OW Markets 2025 In-Depth Review: Opportunity or Trap?

Executive Summary

In the vast and varying landscape of online trading, OW Markets positions itself as a multi-asset broker, catering to both novice and experienced traders alike. With promises of low entry costs and high leverage, it aims to attract a diverse clientele to its platform. However, a deeper examination reveals significant red flags surrounding its regulatory compliance and user experiences. These issues suggest that OW Markets may present more risk than opportunity for serious investors. Novice traders, drawn to its features, should weigh the potential hazards against the allure of high leverage and diverse instruments. In contrast, seasoned traders and cautious investors are better advised to steer clear of this broker, prioritizing fund security and regulatory assurances.

⚠️ Important Risk Advisory & Verification Steps

When considering OW Markets as a trading platform, potential users must be aware of certain risks that could jeopardize their investments.

Risk Statement:

The absence of valid regulation from recognized financial authorities raises significant concerns about OW Markets' trustworthiness.

Potential Harms:

- Loss of entire investments without any prospect of recovery.

- Exposure to high-pressure sales tactics.

- Identity theft or mishandling of personal information due to dubious operational practices.

Self-Verification Steps:

- Visit Official Regulatory Authority Websites: Check if OW Markets is listed as a regulated entity.

- Use Resources such as NFA's BASIC Database:

- Access the website NFA BASIC.

- Enter the broker's details to verify its regulatory status.

- Review User Complaints on Trusted Platforms:

- Look for reviews on sites such as Forex Peace Army and Wikifx to collect insights from current and former users.

- Assess the Broker‘s Website for Transparency:

- Investigate any lack of clear information regarding company operations and regulatory licenses.

- Consult Professional Financial Forums: Engage with communities to check the community's sentiment about the broker’s reliability.

Broker Overview

Company Background and Positioning

OW Markets, also known as One World Markets, launched with the intention to provide comprehensive online brokerage services. The company claims over 20 years of experience in the industry, yet details about its founding and operational history remain vague, leading to speculation about its legitimacy. Located in Seychelles, it operates under a limited regulatory framework, a factor that raises alarm among prospective traders.

Core Business Overview

The broker offers a rich array of trading products, including over 40 forex pairs, commodities, indices, and a selection of cryptocurrencies such as Bitcoin and Ethereum. Utilizing the well-regarded MetaTrader 5 platform across desktop, web, and mobile, OW Markets aims to attract a wide range of traders. However, the claims of regulatory oversight by the Seychelles Financial Services Authority appear dubious, given the multiple user reports flagging potential issues.

Quick-Look Details Table

In-depth Analysis of Each Dimension

Trustworthiness Analysis

In evaluating the trustworthiness of OW Markets, it is vital for users to understand the framework of regulatory oversight.

The conflicting information regarding its regulatory licensing is alarming. OW Markets asserts compliance with the Financial Services Authority of Seychelles, yet multiple sources indicate the absence of a valid license. This poses substantial risk for potential clients, as unregulated brokers may not adhere to adequate operational and ethical standards.

To facilitate self-verification:

- Check Registration with Financial Authority: Look up the brokers name in the regulatory listings.

- Analyze Available Documentation: Review any licenses listed on the broker's website.

- Research Third-party Verification Services: Find reviews from trusted platforms that can confirm the legitimacy of OW Markets.

- Consult User Testimonials: Use community forums and review sites to collect insights about other traders' experiences.

- Verify Physical Address Claims: Confirm that the physical addresses provided by the broker are legitimate and operational.

