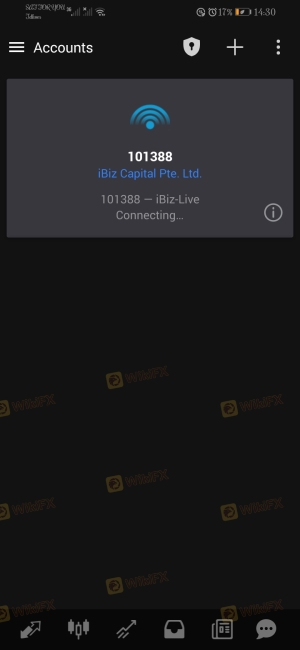

Regarding the legitimacy of IBIZ forex brokers, it provides FSCA and WikiBit, (also has a graphic survey regarding security).

Is IBIZ safe?

Pros

Cons

Is IBIZ markets regulated?

The regulatory license is the strongest proof.

FSCA Derivatives Trading License (EP)

Financial Sector Conduct Authority

Financial Sector Conduct Authority

Current Status:

UnverifiedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

ZENORA CAPITAL (PTY) LTD

Effective Date: Change Record

2009-08-11Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

1 HOOD AVENUEROSEBANKGAUTENG2196Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is ibiz Safe or a Scam?

Introduction

In the rapidly evolving world of forex trading, the choice of a broker can significantly impact a trader's success. One such broker gaining attention is ibiz, which claims to provide a comprehensive trading platform for both novice and experienced traders. However, with numerous reports of scams and unregulated brokers in the market, it is essential for traders to exercise caution and conduct thorough evaluations before engaging with any broker. This article aims to investigate whether ibiz is a safe trading option or a potential scam. Our analysis will be based on a combination of regulatory scrutiny, company background, trading conditions, customer feedback, and overall risk assessment.

Regulation and Legitimacy

A critical aspect of any forex broker's credibility is its regulatory status. Regulation serves as a safety net for traders, ensuring that brokers adhere to specific standards and practices that protect client funds and promote fair trading conditions. Unfortunately, ibiz operates without proper licensing from recognized financial authorities, which raises significant red flags. Below is a summary of the regulatory information related to ibiz:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

The absence of regulation is concerning, as it implies that traders using ibiz may not have access to the protections afforded by regulatory bodies. Legitimate brokers typically provide clear information about their regulatory status, including license numbers and the jurisdictions in which they operate. In this case, the lack of such information suggests a higher risk for traders. Furthermore, the fact that ibiz has been reported to operate in regions with a high incidence of fraud adds to the skepticism surrounding its legitimacy.

Company Background Investigation

Understanding the company behind a broker is vital for assessing its trustworthiness. Unfortunately, information regarding ibiz's history and ownership structure is sparse. The company appears to be relatively new, having been established recently, which often indicates a lack of established credibility in the market. Moreover, the management teams background and professional experience are not sufficiently disclosed, leading to concerns about their qualifications and intentions.

Transparency is a hallmark of reputable brokers, and the absence of detailed information regarding ibiz's management and operational structure raises questions about its reliability. Without a clear understanding of who runs the company, traders may find themselves vulnerable to potential scams. Additionally, the company's website lacks critical information about its physical office location and contact details, further diminishing its credibility.

Trading Conditions Analysis

Evaluating the trading conditions offered by ibiz is crucial for understanding the overall cost of trading with this broker. A thorough examination reveals a somewhat opaque fee structure, which can lead to unexpected costs for traders. Below is a comparison of core trading costs associated with ibiz:

| Fee Type | ibiz | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable | 1-2 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The lack of clarity around spreads and commissions is alarming. Traders often rely on transparent fee structures to gauge the overall cost of trading, and the absence of such information with ibiz suggests a potential for hidden fees. Additionally, reports of unusual or excessive fees have surfaced, which could significantly impact a trader's profitability.

Customer Funds Security

The safety of customer funds is another crucial aspect of evaluating a broker's reliability. A reputable broker should implement stringent security measures to protect client deposits. Unfortunately, ibiz's policies regarding fund security remain ambiguous. There is no clear information available about whether client funds are segregated or if the broker offers any form of investor protection.

Moreover, the absence of negative balance protection policies raises concerns about the potential for traders to incur losses exceeding their deposits. Historical data on ibiz indicates that there have been instances of fund safety issues, which further complicates the assessment of its overall reliability. Traders must be vigilant and consider the risks associated with entrusting their funds to a broker with such a questionable safety record.

Customer Experience and Complaints

Analyzing customer feedback provides valuable insights into the reliability of a broker. Unfortunately, reviews of ibiz reveal a pattern of dissatisfaction among users. Common complaints include delayed withdrawals, unresponsive customer service, and high-pressure tactics encouraging traders to deposit more funds. Below is a summary of the primary complaint types associated with ibiz:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Customer Service Issues | Medium | Unresponsive |

| High-Pressure Sales Tactics | High | Ignored |

Many users report feeling frustrated and misled by ibiz's practices, indicating a lack of professionalism and customer care. For instance, one trader shared their experience of waiting weeks for a withdrawal, only to receive vague responses from customer service. Such experiences are concerning and suggest that traders may face significant challenges when attempting to access their funds.

Platform and Trade Execution

The performance and reliability of a trading platform are critical for successful trading. Unfortunately, many users have reported issues with ibiz's platform, including frequent downtimes and slow execution speeds. The quality of order execution is another area of concern, with reports of slippage and rejected orders. Traders may find themselves at a disadvantage due to these issues, raising questions about the overall integrity of ibiz's trading environment.

Additionally, there are indications that ibiz may engage in platform manipulation, further undermining the trustworthiness of its trading operations. Traders must approach this broker with caution, as a stable and efficient trading platform is essential for a positive trading experience.

Risk Assessment

Engaging with any broker carries inherent risks, and ibiz is no exception. Below is a summary of the key risk areas associated with trading through ibiz:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulation, high fraud potential |

| Financial Risk | High | Lack of fund protection measures |

| Operational Risk | Medium | Platform instability and execution issues |

The overall risk profile of ibiz suggests that traders should exercise extreme caution. The absence of regulatory oversight, combined with reports of financial misconduct and operational inefficiencies, creates a precarious trading environment. It is advisable for potential clients to consider these risks seriously and seek alternative brokers with established reputations.

Conclusion and Recommendations

In conclusion, the investigation into ibiz raises significant concerns regarding its credibility and safety as a forex broker. The lack of regulation, poor customer feedback, and ambiguous trading conditions suggest that ibiz may not be a safe option for traders. The absence of transparency and the presence of numerous complaints further indicate potential fraud risks.

For traders seeking a reliable broker, it is essential to consider alternatives that are regulated and have a proven track record of customer satisfaction. Brokers with established reputations provide greater security and peace of mind, making them a more suitable choice for those looking to engage in forex trading. Always conduct thorough research and consider the risks before making any decisions in the forex market.

Is IBIZ a scam, or is it legit?

The latest exposure and evaluation content of IBIZ brokers.

IBIZ Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

IBIZ latest industry rating score is 1.22, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.22 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.