Regarding the legitimacy of IBUTOKA forex brokers, it provides FCA, DFSA, FSCA, FSA and WikiBit, .

Is IBUTOKA safe?

Business

License

Is IBUTOKA markets regulated?

The regulatory license is the strongest proof.

FCA Forex Execution License (STP)

Financial Conduct Authority

Financial Conduct Authority

Current Status:

UnverifiedLicense Type:

Forex Execution License (STP)

Licensed Entity:

HF Markets (UK) Limited

Effective Date:

2018-11-14Email Address of Licensed Institution:

compliance@hfmarkets.co.ukSharing Status:

No SharingWebsite of Licensed Institution:

www.hfmarkets.co.ukExpiration Time:

--Address of Licensed Institution:

Bloomsbury Building 10 Bloomsbury Way Holborn London WC1A 2SL UNITED KINGDOMPhone Number of Licensed Institution:

+44 2035199890Licensed Institution Certified Documents:

DFSA Derivatives Trading License (MM)

Dubai Financial Services Authority

Dubai Financial Services Authority

Current Status:

UnverifiedLicense Type:

Derivatives Trading License (MM)

Licensed Entity:

HF Markets (DIFC) Limited

Effective Date:

2018-12-12Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

Unit OT 20-53, Level 20, Central Park Offices, DIFC, PO Box 507274, Dubai, UAEPhone Number of Licensed Institution:

971 4 318 4777Licensed Institution Certified Documents:

FSCA Derivatives Trading License (EP)

Financial Sector Conduct Authority

Financial Sector Conduct Authority

Current Status:

UnverifiedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

HF MARKETS SA (PTY) LTD

Effective Date:

2016-02-09Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

KATHERINE & WEST, SUITE 18, SECOND FLOOR 114 WEST STREET, SANDTON 2021Phone Number of Licensed Institution:

087 288 5495Licensed Institution Certified Documents:

FSA Derivatives Trading License (EP)

The Seychelles Financial Services Authority

The Seychelles Financial Services Authority

Current Status:

UnverifiedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

HF Markets (Seychelles) Ltd

Effective Date:

--Email Address of Licensed Institution:

legal@hfm.comSharing Status:

No SharingWebsite of Licensed Institution:

https://www.hfm.com/sc/en/Expiration Time:

--Address of Licensed Institution:

Unit C, F28, Eden Plaza, Eden Island, SeychellesPhone Number of Licensed Institution:

+248 4346123Licensed Institution Certified Documents:

Is Ibutoka Safe or a Scam?

Introduction

Ibutoka is a forex broker that has emerged in the competitive landscape of online trading, primarily targeting retail traders. With the promise of offering a range of trading instruments and account types, Ibutoka aims to attract both novice and experienced traders. However, the forex market is fraught with risks, and the integrity of a broker is paramount for traders who wish to safeguard their investments. In an environment where scams and fraudulent activities are not uncommon, it becomes essential for traders to thoroughly evaluate the credibility of their chosen broker. This article investigates whether Ibutoka is a safe trading option or if it raises red flags that warrant caution. Our analysis is based on a review of its regulatory status, company background, trading conditions, customer feedback, and overall risk profile.

Regulation and Legitimacy

The regulatory status of a broker is a crucial factor in determining its safety and legitimacy. Regulatory bodies serve to protect traders by ensuring that brokers adhere to strict operational standards. Unfortunately, Ibutoka lacks valid regulation, which significantly raises concerns about its credibility.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Unregulated |

The absence of regulation means that there is no oversight from a governmental or financial authority, leaving traders vulnerable to potential malpractice. Regulatory oversight is essential for ensuring the broker's compliance with industry standards, including the segregation of client funds and the maintenance of transparent operations. Without such oversight, investing with Ibutoka can be deemed risky, as traders have little recourse in the event of disputes or financial losses.

Company Background Investigation

Ibutoka was founded in 2015 and claims to operate out of the United States, but the lack of transparency surrounding its ownership and management raises questions about its legitimacy. There is scant information available regarding the companys history, development, and ownership structure. The absence of a clear and transparent corporate structure is concerning for potential investors.

Moreover, the management team behind Ibutoka does not appear to have significant experience or a reputable background in the financial services industry. This lack of expertise can be a red flag, as a knowledgeable and experienced management team is often crucial for maintaining a trustworthy trading environment.