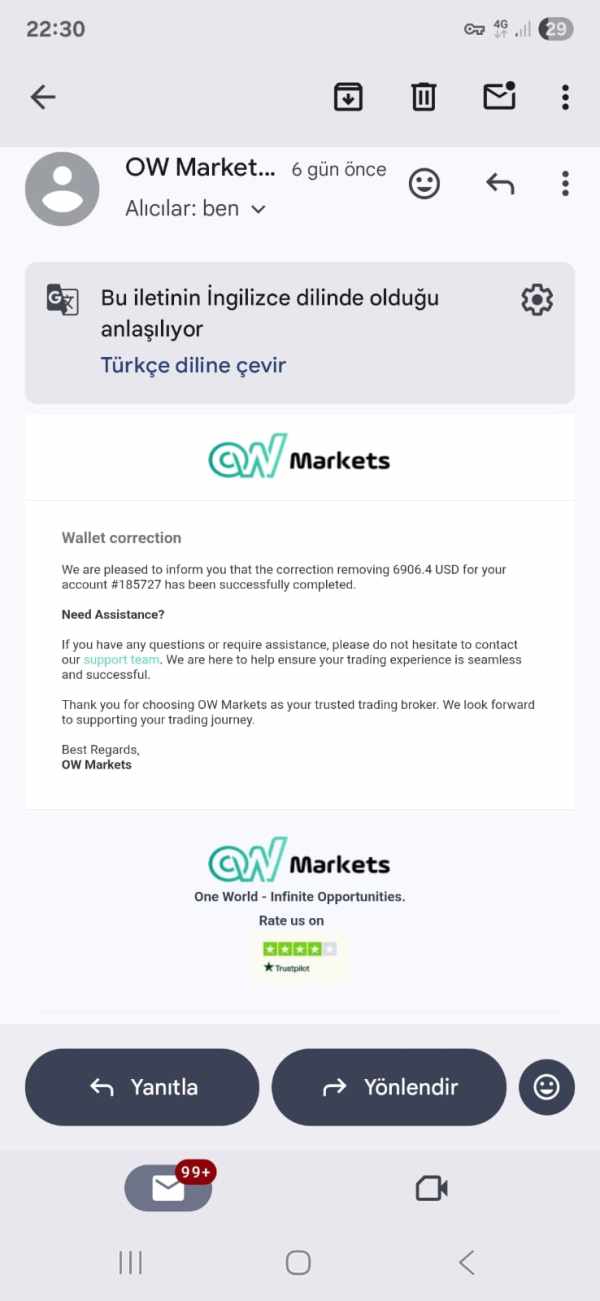

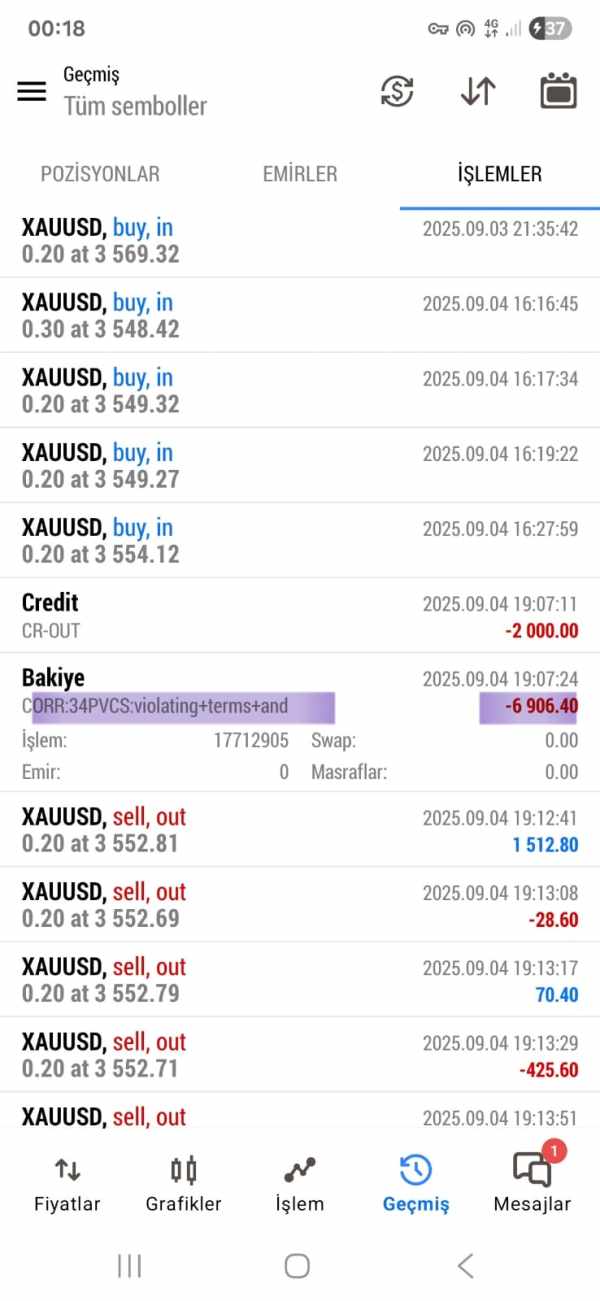

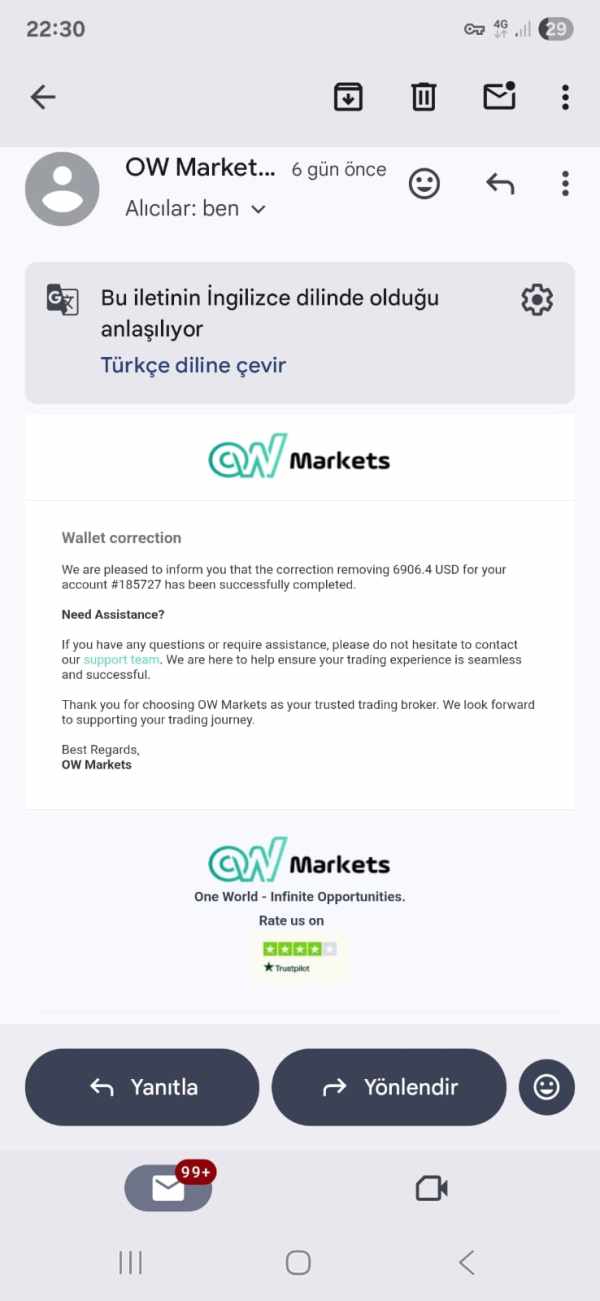

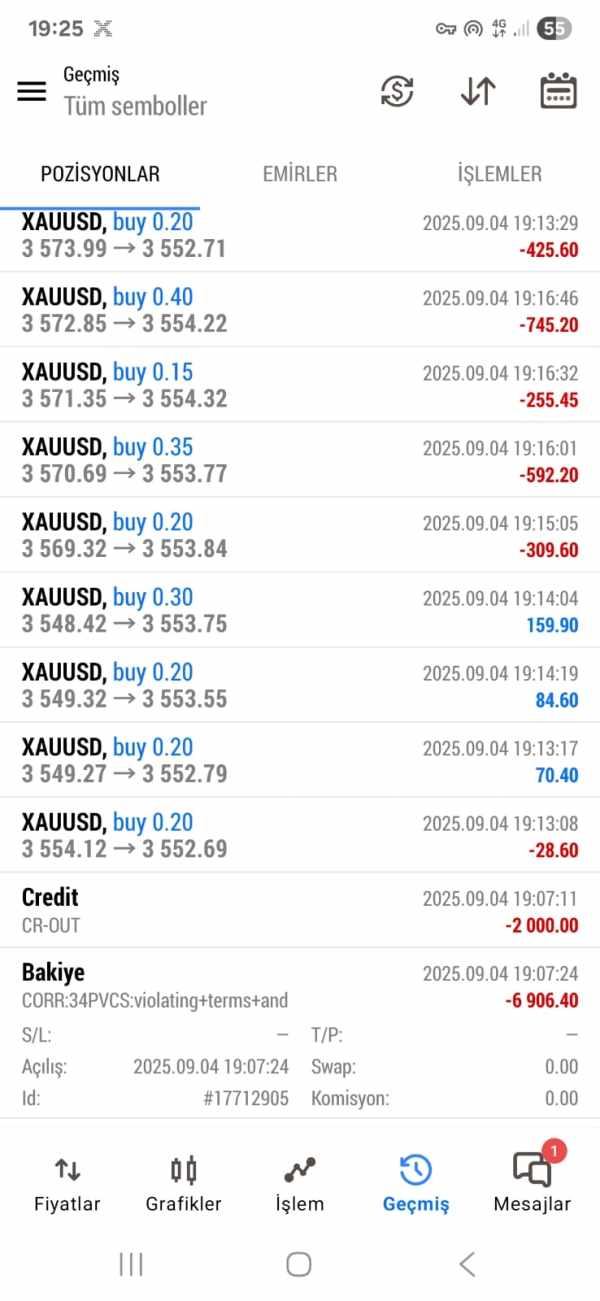

“My account was blocked as soon as I started withdrawing profits. I felt deceived by their promises.” — User Review

This lack of clarity around regulatory compliance leads to serious concerns regarding fund safety and the operational practices of OW Markets.

Trading Costs Analysis

In assessing the trading costs associated with OW Markets, there are benefits and drawbacks that potential traders must consider.

Advantages in Commissions

OW Markets advertises a competitive commission structure, aiming to entice traders with low commissions on certain instruments. Initial costs for setting up an account are low, beginning with a minimum deposit of just $10, which appeals to novice investors.

