Is Mediolanum Invest safe?

Business

License

Is Mediolanum Invest Safe or Scam?

Introduction

Mediolanum Invest is a financial brokerage that positions itself in the forex market, offering a range of trading services to retail and institutional clients. As with any financial entity, especially in the volatile realm of forex trading, it is crucial for traders to conduct thorough due diligence before committing their funds. The forex market is rife with both legitimate brokers and scams, making it imperative for traders to evaluate the credibility and safety of their chosen broker carefully. This article aims to provide an objective analysis of whether Mediolanum Invest is a safe trading option or a potential scam. Our investigation is based on a comprehensive review of regulatory status, company background, trading conditions, customer feedback, and risk assessment.

Regulation and Legitimacy

The regulatory status of a broker is one of the most significant indicators of its legitimacy. A well-regulated broker is more likely to adhere to stringent operational standards, ensuring the safety of client funds and fair trading practices. Mediolanum Invest claims to be regulated, but the specifics of its regulatory oversight require scrutiny.

| Regulator | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Serbian Securities Commission | N/A | Serbia | Unverified |

While Mediolanum Invest operates in Serbia, it lacks robust regulatory oversight from top-tier financial authorities. The absence of a valid regulatory license raises concerns about the broker's operational transparency and adherence to international trading standards. Furthermore, other sources indicate that Mediolanum Invest has no valid regulatory information, suggesting a higher potential risk for traders. It is essential to note that regulatory bodies play a critical role in protecting investors, and the lack of oversight could expose clients to potential fraud or mismanagement.

Company Background Investigation

Mediolanum Invest was established in Serbia and has been operational for several years. The company claims to have a solid foundation and aims to provide investment opportunities in various financial instruments, including forex. However, the ownership structure and management team details are somewhat opaque, which can be a red flag for potential investors.

The management team consists of individuals with varying levels of experience in the financial sector, but specific details about their backgrounds and qualifications are not readily available. This lack of transparency can hinder investors' ability to assess the competence of the team managing their funds. Additionally, the company's information disclosure practices appear to be limited, which further complicates the evaluation of its credibility.

Overall, while Mediolanum Invest presents itself as a legitimate broker, the lack of detailed company background information and transparency raises concerns about its overall trustworthiness.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is essential for evaluating its competitiveness in the market. Mediolanum Invest provides various trading options; however, the specifics of its fee structure and trading costs warrant careful examination.

| Fee Type | Mediolanum Invest | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1.0 - 2.0 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The absence of clear information regarding spreads, commissions, and overnight interest rates is concerning. Typically, reputable brokers provide transparent fee structures, allowing traders to understand the costs associated with their trades. The lack of such information from Mediolanum Invest may indicate potential hidden fees or unfavorable trading conditions.

Furthermore, the industry average for spreads on major currency pairs is around 1.0 to 2.0 pips, and without clear data from Mediolanum Invest, it is challenging to assess how competitive their offerings are. Traders should be cautious and seek clarity on these aspects before engaging with the broker.

Client Fund Security

The safety of client funds is paramount when considering a brokerage. Effective measures should be in place to protect investors' capital from potential losses. Mediolanum Invest claims to implement certain security protocols, but details on fund segregation, investor protection schemes, and negative balance protection policies are not explicitly stated.

In general, reputable brokers ensure that client funds are held in segregated accounts, separate from the company's operational funds. This practice protects investors' capital in the event of the broker's insolvency. Additionally, participation in investor compensation schemes provides an extra layer of security, reimbursing clients for lost assets if the broker fails. However, without clear evidence of such protections in place at Mediolanum Invest, potential clients may face a higher risk of losing their funds.

Historically, there have been instances in the forex market where brokers faced financial difficulties, leading to significant losses for traders. Therefore, it is crucial for prospective clients to ascertain the measures Mediolanum Invest has in place to safeguard their investments comprehensively.

Customer Experience and Complaints

Customer feedback is a critical component of evaluating a brokerage's reliability. Analyzing reviews and testimonials can provide insights into the experiences of other traders. Mediolanum Invest has received mixed reviews, with some clients expressing satisfaction with their services, while others have raised concerns.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Platform Stability | Medium | Unresolved |

| Customer Service Availability | High | Inconsistent |

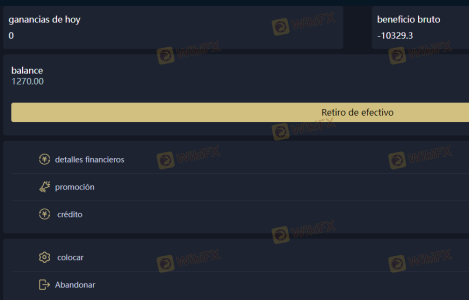

Common complaints include difficulties in withdrawing funds, which is a significant concern for traders. Delays in processing withdrawals can indicate potential liquidity issues or operational inefficiencies within the brokerage. Additionally, feedback regarding platform stability suggests that some users have experienced technical issues during trading, which can adversely affect trading outcomes.

A couple of notable cases involved clients who reported being unable to access their funds for extended periods. In these instances, the company's response was deemed insufficient, leading to frustration among affected traders. These patterns of complaints raise red flags about the overall customer experience at Mediolanum Invest.

Platform and Trade Execution

The trading platform's performance and execution quality are vital factors that can impact a trader's success. A reliable platform should offer stability, quick execution, and minimal slippage. However, user experiences with Mediolanum Invest's platform have been mixed, with some traders reporting issues with order execution and platform reliability.

Traders have noted instances of slippage during high volatility periods, which can lead to unexpected losses. Additionally, reports of rejected orders have surfaced, raising concerns about the broker's execution quality. Such issues can significantly affect trading strategies, particularly for those employing scalping or high-frequency trading techniques.

Overall, while Mediolanum Invest may offer a functional trading platform, the reported issues with execution quality and reliability warrant caution for potential clients.

Risk Assessment

Engaging with any broker comes with inherent risks, and Mediolanum Invest is no exception. The following risk assessment summarizes the key areas of concern associated with this broker:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Lack of robust regulatory oversight |

| Financial Stability Risk | Medium | Mixed reviews on fund withdrawal issues |

| Operational Risk | High | Reports of platform instability |

| Customer Service Risk | Medium | Inconsistent responses to complaints |

Given the high regulatory risk and operational concerns, potential clients should approach Mediolanum Invest with caution. It is advisable to consider alternative brokers with stronger regulatory oversight and a proven track record of customer satisfaction.

Conclusion and Recommendations

In conclusion, the evidence suggests that Mediolanum Invest is not entirely safe for traders. The lack of robust regulatory oversight, mixed customer feedback, and reported issues with fund withdrawals and platform stability raise significant concerns. While the broker may offer certain trading opportunities, the potential risks associated with engaging with Mediolanum Invest cannot be overlooked.

For traders seeking safety and reliability, it is recommended to consider alternative brokers with established regulatory credentials and positive customer reviews. Brokers such as IG, OANDA, or Forex.com are known for their strong regulatory frameworks and commitment to customer service, making them more trustworthy options for forex trading.

In summary, while Mediolanum Invest may present itself as a legitimate brokerage, the potential risks and concerns highlighted in this analysis warrant careful consideration before making any financial commitments.

Is Mediolanum Invest a scam, or is it legit?

The latest exposure and evaluation content of Mediolanum Invest brokers.

Mediolanum Invest Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Mediolanum Invest latest industry rating score is 1.56, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.56 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.