In terms of information disclosure, Ibutoka has not provided comprehensive details that would typically be expected from a reputable broker. This lack of transparency can hinder traders' ability to make informed decisions, further emphasizing the need for caution when considering whether Ibutoka is safe.

Trading Conditions Analysis

When evaluating whether Ibutoka is safe, it is essential to analyze its trading conditions, including fees and commissions. Ibutoka offers a variety of trading instruments, including forex, commodities, and indices, but its fee structure lacks clarity.

| Fee Type | Ibutoka | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.0 pips | 1.0 pips |

| Commission Model | $3 per lot | Varies |

| Overnight Interest Range | N/A | Varies |

While the promise of zero spreads is attractive, the $3 commission per lot is noteworthy. This fee structure can be considered competitive, but the lack of transparency regarding overnight interest rates raises concerns. Traders should be wary of hidden fees that could erode profits, making it essential to read the fine print before engaging in trading activities with Ibutoka.

Customer Funds Safety

The safety of customer funds is another critical aspect to consider when determining whether Ibutoka is safe. The broker has not provided clear information regarding its fund protection measures. The absence of segregated accounts, investor protection schemes, and negative balance protection policies raises significant concerns about the security of traders' investments.

Historically, unregulated brokers have been associated with financial disputes and fund misappropriation. Without a regulatory framework to safeguard client funds, traders may find themselves at risk of losing their investments without any means of recourse.

Customer Experience and Complaints

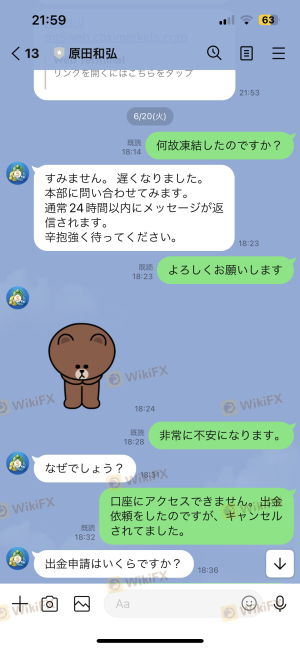

Customer feedback is a valuable source of information when assessing whether Ibutoka is safe. Reviews indicate a mixed bag of experiences, with several users expressing concerns about the broker's responsiveness to complaints and customer service quality.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Lack of Transparency | Medium | Limited response |

| Platform Stability | High | Unresolved issues |

Common complaints include difficulties in withdrawing funds and a lack of transparency regarding trading conditions. These issues can significantly impact a trader's experience and raise questions about the broker's commitment to customer satisfaction.

For instance, one user reported delays in fund withdrawals, which is a serious concern for any trader. The inability to access funds promptly can lead to frustration and financial strain, further emphasizing the importance of choosing a reliable broker.

Platform and Trade Execution

The performance of the trading platform is another critical factor in determining whether Ibutoka is safe. User experiences suggest that the platform may face stability issues, which can affect order execution quality. Traders have reported instances of slippage and rejected orders, which can be detrimental to trading strategies.

A reliable trading platform should provide seamless execution and minimal interruptions. If traders encounter frequent issues, it can lead to financial losses and a lack of trust in the broker.

Risk Assessment

The overall risk profile of trading with Ibutoka is concerning.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Financial Risk | High | Lack of fund protection measures |

| Operational Risk | Medium | Platform stability issues |

The lack of regulation and inadequate customer fund protection measures contribute to a high-risk environment. To mitigate these risks, traders should conduct thorough research and consider using well-regulated brokers that offer investor protection.

Conclusion and Recommendations

Based on the comprehensive analysis, it is evident that Ibutoka raises several red flags that suggest it may not be a safe trading option. The absence of regulation, lack of transparency, and mixed customer feedback indicate that traders should exercise caution.

For those considering trading with Ibutoka, it is advisable to seek alternative brokers with established regulatory oversight and a proven track record of customer satisfaction. Brokers such as ForexChief and ForexMart offer more reliable trading environments, ensuring that traders can invest with greater confidence.

In summary, while Ibutoka may present attractive trading conditions, the associated risks and lack of regulatory protection make it a questionable choice for traders. It is essential to prioritize safety and due diligence when selecting a broker in the forex market.

Is IBUTOKA a scam, or is it legit?

The latest exposure and evaluation content of IBUTOKA brokers.

IBUTOKA Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

IBUTOKA latest industry rating score is 1.42, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.42 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.