Is MXC Group safe?

Business

License

Is MXC Group A Scam?

Introduction

MXC Group, a forex broker established in 2018, has garnered attention within the trading community for its diverse range of trading instruments, including forex, commodities, and cryptocurrencies. However, the forex market is notorious for its risks, and traders must exercise caution when selecting a broker. In an industry where scams and fraudulent schemes are prevalent, it becomes crucial for potential investors to conduct thorough assessments of brokers before committing their funds. This article aims to provide an objective analysis of MXC Group, focusing on its regulatory status, company background, trading conditions, client fund security, customer experiences, platform performance, and overall risk assessment.

The evaluation methodology employed in this article includes a comprehensive review of available online resources, user feedback, and expert opinions. By utilizing a structured framework, we aim to provide a balanced view of whether MXC Group is safe or if it exhibits characteristics that may indicate potential risks or fraudulent behavior.

Regulation and Legitimacy

The regulatory environment in which a broker operates is a critical factor in assessing its legitimacy and trustworthiness. Regulatory bodies are responsible for monitoring broker activities, ensuring compliance with financial laws, and protecting investors. In the case of MXC Group, the broker was previously regulated by the Labuan Financial Services Authority (LFSA). However, recent reports indicate that its regulatory status has been revoked, raising significant concerns about its operational legitimacy.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Labuan FSA | MB/18/0021 | Malaysia | Revoked |

The revocation of the LFSA license serves as a red flag for potential investors. It suggests that MXC Group may not adhere to the necessary regulatory standards, which can lead to a lack of oversight and increased risks for traders. Furthermore, the absence of a valid regulatory license diminishes the broker's credibility and raises questions about its compliance history. This situation highlights the importance of selecting brokers with robust regulatory frameworks to safeguard investments.

Company Background Investigation

MXC Group was founded in 2018 and is registered under MX Capital Financial Limited. The company operates from Labuan, Malaysia, a well-known offshore financial center. However, the transparency of MXC Group's operations has been called into question, particularly regarding its physical presence. Reports from users indicate that the supposed office location in Labuan does not correspond to an actual operational site, further complicating the broker's legitimacy.

The management team behind MXC Group has not been extensively detailed in available resources, which raises concerns about their professional experience and expertise in the financial sector. A lack of information about the leadership can lead to uncertainties regarding the broker's operational integrity and strategic direction. Transparency in management and ownership structures is vital for establishing trust with clients.

Moreover, the level of information disclosure by MXC Group appears limited, which can hinder potential investors from making informed decisions. A broker that is unwilling to provide comprehensive information about its operations, management, and compliance history may not be a reliable choice for traders seeking a safe trading environment.

Trading Conditions Analysis

When evaluating a broker's trading conditions, it is essential to examine its fee structure, spreads, and overall trading environment. MXC Group offers a variety of account types, including Standard, VIP, Perfect, and Gold accounts, each with different features and minimum deposit requirements. However, the overall fee structure appears to be less competitive compared to industry standards.

| Fee Type | MXC Group | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.5-2.0 pips | 1.0-1.5 pips |

| Commission Model | Variable | Fixed/Variable |

| Overnight Interest Range | High | Moderate |

The spreads offered by MXC Group, starting from 1.5 pips, are higher than many competitors, which may affect trading profitability. Additionally, the commission structure remains unclear, with reports suggesting that traders may face unexpected fees. Such practices can indicate a lack of transparency and may lead to dissatisfaction among clients.

It is crucial for traders to be aware of any unusual fee policies that could impact their trading experience. High spreads and ambiguous commission structures can erode potential profits and create barriers to successful trading. Therefore, potential investors should carefully assess the trading conditions offered by MXC Group before proceeding.

Client Fund Security

The security of client funds is paramount when selecting a forex broker. MXC Group claims to implement several safety measures, including fund segregation and negative balance protection. However, the effectiveness of these measures is questionable given the broker's revoked regulatory status.

Investors should be aware of the following aspects regarding fund security:

Segregation of Funds: MXC Group states that client funds are kept in separate accounts to protect them from operational risks. However, without regulatory oversight, the enforcement of this policy remains uncertain.

