Is HSC safe?

Pros

Cons

Is HSC Safe or Scam?

Introduction

HSC, or Ho Chi Minh City Securities Corporation, is a prominent player in the Vietnamese financial market, primarily focusing on securities brokerage and investment banking. Established in 2003, HSC has positioned itself as a key provider of financial services, catering to both individual and institutional clients. Given the rapid expansion of the forex market and the increasing number of trading platforms available, it is crucial for traders to carefully evaluate the trustworthiness of brokers like HSC. This evaluation is essential to protect their investments and ensure a secure trading environment.

In this article, we will investigate whether HSC is a safe option for traders or if it bears the hallmarks of a scam. Our analysis will rely on various sources, including regulatory information, customer feedback, and industry assessments. We will also employ a structured framework to evaluate HSC's safety, focusing on its regulation, company background, trading conditions, customer fund security, customer experiences, platform performance, and overall risk assessment.

Regulation and Legitimacy

The regulatory landscape is a critical factor in determining the safety of any forex broker. Regulation serves as a safeguard for traders, ensuring that brokers adhere to specific operational standards and that clients' funds are protected. In the case of HSC, the broker operates without proper regulatory oversight, which raises significant concerns.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

HSC lacks a valid regulatory license, which is a significant red flag. The absence of regulation means that there is no overseeing authority to hold the broker accountable for its actions. Additionally, the broker has received a low score in various assessments, indicating a high potential risk for traders. Historical compliance issues further exacerbate these concerns, as traders have reported difficulties in withdrawing funds, citing excuses related to margin requirements and other financial obstacles. This lack of regulatory oversight and the history of compliance issues strongly suggest that traders should approach HSC with caution.

Company Background Investigation

Understanding a broker's history and ownership structure provides valuable insight into its reliability. HSC was founded in 2003 and has since developed a reputation as a leading securities brokerage in Vietnam. However, the lack of transparency regarding its ownership and management team raises questions about its operational integrity.

The management team at HSC includes experienced professionals in finance and investment, but the limited information available about their backgrounds makes it challenging to fully assess their credibility. Furthermore, the company's transparency regarding its operations and financial performance is lacking. The absence of detailed disclosures about its financial health or internal practices contributes to a sense of uncertainty surrounding HSC.

While HSC has established itself as a significant player in the Vietnamese market, the lack of regulatory oversight and transparency in its operations raises concerns about its legitimacy. Without clear information on its ownership and management practices, traders may find it difficult to trust HSC with their investments.

Trading Conditions Analysis

When evaluating a forex broker, understanding the trading conditions it offers is essential. HSC provides a range of trading services, but the overall fee structure and trading costs associated with its platform require careful scrutiny.

| Fee Type | HSC | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable | 1.0 pips |

| Commission Model | None | $5 per lot |

| Overnight Interest Range | High | Moderate |

HSC's trading costs appear to be higher than the industry average, particularly concerning overnight interest rates. The variable spreads can also lead to unexpected costs for traders, especially during volatile market conditions. Additionally, the absence of a transparent commission model may leave traders vulnerable to hidden fees that could erode their profits.

The overall trading conditions at HSC may not be competitive compared to other brokers in the market. This lack of clarity regarding fees and the potential for increased costs could deter traders from choosing HSC as their preferred broker. As such, it is crucial for traders to weigh these factors carefully when considering whether HSC is safe for their trading needs.

Customer Fund Security

The safety of customer funds is a paramount concern for any trader. HSC's measures regarding fund security are critical in determining whether it is a safe broker. Unfortunately, the lack of regulatory oversight raises questions about the safety of clients' investments.

HSC does not provide clear information regarding its fund segregation practices, investor protection mechanisms, or negative balance protection policies. The absence of these safeguards leaves traders vulnerable to potential losses in the event of operational failures or financial instability. Moreover, reports of difficulties in withdrawing funds from HSC only add to the concerns regarding the safety of customer funds.

Given the historical complaints about fund withdrawal issues, it is essential for traders to exercise caution. The lack of transparency regarding fund security measures and the absence of regulatory oversight suggest that HSC may not be the safest option for traders looking to protect their investments.

Customer Experience and Complaints

Customer feedback plays a vital role in assessing a broker's reliability. Analyzing user experiences can reveal patterns of behavior that may indicate whether a broker is trustworthy or potentially a scam. In the case of HSC, there have been numerous complaints regarding withdrawal issues and poor customer service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow Response |

| Poor Customer Support | Medium | Inconsistent |

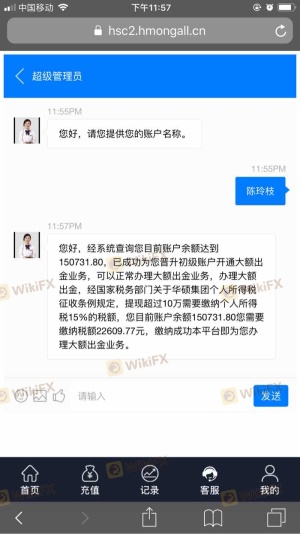

Many users have reported being unable to withdraw their funds, often citing delays and excuses related to margin requirements or account verification processes. These complaints highlight a pattern of behavior that raises serious concerns about HSC's operational integrity. Furthermore, the company's response to these complaints has been described as slow and inconsistent, further eroding trust among its client base.

A few notable cases include traders who reported being unable to access their funds for months, leading to frustration and financial losses. These experiences serve as a warning to potential clients, emphasizing the need for thorough due diligence before engaging with HSC.

Platform and Trade Execution

The performance of a trading platform is crucial for a positive trading experience. Traders rely on stable, efficient platforms for executing their trades, and any issues in this area can significantly impact their success. HSC's platform has been criticized for its stability and execution quality.

Traders have reported instances of slippage and order rejections, which can lead to unexpected losses. The platform's performance has been described as inconsistent, particularly during high volatility periods. Additionally, there have been concerns about potential platform manipulation, which could further jeopardize traders' investments.

Given these issues, it is essential for traders to assess whether HSC's platform meets their trading needs. The combination of execution problems and potential manipulation raises significant concerns about the overall safety and reliability of HSC as a trading platform.

Risk Assessment

When considering whether HSC is safe, it is crucial to evaluate the overall risk associated with using this broker. The absence of regulatory oversight, historical withdrawal issues, and platform performance concerns contribute to a high-risk profile.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | No valid regulatory oversight |

| Operational Risk | High | History of withdrawal issues |

| Platform Risk | Medium | Inconsistent execution and slippage |

Given these risks, traders are advised to exercise caution when considering HSC as their broker. It is essential to prioritize risk mitigation strategies, such as setting strict limits on investments and being prepared for potential withdrawal challenges.

Conclusion and Recommendations

In conclusion, the evidence suggests that HSC may not be a safe option for traders. The lack of regulatory oversight, combined with a history of withdrawal issues, questionable trading conditions, and negative customer experiences, raises significant red flags. While HSC has established itself as a key player in the Vietnamese market, the risks associated with trading through this broker cannot be overlooked.

For traders seeking a reliable and secure trading environment, it may be prudent to consider alternative brokers with strong regulatory oversight and a proven track record of customer satisfaction. Brokers regulated by top-tier authorities, offering transparent trading conditions and robust customer support, may provide a safer option for traders looking to protect their investments.

Ultimately, thorough research and due diligence are essential for any trader considering HSC or similar brokers in the forex market.

Is HSC a scam, or is it legit?

The latest exposure and evaluation content of HSC brokers.

HSC Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

HSC latest industry rating score is 1.65, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.65 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.