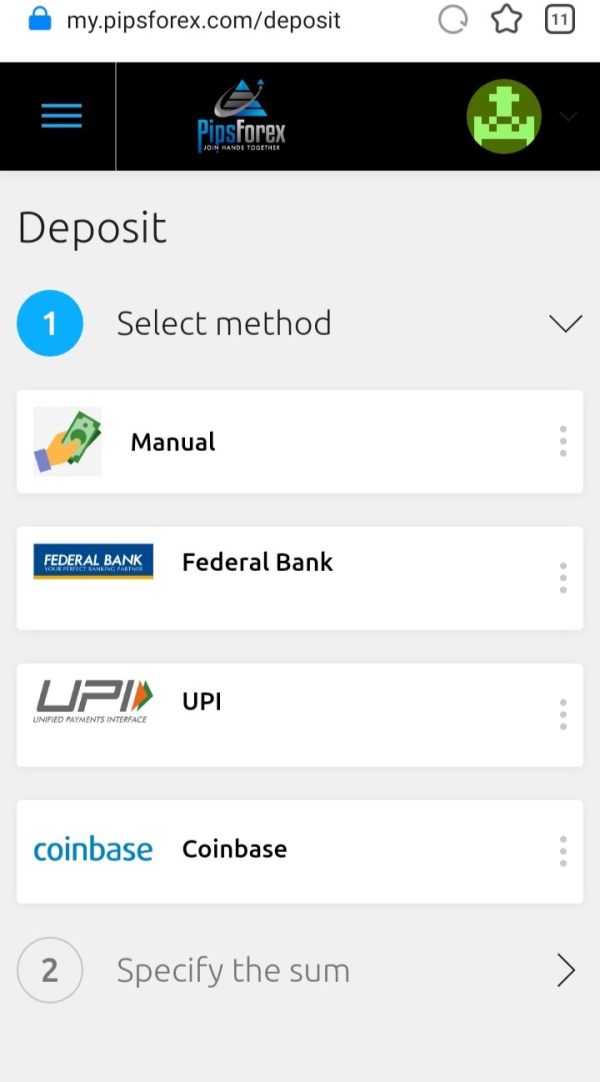

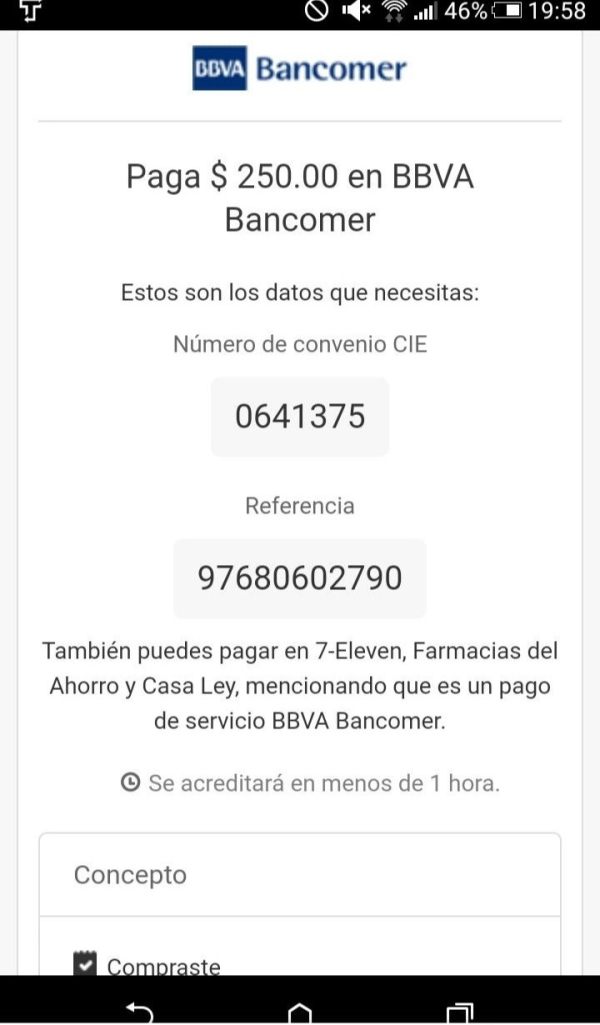

Deposit and Withdrawal Methods: Specific information about supported payment methods for deposits and withdrawals is not detailed in available sources. User feedback suggests difficulties with withdrawal processes.

Minimum Deposit Requirements: The broker requires a minimum deposit of $100. This aligns with industry standards for retail forex brokers and makes the platform accessible to beginning traders.

