Is Huangding International safe?

Business

License

Is Huangding International Safe or a Scam?

Introduction

Huangding International is a forex broker that has positioned itself within the competitive landscape of the foreign exchange market. With the increasing number of brokers available, traders must approach their selection with caution. The forex market, while offering significant profit potential, is also fraught with risks, including the presence of unregulated or fraudulent brokers. Therefore, it is crucial for traders to conduct thorough due diligence before committing their funds to any broker. This article aims to assess the safety and legitimacy of Huangding International by examining its regulatory status, company background, trading conditions, client fund security, customer experiences, platform performance, and overall risk profile. The investigation is based on a review of multiple sources, including regulatory databases and user feedback.

Regulation and Legitimacy

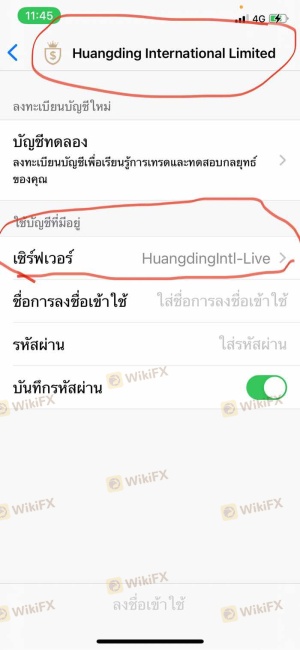

A brokers regulatory status is a key factor in determining its legitimacy. Huangding International operates without oversight from major financial regulatory authorities, which raises significant concerns about its reliability. The absence of regulation can leave traders vulnerable to malpractice and fraud, as unregulated brokers are not held to the same standards as their regulated counterparts.

Here is a summary of the core regulatory information for Huangding International:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Unverified |

This table highlights that Huangding International does not hold any licenses from recognized regulatory bodies such as the Financial Conduct Authority (FCA) or the Commodity Futures Trading Commission (CFTC). The lack of regulation means that there are no safeguards to protect traders' funds, making it imperative for potential clients to exercise extreme caution. The historical compliance record of Huangding International is also questionable, as there have been reports of suspicious activities associated with brokers operating in similar jurisdictions.

Company Background Investigation

Huangding International has a relatively short history in the forex trading industry, with operations reportedly spanning between two to five years. However, the information available regarding its ownership structure and management team is sparse. Transparency is a vital aspect of any brokerage, and the lack of accessible information about the companys leadership raises red flags.

The management teams background is essential for assessing the broker's reliability. A team with extensive experience in finance and trading can indicate a higher level of professionalism and trustworthiness. Unfortunately, the anonymity surrounding Huangding International's management prevents potential clients from making an informed assessment.

Furthermore, the company's website does not provide comprehensive information about its services, which further diminishes its credibility. Without clear disclosures and transparency, traders may find it challenging to trust Huangding International with their capital.

Trading Conditions Analysis

When evaluating a forex broker, understanding the trading conditions is crucial. Huangding International's fee structure and trading costs are essential factors that traders should consider. While specific fee details are not readily available, several reviews indicate potential issues with hidden fees and unfavorable trading conditions.

Here is a comparison of core trading costs based on available information:

| Fee Type | Huangding International | Industry Average |

|---|---|---|

| Spread on Major Pairs | N/A | 1.0 - 2.0 pips |

| Commission Structure | N/A | Varies by broker |

| Overnight Interest | N/A | Varies by broker |

The lack of transparency regarding these costs can be a significant concern. Traders may find themselves facing unexpected charges that can erode their profits. Furthermore, if the spreads are significantly wider than the industry average, it could indicate that Huangding International is not a competitive broker. Traders should always seek brokers that offer clear and fair pricing structures to avoid unpleasant surprises.

