Is KirikFx safe?

Business

License

Is KirikFX A Scam?

Introduction

KirikFX, operating under the name Kirik Markets Ltd, has positioned itself as a forex broker in the competitive landscape of online trading. Established in 2018 and headquartered in Saint Vincent and the Grenadines, KirikFX offers a range of trading services, including forex, commodities, and cryptocurrencies. However, the legitimacy of forex brokers is often a concern for traders, as the industry is rife with scams and unregulated entities. For traders looking to invest their hard-earned money, it is crucial to carefully evaluate the trustworthiness of a broker before proceeding. This article aims to provide a comprehensive assessment of KirikFX, utilizing various sources to analyze its regulatory status, company background, trading conditions, customer experiences, and overall risk profile.

Regulation and Legitimacy

The regulatory status of a broker is a key indicator of its legitimacy and reliability. KirikFX is registered in Saint Vincent and the Grenadines, a jurisdiction known for its lax regulatory framework. This raises concerns about the safety of client funds and the broker's adherence to industry standards. The following table summarizes the core regulatory information for KirikFX:

| Regulatory Authority | License Number | Regulatory Area | Verification Status |

|---|---|---|---|

| None | N/A | Saint Vincent | Unregulated |

As seen in the table, KirikFX lacks a regulatory license from any reputable authority. This absence of regulation is a significant red flag, as it means that the broker is not subject to oversight by any financial authority, leaving traders with limited recourse in case of disputes or fraudulent activities. Furthermore, many reviews indicate that KirikFX has received numerous complaints regarding withdrawal issues and customer service, which often points to a lack of accountability typical of unregulated brokers.

Company Background Investigation

KirikFX is operated by Kirik Markets Ltd, a company that has been active in the forex market for over five years. However, detailed information about the company's ownership structure and management team is scarce. The lack of transparency regarding the individuals behind the broker raises concerns about accountability and trust. A thorough background check reveals that the management team has not been prominently featured in credible financial publications or trading forums, which could indicate a lack of experience or expertise in the industry.

Moreover, the company's operational history includes several negative reviews and allegations of fraudulent practices, which further casts doubt on its legitimacy. The absence of publicly available information regarding the broker's financial health and operational practices is concerning for potential investors. In light of these factors, it is prudent for traders to approach KirikFX with caution and consider the potential risks involved.

Trading Conditions Analysis

When evaluating the trading conditions offered by KirikFX, it is essential to consider the overall cost structure and any unusual fees that may be associated with trading. KirikFX advertises a minimum deposit of $100 and leverages up to 1:500, which can be attractive to new traders. However, the broker's fee structure raises some questions. The following table outlines the core trading costs associated with KirikFX:

| Fee Type | KirikFX | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | 0.6 pips | 1.0 pips |

| Commission Model | None | Varies (Typically $3-$7 per lot) |

| Overnight Interest Range | Varies | Varies |

While KirikFX offers competitive spreads, the absence of a commission model may indicate that the broker compensates for this through wider spreads or other hidden fees. Additionally, traders have reported difficulties in withdrawing funds, which can be indicative of a broker attempting to retain client money through unclear withdrawal policies. This is a significant concern when assessing whether KirikFX is safe for trading.

Client Fund Safety

The safety of client funds is paramount when choosing a forex broker. KirikFX claims to implement various security measures, but the lack of regulation raises questions about the effectiveness of these measures. Reports suggest that client funds are not held in segregated accounts, which means that in the event of financial difficulties, the broker may not be able to return funds to clients. Additionally, there have been no clear indications of investor protection schemes or negative balance protection policies in place, which are essential for safeguarding traders' investments.

Historically, there have been allegations of clients facing difficulties in accessing their funds, with multiple complaints highlighting issues with withdrawal requests. Such incidents further exacerbate concerns about the broker's commitment to client fund safety. In light of these risks, traders must consider whether they are comfortable with the potential loss of their investments when trading with KirikFX.