Bonus and Promotional Offers: No specific information regarding bonus programs or promotional activities is mentioned in available documentation.

Trading Assets: The platform supports a diverse range of trading instruments including forex currency pairs, commodities such as gold and oil, stock indices from major global markets, cryptocurrencies, and various CFD products.

Cost Structure: Detailed information about spreads, commissions, and other trading costs is not comprehensively available in the reviewed sources. This makes it difficult to assess the broker's competitiveness in terms of pricing.

Leverage Ratios: PipsForex offers maximum leverage of 500:1. This provides significant trading power but also increases risk exposure for traders.

Platform Options: The broker utilizes the MT5 trading platform. This provides users with professional-grade trading tools and analytical capabilities.

Geographic Restrictions: Specific information about regional restrictions or limitations is not detailed in available sources.

Customer Support Languages: The range of supported languages for customer service is not specified in the reviewed materials.

This pipsforex review highlights the limited transparency in several key operational areas. Potential clients should consider this carefully before opening trading accounts.

Account Conditions Analysis

PipsForex's account structure appears relatively straightforward with a minimum deposit requirement of $100. This makes it accessible to retail traders entering the forex market, but the available information lacks comprehensive details about different account types, their specific features, or any tiered structure that might offer enhanced benefits for higher-volume traders. This limited transparency regarding account classifications represents a significant gap in the broker's presentation to potential clients.

The account opening process details are not thoroughly documented in available sources. This raises concerns about the broker's operational transparency, and most established brokers provide clear information about verification requirements, documentation needs, and the typical timeframe for account activation. The absence of such details in PipsForex's public information suggests either incomplete disclosure or potentially streamlined processes that may not meet standard industry practices.

Regarding special account features such as Islamic accounts for Shariah-compliant trading, no specific information is available in the reviewed sources. This omission may indicate that such specialized services are not offered, or alternatively, that the broker has not adequately communicated these options to potential clients, and the lack of detailed account condition information significantly impacts the ability to conduct a thorough evaluation in this pipsforex review.

User feedback regarding account conditions is limited. Most available comments focus on withdrawal difficulties rather than account setup or management experiences, and this pattern suggests that while account opening may not present immediate concerns, ongoing account management and fund access could pose challenges for traders.

