Is MONEY plant FX safe?

Pros

Cons

Is Moneyplant Safe or Scam?

Introduction

Moneyplant is an online forex broker that operates in the foreign exchange market, offering a range of trading services to retail investors. As the forex market is known for its high volatility and potential for significant profits, it attracts a diverse group of traders. However, this also means that traders need to be vigilant and conduct thorough evaluations of any broker they consider working with. The importance of assessing a broker's safety and legitimacy cannot be overstated, as unregulated or poorly regulated brokers can expose traders to high risks, including potential loss of funds. This article investigates whether Moneyplant is a safe trading platform or a potential scam, using a combination of regulatory analysis, company background checks, and customer feedback.

Regulation and Legitimacy

When evaluating the safety of a forex broker like Moneyplant, the first factor to consider is its regulatory status. Regulation serves as a safeguard for traders, ensuring that brokers adhere to specific standards and practices that protect investors' interests. Unfortunately, Moneyplant operates without any valid regulatory oversight, which poses a significant risk for potential clients.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

The absence of regulation means that Moneyplant is not subject to the rigorous compliance standards typically enforced by financial authorities. This lack of oversight raises concerns about the broker's legitimacy and operational practices. Traders should be particularly cautious when dealing with unregulated brokers, as they may not have the same level of accountability as those regulated by reputable authorities. The potential for fraud and mismanagement is significantly higher in such cases, making it essential for traders to conduct their due diligence before committing to any investments.

Company Background Investigation

Moneyplant claims to have been in operation for several years, but there is limited verifiable information regarding its history and ownership structure. The company appears to be based in the United Kingdom, but it lacks transparency about its management team and their professional backgrounds. A lack of information about the company's founders or executives can be a red flag for potential investors, as it raises questions about the broker's credibility and operational integrity.

In terms of transparency, Moneyplant does not provide sufficient details about its business practices, financial health, or the regulatory measures it claims to follow. This lack of clarity can lead to distrust among potential clients and further emphasizes the need for caution when considering whether "Is Moneyplant safe?"

Trading Conditions Analysis

The trading conditions offered by Moneyplant are another critical aspect to consider. The broker reportedly provides a standard account type with a minimum deposit requirement of $100 and maximum leverage of up to 1:500. While these conditions may seem attractive, the absence of regulatory oversight raises concerns about the overall cost structure and potential hidden fees.

| Fee Type | Moneyplant | Industry Average |

|---|---|---|

| Spread for Major Pairs | Starts at 1.2 pips | 1.0 - 1.5 pips |

| Commission Structure | None stated | Varies widely |

| Overnight Interest Rates | Not disclosed | 0.5% - 2% |

The spread offered by Moneyplant for major currency pairs starts at 1.2 pips, which is slightly higher than the industry average. Additionally, the lack of clarity regarding commission structures and overnight interest rates can lead to unexpected costs for traders. Transparency in fee structures is essential for building trust, and Moneyplant's vague policies may signal potential issues.

Client Fund Security

The security of client funds is paramount when considering whether "Is Moneyplant safe?" Unfortunately, Moneyplant does not provide detailed information about its fund protection measures. With no regulatory body overseeing its operations, there are no guarantees regarding fund segregation, investor protection, or negative balance protection policies.

Traders must be aware that if a broker does not implement robust security measures, their investments may be at risk. The absence of a regulatory framework means that clients may have limited recourse in the event of financial disputes or insolvency. Historical issues related to fund security further complicate the picture, as unregulated brokers may not have a proven track record of safeguarding client assets.

Customer Experience and Complaints

Customer feedback is vital in assessing the overall reliability of a broker. Reviews and testimonials about Moneyplant reveal a mixed bag of experiences, with some traders expressing dissatisfaction over the lack of support and transparency. Common complaints include difficulties in withdrawing funds and slow customer service responses.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Customer Support | Medium | Inconsistent |

| Transparency Concerns | High | Poor |

Two typical cases include traders who reported delays in fund withdrawals and a lack of communication regarding their account status. These issues highlight the potential risks associated with trading with Moneyplant and raise questions about the broker's commitment to customer service.

Platform and Execution

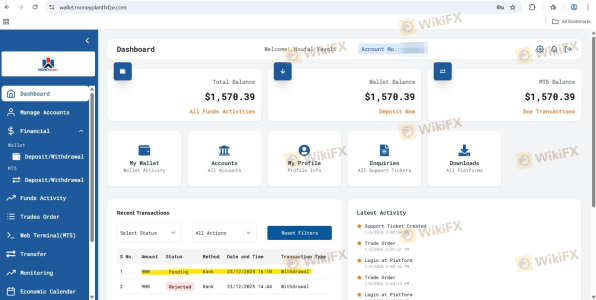

The trading platform offered by Moneyplant is reported to be user-friendly, utilizing the MT5 trading system. However, the lack of regulatory oversight raises concerns about the quality of order execution. Traders should be wary of potential slippage and order rejections, as these issues can significantly impact trading performance.

Overall, the stability and reliability of the trading platform are crucial for a seamless trading experience. If traders encounter frequent issues with execution quality, it may indicate underlying problems within the broker's operational framework.

Risk Assessment

Using Moneyplant comes with a range of risks that potential traders should consider. The absence of regulatory oversight, vague fee structures, and customer complaints all contribute to a higher risk profile when dealing with this broker.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No valid oversight |

| Financial Transparency | High | Lack of clear info |

| Customer Support | Medium | Inconsistent responses |

To mitigate these risks, traders should conduct thorough research, consider using demo accounts, and only invest amounts they can afford to lose. Additionally, seeking out regulated alternatives may provide better security and peace of mind.

Conclusion and Recommendations

In conclusion, the investigation into Moneyplant raises significant concerns regarding its safety and legitimacy. The lack of regulation, unclear fee structures, and mixed customer feedback suggest that potential clients should exercise extreme caution. The question of "Is Moneyplant safe?" leans toward a negative response, given the available evidence.

For traders seeking reliable brokers, it is advisable to consider regulated alternatives with proven track records and transparent practices. Brokers regulated by top-tier authorities, such as the FCA or ASIC, offer greater security and accountability, making them safer options for trading. Ultimately, thorough research and due diligence are essential for safeguarding investments in the forex market.

Is MONEY plant FX a scam, or is it legit?

The latest exposure and evaluation content of MONEY plant FX brokers.

MONEY plant FX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

MONEY plant FX latest industry rating score is 1.96, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.96 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.