Regarding the legitimacy of HUNGSING forex brokers, it provides SFC and WikiBit, (also has a graphic survey regarding security).

Is HUNGSING safe?

Business

License

Is HUNGSING markets regulated?

The regulatory license is the strongest proof.

SFC Derivatives Trading License (AGN)

Securities and Futures Commission of Hong Kong

Securities and Futures Commission of Hong Kong

Current Status:

RevokedLicense Type:

Derivatives Trading License (AGN)

Licensed Entity:

Hung Sing Futures Limited

Effective Date:

2004-11-23Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

http://www.hungsing.orgExpiration Time:

--Address of Licensed Institution:

香港上環干諾道中200號信德中心西座25樓2505室Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is Hungsing Safe or Scam?

Introduction

Hungsing, a Hong Kong-based forex broker established in 2017, has gained attention in the trading community for its range of financial services, including forex and contract for difference (CFD) trading. As the forex market continues to grow, traders must exercise caution when selecting brokers, as the risk of encountering scams is ever-present. Evaluating a broker's legitimacy involves a thorough examination of its regulatory status, company background, trading conditions, and customer experiences. This article aims to assess whether Hungsing is a safe trading platform or a potential scam by utilizing various research methodologies and evaluation frameworks.

Regulation and Legitimacy

The regulatory environment is crucial for any forex broker, as it ensures that the broker adheres to industry standards and provides a level of security for client funds. Hungsing operates under the oversight of the Securities and Futures Commission (SFC) of Hong Kong; however, it has faced revocation of its licenses in the past. This raises significant concerns regarding its operational legitimacy. Below is a summary of Hungsing's regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Securities and Futures Commission (SFC) | AFC168, ABS697 | Hong Kong | Revoked |

The revocation of licenses indicates that Hungsing may not currently comply with the regulatory requirements set forth by the SFC. Such a lack of regulatory oversight can expose traders to significant risks, including potential fraud. Furthermore, the absence of a robust regulatory framework often correlates with a higher likelihood of unethical practices. Given these factors, it is essential for traders to question is Hungsing safe? and to consider the implications of trading with an unregulated broker.

Company Background Investigation

Hungsing was founded in 2017, and its operational history, while relatively short, has already been marred by regulatory issues. The company's ownership structure and management team are critical to understanding its credibility. Hungsing claims to have a management team with extensive experience in the financial services sector; however, specific details about their backgrounds are scarce. This lack of transparency can be a red flag for potential investors.

Moreover, the company's commitment to information disclosure appears limited. Transparency in operations and clear communication with clients are vital for building trust. The absence of comprehensive information regarding the management team's qualifications and the company's operational history raises questions about Hungsing's overall integrity. As traders seek to understand is Hungsing safe?, these factors must be taken into account, as they can significantly impact the broker's reliability.

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions they offer is essential. Hungsing provides a variety of trading instruments, including forex pairs and CFDs, but its fee structure is a point of concern. A detailed analysis of Hungsing's fees reveals certain inconsistencies when compared to industry averages. Below is a comparison of core trading costs:

| Fee Type | Hungsing | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable | 1.0 - 2.0 pips |

| Commission Model | None | $5 - $10 per lot |

| Overnight Interest Range | High | Low to Medium |

Hungsing's variable spreads can be a disadvantage, especially if they are significantly higher than the industry average. Additionally, the absence of a clear commission model may lead to hidden fees, which could catch traders off-guard. Understanding these conditions is vital for assessing whether is Hungsing safe for trading, as high trading costs can erode potential profits and indicate a lack of transparency.

Client Fund Safety

The safety of client funds is another critical aspect when determining the legitimacy of a broker. Hungsing claims to implement various security measures, including segregated accounts for client funds. However, the lack of regulatory oversight raises questions about the effectiveness of these measures.

Furthermore, Hungsing does not provide any information regarding investor protection schemes or negative balance protection. This omission is concerning, as it leaves clients vulnerable to potential losses that exceed their initial investments. Historical reports of fund security issues further complicate the assessment of Hungsing's safety. As such, potential traders must evaluate is Hungsing safe? by considering the adequacy of its fund protection measures.

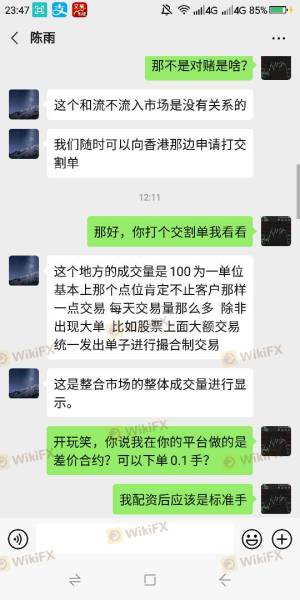

Customer Experience and Complaints

Customer feedback is an essential indicator of a broker's reliability. Reviews and testimonials about Hungsing reveal a mixed bag of experiences, with some users reporting satisfactory service while others have raised serious complaints. Common issues include delayed withdrawals, poor customer service, and lack of responsiveness to inquiries. Below is a summary of the primary complaint types:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow, often unresponsive |

| Poor Customer Service | Medium | Inconsistent, long wait times |

| Lack of Transparency | High | Minimal information provided |

Several users have reported difficulties in accessing their funds, which is a significant red flag when evaluating is Hungsing safe? The company's slow response to complaints and lack of transparency can be indicative of deeper issues within the organization that could potentially harm clients.

Platform and Trade Execution

The performance and reliability of a trading platform are crucial for successful trading. Hungsing offers a proprietary trading platform, but user reviews suggest that it may not be as stable or user-friendly as competitors. Issues such as slippage, order rejections, and slow execution times have been reported. These factors can significantly impact trading performance and raise questions about the broker's operational integrity.

Moreover, any signs of platform manipulation, such as frequent disconnections or unexplained price movements, can be alarming. Traders should be cautious and consider the implications of these issues when asking themselves, is Hungsing safe? A reliable trading environment is fundamental to a trader's success, and the reported issues with Hungsing's platform could deter potential clients.

Risk Assessment

Engaging with any broker involves inherent risks, and Hungsing is no exception. The following risk assessment summarizes the primary concerns associated with trading through Hungsing:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Lack of current regulation raises compliance concerns. |

| Financial Security Risk | High | No investor protection or negative balance protection policies. |

| Operational Risk | Medium | Reports of platform instability and execution issues. |

To mitigate these risks, traders should conduct thorough research and consider utilizing regulated alternatives. Engaging with a broker that has a solid regulatory framework and a proven track record can significantly reduce exposure to potential pitfalls.

Conclusion and Recommendations

In conclusion, while Hungsing presents itself as a forex broker with a variety of services, the evidence suggests that it may not be a safe choice for traders. The revocation of its regulatory licenses, combined with customer complaints and operational issues, raises serious concerns about its legitimacy. Therefore, traders should approach Hungsing with caution and ask themselves, is Hungsing safe?

For traders seeking reliable alternatives, it is advisable to consider brokers with robust regulatory oversight, transparent fee structures, and positive customer feedback. Brokers such as Pepperstone, FP Markets, and Plus500 have established themselves as trustworthy options in the forex market, offering a safer trading environment for both novice and experienced traders.

Is HUNGSING a scam, or is it legit?

The latest exposure and evaluation content of HUNGSING brokers.

HUNGSING Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

HUNGSING latest industry rating score is 1.62, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.62 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.