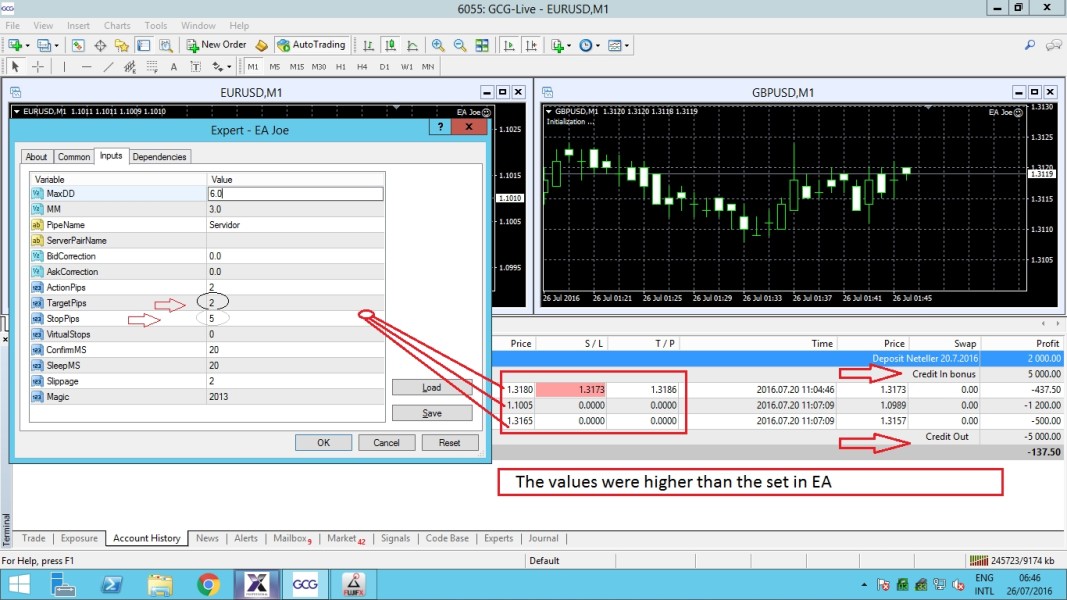

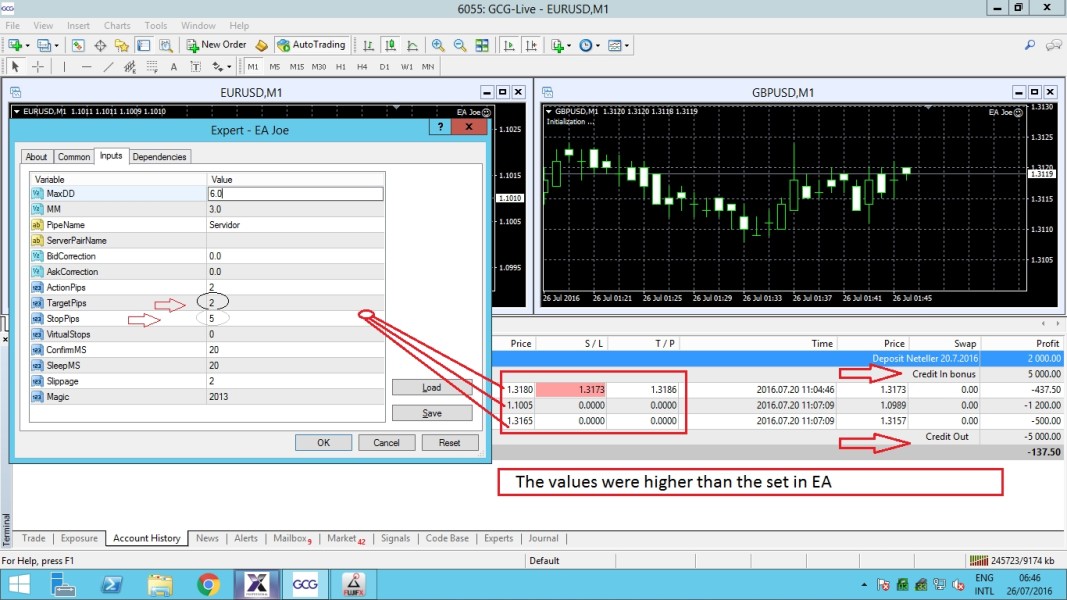

PipsForex utilizes the MetaTrader 5 platform as its primary trading interface. This provides users with access to advanced charting tools, technical indicators, and automated trading capabilities through Expert Advisors, while the MT5 platform is widely recognized in the industry for its comprehensive functionality, including multiple timeframes, extensive technical analysis tools, and support for algorithmic trading strategies.

However, beyond the basic MT5 platform offering, specific information about additional proprietary tools, research resources, or educational materials is notably absent from available sources. Most established brokers supplement their platform offerings with market analysis, economic calendars, trading signals, or educational content to support trader development, and the lack of detailed information about such resources in this pipsforex review suggests either limited additional tool availability or insufficient communication about existing resources.

The absence of comprehensive research and analysis resources represents a significant limitation for traders who rely on fundamental analysis or market insights to inform their trading decisions. Educational resources, which are particularly important for novice traders, also appear to be inadequately documented or potentially unavailable through the PipsForex platform.

User feedback regarding the quality and reliability of trading tools is limited in available sources. This makes it difficult to assess the practical performance of the platform under real trading conditions, and the lack of user testimonials about tool effectiveness or platform stability raises questions about the overall trading infrastructure quality.

Customer Service and Support Analysis

Customer service quality emerges as a significant concern in this evaluation. Multiple user complaints are documented regarding response times and issue resolution effectiveness, while the available feedback indicates particular difficulties with withdrawal-related inquiries, suggesting that the customer support infrastructure may be inadequately equipped to handle financial transaction issues promptly and effectively.

Specific information about customer service channels, availability hours, or response time guarantees is not comprehensively available in reviewed sources. Most professional brokers provide multiple contact methods including live chat, email support, and telephone assistance with clearly defined service hours and response commitments, and the absence of such detailed service information represents a transparency gap that potential clients should consider carefully.

The reported withdrawal difficulties mentioned in user feedback suggest systemic issues that extend beyond simple customer service responsiveness to potentially more serious operational or financial concerns. When traders experience difficulties accessing their funds, it often indicates underlying problems with the broker's financial management or operational procedures.

Language support information is also not detailed in available sources. This could present challenges for international clients seeking assistance in their native languages, and professional forex brokers typically provide multilingual support to accommodate their diverse client base. The lack of clear language support information raises questions about the broker's international service capabilities.

Trading Experience Analysis

The trading experience evaluation for PipsForex is hampered by limited user feedback regarding platform stability, execution quality, and overall trading conditions. While the MT5 platform provides a familiar interface for experienced traders, the specific implementation and performance characteristics of PipsForex's trading infrastructure remain unclear based on available information.

