Is Lunboux safe?

Business

License

Is Lunboux Safe or Scam?

Introduction

Lunboux is a relatively new player in the forex market, claiming to offer a range of trading services, including forex and CFD trading. However, as with any financial service, it is crucial for traders to carefully assess the legitimacy and safety of the broker before committing their funds. The forex market is rife with both reputable brokers and scams, making it essential for traders to conduct thorough research. In this article, we will investigate whether Lunboux is safe or a scam by examining its regulatory status, company background, trading conditions, customer experiences, and overall risk factors.

Regulatory and Legality

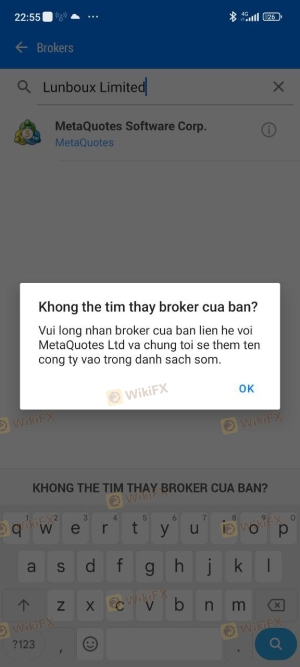

Understanding the regulatory framework surrounding a broker is vital for assessing its safety. Regulation helps ensure that brokers adhere to strict standards, providing a level of security for traders' funds. Unfortunately, Lunboux does not appear to be regulated by any recognized financial authority. Below is a summary of its regulatory status:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unverified |

The absence of regulation is a significant red flag. Lunboux claims to operate from Hong Kong but has not registered with the Hong Kong Securities and Futures Commission (SFC), which is a requirement for any broker offering financial services in the region. This lack of oversight raises concerns about the safety of client funds and the potential for unethical practices. Without regulatory supervision, traders have no recourse if issues arise, making it imperative to question: Is Lunboux safe?

Company Background Investigation

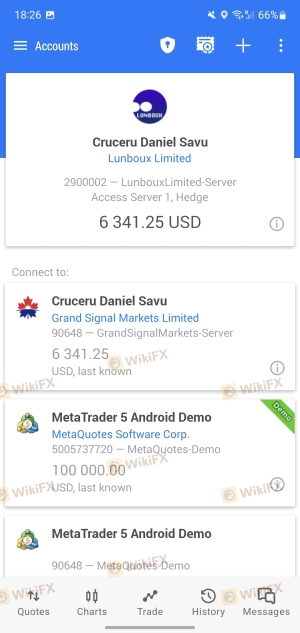

Lunboux Limited, the entity behind the broker, claims to have been established in 2010 with an experienced team. However, a closer look reveals that the domain was registered only in February 2022, indicating that the company is relatively new. Furthermore, there is little information available regarding the ownership structure or the identities of the management team, which is often a sign of a lack of transparency.

The companys website lacks essential details such as contact information and physical addresses, which are standard for legitimate brokers. This opacity in operations raises additional concerns regarding the company's integrity and trustworthiness. Given these factors, it is reasonable to question whether Lunboux is safe for traders seeking a reliable forex broker.

Trading Conditions Analysis

When evaluating a broker, understanding its trading conditions is crucial. Lunboux claims to offer competitive trading fees; however, there is limited information available regarding its fee structure. Below is a comparison of core trading costs:

| Fee Type | Lunboux | Industry Average |

|---|---|---|

| Major Currency Pair Spreads | Not disclosed | 0.1 - 1.5 pips |

| Commission Model | Not specified | Varies by broker |

| Overnight Interest Range | Not specified | Varies by broker |

The lack of transparency regarding fees is concerning. Traders should be wary of hidden charges that can negatively impact their trading profitability. Moreover, if a broker does not clearly outline its fee structure, it raises the question of whether Lunboux is safe to trade with, especially for those who are new to the forex market.

Client Funds Security

The safety of client funds is paramount when dealing with a forex broker. Lunboux has not provided clear information regarding its security measures for client funds. Key aspects such as fund segregation, investor protection, and negative balance protection are critical indicators of a brokers commitment to safeguarding client assets.

Without regulatory oversight, there are no guarantees that client funds are held in segregated accounts, which would protect them in the event of the broker's insolvency. Additionally, the absence of investor protection schemes means that traders could potentially lose their entire investment without any form of recourse. This lack of clarity on fund security raises serious doubts about whether Lunboux is safe for trading.

Customer Experience and Complaints

Customer feedback is a valuable source of information when evaluating a broker's reliability. There are numerous complaints online regarding Lunboux, with many users reporting difficulties in withdrawing funds. Below is a summary of common complaints:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Poor Customer Service | Medium | Unresponsive |

| Platform Stability | High | Frequent errors |

Several clients have expressed frustration with the broker's customer service, describing it as slow and unresponsive. Additionally, reports of withdrawal issues suggest a pattern that cannot be overlooked. This feedback raises significant concerns about Lunboux's operational integrity and whether Lunboux is safe for potential traders.

Platform and Trade Execution

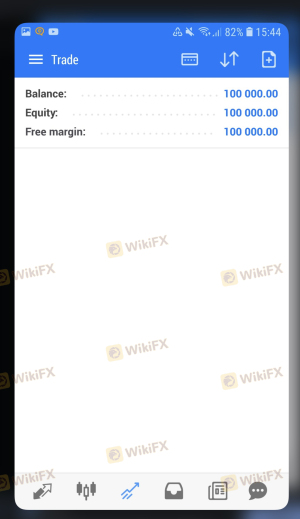

A broker's trading platform is the primary interface through which traders interact with the market. Lunboux claims to offer the popular MetaTrader 5 platform, but there have been reports of poor performance, including frequent errors and instability. Such issues can severely impact order execution quality, leading to slippage and rejected orders.

The platform's reliability is crucial for traders, and any signs of manipulation or technical glitches can further erode trust. If traders experience difficulties in executing trades or accessing their accounts, it raises the question of whether Lunboux is safe to trade with.

Risk Assessment

Engaging with an unregulated broker like Lunboux poses inherent risks. Below is a risk assessment summary:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Compliance | High | No regulation raises fraud concerns |

| Fund Security | High | Lack of segregation and protection |

| Customer Service | Medium | Reports of slow and unresponsive support |

| Platform Reliability | High | Frequent technical issues reported |

To mitigate risks when trading with Lunboux, potential clients should consider using smaller amounts for initial investments, thoroughly documenting all communications, and exploring options for chargebacks if they encounter issues.

Conclusion and Recommendations

In conclusion, based on the evidence gathered, Lunboux appears to exhibit several red flags that indicate it may not be a safe trading option. The lack of regulation, transparency issues, complaints regarding customer service, and operational difficulties all contribute to a concerning picture.

For traders considering their options, it is advisable to exercise caution and explore alternative brokers that are properly regulated and have a proven track record of reliability. Brokers with solid regulatory oversight, clear fee structures, and positive client feedback should be prioritized to ensure a safer trading experience.

Ultimately, the question remains: Is Lunboux safe? The evidence suggests that it may be prudent for traders to seek safer alternatives in the forex market.

Is Lunboux a scam, or is it legit?

The latest exposure and evaluation content of Lunboux brokers.

Lunboux Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Lunboux latest industry rating score is 1.46, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.46 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.