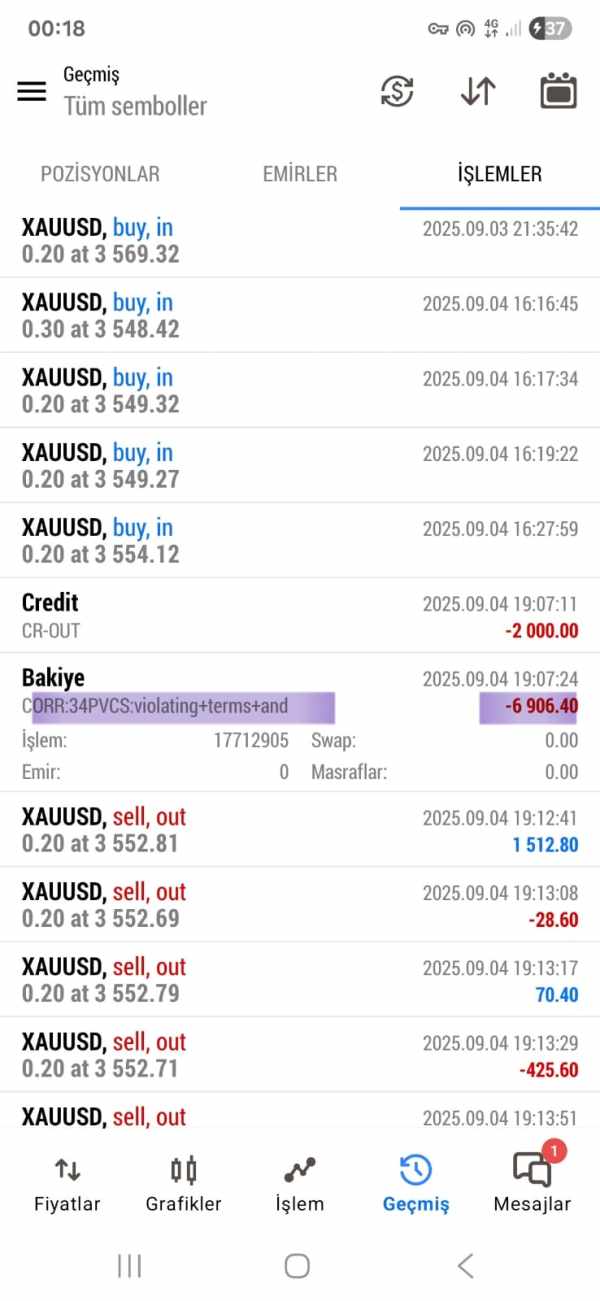

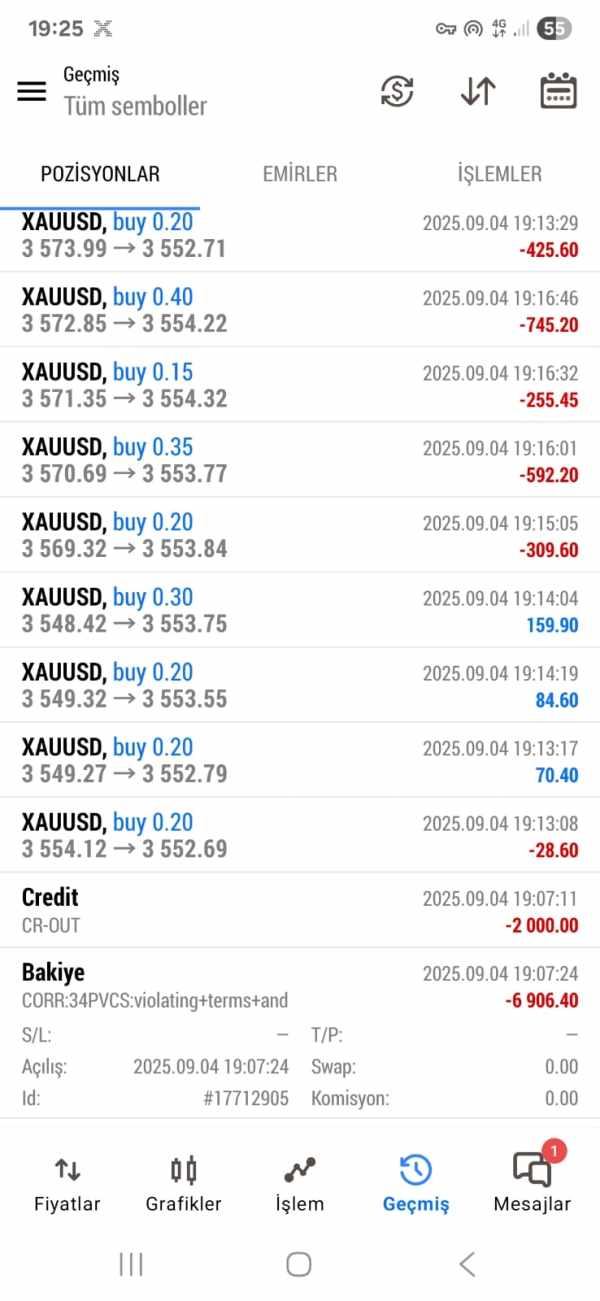

The "Traps" of Non-Trading Fees

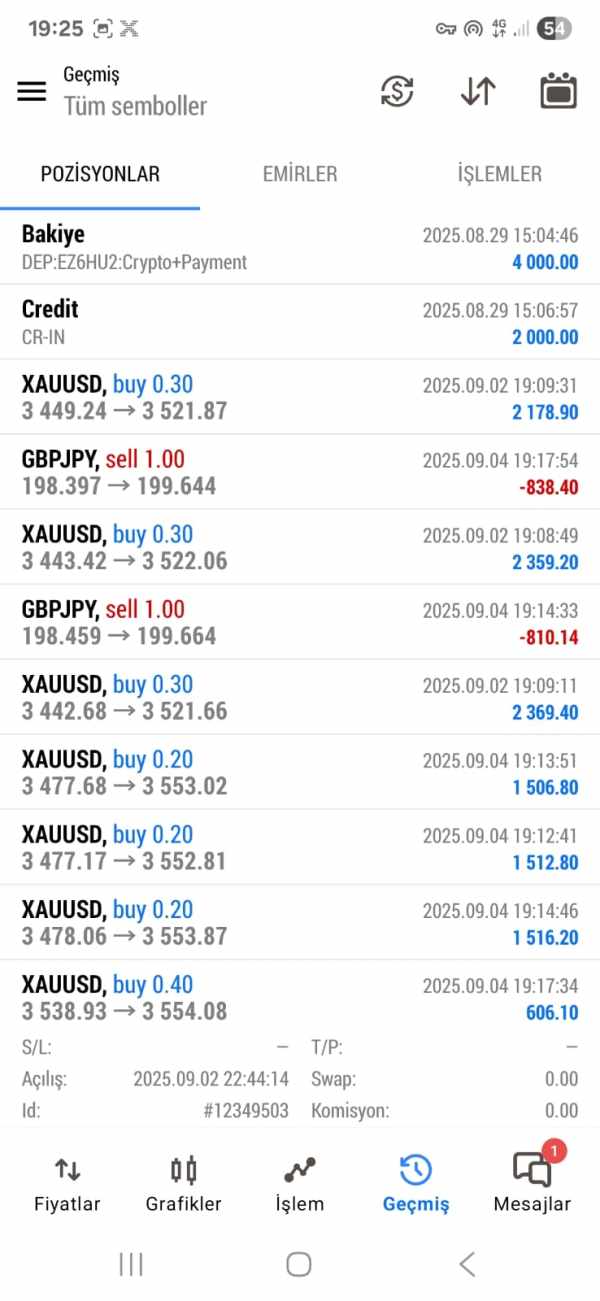

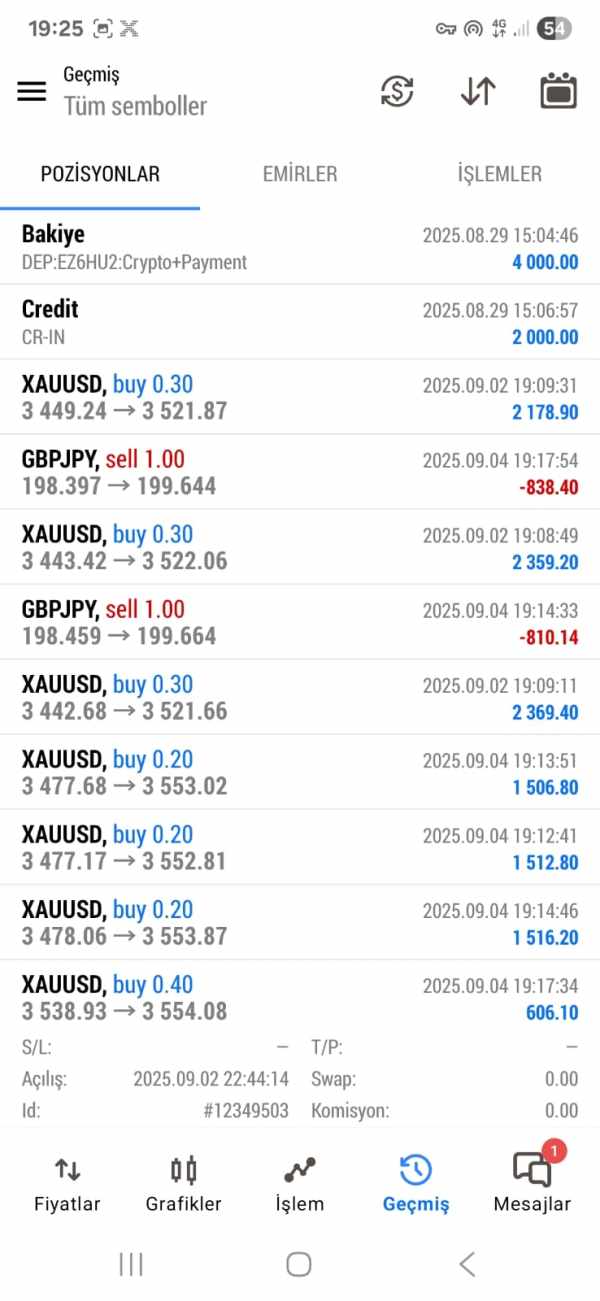

However, traders should be wary of hidden fees. User complaints frequently highlight $35 withdrawal fees and vague references to other commissions that can diminish profits.

“I lost money trying to withdraw my own funds. They hit me with so many fees.” — User Review

Understanding the full cost structure is essential for informed trading decisions, as high non-trading fees can reduce the attractiveness of low commissions.

OW Markets promotes the use of its trading platforms and resources to meet users' diverse trading needs.

Platform Diversity

Primarily utilizing the MetaTrader 5 platform, OW Markets provides a robust interface favored by traders. The platform supports various features including automated trading and advanced charting tools. However, many users have reported performance issues, including sluggish loading times and latency disruptions.

Quality of Tools and Resources

While OW Markets claims to furnish users with quality educational resources, real-world experiences suggest a lack of comprehensive support. Feedback reveals that the platform is often difficult to navigate, limiting the user experience.

