Is KYOLO MARKETS LIMITED safe?

Business

License

Is Kyolo Markets Limited A Scam?

Introduction

Kyolo Markets Limited positions itself as an online forex broker that claims to provide a wide range of trading services, including forex, commodities, and cryptocurrencies. As the forex market continues to grow, traders are increasingly drawn to online platforms for their trading needs. However, the rise of these platforms has also led to an increase in fraudulent schemes, making it crucial for traders to evaluate the legitimacy of brokers before investing their hard-earned money. This article aims to investigate whether Kyolo Markets Limited is a trustworthy broker or merely a scam. We will employ a comprehensive evaluation framework that includes regulatory compliance, company background, trading conditions, customer safety, and user experiences.

Regulation and Legitimacy

The regulatory status of a forex broker is one of the most critical factors in determining its legitimacy. A regulated broker is typically required to adhere to strict guidelines that protect traders' interests. Kyolo Markets Limited claims to be registered in Australia, which would necessitate oversight by the Australian Securities and Investments Commission (ASIC). However, upon checking the ASIC registry, there are no records of Kyolo Markets Limited, indicating that it is unregulated.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | N/A | Australia | Not Listed |

The absence of regulatory oversight raises significant concerns about the safety and security of funds deposited with Kyolo Markets Limited. Without a governing body to hold the broker accountable, traders face increased risks, including the potential loss of their investments without any recourse. Furthermore, the lack of transparency about their regulatory status is a major red flag, as legitimate brokers usually provide clear information regarding their licenses and regulatory compliance history.

Company Background Investigation

Kyolo Markets Limited claims to have a reputable history and a strong presence in the forex market; however, a closer examination reveals a lack of verifiable information. The company's website does not provide any detailed background, including its founding year, ownership structure, or management team. This lack of transparency is concerning, as it raises questions about the integrity of the broker and its willingness to disclose essential information to potential clients.

In addition, the management teams qualifications and experience are critical in assessing a broker's reliability. Without any disclosed information about the team behind Kyolo Markets Limited, traders are left in the dark regarding the expertise and professionalism guiding the company. The absence of contact details, such as a physical address or phone number, further compounds the issue, as legitimate brokers typically offer multiple channels for customer support and communication.

Trading Conditions Analysis

When evaluating whether Kyolo Markets Limited is safe, it is important to scrutinize the trading conditions it offers. The broker advertises competitive spreads and high leverage, claiming to provide a favorable trading environment. However, the lack of specific information regarding fees and trading costs raises concerns about transparency.

| Fee Type | Kyolo Markets Limited | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Not Specified | 0.1 - 1.5 pips |

| Commission Structure | Not Specified | $0 - $10 per lot |

| Overnight Interest Range | Not Specified | Varies by broker |

The absence of detailed information regarding spreads, commissions, and overnight fees is a significant warning sign. Legitimate brokers are typically upfront about their fee structures, allowing traders to make informed decisions. The vague claims of "ultra-low spreads" without specific figures are particularly concerning, as they may be designed to mislead potential clients.

Client Fund Safety

The safety of client funds is paramount when assessing whether Kyolo Markets Limited is safe. A reputable broker should have robust measures in place to protect client deposits, such as segregated accounts and investor protection schemes. However, Kyolo Markets Limited does not provide any information on these critical safety measures.

Without segregated accounts, client funds may be at risk if the broker faces financial difficulties. Moreover, the lack of negative balance protection means that traders could potentially lose more than their initial investment. The absence of any history regarding fund security incidents further raises questions about the broker's reliability.

Customer Experience and Complaints

Customer feedback is a valuable resource in evaluating the legitimacy of a broker. Reviews and testimonials can provide insights into the user experience and highlight any common issues. Unfortunately, Kyolo Markets Limited has garnered a number of negative reviews across various platforms, indicating widespread dissatisfaction among clients.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor Response |

| Misleading Marketing Claims | Medium | No Response |

| Customer Support Delays | High | Poor Response |

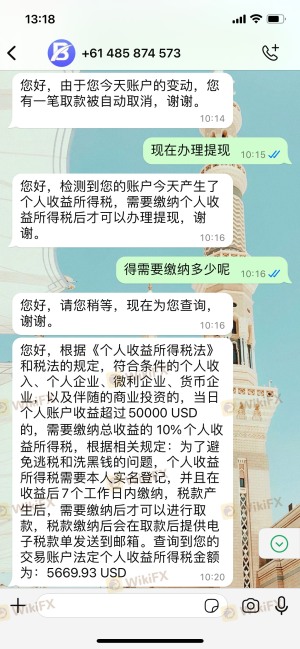

Common complaints include difficulties in withdrawing funds, misleading marketing practices, and inadequate customer support. One notable case involved a user who successfully made initial withdrawals but faced challenges when attempting to access larger sums, leading to allegations of fraudulent practices. Such complaints are alarming and suggest that Kyolo Markets Limited may not prioritize customer satisfaction or transparency.

Platform and Execution

The performance of a trading platform is crucial in determining the overall user experience. Kyolo Markets Limited claims to offer a user-friendly platform, but many reviews suggest otherwise. Users have reported issues with platform stability, order execution quality, and high slippage rates, which can significantly impact trading outcomes.

Moreover, the requirement for users to submit extensive personal information before accessing the trading platform raises additional concerns. This practice is atypical for legitimate brokers and suggests a possible attempt to extract sensitive data from clients.

Risk Assessment

Using Kyolo Markets Limited comes with a variety of risks that traders should consider. The lack of regulation, transparency, and customer support all contribute to a high-risk trading environment.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Financial Risk | High | Potential for loss of funds |

| Operational Risk | Medium | Platform stability and execution issues |

| Data Security Risk | High | Lack of secure data handling practices |

Given these risks, it is crucial for traders to employ risk mitigation strategies, such as limiting their investment amounts and conducting thorough research before committing funds.

Conclusion and Recommendations

In conclusion, the investigation into Kyolo Markets Limited raises several red flags that indicate it may not be a safe trading option. The lack of regulatory oversight, transparency, and customer support, combined with numerous negative reviews, strongly suggest that this broker operates in a high-risk environment.

For traders considering entering the forex market, it is advisable to steer clear of Kyolo Markets Limited and seek out regulated and reputable alternatives. Brokers that are licensed by recognized regulatory bodies, offer transparent trading conditions, and prioritize customer service are far more likely to provide a safe trading experience.

If you are looking for reliable options, consider established brokers that have a proven track record of customer satisfaction and regulatory compliance. Remember, when evaluating whether Kyolo Markets Limited is safe, the evidence overwhelmingly points to a need for caution and due diligence before engaging with this broker.

Is KYOLO MARKETS LIMITED a scam, or is it legit?

The latest exposure and evaluation content of KYOLO MARKETS LIMITED brokers.

KYOLO MARKETS LIMITED Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

KYOLO MARKETS LIMITED latest industry rating score is 1.41, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.41 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.