Is Max Markets safe?

Business

License

Is Max Markets Safe or Scam?

Introduction

Max Markets is a forex broker that has been operating since 2008, providing access to various financial markets, including forex, stocks, indices, and cryptocurrencies. As traders increasingly turn to online platforms for investment opportunities, it is crucial to assess the legitimacy and safety of these brokers. The foreign exchange market is rife with risks, and choosing an unregulated or unreliable broker can lead to significant financial losses. This article aims to provide a comprehensive evaluation of Max Markets, focusing on its regulatory status, company background, trading conditions, customer fund safety, user experiences, and overall risk assessment. The information is drawn from multiple reputable sources, including user reviews and regulatory databases, to ensure an objective analysis.

Regulation and Legitimacy

The regulatory status of a broker is a critical factor for traders when determining whether a broker is safe or potentially a scam. In the case of Max Markets, it is essential to note that the broker operates without a valid regulatory license, raising significant concerns about its legitimacy. The following table summarizes the core regulatory information regarding Max Markets:

| Regulatory Authority | License Number | Regulatory Area | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

The absence of regulatory oversight means that Max Markets is not subject to the rigorous standards typically imposed by financial authorities, which can protect traders from fraud and malpractice. Furthermore, the broker's operational base in the Marshall Islands, a region known for lax regulatory frameworks, adds to the skepticism surrounding its legitimacy. Historically, brokers without proper regulation have been associated with higher risks, including potential fraud and untrustworthy practices. As such, the question "Is Max Markets safe?" remains troubling, as traders may have little recourse in the event of disputes or financial losses.

Company Background Investigation

Max Markets, registered under Maxi Services Ltd., has been in operation for over 15 years. However, the lack of transparency regarding its ownership and management raises red flags. The company's website offers limited information about its founders or executive team, which is a common trait among less trustworthy brokers. A transparent broker typically provides detailed backgrounds of its management team, showcasing their expertise and experience in the financial sector.

Moreover, the company's history is marred by claims of suspicious practices and a lack of accountability. Many brokers that operate in unregulated environments often engage in questionable activities, such as manipulating spreads or delaying withdrawals. The opacity in Max Markets' operations makes it difficult for potential clients to gauge the trustworthiness of the broker. Consequently, the question "Is Max Markets safe?" is further complicated by the broker's ambiguous corporate structure and lack of publicly available information.

Trading Conditions Analysis

When evaluating a broker, understanding its trading conditions is crucial for traders. Max Markets offers a variety of trading accounts, with minimum deposits starting at $500, which is relatively high compared to industry standards. The following table illustrates the core trading costs associated with Max Markets:

| Cost Type | Max Markets | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | High | Low |

| Commission Structure | None | Varies |

| Overnight Interest Range | Unknown | Varies |

The high spreads on major currency pairs can significantly erode a trader's profits, especially for those engaging in frequent trading. Additionally, the lack of a clear commission structure raises concerns about hidden fees that could be levied on traders. Such practices are often indicative of less reputable brokers, leading to the question of whether “Is Max Markets safe?”—the answer appears to lean towards caution.

Client Fund Safety

The safety of client funds is paramount when choosing a broker. Max Markets has not provided clear information regarding its fund safety measures, such as whether client funds are kept in segregated accounts or if they have any investor protection schemes in place. The absence of these safeguards raises significant concerns. Traders should always prioritize brokers that offer transparent fund protection policies and adhere to strict financial regulations.

Additionally, the lack of any historical issues related to fund security is not necessarily a positive sign; rather, it could indicate a lack of operations that have been scrutinized. Therefore, the question “Is Max Markets safe?” seems to indicate a high level of risk for potential investors, as there is no assurance of fund safety.

Customer Experience and Complaints

User feedback is an essential component of evaluating a broker's reliability. Many reviews of Max Markets highlight issues such as withdrawal delays, poor customer service, and unresponsive support channels. The following table summarizes the primary complaint types associated with Max Markets:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

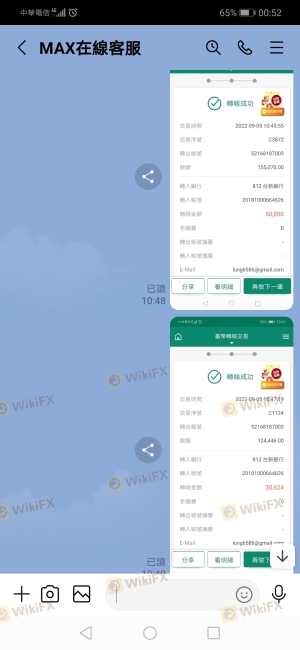

| Withdrawal Issues | High | Poor |

| Customer Service Delays | Medium | Unresponsive |

| Account Management Problems | High | Poor |

Common complaints include users reporting difficulties in withdrawing their funds, which is a significant red flag for any broker. Additionally, the overall quality of customer service has been criticized, with many users experiencing long wait times or no responses at all. These issues contribute to the growing concerns regarding the safety and reliability of Max Markets, further complicating the question: “Is Max Markets safe?”

Platform and Trade Execution

The trading platform's performance is another critical aspect of a broker's evaluation. Max Markets offers various trading platforms, including MetaTrader 4 and 5. However, user reviews indicate that there are frequent issues with platform stability and order execution quality. Traders have reported instances of slippage and rejected orders, which can significantly impact trading outcomes.

The lack of transparency regarding the execution policies and potential manipulation of trades raises further concerns. Therefore, when asking, “Is Max Markets safe?” the answer leans towards skepticism, as traders may find themselves at a disadvantage due to these execution issues.

Risk Assessment

Using Max Markets involves several inherent risks, primarily due to its unregulated status and questionable operational practices. The following risk assessment summarizes the key risks associated with trading through Max Markets:

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | No valid regulatory oversight leads to potential fraud. |

| Fund Safety Risk | High | Lack of client fund protection and transparency. |

| Trading Execution Risk | Medium | Issues with order execution and platform stability. |

To mitigate these risks, traders should consider using alternative brokers with robust regulatory frameworks and transparent operations. Conducting thorough research and staying informed about market conditions can also help traders make more informed decisions.

Conclusion and Recommendation

In conclusion, the evidence gathered suggests that Max Markets poses significant risks for potential traders. The absence of regulatory oversight, questionable trading conditions, and numerous user complaints raise serious concerns about the broker's legitimacy. Therefore, it is advisable for traders to exercise extreme caution when considering Max Markets as a trading platform.

For those seeking a reliable trading experience, it is recommended to explore alternative brokers that are well-regulated and have a proven track record of transparency and customer satisfaction. Ultimately, the question “Is Max Markets safe?” is best answered with a resounding caution, urging traders to prioritize their financial security and choose wisely.

Is Max Markets a scam, or is it legit?

The latest exposure and evaluation content of Max Markets brokers.

Max Markets Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Max Markets latest industry rating score is 1.57, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.57 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.