Is JINKRA safe?

Business

License

Is Jinkra Safe or Scam?

Introduction

Jinkra, a forex broker operating under the name Jinkra International Finance Ltd, has garnered attention in the forex trading community. Established in the United Kingdom, Jinkra offers a range of trading services, including forex, commodities, and CFDs. However, as the forex market continues to grow, so does the necessity for traders to exercise caution when selecting a broker. The potential for scams and unregulated entities is significant, making it vital for traders to evaluate brokers thoroughly before committing their funds. This article aims to provide an objective assessment of Jinkra's legitimacy by analyzing its regulatory status, company background, trading conditions, customer experiences, and overall risk factors. Our investigation draws on various online sources, including regulatory databases, user reviews, and financial publications.

Regulation and Legitimacy

The regulatory standing of a forex broker is crucial in determining its legitimacy and safety. A regulated broker is subject to oversight by financial authorities, which helps ensure that they adhere to industry standards and protect clients' funds. Jinkra, however, operates without any valid regulatory oversight, which raises significant concerns regarding its legitimacy.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

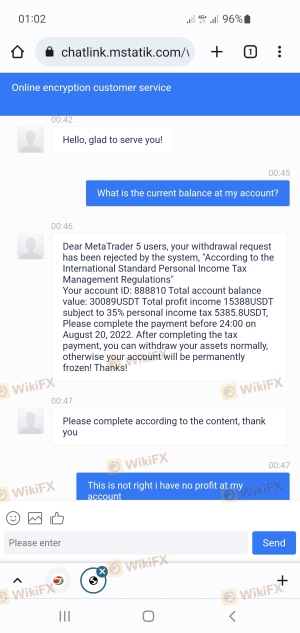

Jinkra's lack of regulation is alarming. It has been reported that the broker does not hold any valid licenses from reputable financial authorities such as the Financial Conduct Authority (FCA) in the UK or the Australian Securities and Investments Commission (ASIC). This absence of oversight not only exposes traders to higher risks but also indicates a lack of accountability. Furthermore, historical compliance issues, such as demands for unjustified income tax payments and threats of account freezes, have been reported by clients, further questioning the broker's integrity.

Company Background Investigation

Jinkra International Finance Ltd was incorporated in April 2022, making it a relatively new player in the forex market. The company operates from a registered office in London, UK. However, the brief history raises concerns about its operational stability and reliability.

The management team behind Jinkra has not been prominently featured in public profiles or financial disclosures, leading to questions about their experience and qualifications in the financial services industry. Transparency is essential for building trust, and Jinkra's limited information about its ownership structure and management team does not inspire confidence. The lack of detailed disclosures regarding its business practices and financial health further compounds the skepticism surrounding Jinkra's operations.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is critical for evaluating its overall value proposition. Jinkra presents a trading environment that includes a minimum deposit requirement of $500, which is considered high compared to industry standards. Traders can access popular trading platforms, such as MetaTrader 5, but the absence of transparency regarding fees and spreads is concerning.

| Fee Type | Jinkra | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Unclear | 1-2 pips |

| Commission Model | Unclear | $0 - $10 per lot |

| Overnight Interest Range | Unclear | 0.5% - 2% |

The lack of clarity regarding trading costs, including spreads and commissions, is a potential red flag. Traders may find themselves facing unexpected fees that could erode their profits. Additionally, the absence of detailed information about overnight interest rates raises further questions about the broker's transparency and fairness in its trading practices.

Client Fund Safety

The safety of client funds is paramount when assessing a forex broker. Jinkra's practices regarding fund security are troubling. The broker does not provide clear information about whether client funds are held in segregated accounts, which is a standard practice among reputable brokers. Segregation ensures that client funds are protected and not used for the broker's operational expenses.

