Regarding the legitimacy of PBFX forex brokers, it provides VFSC, ASIC and WikiBit, (also has a graphic survey regarding security).

Is PBFX safe?

Pros

Cons

Is PBFX markets regulated?

The regulatory license is the strongest proof.

VFSC Forex Trading License (EP)

Vanuatu Financial Services Commission

Vanuatu Financial Services Commission

Current Status:

RevokedLicense Type:

Forex Trading License (EP)

Licensed Entity:

Prime Business Co., Limited

Effective Date:

2019-01-17Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

--Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

ASIC Inst Deriv Trading License (STP)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

UnverifiedLicense Type:

Inst Deriv Trading License (STP)

Licensed Entity:

BTCDANA AUST PTY LTD

Effective Date: Change Record

2004-05-21Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

'TOWER 5 COLLINS SQUARE' L 23 727 COLLINS ST DOCKLANDS VIC 3008Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is PBFX A Scam?

Introduction

PBFX is an online forex broker that has emerged in the trading landscape since its establishment in 2018. Operating under the name Prime Business Co., Limited, PBFX claims to offer a wide range of financial instruments, including forex pairs, commodities, and indices, primarily through the popular MetaTrader 4 platform. However, for traders looking to invest their funds, it is crucial to conduct thorough due diligence when evaluating the credibility of any forex broker. The forex market is rife with scams and unregulated entities, making it imperative for traders to discern trustworthy platforms from fraudulent ones. This article aims to analyze the safety and legitimacy of PBFX by examining its regulatory status, company background, trading conditions, customer experiences, and potential risks associated with trading on this platform.

To gather information for this assessment, we reviewed various online sources, including regulatory databases, user reviews, and expert analyses. The evaluation framework includes an in-depth look at PBFX's regulatory compliance, operational history, fee structures, customer safety measures, and overall user experience.

Regulation and Legitimacy

The regulatory environment within which a broker operates is a critical factor in determining its legitimacy. Regulations are designed to protect traders and ensure that brokers adhere to strict operational standards. PBFX claims to be registered with several regulatory authorities, including the New Zealand Financial Service Providers Register (FSPR) and the Australian Securities and Investments Commission (ASIC). However, the status of these licenses raises several red flags, as detailed below.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FSPR | 551686 | New Zealand | Revoked |

| ASIC | 269820 | Australia | Suspicious Clone |

| VFSC | Unreleased | Vanuatu | Revoked |

The FSPR license held by PBFX has been revoked, which indicates that it is no longer authorized to operate legally in New Zealand. Furthermore, the ASIC license is flagged as a suspicious clone, suggesting that PBFX may be misrepresenting its regulatory status to gain the trust of potential clients. The Vanuatu Financial Services Commission (VFSC) license is also revoked, further compromising PBFX's credibility. Overall, the lack of valid regulatory oversight raises significant concerns regarding the safety of funds and the transparency of operations at PBFX.

Company Background Investigation

PBFX, operating under Prime Business Co., Limited, was established in 2018. However, there is limited information available regarding the company's ownership structure and the backgrounds of its management team. The lack of transparency surrounding the company's operations is concerning, as it raises questions about the accountability of its leadership.

A reputable broker typically provides detailed information about its founders and management team, showcasing their experience and qualifications in the finance and trading sectors. Unfortunately, PBFX does not disclose such information, leaving potential investors in the dark about who is managing their funds. This opacity can be a significant warning sign, as it suggests that the company may not be fully committed to maintaining transparency with its clients.

Moreover, the company's website does not provide clear contact information or physical addresses, making it difficult for clients to reach out for support or inquiries. This lack of transparency and information disclosure is a red flag when evaluating whether PBFX is safe for trading.

Trading Conditions Analysis

When assessing whether PBFX is a scam, it is essential to evaluate its trading conditions, including fees and spreads. Understanding the cost structure is vital for traders, as hidden fees can significantly affect profitability. PBFX offers three types of accounts, each with different minimum deposit requirements and trading conditions.

| Fee Type | PBFX | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.7 pips | 1.5 pips |

| Commission Model | Unspecified | Varies by broker |

| Overnight Interest Range | Unspecified | Varies by broker |

The spread for major currency pairs at PBFX is set at 1.7 pips, which is relatively higher than the industry average of 1.5 pips. Additionally, the lack of transparency regarding commissions and overnight interest rates raises concerns about potential hidden costs. Traders should be cautious of brokers that do not clearly outline their fee structures, as this can lead to unexpected charges that negatively impact trading results.

