Regarding the legitimacy of MGCCKJ forex brokers, it provides ASIC and WikiBit, (also has a graphic survey regarding security).

Is MGCCKJ safe?

Business

License

Is MGCCKJ markets regulated?

The regulatory license is the strongest proof.

ASIC Market Making License (MM)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

UnverifiedLicense Type:

Market Making License (MM)

Licensed Entity:

DBG MARKETS (AUSTRALIA) PTY LTD

Effective Date: Change Record

2004-03-10Email Address of Licensed Institution:

compliance@dbgmarket.com.auSharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

SE 14 L 11 65 YORK ST SYDNEY NSW 2000Phone Number of Licensed Institution:

0426281215Licensed Institution Certified Documents:

Is MGCCKJ a Scam?

Introduction

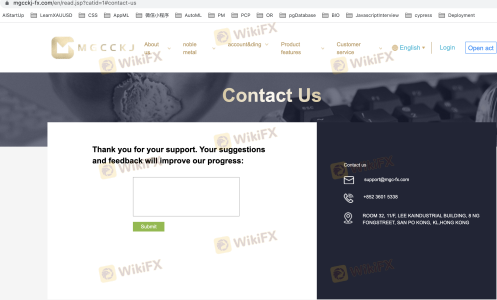

MGCCKJ is a relatively new player in the forex market, having been established in 2021 and operating out of Hong Kong. As a broker, it positions itself as a platform for trading various financial instruments, including forex, CFDs, and binary options. However, the rapid growth of the forex industry has also attracted numerous fraudulent entities, making it crucial for traders to conduct thorough due diligence before investing their hard-earned money. This article aims to provide a comprehensive evaluation of MGCCKJ, analyzing its regulatory status, company background, trading conditions, customer experiences, and overall safety. The information presented here is based on a thorough review of various credible online sources, including customer reviews, regulatory filings, and expert analyses.

Regulation and Legitimacy

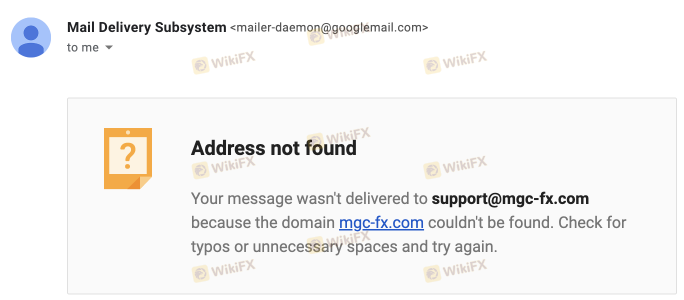

The regulatory status of a broker is one of the most critical factors that determine its legitimacy. MGCCKJ claims to be regulated by several authorities, including the Australian Securities and Investments Commission (ASIC) and the National Futures Association (NFA). However, there are significant concerns about the authenticity of these claims.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | 247017 | Australia | Suspicious Clone |

| NFA | 0542561 | USA | Unauthorized |

The above table highlights that while MGCCKJ claims to be regulated, it has been marked as a "suspicious clone" by several experts. This classification raises serious questions about its operational legitimacy. Regulatory oversight is essential in ensuring that brokers adhere to industry standards and protect traders' funds. Without credible regulatory backing, traders may find themselves exposed to various risks, including fraud and mismanagement of funds. Given these concerns, it is essential to ask: Is MGCCKJ safe? The answer seems to lean toward caution, as the lack of a robust regulatory framework significantly undermines its credibility.

Company Background Investigation

MGCCKJ was established in 2021, and its operational history is relatively short compared to many established brokers in the forex market. The company's ownership structure and management team remain opaque, with little information available to the public. Transparency in a brokers operations is crucial, as it fosters trust among potential clients.

Moreover, the absence of detailed information about the management team raises red flags. A reputable broker typically provides background information about its leaders, including their qualifications and industry experience. The lack of such disclosures makes it challenging for potential clients to assess the broker's competence and reliability.

In terms of operational transparency, MGCCKJ has been criticized for its inadequate information dissemination. Traders should be wary of brokers that do not provide clear details about their operations, as this could indicate potential malfeasance. Therefore, when considering whether MGCCKJ is safe, the answer appears to be negative, primarily due to its lack of transparency and questionable management.

Trading Conditions Analysis

An essential aspect of evaluating any broker is understanding its trading conditions, including fees, spreads, and commissions. MGCCKJ offers two types of accounts: ECN and STP, with a maximum leverage of 1:400, which is relatively high compared to industry standards. However, high leverage can also amplify risks, making it crucial for traders to use it judiciously.

| Fee Type | MGCCKJ | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | 0.0 pips | 1.0 pips |

| Commission Model | Not specified | $5 per lot |

| Overnight Interest Range | Not specified | Varies widely |

The table above illustrates that MGCCKJ claims to offer competitive spreads, but it does not specify its commission structure or overnight interest rates. The lack of clarity regarding these costs can lead to unexpected charges, which is a common complaint among traders. Moreover, the absence of detailed information about fees raises concerns about potential hidden costs, making it imperative to question whether MGCCKJ is safe for trading.

