IBIZ Review 1

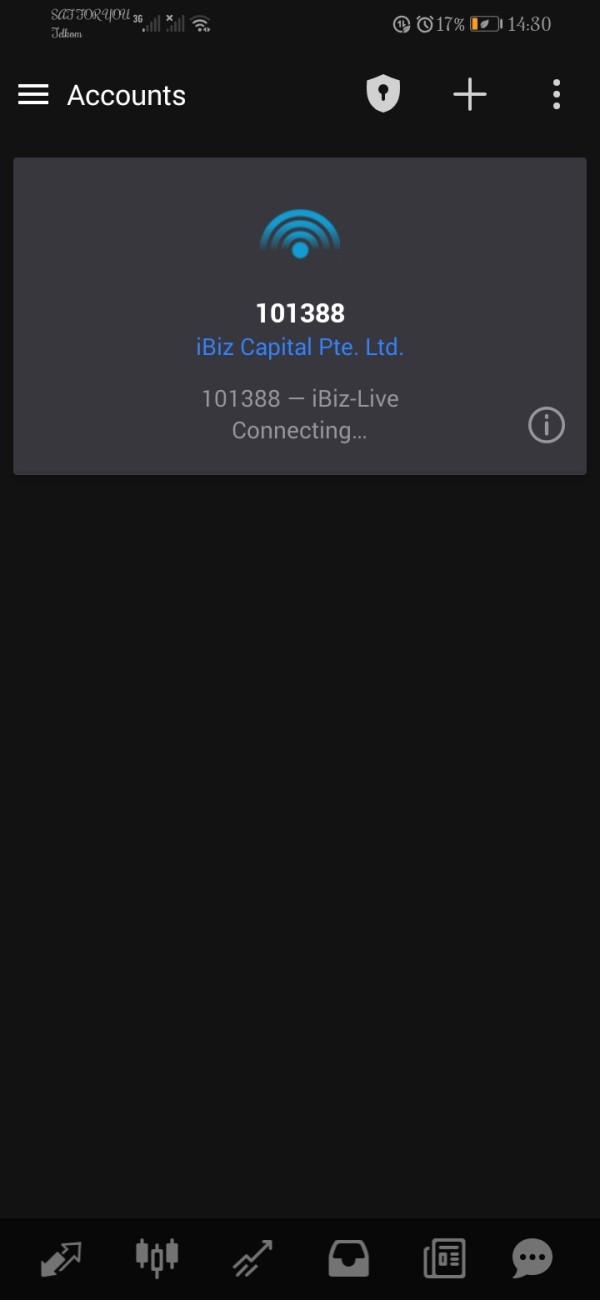

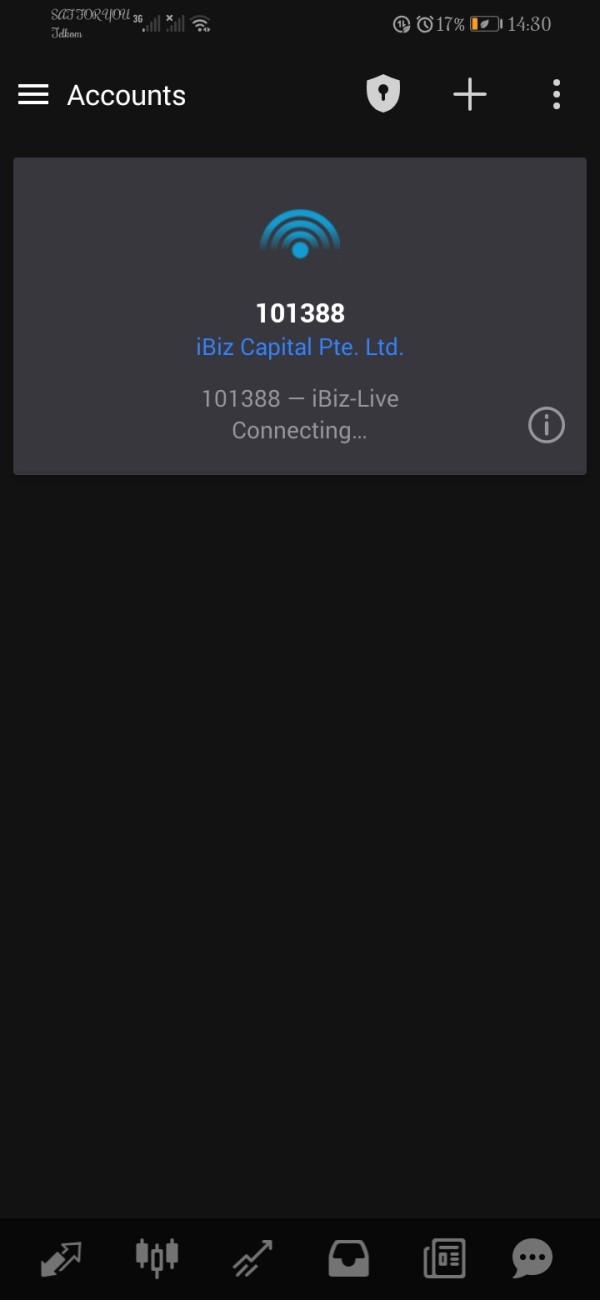

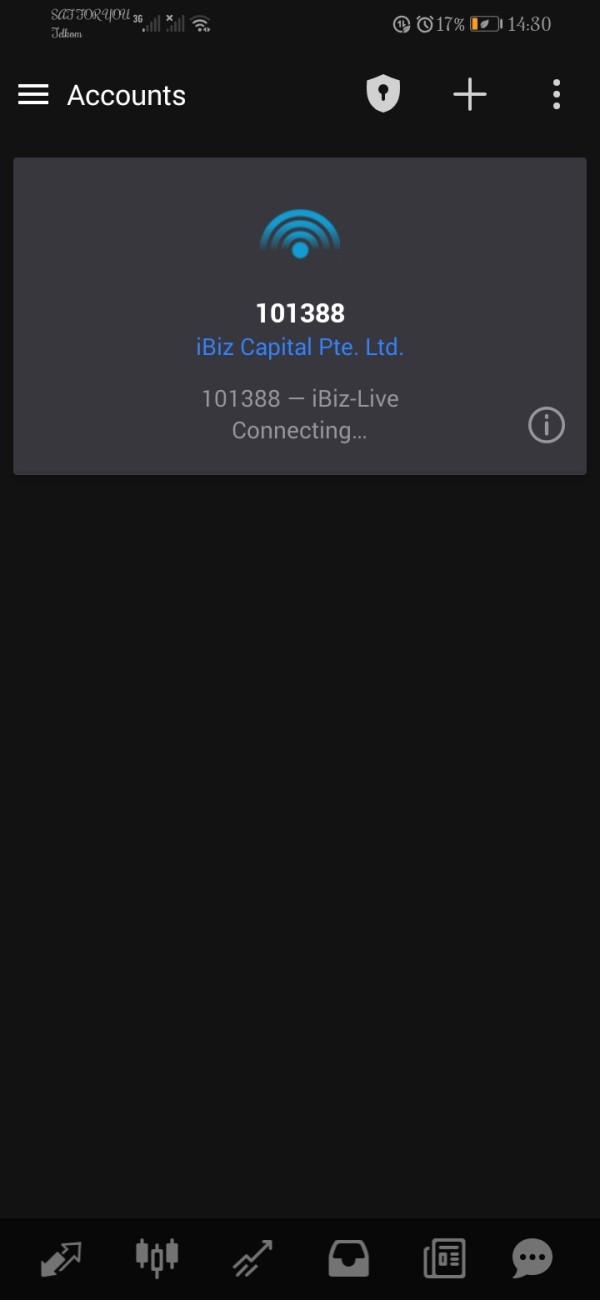

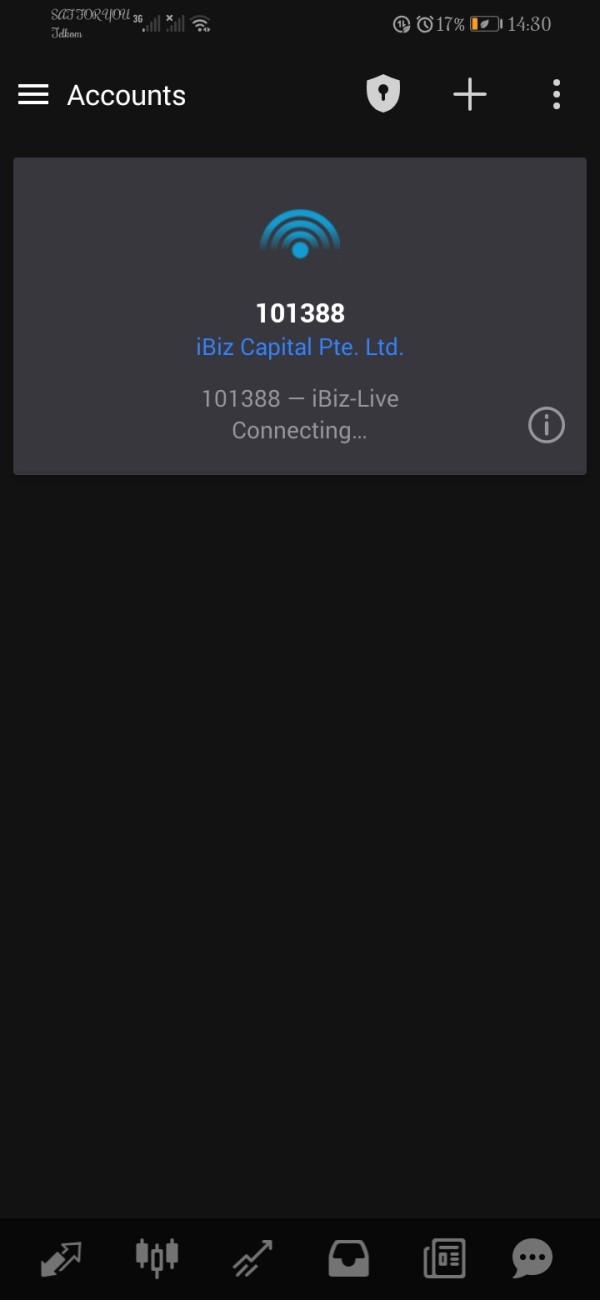

I'm unble to log in to meta trader 4 of ibiz broker it keeps on telling me connecting

IBIZ Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

I'm unble to log in to meta trader 4 of ibiz broker it keeps on telling me connecting

The "ibiz" brokerage emerged as a potential contender in the trading market, claiming to provide a wide range of trading opportunities across various instruments with competitive costs. However, serious doubts about its legitimacy arise when examining its regulatory standing and user feedback. Designed for traders willing to accept higher risks in exchange for lower fees, ibiz seems particularly attractive to those experienced in navigating trading platforms lacking robust support.