Order execution quality, including factors such as slippage rates, requote frequency, and fill rates, is not adequately documented in user feedback or broker disclosures. These technical performance metrics are crucial for traders, particularly those employing scalping strategies or trading during high-volatility periods, and the absence of detailed execution data makes it difficult to assess the broker's suitability for different trading styles.

Platform stability and uptime information is similarly lacking in available sources. Reliable platform performance is essential for active traders, and the absence of performance guarantees or historical uptime data represents a significant information gap while most established brokers provide service level agreements or historical performance data to demonstrate their technical reliability.

Mobile trading capabilities and cross-device synchronization features are not specifically detailed in the reviewed materials. Modern traders increasingly rely on mobile platforms for market monitoring and trade management, making mobile functionality a critical component of the overall trading experience, and the lack of comprehensive mobile platform information in this pipsforex review suggests either limited mobile offerings or inadequate communication about existing capabilities.

Trust and Security Analysis

The trust and security evaluation reveals the most significant concerns regarding PipsForex's operations. The broker's trust score of 58 indicates moderate reliability concerns within the trading community, while the absence of clear regulatory oversight from recognized financial authorities represents a fundamental security issue for potential clients.

Regulatory compliance forms the foundation of broker trustworthiness. Regulated brokers must adhere to strict operational standards, maintain segregated client funds, and provide dispute resolution mechanisms, and the lack of clear regulatory information for PipsForex suggests that clients may not have access to standard investor protection measures typically available through regulated brokers.

Fund security measures, including client money segregation, insurance coverage, and audit procedures, are not detailed in available sources. Professional brokers typically maintain client funds in segregated accounts separate from operational funds and provide clear information about fund protection measures, while the absence of such information raises serious questions about client fund safety.

Company transparency regarding management structure, financial reporting, and operational procedures appears limited based on available information. Established brokers typically provide comprehensive information about their corporate structure, management team, and financial stability, and the limited transparency in these areas contributes to the moderate trust score and should be a significant consideration for potential clients.

User trust feedback indicates concerns about withdrawal processes and overall operational reliability. This aligns with the moderate trust scoring and suggests systemic issues that extend beyond simple operational inefficiencies to potentially more serious concerns about the broker's financial stability and operational integrity.

User Experience Analysis

Overall user satisfaction with PipsForex appears to be significantly impacted by reported withdrawal difficulties and customer service challenges. The available user feedback concentrates primarily on negative experiences, particularly regarding fund access and support responsiveness, which suggests systemic issues with the broker's operational procedures.

The user interface and platform design experience is not comprehensively documented in available feedback. The use of the MT5 platform provides a familiar environment for traders experienced with MetaTrader products, but any customizations or proprietary features that PipsForex may have implemented are not detailed in user reviews.

Registration and account verification processes are not thoroughly described in user feedback. This could indicate either streamlined procedures or insufficient user engagement with the platform beyond initial setup, and the lack of detailed onboarding experience feedback makes it difficult to assess the broker's user acquisition and verification procedures.

Fund operation experiences, particularly withdrawal processes, represent the most significant user concern based on available feedback. Multiple reports of withdrawal difficulties suggest that while deposit processes may function adequately, fund retrieval presents ongoing challenges that significantly impact user satisfaction and trust.

The primary user complaints focus on withdrawal delays and customer service unresponsiveness. These are fundamental operational issues that affect the core trading relationship between broker and client, and these concerns suggest that PipsForex may be more suitable for traders who plan to maintain funds on the platform for extended periods rather than those requiring frequent fund access.

Conclusion

This comprehensive pipsforex review reveals a broker with mixed characteristics that potential traders should evaluate carefully. PipsForex offers some attractive features including high leverage up to 500:1, diverse asset selection encompassing forex, commodities, and cryptocurrencies, and accessibility through a reasonable $100 minimum deposit requirement while the MT5 platform provides familiar trading environment for experienced users.

However, significant concerns emerge regarding regulatory oversight, user experience, and operational reliability. The absence of clear regulatory supervision from recognized authorities, combined with user reports of withdrawal difficulties and customer service challenges, raises serious questions about the broker's long-term viability and client protection measures.

PipsForex may appeal to traders seeking high leverage opportunities and diverse asset portfolios. The moderate trust score of 58 and reported operational issues suggest that potential clients should exercise considerable caution, and traders considering this platform should carefully evaluate their risk tolerance and consider whether the potential benefits outweigh the documented concerns regarding fund security and operational reliability.