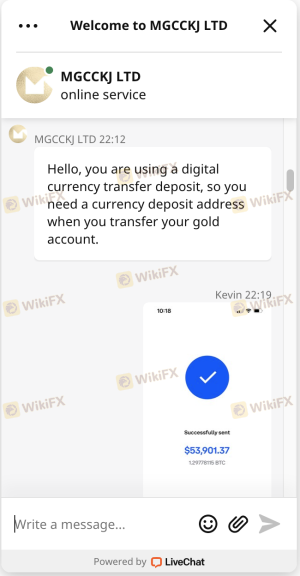

Customer Fund Security

The security of client funds is a paramount concern for any trader. MGCCKJ claims to implement various security measures, including segregated accounts for client funds and investor protection policies. However, the effectiveness of these measures is difficult to assess without credible regulatory oversight.

Traders should be aware that the absence of a robust regulatory framework can significantly impact the safety of their funds. If a broker is not subject to regular audits and compliance checks, the risk of mismanagement or fraud increases. Historical complaints about MGCCKJ indicate issues with fund withdrawals and customer service, raising further questions about the broker's reliability in safeguarding client investments.

Given these factors, it is crucial to consider whether MGCCKJ is safe for investment. The combination of dubious regulatory status and the lack of transparency regarding fund security measures suggests that traders should exercise extreme caution.

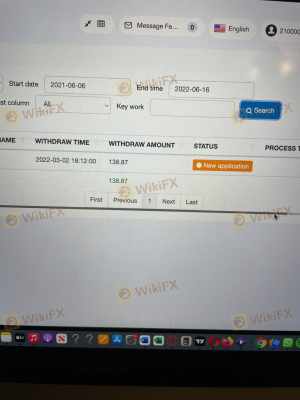

Customer Experience and Complaints

Customer feedback is often a good indicator of a broker's reliability. A review of various online platforms reveals a concerning trend of negative experiences associated with MGCCKJ. Common complaints include difficulties in withdrawing funds, inadequate customer service, and a lack of responsiveness to queries.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service Delays | Medium | Poor |

| Misleading Information | High | None |

The table above summarizes the types of complaints received by MGCCKJ and the company's response quality. The high severity of withdrawal issues indicates significant operational problems, suggesting that traders may encounter serious challenges when attempting to access their funds. Furthermore, the lack of effective responses from the company raises concerns about its commitment to customer satisfaction.

For instance, one typical case involved a trader who reported being unable to withdraw their funds for over two weeks, only to receive vague responses from customer service. Such experiences highlight the risks involved in trading with MGCCKJ, prompting the question: Is MGCCKJ safe? Based on customer experiences, the answer appears to be a resounding no.

Platform and Trade Execution

The performance of a broker's trading platform is crucial for ensuring a seamless trading experience. MGCCKJ utilizes the MetaTrader 5 platform, which is known for its advanced features and user-friendly interface. However, concerns have been raised regarding platform stability and execution quality.

Traders have reported instances of slippage and rejections, which can significantly impact trading outcomes. If a broker's platform exhibits high levels of slippage, it may indicate underlying issues with liquidity or execution practices. Moreover, any signs of platform manipulation should be taken seriously, as they can lead to substantial financial losses for traders.

In evaluating whether MGCCKJ is safe, the mixed reviews regarding platform performance suggest that traders may face challenges when executing trades. The potential for slippage and rejected orders raises red flags about the brokers operational integrity.

Risk Assessment

Given the various factors discussed, it is essential to conduct a comprehensive risk assessment regarding trading with MGCCKJ.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Lack of credible regulation raises concerns. |

| Fund Security Risk | High | Inadequate measures for protecting client funds. |

| Customer Service Risk | Medium | Poor responsiveness to customer complaints. |

| Platform Execution Risk | Medium | Reports of slippage and order rejections. |

The table above summarizes the key risks associated with trading with MGCCKJ. The high regulatory and fund security risks indicate that traders may be exposed to significant financial dangers.

To mitigate these risks, traders are advised to conduct thorough research, utilize demo accounts to test the platform, and consider diversifying their investments across multiple brokers to minimize potential losses.

Conclusion and Recommendations

In conclusion, the evidence suggests that MGCCKJ is not safe for trading. The combination of dubious regulatory status, poor customer experiences, and significant operational risks raises serious concerns about the broker's legitimacy. Traders should be particularly cautious about investing their funds with MGCCKJ, as numerous complaints indicate a pattern of problematic behavior.

For traders seeking reliable alternatives, it is advisable to consider well-regulated brokers with transparent operations and positive customer feedback. Some reputable options include brokers regulated by the FCA, ASIC, or CySEC. Always prioritize due diligence to ensure the safety of your investments in the volatile forex market.

Is MGCCKJ a scam, or is it legit?

The latest exposure and evaluation content of MGCCKJ brokers.

MGCCKJ Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

MGCCKJ latest industry rating score is 1.49, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.49 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.