Yet, the absence of regulatory oversight raises significant concerns regarding fund safety and customer service quality. Traders who prioritize secure transactions and require support may find themselves better off with more reputable firms. Thus, while ibiz may offer an enticing platform for experienced and risk-tolerant traders seeking minimal fees, the associated risks could prove damaging for those less prepared to face potential pitfalls.

Self-Verification Steps:

| Dimension | Rating (out of 5) | Justification |

|---|---|---|

| Trustworthiness | 1 | Lacks proper regulation and user trust; numerous complaints about withdrawals. |

| Trading Costs | 4 | Appealing low commissions can attract traders willing to take risks. |

| Platforms & Tools | 3 | Offers multiple platforms, but quality and user experience are inconsistent. |

| User Experience | 2 | User complaints highlight significant usability issues and lack of professional design. |

| Customer Support | 1 | Consistently unresponsive customer service leading to dissatisfaction. |

| Account Conditions | 3 | Various account types available; however, the minimum deposit and fees remain unclear. |

Established in 2024, the ibiz brokerage operates under the banner of ibiz capital pte. ltd., registered in Singapore. Nonetheless, the companys claims of offering a secure and comprehensive trading experience are undermined by its notable absence of official regulatory recognition and transparency about its management. Without established credibility, it occupies a questionable position in the trading landscape, focusing primarily on attracting traders who are price-sensitive and less concerned about oversight.