Customer Funds Security

The security of customer funds is a paramount concern for any trader. PBFX claims to implement various measures to safeguard client funds; however, the effectiveness of these measures is questionable given the broker's regulatory status. The lack of segregation of client funds and investor protection policies is alarming.

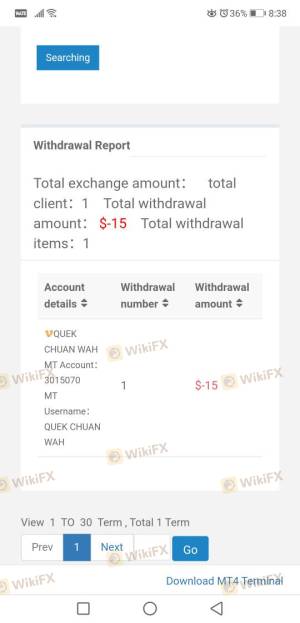

Without proper regulatory oversight, PBFX is not required to maintain client funds in segregated accounts, which means that in the event of financial difficulties, clients may not have access to their funds. Furthermore, there are no indications that PBFX offers negative balance protection, which can expose traders to substantial losses beyond their initial investments. Historical complaints and negative reviews suggest that customers have faced significant challenges when attempting to withdraw funds, raising further concerns about the safety of their investments.

Customer Experience and Complaints

Analyzing customer feedback is crucial for understanding the overall experience of trading with PBFX. Numerous online reviews indicate a pattern of complaints, particularly regarding withdrawal issues and poor customer service.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Unresponsive Customer Service | High | Poor |

| Account Blocking | Medium | Poor |

Many users have reported being unable to withdraw their funds after making profits, with some alleging that their accounts were blocked without explanation. Complaints about unresponsive customer service further exacerbate the situation, leading to frustration among traders who feel trapped in a challenging trading environment. These patterns of complaints suggest that PBFX may not prioritize customer satisfaction or support, raising significant concerns about the overall integrity of the broker.

Platform and Execution

The trading platform offered by PBFX is primarily MetaTrader 4 (MT4), which is known for its user-friendly interface and advanced trading features. However, user experiences indicate that the platform may suffer from stability issues, including slippage and order rejections.

Traders have reported instances of significant slippage during volatile market conditions, which can lead to unexpected losses. Moreover, the refusal to execute trades or delays in order processing are concerning signs that may indicate platform manipulation. Such issues can severely impact a trader's ability to execute strategies effectively and can be particularly detrimental for those employing high-frequency trading techniques.

Risk Assessment

Using PBFX involves several risks that potential traders should consider carefully.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Operating without valid licenses. |

| Fund Security Risk | High | Lack of fund segregation and protection. |

| Customer Service Risk | Medium | Complaints about unresponsive support. |

Given the high regulatory and fund security risks associated with PBFX, potential traders should exercise extreme caution. It is advisable to conduct thorough due diligence before committing any funds to this broker. Traders should also consider diversifying their investments by exploring more reputable and regulated alternatives.

Conclusion and Recommendations

In conclusion, the evidence gathered suggests that PBFX exhibits several characteristics typically associated with scam brokers. The revoked regulatory licenses, lack of transparency regarding company operations, high fees, and numerous customer complaints raise significant red flags.

For traders seeking a safe trading environment, PBFX is not recommended. Instead, it would be prudent to consider well-established and regulated brokers that offer robust investor protection, clear fee structures, and responsive customer support. Some reputable alternatives include brokers regulated by the Financial Conduct Authority (FCA), the Australian Securities and Investments Commission (ASIC), or the Cyprus Securities and Exchange Commission (CySEC).

In summary, is PBFX safe? The overwhelming evidence suggests it is not, and traders should be wary of engaging with this broker.

Is PBFX a scam, or is it legit?

The latest exposure and evaluation content of PBFX brokers.

PBFX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

PBFX latest industry rating score is 2.27, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 2.27 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.