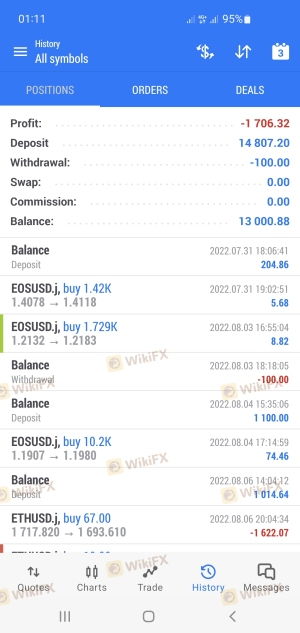

Moreover, the absence of investor protection schemes, such as those provided by regulatory bodies, leaves traders vulnerable in the event of broker insolvency. There have been reports of clients facing difficulties in withdrawing their funds, further emphasizing the need for caution when considering Jinkra as a trading partner. Historical incidents involving account freezes and unjustified tax demands only add to the concerns surrounding the broker's commitment to client fund safety.

Customer Experience and Complaints

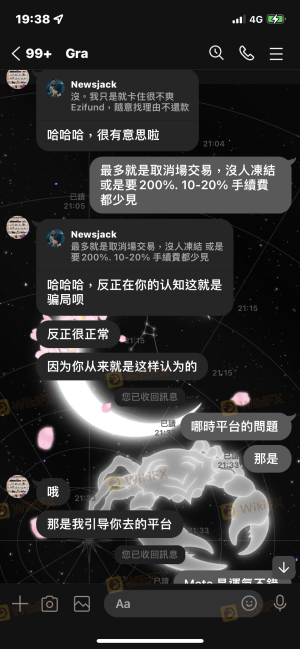

Customer feedback is a crucial indicator of a broker's reliability and service quality. Reviews of Jinkra reveal a mixed bag of experiences, with many clients expressing frustration over withdrawal issues and unresponsive customer service. Common complaints include difficulties in accessing funds, lack of communication from support staff, and unclear fee structures.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Unresponsive Support | Medium | Poor |

| Fee Transparency Issues | Medium | Unclear |

One notable case involves a client who was pressured to pay an income tax on losses, leading to threats of account freezing. Such experiences highlight the potential risks of trading with Jinkra and raise significant concerns about the broker's ethical practices. The overall sentiment among users suggests that Jinkra may not prioritize customer satisfaction, which is a critical aspect of a trustworthy trading environment.

Platform and Execution

The trading platform's performance and execution quality are essential for a seamless trading experience. Jinkra offers the MetaTrader 5 platform, which is well-regarded in the industry for its functionality and user-friendly interface. However, user reviews indicate that there may be issues with order execution and slippage, which can significantly impact trading outcomes.

Traders have reported instances of delayed order executions and unexpected slippage during volatile market conditions. These issues can lead to significant financial losses, particularly for those employing high-frequency trading strategies. Furthermore, any signs of platform manipulation, such as price discrepancies or unauthorized trade alterations, should be taken seriously by potential clients.

Risk Assessment

Given the information gathered, the overall risk associated with trading with Jinkra appears to be high. The absence of regulation, unclear trading conditions, and negative customer experiences contribute to a precarious trading environment.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No valid licenses or oversight |

| Financial Risk | High | Unclear fees and withdrawal issues |

| Operational Risk | Medium | Potential platform execution problems |

To mitigate these risks, traders should consider starting with a minimal investment, thoroughly reading the terms and conditions, and being cautious about the promises made by the broker. Seeking out established, regulated alternatives is highly recommended.

Conclusion and Recommendations

In conclusion, the evidence suggests that Jinkra is not a safe option for forex trading. The lack of regulation, questionable trading practices, and negative customer feedback raise significant red flags. Traders should exercise extreme caution when considering this broker, as it exhibits several characteristics commonly associated with scams.

For traders seeking reliable alternatives, it is advisable to choose brokers that are well-regulated and have a proven track record of customer satisfaction. Brokers such as IG, OANDA, and Forex.com offer robust regulatory oversight and transparent trading conditions, making them safer options for forex trading. Ultimately, due diligence and thorough research are essential for protecting one's investments in the forex market.

Is JINKRA a scam, or is it legit?

The latest exposure and evaluation content of JINKRA brokers.

JINKRA Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

JINKRA latest industry rating score is 1.46, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.46 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.