ibiz aims to facilitate trading opportunities across several asset classes, such as CFDs in commodities, stocks, and forex. While it markets itself as an accessible platform for both experienced and novice traders, numerous reports about regulatory deficiencies and unresponsive customer service suggest that potential clients should tread carefully. The broker does not routinely disclose its physical office or detailed information about its management team, which further adds to doubts about its legitimacy.

| Attribute | Details |

|---|---|

| Regulation | None valid from recognized authorities |

| Minimum Deposit | $100 for some account types |

| Leverage | Up to 1:1000 |

| Major Fees | Withdrawal fees frequently reported |

| Trading Instruments | Stocks, Forex, Commodities, Futures |

"Teaching users to manage uncertainty."

The broker ibiz raises alarms due to its missing regulatory licenses. Reports suggest that it operates without proper oversight, making the safety of client funds uncertain. Discrepancies between the companys claims and industry practices further exacerbate trust issues.

Analysis of Regulatory Information Conflicts: The absence of necessary licenses from reputable financial authorities raises significant warnings for potential clients. The lack of a robust regulatory framework compromises client protection.

User Self-Verification Guide:

Visit recognized regulatory body websites (e.g., the Australian Securities and Investments Commission (ASIC), Financial Conduct Authority (FCA)).

Search for brokerage licenses under the broker's name.

Review user experiences on platforms dedicated to financial reviews.

Inspect for any legal actions or complaints logged against the broker.

Industry Reputation and Summary: Users consistently report negative experiences primarily related to delayed withdrawals and unresponsive service, reflecting a serious lapse in operational integrity.

“I faced numerous issues withdrawing my funds, and once the deposit was made, the broker became unresponsive.” - User Feedback.

"The double-edged sword effect."

While ibiz boasts competitive commission structures, the hidden fees could result in even more significant costs for traders.

Advantages in Commissions: The broker claims low commission rates designed to attract high-frequency traders and beginners—including commission-free trading up to a certain volume.

The "Traps" of Non-Trading Fees: Nonetheless, user complaints highlight punitive withdrawal fees and unexpected charges, which can diminish the benefits of lower trading costs.

"My experience felt like being hit with hidden charges when attempting to withdraw my money after making a few trades." - User Complaint.

"Professional depth vs. beginner-friendliness."

Platform Diversity: ibiz claims to offer various platforms (including MT4 and MT5). However, their performance and reliability may not match user expectations.

Quality of Tools and Resources: Many users find that while the platform has potential, its execution often lacks the user-friendliness required for smooth trading experiences.

Platform Experience Summary: User feedback often criticizes the platform's usability, indicating that inexperienced traders may struggle with its complexities.

"Navigating the platform was frustrating due to poor design and non-intuitive controls." - Recent User Review.

"Balancing user satisfaction with operational adequacy."

User Accessibility and Navigation: Users have reported significant difficulties navigating the platform, leading to general dissatisfaction.

Feedback and Community Interaction: There is a notable absence of community engagement from the broker, limiting user feedback loops and further discouraging investor confidence.

Overall Experience Summary: The lack of professionalism in design and user interface detracts from the overall trading experience.

"Assessing crucial responsiveness."

Support Availability: Complaints about long wait times and unresponsive customer service teams are common, prompting concerns about the level of support clients can expect.

Channels of Communication: Users report inadequate communication channels, meaning gaining assistance can prove difficult.

Support Effectiveness Summary: The dire situation with support often leads to frustration, especially during urgent withdrawal requests.

"Detailing the foundational requirements."

Account Types and Fees: ibiz offers varied account types, yet many specifics around fees and conditions remain vague.

Withdrawal Policies: User feedback indicates issues with withdrawing funds, which can lead to exasperation.

Overall Conditions Summary: The account conditions might initially appear appealing, but the reality often brings forth frustrating experiences.

In conclusion, while ibiz positions itself as an accessible trading platform with low fees, multiple red flags present serious concerns for potential clients. The lack of regulatory oversight, combined with user complaints about service quality and operational transparency, creates a questionable environment where the safety of client funds may be compromised. Therefore, traders should exercise extreme caution when considering the ibiz brokerage and opt for platforms with proven reliability and integrity for investment activities.

FX Broker Capital Trading Markets Review