Is MATG safe?

Business

License

Is MATG Safe or Scam?

Introduction

In the ever-evolving landscape of the foreign exchange (forex) market, MATG has emerged as a player that attracts both novice and experienced traders. As a forex broker, MATG offers various trading instruments and platforms, positioning itself as a potential option for traders looking to diversify their portfolios. However, with the proliferation of online trading platforms, it becomes imperative for traders to exercise caution and thoroughly evaluate the credibility of any forex broker they consider. The potential for scams in this industry is significant, making it essential to conduct a comprehensive assessment of MATG's legitimacy. This article employs a multi-faceted evaluation framework to analyze MATG's regulatory status, company background, trading conditions, fund safety measures, customer experiences, and overall risk profile.

Regulation and Legitimacy

The regulatory environment is a critical factor in determining whether a forex broker is safe or a scam. Brokers that operate under stringent regulatory oversight are generally seen as more trustworthy, as they are required to adhere to specific standards designed to protect traders. MATG claims to be registered in New Zealand; however, a closer inspection reveals some inconsistencies regarding its regulatory status.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Financial Services Provider Register (FSPR) | 51761 | New Zealand | Not verified |

The lack of a verified physical office in New Zealand raises concerns about MATG's compliance with local regulations. Reports indicate that the office address listed for MATG does not exist, which is a significant red flag. Furthermore, the absence of a solid regulatory framework implies that MATG may not be subject to the same rigorous oversight as brokers regulated by top-tier authorities like the FCA in the UK or ASIC in Australia. This lack of oversight can expose traders to higher risks, including the potential for fraud or mismanagement of funds. Therefore, it is crucial to question is MATG safe? The evidence suggests that it may not be.

Company Background Investigation

Understanding the history and ownership structure of a broker can provide insights into its reliability. MATG is owned by Mark Adrian Thomas Gatward, a name that does not appear prominently in the forex industry. The company's history is relatively obscure, with limited information available regarding its establishment and operational milestones. The lack of transparency raises questions about the broker's commitment to ethical practices and customer engagement.

Moreover, the management team's background is crucial in assessing the broker's operational integrity. A team with extensive experience in financial markets can instill confidence among traders. However, the absence of publicly available information about MATG's management team further complicates the assessment of its credibility. In a market where transparency is vital, the inability to find relevant details about the company's leadership is concerning. This raises the question: is MATG safe for traders looking for a trustworthy broker? The lack of transparency and experience in the management team suggests that caution is warranted.

Trading Conditions Analysis

The trading conditions offered by a broker can significantly impact a trader's experience and profitability. MATG presents a variety of trading conditions, including different account types and leverage options. However, it is essential to scrutinize these conditions to determine if they are competitive or potentially exploitative.

| Fee Type | MATG | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.6 pips | 1.0 - 1.5 pips |

| Commission Model | Not disclosed | $5 - $10 per lot |

| Overnight Interest Range | Not specified | Varies widely |

While MATG offers a spread of 1.6 pips, which is on the higher end compared to industry averages, the lack of transparency regarding commissions and overnight interest raises concerns. Traders may find themselves facing unexpected fees that could erode profits. The absence of a clear fee structure could lead to confusion, making it difficult for traders to assess the true cost of trading with MATG. This uncertainty prompts further investigation into whether MATG is safe for traders who value clarity in their trading costs.

Client Fund Safety

The security of client funds is paramount in determining the trustworthiness of a forex broker. MATG's claims regarding fund safety measures warrant scrutiny. Effective fund protection strategies typically include segregated accounts and investor compensation schemes. However, there is limited information available about MATG's policies in these areas.

Without clear statements on fund segregation or protection against negative balances, traders may be exposed to significant risks. The lack of transparency regarding these safety measures raises the question of whether MATG has experienced any historical issues with fund security. If past incidents exist, they could indicate a pattern of negligence or mismanagement. Therefore, it is crucial for potential clients to consider whether MATG is safe when it comes to protecting their investments.

Customer Experience and Complaints

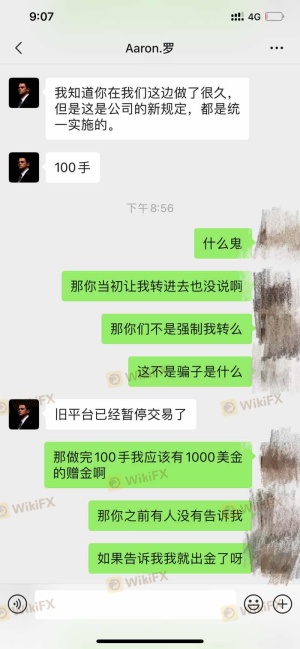

Customer feedback is an invaluable resource for assessing a broker's reliability. Analyzing user experiences can highlight common issues and the company's responsiveness. While some reviews may praise MATG for its trading platform, others express concerns about withdrawal delays and customer service quality.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response times |

| Poor Customer Support | Medium | Inconsistent communication |

| Account Verification | Low | Lengthy process |

The patterns of complaints suggest that MATG may struggle with customer service, particularly regarding withdrawal processes. This can be a significant deterrent for traders who prioritize timely access to their funds. A lack of effective communication can exacerbate frustrations and lead to a negative trading experience. For those asking is MATG safe, the evidence points toward a potentially problematic customer service experience.

Platform and Trade Execution

The trading platform's performance is critical in determining a broker's reliability. MATG offers access to MetaTrader 4 and 5, both of which are well-regarded platforms. However, user experiences vary when it comes to execution quality. Reports of slippage and order rejections may indicate underlying issues with the broker's liquidity or order processing.

Traders expect a seamless experience when executing trades, and any signs of manipulation or inefficiency can lead to significant losses. If MATG fails to deliver on this front, it raises concerns about the overall integrity of the trading environment. Therefore, traders must consider whether MATG is safe in terms of platform reliability and execution quality.

Risk Assessment

Evaluating the overall risk associated with a broker is essential for informed trading decisions. The following risk assessment summarizes key areas of concern regarding MATG:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Lack of verified regulatory oversight |

| Transparency Risk | High | Insufficient information on management |

| Customer Service Risk | Medium | Complaints about withdrawal delays |

| Trading Cost Risk | Medium | Unclear fee structure |

Given the identified risks, potential traders must exercise caution. It is advisable to engage with MATG only after thorough due diligence and consideration of alternative brokers with better regulatory standing and transparency.

Conclusion and Recommendations

In conclusion, while MATG presents itself as a forex broker with various trading options, the evidence suggests that MATG may not be safe for traders. The lack of verified regulatory oversight, insufficient transparency regarding management and fees, and reports of poor customer service raise significant red flags. Traders are encouraged to conduct their own research and consider alternative options that offer stronger regulatory protections and clearer fee structures.

For those seeking reliable forex brokers, alternatives such as brokers regulated by the FCA or ASIC may provide a safer trading environment. Ultimately, the decision should be based on a careful evaluation of the risks and benefits associated with any broker, including MATG.

Is MATG a scam, or is it legit?

The latest exposure and evaluation content of MATG brokers.

MATG Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

MATG latest industry rating score is 1.56, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.56 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.