Investor Protection: The absence of a regulatory body means that clients may not be entitled to any compensation schemes in the event of insolvency or financial mismanagement.

Negative Balance Protection: While the broker claims to offer this feature, the lack of regulatory backing raises concerns about its implementation and reliability.

Additionally, there have been reports of withdrawal difficulties and complaints from users regarding their inability to access funds. Such issues can severely undermine trust in a broker's commitment to safeguarding client assets. Therefore, potential investors should approach MXC Group with caution regarding fund security.

Customer Experience and Complaints

Customer feedback is a valuable resource for assessing a broker's reliability and service quality. In the case of MXC Group, reviews indicate a mixed experience among clients. While some users report satisfactory trading experiences, others have raised significant concerns about withdrawal issues and customer support responsiveness.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Difficulties | High | Poor |

| Customer Support Issues | Medium | Average |

| Account Blocking | High | Poor |

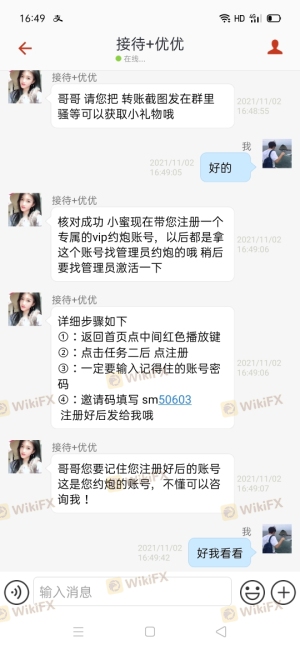

Common complaints include difficulties in withdrawing funds, unresponsive customer support, and allegations of account blocking. Users have reported that after depositing funds, they faced challenges in accessing their accounts or withdrawing their money, which is a significant concern for any potential trader. The company's response to these complaints has often been inadequate, leading to further frustration among clients.

For instance, one user reported being unable to withdraw their funds after multiple attempts, ultimately leading to allegations of fraud. Such cases highlight the importance of evaluating customer experiences when determining whether MXC Group is safe for trading.

Platform and Execution

The trading platform offered by MXC Group is the widely used MetaTrader 4 (MT4), known for its robust features and user-friendly interface. However, the platform's performance and execution quality have been scrutinized by users. Reports of slippage and order rejections have raised concerns about the broker's execution reliability.

Traders have noted instances where orders were not executed at the desired price, leading to unexpected losses. This situation can be particularly detrimental in fast-moving markets, where timely execution is crucial. Additionally, any signs of platform manipulation or inefficiencies can further erode trust in the broker's operational integrity.

Risk Assessment

Using MXC Group as a trading platform carries inherent risks. The combination of regulatory issues, customer complaints, and execution problems contributes to an overall risk profile that potential investors should carefully consider.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Compliance | High | Revoked license raises significant concerns. |

| Fund Security | High | Lack of regulatory oversight may jeopardize client funds. |

| Customer Support | Medium | Inconsistent responses to complaints can lead to unresolved issues. |

| Execution Quality | High | Reports of slippage and rejections can impact trading performance. |

To mitigate these risks, potential investors are advised to conduct thorough research, consider alternative brokers with stronger regulatory backing, and remain vigilant regarding their trading activities.

Conclusion and Recommendations

In conclusion, the evidence suggests that MXC Group raises several red flags that warrant caution from potential investors. The revocation of its regulatory license, coupled with reports of withdrawal difficulties and inadequate customer support, indicates that the broker may not provide a safe trading environment. While some traders have reported satisfactory experiences, the overall risk profile suggests that MXC Group is not safe for those seeking a reliable forex trading platform.

For traders looking for safer alternatives, consider brokers that are well-regulated, have transparent fee structures, and demonstrate a commitment to customer service. Some reputable options include XM, eToro, and IG, which are known for their regulatory compliance and positive user experiences. Always prioritize safety and due diligence when selecting a broker in the forex market.

Is MXC Group a scam, or is it legit?

The latest exposure and evaluation content of MXC Group brokers.

MXC Group Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

MXC Group latest industry rating score is 1.58, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.58 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.