Client Fund Security

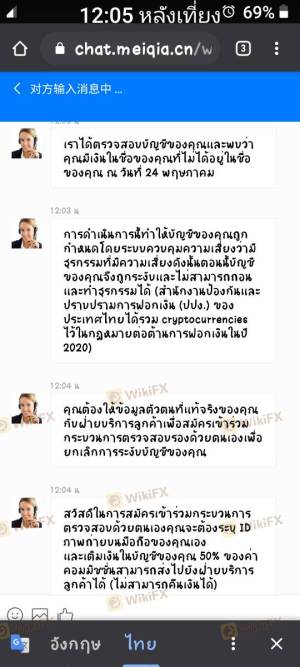

The safety of client funds is paramount when assessing any forex broker. Huangding International's approach to fund security is unclear, as there is no verifiable information regarding its policies on fund segregation or investor protection. In regulated environments, brokers are typically required to keep client funds in separate accounts to protect them in the event of insolvency.

The absence of such assurances raises critical questions about the safety of deposits with Huangding International. Furthermore, there are no indications of any negative balance protection policies, which can leave traders exposed to significant losses. Historical issues related to fund security with similar brokers underscore the importance of choosing a broker with a proven track record of protecting client assets.

Customer Experience and Complaints

Customer feedback is a valuable resource for understanding a broker's reliability. Reviews of Huangding International indicate a mixed bag of experiences, with several users expressing concerns about withdrawal difficulties and lack of responsive customer support.

Here is a summary of common complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support Availability | Medium | Fair |

| Transparency of Fees | High | Poor |

Typical cases highlight instances where clients have struggled to withdraw their funds, leading to frustration and distrust. Moreover, the responses from the company have been reported as inadequate, further exacerbating customer dissatisfaction. A broker that fails to address user concerns effectively may not be worth the risk.

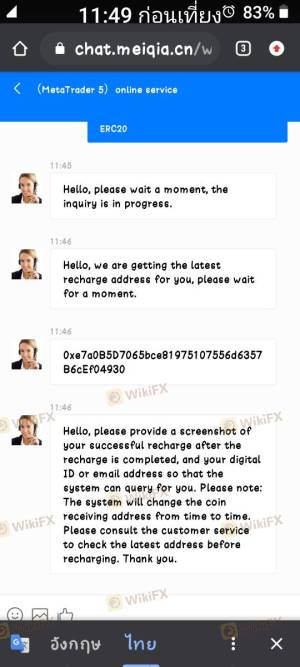

Platform and Trade Execution

The performance of the trading platform is another critical component of the overall trading experience. Huangding International reportedly uses popular trading platforms like MetaTrader 4 and 5, which are known for their robust capabilities. However, user reviews suggest that there may be issues with platform stability and execution quality.

Traders have reported instances of slippage and order rejections, which can severely impact trading performance. If a broker's platform is prone to such issues, it can lead to frustration and potential financial loss for traders.

Risk Assessment

Engaging with Huangding International carries several risks, primarily due to its lack of regulation and transparency. Here is a summary of the key risk areas:

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | No oversight from major authorities. |

| Fund Security Risk | High | Lack of clear policies on fund protection. |

| Customer Service Risk | Medium | Poor responsiveness to client issues. |

| Trading Conditions Risk | High | Potential for hidden fees and unfavorable spreads. |

To mitigate these risks, traders should consider starting with a minimal investment, thoroughly researching the broker's reputation, and being prepared to switch to a more reliable alternative if issues arise.

Conclusion and Recommendations

In conclusion, the evidence surrounding Huangding International suggests that traders should approach this broker with caution. The lack of regulation, transparency, and poor customer feedback raises significant concerns about its legitimacy and reliability. While it may offer trading opportunities, the potential risks outweigh the benefits.

For traders seeking a safer environment, it is advisable to consider regulated brokers that provide clear information about their services, fees, and security measures. Some reputable alternatives include brokers regulated by the FCA or ASIC, which offer robust investor protections and transparent trading conditions. Always prioritize safety and due diligence when selecting a forex broker to ensure a secure trading experience.

In summary, is Huangding International safe? The answer leans towards skepticism, and potential traders should proceed with caution.

Is Huangding International a scam, or is it legit?

The latest exposure and evaluation content of Huangding International brokers.

Huangding International Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Huangding International latest industry rating score is 1.52, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.52 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.