Is IngoSky safe?

Business

License

Is IngoSky Safe or Scam?

Introduction

IngoSky is a forex broker that has recently attracted attention in the trading community. Operating primarily in the online trading space, it claims to offer a range of financial instruments and trading services. However, as with any broker, traders must exercise caution and perform due diligence before entrusting their funds. The forex market is rife with both legitimate brokers and scams, making it imperative for traders to assess the credibility of any broker they consider. This article aims to investigate whether IngoSky is a safe trading option or a potential scam. The evaluation will be based on regulatory status, company background, trading conditions, client fund security, user experiences, and potential risks associated with trading with IngoSky.

Regulation and Legitimacy

The regulatory status of a broker is crucial in determining its legitimacy and reliability. IngoSky operates without any significant regulatory oversight, which raises red flags for potential investors. An absence of regulation means that the broker is not held accountable by any authoritative body, increasing the risk of fraudulent activities. Below is a summary of IngoSky's regulatory status:

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unverified |

The lack of any valid regulatory information indicates that IngoSky does not adhere to the stringent standards set by reputable financial authorities. This lack of oversight can result in a high potential for risk, as unregulated brokers often engage in practices that can jeopardize clients' funds. Furthermore, the absence of a regulatory framework means that traders have limited recourse in the event of disputes or financial mishaps. Therefore, it is vital for traders to consider this aspect when assessing whether IngoSky is safe.

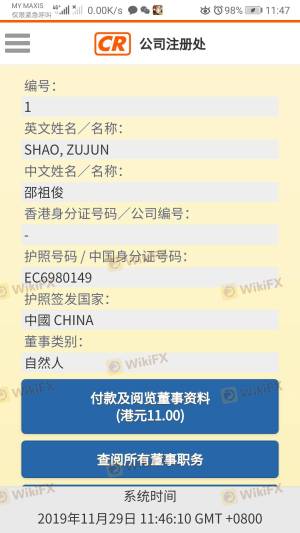

Company Background Investigation

IngoSky's company background is another critical factor in determining its trustworthiness. The broker's ownership structure and management team play a significant role in its operations and credibility. Unfortunately, information regarding IngoSky's history, ownership, and management team is sparse. The company appears to lack transparency, which is a common trait among dubious brokers. A thorough investigation reveals that IngoSky is registered in Hong Kong, yet it does not provide adequate details about its founders or key personnel, which is a significant concern.

Moreover, the absence of a clear operational history coupled with insufficient information about its management raises doubts about the broker's legitimacy. A trustworthy broker typically offers comprehensive information about its team and operational practices, which helps build confidence among potential clients. Given the limited transparency surrounding IngoSky, traders should approach this broker with caution and consider the potential implications of investing with an unproven entity.

Trading Conditions Analysis

The trading conditions offered by a broker can significantly affect a trader's experience and profitability. IngoSky claims to provide competitive spreads and various trading options; however, the specifics of its fee structure remain unclear. Traders must be wary of any hidden fees or unusual cost policies that could impact their trading outcomes. Below is a comparison of IngoSky's trading costs against industry averages:

| Fee Type | IngoSky | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1.0 - 1.5 pips |

| Commission Model | N/A | Varies (0 - $10) |

| Overnight Interest Range | N/A | Varies |

The absence of detailed information on spreads, commissions, and overnight fees is concerning. Typically, reputable brokers provide clear and transparent trading conditions that allow clients to understand the costs involved. Traders should be cautious with brokers like IngoSky that do not disclose their fee structures, as this can lead to unexpected costs and reduced profitability.

Client Fund Security

When evaluating whether IngoSky is safe, it is essential to consider the security measures in place to protect client funds. A reputable broker should have robust systems for fund segregation, investor protection, and negative balance protection. Unfortunately, IngoSky does not provide sufficient information regarding these critical security measures. The lack of transparency raises concerns about the safety of client funds.

Typically, regulated brokers are required to keep client funds in segregated accounts, ensuring that they are not used for operational expenses. Furthermore, many reputable brokers offer investor protection schemes that safeguard clients' deposits in case of insolvency. IngoSky's failure to provide such assurances puts traders at risk, making it imperative to consider the potential implications of trading with an unregulated broker.

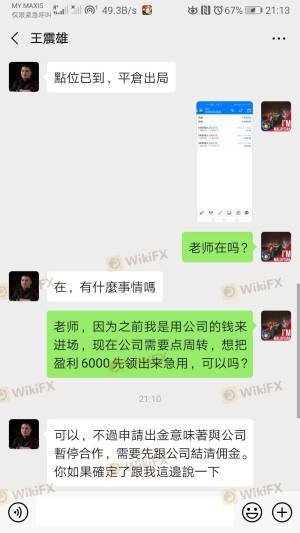

Customer Experience and Complaints

Customer feedback is a valuable indicator of a broker's reliability and service quality. A review of online forums and user experiences reveals a concerning pattern of complaints against IngoSky. Many users have reported issues related to withdrawal difficulties, lack of customer support, and unresponsive service. Below is a summary of the main complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support | Medium | Poor |

| Misleading Information | High | Poor |

The high severity of complaints regarding withdrawal issues is particularly alarming. Many users have reported being unable to access their funds, which is a significant red flag. The lack of timely and effective responses from the company further exacerbates these concerns. Traders must be cautious when dealing with brokers that exhibit such patterns of customer dissatisfaction, as this can indicate deeper issues within the organization.

Platform and Trade Execution

The trading platform's performance is another crucial aspect of evaluating whether IngoSky is safe. A reliable trading platform should offer stability, user-friendly navigation, and efficient order execution. However, numerous users have reported issues with IngoSky's platform, including frequent downtimes and slow execution speeds. These problems can lead to significant losses, particularly in the volatile forex market.

Additionally, the presence of any signs of platform manipulation, such as slippage or order rejections, should be closely monitored. Traders must ensure that they are using a platform that prioritizes transparency and efficiency to safeguard their trading interests.

Risk Assessment

Using IngoSky involves various risks that traders should be aware of. The absence of regulation, coupled with customer complaints and unclear trading conditions, contributes to a high-risk profile for this broker. Below is a summary of the key risk areas associated with trading with IngoSky:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Financial Risk | High | Unclear trading conditions and fees |

| Security Risk | High | Lack of transparency regarding fund safety |

| Customer Service Risk | Medium | Poor response to customer complaints |

To mitigate these risks, traders are advised to conduct thorough due diligence before engaging with IngoSky. It may be beneficial to seek alternative, regulated brokers that offer more robust protections and transparent trading conditions.

Conclusion and Recommendations

Based on the evidence presented, it is clear that IngoSky raises significant concerns regarding its safety and legitimacy. The lack of regulatory oversight, coupled with numerous customer complaints and unclear trading conditions, suggests that traders should exercise extreme caution. While the potential for profit exists in the forex market, it is essential to choose a broker that prioritizes transparency, security, and customer service.

For traders looking for safer alternatives, consider brokers that are well-regulated and have a proven track record of positive customer experiences. These brokers typically offer better protections for client funds and more transparent trading conditions. Ultimately, the decision to trade with IngoSky should be made with careful consideration of the associated risks and potential consequences.

Is IngoSky a scam, or is it legit?

The latest exposure and evaluation content of IngoSky brokers.

IngoSky Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

IngoSky latest industry rating score is 1.56, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.56 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.