Is Profitto safe?

Pros

Cons

Is Profitto A Scam?

Introduction

Profitto, operating under the domain profitto ltd .com, positions itself as a forex broker offering various trading services, including forex, commodities, and indices. However, the legitimacy of Profitto has come under scrutiny, prompting traders to carefully evaluate its reliability. The forex market is rife with both legitimate and fraudulent brokers, making it crucial for traders to conduct thorough research before committing their funds. This article aims to provide a comprehensive assessment of Profitto by examining its regulatory status, company background, trading conditions, customer fund safety, user experiences, platform performance, and overall risk assessment.

Regulation and Legitimacy

Understanding the regulatory framework surrounding a broker is essential for assessing its safety and reliability. Profitto claims to be registered in Saint Vincent and the Grenadines, a jurisdiction notorious for its lack of regulatory oversight in the forex sector. This raises significant concerns about the safety of client funds and the broker's adherence to industry standards.

| Regulatory Authority | License Number | Regulated Region | Verification Status |

|---|---|---|---|

| None | N/A | Saint Vincent and the Grenadines | Unregulated |

The absence of regulation means that Profitto is not subject to any oversight by recognized financial authorities, which could lead to potential risks for traders. Unlike regulated brokers who must adhere to strict guidelines regarding capital requirements and client fund protection, Profitto operates without such constraints. This lack of regulatory quality raises alarms about the broker's legitimacy and the potential for fraudulent activities.

Company Background Investigation

Profitto was established in 2019, and its ownership structure remains obscure, with little information available about its founders or management team. The company's headquarters are located at Suite 305, Griffith Corporate Centre, Beachmont, Kingstown, Saint Vincent and the Grenadines. The lack of transparency regarding the company's ownership and management raises concerns about its credibility and accountability.

Additionally, the absence of a clear history or track record further complicates the assessment of Profitto's legitimacy. A reputable broker typically provides detailed information about its management team, including their backgrounds and professional experiences. However, Profitto has not disclosed such information, which diminishes its trustworthiness and raises questions about its operational integrity.

Trading Conditions Analysis

Profitto offers a low minimum deposit requirement of $10, which is appealing to novice traders. However, this low entry point is often a tactic used by unregulated brokers to attract clients. The broker provides high leverage of up to 1:1000, which is considered extremely risky and is banned in many jurisdictions due to the potential for significant losses.

| Fee Type | Profitto | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.1 pips | 1.0 pips |

| Commission Model | $3 per lot | $5 per lot |

| Overnight Interest Range | Varies | Varies |

Despite the low spreads advertised, traders should be cautious, as unregulated brokers often have hidden fees and unfavorable terms that can erode profits. The vague nature of Profitto's fee structure raises concerns about potential undisclosed charges that could impact trading costs.

Client Fund Safety

The safety of client funds is paramount when evaluating a broker. Profitto does not provide adequate assurances regarding the segregation of client funds or investor protection measures. The absence of regulatory oversight means that there are no guarantees in place to protect traders' investments in the event of the broker's insolvency.

Furthermore, Profitto does not offer negative balance protection, which is a crucial feature provided by regulated brokers to prevent clients from losing more than their initial investment. The lack of these safety measures poses a significant risk to traders, particularly in a volatile market environment.

Customer Experience and Complaints

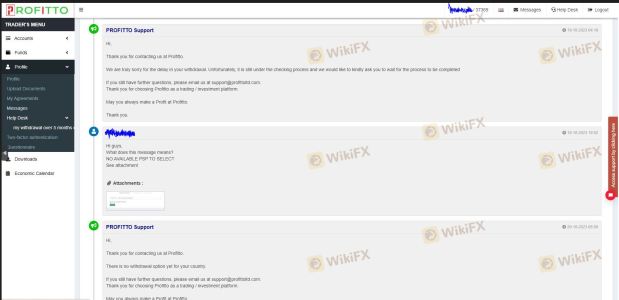

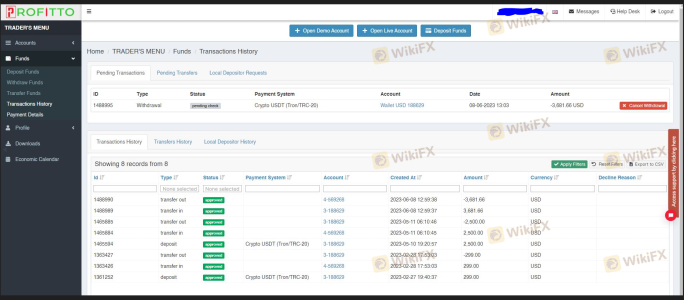

User feedback and experiences play a vital role in assessing a broker's reliability. Numerous complaints have surfaced regarding Profitto, particularly concerning withdrawal issues and poor customer service. Many users have reported difficulties in accessing their funds, with some stating that their withdrawal requests remain unprocessed for extended periods.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow or non-responsive |

| Poor Customer Support | Medium | Unresolved complaints |

For instance, one user reported waiting over four months for a withdrawal to be approved, while another highlighted the lack of responsiveness from customer support. Such patterns of complaints indicate systemic issues within Profitto's operations, raising further concerns about its credibility and trustworthiness.

Platform and Trade Execution

Profitto utilizes the widely recognized MetaTrader 4 (MT4) platform, which is known for its user-friendly interface and robust trading features. However, the performance of the platform can significantly impact the trading experience. Reports of connection issues and order execution delays have emerged, leading to frustration among traders.

The quality of order execution is critical for successful trading, and any signs of slippage or rejection of orders can lead to substantial losses. Users have noted instances of significant slippage during volatile market conditions, which raises questions about the platform's reliability and the broker's integrity.

Risk Assessment

Engaging with Profitto presents several risks that potential traders should consider. The lack of regulation, combined with reported withdrawal issues and poor customer service, creates an environment fraught with uncertainty.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated, no oversight |

| Financial Risk | High | High leverage, potential losses |

| Operational Risk | Medium | Withdrawal issues, slow support |

To mitigate these risks, traders are advised to conduct thorough due diligence, consider using regulated brokers, and start with a small investment to test the waters before committing larger sums.

Conclusion and Recommendations

In conclusion, the evidence suggests that Profitto exhibits several red flags that warrant caution. The lack of regulation, ongoing complaints about withdrawal issues, and the absence of transparency regarding its ownership and management raise significant concerns about its legitimacy.

Traders looking for a safe and reliable trading environment should consider alternatives that are properly regulated and have a proven track record of positive user experiences. Brokers such as XM, IG, or OANDA offer robust regulatory oversight and a more secure trading environment.

In light of these findings, it is strongly advised that traders exercise extreme caution when considering Profitto as their broker. The risks associated with trading through an unregulated platform far outweigh any potential benefits.

Is Profitto a scam, or is it legit?

The latest exposure and evaluation content of Profitto brokers.

Profitto Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Profitto latest industry rating score is 1.55, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.55 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.