Is MOKFX safe?

Business

License

Is Mokfx Safe or Scam?

Introduction

Mokfx, a relatively new player in the forex market, has garnered attention for its trading services. Established in 2021, Mokfx positions itself as a global broker providing access to various financial markets. However, with the increasing number of scams in the forex industry, it is crucial for traders to carefully evaluate the legitimacy of brokers like Mokfx. This article aims to investigate whether Mokfx is a safe broker or a potential scam by analyzing its regulatory status, company background, trading conditions, client fund security, customer experiences, platform performance, and associated risks. Our assessment is based on a comprehensive review of available online resources and user feedback.

Regulation and Legitimacy

The regulatory status of a broker is paramount in determining its legitimacy and trustworthiness. Mokfx claims to be regulated by the National Futures Association (NFA) in the United States; however, there are significant concerns regarding this claim. The broker does not appear to be listed as a member of the NFA, raising red flags about its regulatory compliance.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| NFA | 0543998 | United States | Suspicious Clone |

The absence of proper regulation can expose traders to various risks, including fraud and mismanagement of funds. Regulatory bodies like the NFA enforce strict guidelines to ensure brokers operate transparently and fairly. Mokfx's lack of verified regulatory oversight means that traders may have limited recourse in case of disputes or issues. This lack of regulation significantly impacts the overall safety of trading with Mokfx, making it essential for potential clients to consider these factors carefully.

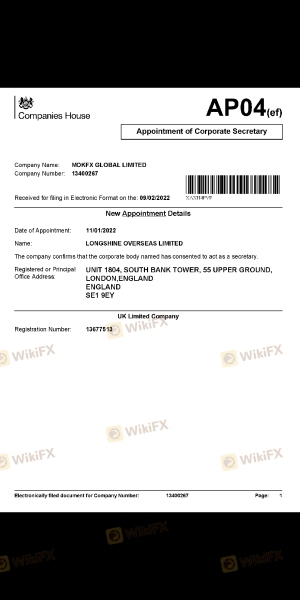

Company Background Investigation

Mokfx operates under the name Mokfx Global Limited, which raises questions about its ownership structure and operational transparency. The broker's website lacks detailed information about its management team and corporate history, which are critical elements for assessing trustworthiness. Without clear insights into who runs the company, traders are left in the dark about the qualifications and backgrounds of those managing their investments.

Mokfx's website also does not provide adequate information regarding its physical address or contact details, which is another red flag. Legitimate brokers typically offer transparency in their operations, including clear information about their headquarters and management. The opacity surrounding Mokfx's operations suggests a lack of accountability, which is concerning for potential investors.

Trading Conditions Analysis

Mokfx advertises competitive trading conditions, but a closer look reveals potential issues with its fee structure. The broker claims to offer low spreads and commissions, but user reviews indicate that hidden fees may exist. These fees can significantly impact trading profitability and may not be disclosed upfront.

| Fee Type | Mokfx | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.5 pips | 1.0 pips |

| Commission Model | Variable | Fixed/Variable |

| Overnight Interest Range | 0.5% | 0.3% |

The comparison shows that Mokfx's spreads are higher than the industry average, which could deter traders looking for cost-effective trading options. Additionally, the lack of clarity regarding commission structures can lead to unexpected costs, further complicating the trading experience. Traders should be cautious and fully understand the fee structure before committing their funds.

Client Fund Security

The security of client funds is a vital aspect of any brokerage. Mokfx claims to implement various measures to protect client funds, including segregated accounts and negative balance protection. However, the lack of regulatory oversight raises concerns about the effectiveness of these measures.

Traders must be aware that without a regulatory framework, there is no guarantee that Mokfx will adhere to these security promises. Historical issues with fund security have been reported by users, including difficulties in withdrawing funds and allegations of fund mismanagement. These issues highlight the importance of choosing a broker with a proven track record of safeguarding client assets.

Customer Experience and Complaints

Customer feedback is an essential indicator of a broker's reliability. Reviews of Mokfx reveal a troubling pattern of complaints, particularly regarding withdrawal issues and unresponsive customer support. Many users have reported being unable to withdraw their funds, often citing vague explanations from the broker.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support Accessibility | Medium | Poor |

| Misleading Information | High | Poor |

Notably, several traders have reported that after initial successful withdrawals, subsequent requests were met with claims of additional fees or procedural hurdles. This pattern raises significant concerns about Mokfx's operational integrity and its commitment to customer service. The company's lack of responsiveness to these complaints further exacerbates the situation, leading many to question whether Mokfx is a safe platform for trading.

Platform and Execution

Mokfx utilizes the popular MetaTrader 4 (MT4) platform, which is known for its user-friendly interface and robust trading tools. However, user experiences indicate that while the platform is functional, there are concerns regarding order execution quality. Reports of slippage and order rejections have been prevalent among users, which can negatively impact trading outcomes.

A reliable trading platform should ensure timely execution of trades without unnecessary delays or rejections. The reported issues with Mokfx's platform performance suggest potential operational weaknesses that traders should consider before engaging with the broker.

Risk Assessment

Trading with Mokfx presents several risks that potential investors should be aware of. The lack of regulation, combined with numerous user complaints and reported issues, creates a high-risk environment for traders.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No verified regulatory oversight |

| Financial Risk | High | Potential for hidden fees and fund mismanagement |

| Operational Risk | Medium | Issues with platform performance and customer support |

To mitigate these risks, traders are advised to conduct thorough research before investing and consider using regulated brokers with a proven track record. Additionally, setting strict risk management strategies can help safeguard investments.

Conclusion and Recommendations

In conclusion, the evidence suggests that Mokfx exhibits several characteristics typical of potentially fraudulent brokers. The lack of regulatory oversight, combined with numerous complaints regarding fund security and customer service, raises significant concerns about the safety of trading with Mokfx.

Traders should exercise caution and consider alternative options that offer robust regulatory protection and transparent operations. For those seeking reliable forex brokers, it is advisable to explore options that are well-regulated by reputable authorities, ensuring a safer trading experience.

In summary, is Mokfx safe? The overwhelming evidence points towards a high level of risk associated with this broker, making it essential for traders to conduct further due diligence before engaging in any trading activities.

Is MOKFX a scam, or is it legit?

The latest exposure and evaluation content of MOKFX brokers.

MOKFX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

MOKFX latest industry rating score is 1.46, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.46 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.