“The platform's interface feels outdated and not user-friendly.” — User Review

As such, while OW Markets offers the potential for sophisticated trading, its execution and resource availability require significant improvement.

User Experience Analysis

User experience at OW Markets risks being overshadowed by several negative factors that have emerged from trader feedback.

Many users have expressed dissatisfaction with the website's quality, citing slow load times and an unintuitive design. This indicates neglect of user interface considerations, which can be critical for traders requiring quick access to market information.

Moreover, traders commonly report a lack of essential customer support, exacerbating the difficulties in resolving trading issues promptly.

Customer Support Analysis

Customer support has been a major area of contention for users of OW Markets.

Reports frequently highlight unresponsiveness from support channels and a lack of effective solutions offered by their customer service team. Many users indicate that once they encounter issues requiring assistance, they are often left without help.

“Every time I needed support, it felt like I was talking to a wall. They just disappear.” — User Review

This disconnection elevates the risk of amateur traders, who may find themselves unable to navigate the complexities of trading without adequate support.

Account Conditions Analysis

OW Markets presents if a multitude of account options to attract new traders, but the conditions surrounding these accounts warrant scrutiny.

Promising exceptional leverage ratios reaching up to 1:1000, the broker seeks to draw in high-volume traders looking to maximize their capital use. However, such high leverage also magnifies risks, putting inexperienced traders at significant financial peril should trades turn against them.

The minimum deposit requirements are notably low, but this low barrier to entry does not mitigate the overall issues regarding safety and regulatory compliance.

Conclusion

In conclusion, while OW Markets showcases itself as a multi-faceted trading platform with appealing features, serious concerns about regulatory compliance and user experiences cast a shadow over its reliability. For novice investors drawn in by low entry costs and the promise of high leverage, the significant risks associated should not be taken lightly. By contrast, experienced traders who prioritize security and fund safety should consider carefully before engaging with OW Markets. Prioritizing due diligence and exercising caution is paramount in navigating the often perilous waters of online trading.