Regarding the legitimacy of OW Markets forex brokers, it provides FSA and WikiBit, .

Is OW Markets safe?

Pros

Cons

Is OW Markets markets regulated?

The regulatory license is the strongest proof.

FSA Derivatives Trading License (EP)

The Seychelles Financial Services Authority

The Seychelles Financial Services Authority

Current Status:

Offshore RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

One World Markets LTD

Effective Date:

--Email Address of Licensed Institution:

info@owmarkets.comSharing Status:

No SharingWebsite of Licensed Institution:

www.owmarkets.comExpiration Time:

--Address of Licensed Institution:

CT House, Office 3B, Providence, Mahe, SeychellesPhone Number of Licensed Institution:

+248 4379826Licensed Institution Certified Documents:

Is OW Markets Safe or a Scam?

Introduction

OW Markets, a multi-asset brokerage, claims to provide a unique trading environment for investors across various financial markets, including forex, commodities, and cryptocurrencies. With over 20 years of experience, the broker positions itself as a reliable partner for traders of all levels. However, the forex market is rife with scams and unregulated entities, making it crucial for traders to conduct thorough evaluations before committing their funds. This article investigates the legitimacy of OW Markets by analyzing its regulatory status, company background, trading conditions, client fund security, customer experiences, platform performance, and associated risks. The findings are based on a comprehensive review of online sources, including user feedback, expert analyses, and regulatory information.

Regulation and Legitimacy

The regulatory status of a broker is paramount in determining its safety and reliability. OW Markets claims to adhere to stringent regulatory guidelines and maintains that it is a fully licensed broker. However, a closer examination reveals some discrepancies. Below is the core regulatory information for OW Markets:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Financial Services Authority (FSA) | SD 187 | Seychelles | Verified |

While OW Markets is registered with the FSA in Seychelles, it is essential to note that this regulatory body is considered a low-tier authority. Brokers regulated in jurisdictions like the UK or the US typically provide more robust investor protections and oversight. The lack of stringent regulations raises concerns about the broker's operational transparency and compliance history. Furthermore, several reviews indicate that OW Markets has faced allegations of operating without proper oversight, which could pose significant risks to traders.

Company Background Investigation

OW Markets, also known as One World Markets, has a somewhat opaque corporate structure. The company is registered in Seychelles, but detailed information regarding its ownership and management team is scarce. The absence of clear and accessible information about the company's history and its key personnel raises red flags regarding its transparency. A reliable broker typically discloses information about its founders, management team, and their professional backgrounds, which OW Markets fails to do adequately.

Moreover, the lack of a physical office address on its website further contributes to the uncertainty surrounding its legitimacy. This is a common tactic employed by fraudulent brokers to evade accountability. Without a transparent history or a clear ownership structure, potential investors should exercise caution when considering OW Markets as a trading partner.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is crucial for traders seeking to maximize their profitability. OW Markets advertises competitive trading conditions, including low spreads and high leverage. However, it is essential to analyze the fee structure critically. Below is a comparison of core trading costs:

| Fee Type | OW Markets | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.0 pips | 1.0 pips |

| Commission Model | None | $3 - $10 per lot |

| Overnight Interest Range | Varies | Varies |

While OW Markets promotes spreads starting from 0.0 pips, the lack of transparency regarding commissions and overnight interest rates raises concerns. Many brokers typically charge commissions on trades, which are not clearly outlined by OW Markets. This could indicate hidden fees that may erode trader profits. Additionally, the broker's high leverage ratio of up to 1:1000, while appealing, can significantly amplify risks, especially for inexperienced traders.

Client Fund Security

The safety of client funds is a critical aspect of any brokerage's reliability. OW Markets claims to implement various measures to protect client funds, including segregating client accounts from company funds and adhering to high financial standards. However, the effectiveness of these measures is questionable, particularly given its regulatory status.