Customer Experience and Complaints

Customer feedback is a valuable resource for assessing the reliability of a broker. Reviews of KirikFX reveal a mixed bag of experiences, with many users reporting dissatisfaction with customer service and withdrawal processes. Common complaints include delayed responses from support staff, difficulty in withdrawing funds, and issues with account management. The following table summarizes the main complaint types and their severity:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow/Unresponsive |

| Customer Support Quality | Medium | Inconsistent |

| Account Management Problems | High | Unresolved |

One notable case involved a trader who successfully made profits but faced significant challenges when attempting to withdraw funds. After multiple requests, the trader's account was eventually deleted, leading to fears of a potential scam. Such experiences are not isolated, and they contribute to the perception that KirikFX may not be a safe option for traders.

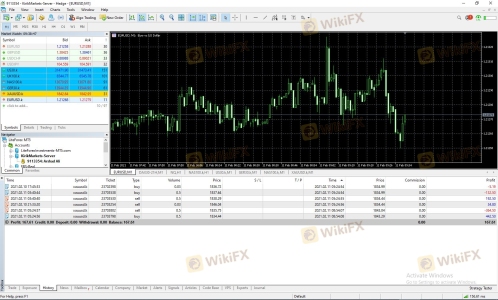

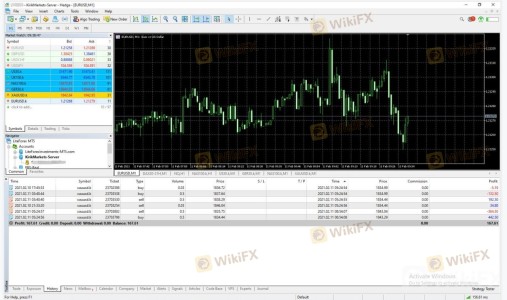

Platform and Trade Execution

The trading platform offered by KirikFX is a critical component of the overall trading experience. The broker primarily utilizes the MetaTrader 4 and MetaTrader 5 platforms, which are popular among traders for their user-friendly interfaces and robust features. However, user reviews indicate that the platform's performance can be inconsistent, with reports of slippage during high volatility periods and occasional execution delays.

Additionally, there are concerns about potential platform manipulation, as some traders have reported discrepancies between the prices displayed on the platform and the actual market prices. Such issues can significantly impact trading outcomes and raise questions about the broker's integrity. Therefore, assessing the platform's reliability is crucial for determining whether KirikFX is indeed safe for trading.

Risk Assessment

Using KirikFX presents several risks that potential traders should be aware of. The following risk assessment summarizes the key risk areas associated with trading with this broker:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated status increases risk |

| Fund Safety Risk | High | Lack of segregation of funds |

| Customer Service Risk | Medium | Inconsistent support responses |

| Execution Risk | Medium | Potential for slippage and delays |

To mitigate these risks, traders are advised to conduct thorough research before investing, limit their initial deposits, and consider using a demo account to test the broker's platform. It is also advisable to have a clear exit strategy in place in case of unfavorable trading conditions.

Conclusion and Recommendations

In summary, the evidence suggests that KirikFX exhibits several characteristics that raise concerns about its legitimacy and safety. The lack of regulation, combined with numerous complaints about withdrawal issues and customer service, points to a potentially risky trading environment. While some traders may find attractive trading conditions, the overall risks associated with KirikFX may outweigh the benefits.

For traders considering whether KirikFX is safe, it is crucial to exercise caution. It may be wise to explore alternative brokers that are regulated by reputable authorities and have a proven track record of positive customer experiences. Recommended alternatives include brokers like Pepperstone and eToro, which are known for their regulatory compliance and strong customer support. Ultimately, traders should prioritize their safety and ensure they are making informed decisions when selecting a forex broker.

Is KirikFx a scam, or is it legit?

The latest exposure and evaluation content of KirikFx brokers.

KirikFx Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

KirikFx latest industry rating score is 1.57, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.57 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.