Is IQ4Capital safe?

Business

License

Is IQ4Capital A Scam?

Introduction

IQ4Capital is an online trading platform that positions itself within the forex market, offering traders access to various financial instruments, including currencies, commodities, and cryptocurrencies. In an era where online trading has gained immense popularity, it is imperative for traders to exercise caution and thoroughly evaluate the brokers they choose to work with. The potential for scams and fraudulent activities in the financial sector has led to significant losses for unsuspecting investors. This article aims to provide a comprehensive analysis of IQ4Capital, assessing its legitimacy, regulatory standing, and overall trustworthiness. The evaluation is based on a review of available data, user feedback, and industry standards.

Regulation and Legitimacy

Understanding the regulatory framework within which a broker operates is crucial for assessing its safety and reliability. Regulatory bodies are established to protect traders and ensure that brokers adhere to strict standards of conduct. In the case of IQ4Capital, the lack of clear regulatory oversight raises significant concerns.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

As shown in the table above, IQ4Capital does not appear to be regulated by any recognized financial authority. This absence of regulation is alarming, as it means that there are no legal protections in place for traders. Without oversight, brokers can engage in unethical practices without fear of repercussions. The quality of regulation is paramount; brokers operating under stringent regulatory frameworks are typically held to higher standards of transparency and accountability. Historical compliance records are also essential indicators of a broker's reliability. Unfortunately, IQ4Capital's lack of regulatory affiliation suggests a higher risk for traders, making it imperative to consider whether IQ4Capital is safe for investment.

Company Background Investigation

A thorough background investigation is essential to understand the operational integrity of a trading platform. IQ4Capital does not provide comprehensive information regarding its company history, ownership structure, or management team. This lack of transparency can be a significant red flag for potential investors.

The absence of a clearly defined ownership structure raises questions about who is ultimately responsible for the platform's operations and customer funds. Furthermore, without information on the management team's professional backgrounds, it is difficult to assess their qualifications and experience in the financial industry. Transparency in company operations is vital for building trust, and the lack of such information regarding IQ4Capital creates uncertainty about its legitimacy.

Trading Conditions Analysis

The trading conditions offered by a broker are crucial factors that can significantly impact a trader's profitability. IQ4Capital's fee structure and trading costs warrant close examination, especially in light of its unregulated status.

| Fee Type | IQ4Capital | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable | 1.0 - 2.0 pips |

| Commission Model | None | $5 per lot |

| Overnight Interest Range | High | Low to Moderate |

From the table, we can observe that IQ4Capital's spreads may vary significantly, which is common among unregulated brokers. Traders should be wary of high overnight interest rates, as these can erode profits over time. A lack of transparency regarding commission structures and hidden fees can further exacerbate the trading costs associated with using this platform. Given these factors, it is crucial to question whether IQ4Capital is safe for traders looking to maximize their investments.

Client Fund Safety

The safety of client funds is a primary concern for any trader. Brokers typically implement various measures to protect client deposits, such as segregated accounts and investor protection schemes. However, IQ4Capital's approach to fund safety remains unclear.

The absence of information regarding fund segregation and investor protection policies raises serious concerns about the safety of client funds. In the event of financial difficulties or insolvency, traders could face significant risks, including the potential loss of their deposits. Additionally, any historical issues related to fund safety or disputes should be thoroughly investigated, as they can provide valuable insights into a broker's reliability.

Customer Experience and Complaints

Customer feedback is an invaluable resource for assessing a broker's performance and reliability. An analysis of user experiences with IQ4Capital reveals a concerning pattern of complaints and negative reviews.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Lack of Customer Support | Moderate | Inconsistent |

| Misleading Information | High | Unresponsive |

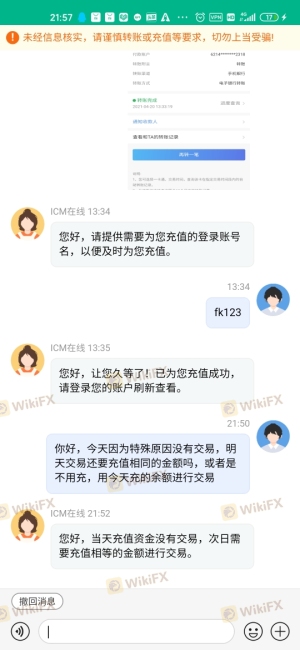

Common complaints include difficulties in withdrawing funds, lack of responsive customer support, and allegations of misleading information regarding trading conditions. These issues can significantly impact a trader's experience and raise further questions about whether IQ4Capital is safe. Two notable case studies highlight these issues: one user reported being unable to access their funds after repeated attempts to withdraw, while another expressed frustration over a lack of assistance from customer support during critical trading periods.

Platform and Execution

The performance of a trading platform is vital for ensuring a smooth trading experience. Evaluating the stability, user experience, and execution quality of IQ4Capital's platform reveals several areas of concern.

Issues related to order execution, slippage, and order rejections have been reported by users. A high rate of slippage can lead to unexpected losses, especially in volatile markets. Furthermore, any signs of potential platform manipulation must be scrutinized, as they can severely undermine trust in the broker.

Risk Assessment

Using IQ4Capital carries inherent risks that traders must carefully consider.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Lack of regulation increases the potential for fraud. |

| Fund Safety Risk | High | Unclear fund protection measures expose traders to loss. |

| Execution Risk | Medium | Reports of slippage and order rejections can affect trading outcomes. |

To mitigate these risks, traders should conduct thorough research, consider using regulated brokers, and maintain a diversified trading strategy.

Conclusion and Recommendations

In conclusion, the analysis of IQ4Capital raises significant concerns regarding its legitimacy and safety. The absence of regulatory oversight, coupled with a lack of transparency and numerous customer complaints, suggests that traders should approach this broker with caution. The evidence indicates that IQ4Capital is not safe for investment, and potential clients should be wary of the risks involved.

For traders seeking reliable alternatives, several regulated brokers offer safer trading environments with better protections for client funds. It is highly recommended to choose brokers with established reputations, clear regulatory compliance, and positive user feedback to ensure a secure trading experience.

Is IQ4Capital a scam, or is it legit?

The latest exposure and evaluation content of IQ4Capital brokers.

IQ4Capital Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

IQ4Capital latest industry rating score is 1.51, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.51 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.