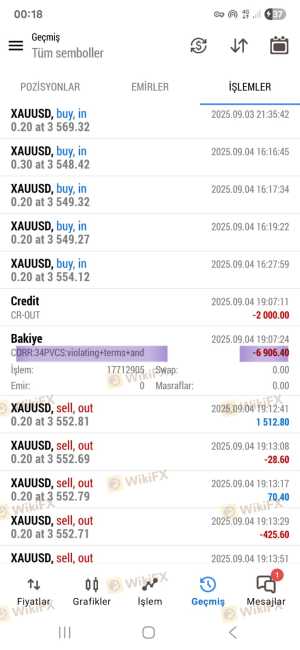

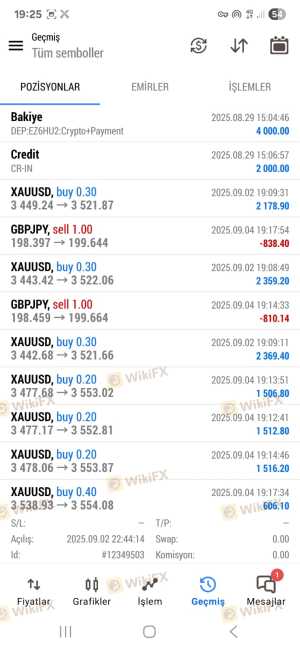

Traders should be aware of the potential risks associated with unregulated brokers. OW Markets claims of fund protection lack the backing of a stringent regulatory authority that would typically enforce such safety measures. Additionally, there have been reports of withdrawal issues and unresponsive customer service, which further complicates the assessment of fund security.

Customer Experience and Complaints

Evaluating customer experiences is vital in determining the credibility of a broker. Feedback from users of OW Markets has been mixed, with many reporting significant issues. Common complaints include difficulties in fund withdrawals, high-pressure sales tactics, and inadequate customer support. Below is a summary of major complaint types and their severity assessments:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support | Medium | Slow |

| Misleading Promotions | High | Inconsistent |

Several users have shared their experiences of being unable to withdraw their funds after making deposits, which is a significant red flag for any broker. Additionally, the company's slow response to inquiries and complaints indicates a lack of adequate customer service, which can further frustrate traders seeking assistance.

Platform and Trade Execution

The trading platform's performance is another critical factor in assessing the reliability of a broker. OW Markets utilizes the MetaTrader 5 (MT5) platform, which is widely regarded for its robust features and user-friendly interface. However, the quality of order execution, including slippage and rejection rates, is essential to consider. Reports suggest that some users have experienced issues with trade execution speed, which can affect trading outcomes.

Furthermore, any signs of platform manipulation should be taken seriously. While there are no explicit allegations against OW Markets regarding platform manipulation, the lack of transparency in execution practices raises concerns about the integrity of the trading environment.

Risk Assessment

Engaging with OW Markets involves several risks that potential traders should consider. Below is a summary of the key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Lack of robust regulation increases the risk of fraud. |

| Fund Security Risk | High | Allegations of withdrawal issues and lack of transparency. |

| Customer Support Risk | Medium | Slow and inadequate responses to client inquiries. |

To mitigate these risks, traders are advised to conduct thorough due diligence before investing. It is crucial to understand the trading conditions, fee structures, and the regulatory environment of any broker.

Conclusion and Recommendations

In conclusion, the analysis of OW Markets raises several concerns regarding its legitimacy and safety. The lack of stringent regulation, combined with numerous customer complaints, suggests that traders should exercise caution when considering this broker. While OW Markets presents itself as a legitimate trading platform, the potential risks associated with engaging with an unregulated broker cannot be overlooked.

For traders seeking safer alternatives, it is advisable to consider reputable brokers regulated by top-tier authorities such as the FCA or ASIC. These brokers typically offer stronger investor protections, transparent fee structures, and reliable customer support. Ultimately, if you prioritize the safety of your investments, it would be prudent to steer clear of OW Markets and explore more trustworthy options.

Is OW Markets a scam, or is it legit?

The latest exposure and evaluation content of OW Markets brokers.

OW Markets Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

OW Markets latest industry rating score is 4.05, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 4.05 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.