HSC Review 2

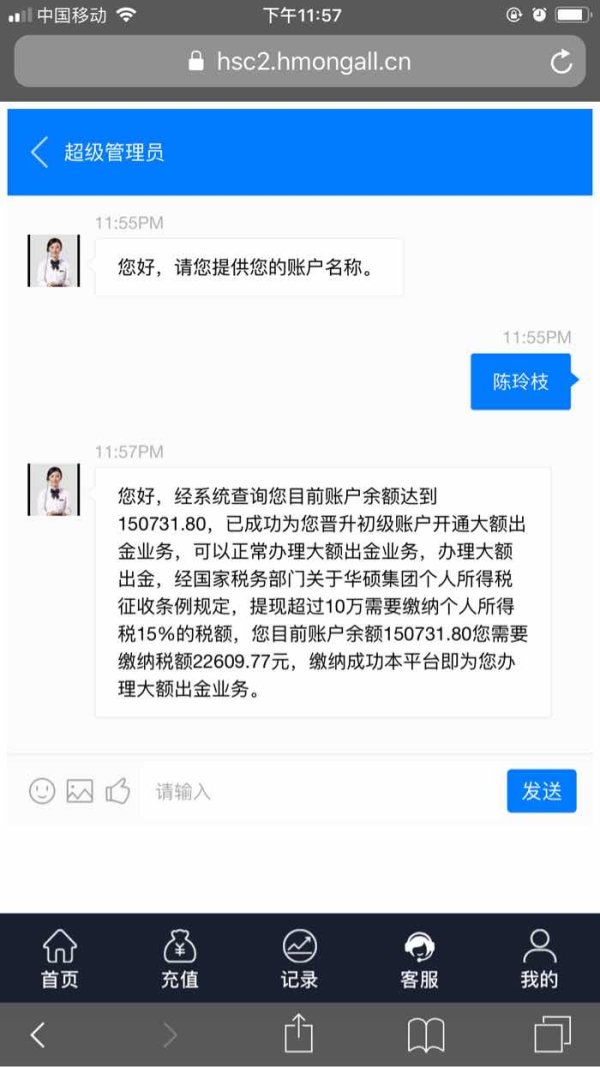

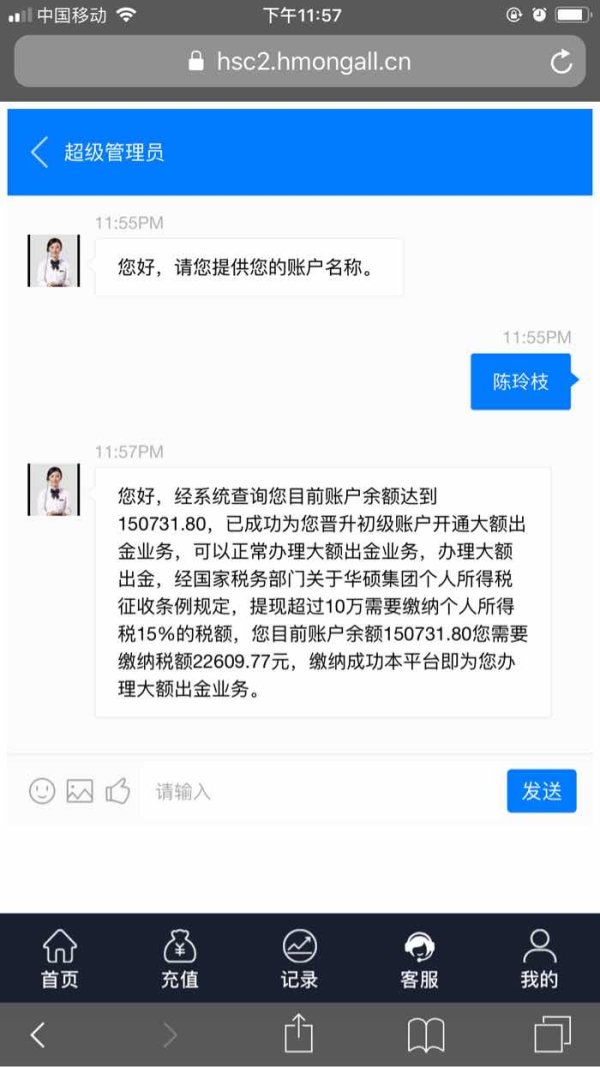

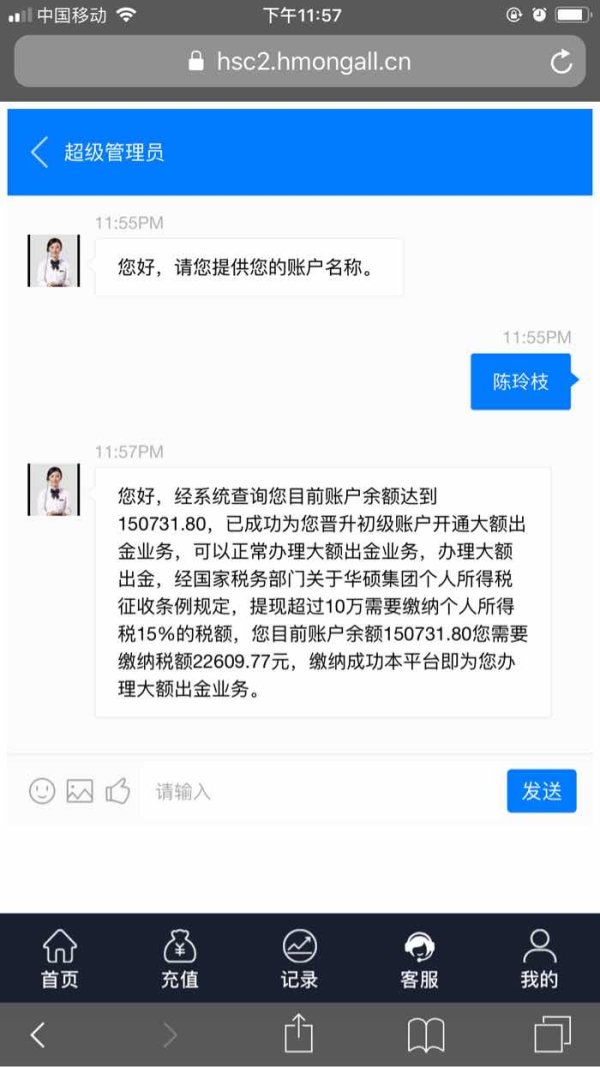

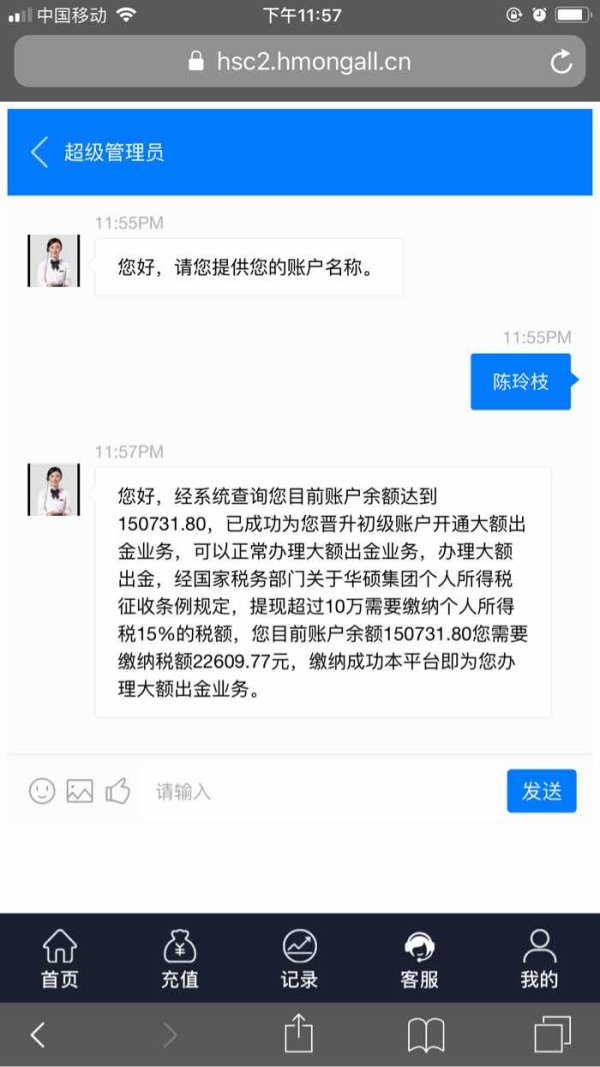

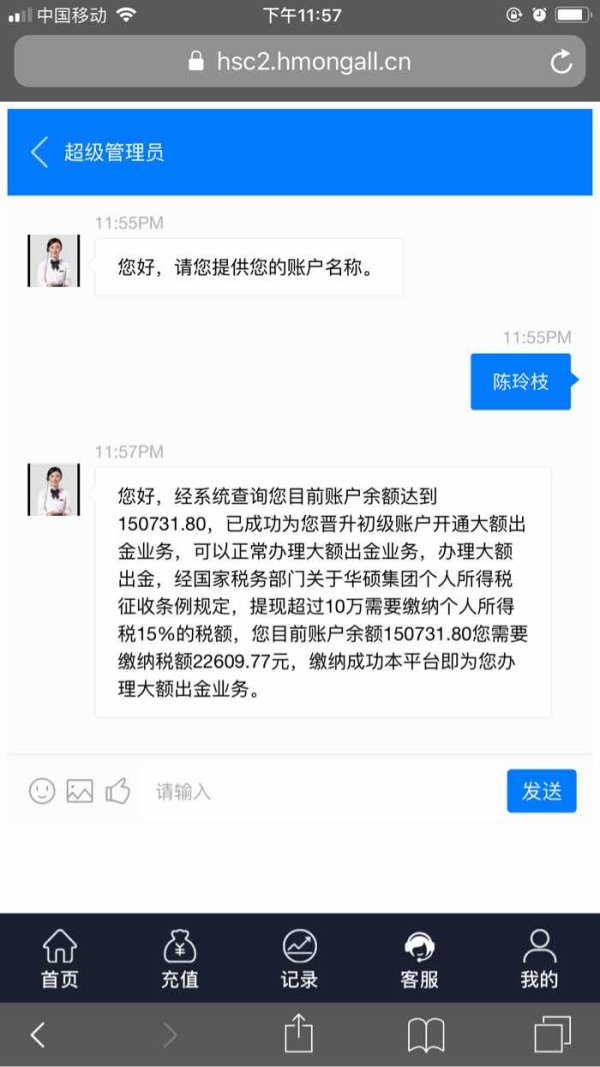

Can’t withdraw with excuses of margin, unfreezing fund, liquidated damages, tax.

Can’t withdraw with reasons of deposits, margin, unfreezing fund, tax, wrong bank card number.

HSC Forex Broker provides real users with * positive reviews, * neutral reviews and 2 exposure review!

Can’t withdraw with excuses of margin, unfreezing fund, liquidated damages, tax.

Can’t withdraw with reasons of deposits, margin, unfreezing fund, tax, wrong bank card number.

This hsc review examines HSC Business Brokers. HSC is a specialized firm operating from Delano, Minnesota, that focuses exclusively on facilitating business sales and acquisitions. Unlike traditional forex brokers, HSC operates in the business brokerage sector. They provide valuation support and leverage their network to help clients navigate complex business transactions. The company positions itself as an intermediary for individuals and business owners seeking to buy or sell enterprises. HSC offers experience-based guidance throughout the transaction process.

HSC's primary value proposition centers on their expertise in business valuations and their established network within the business community. The firm targets entrepreneurs, business owners, and investors. These clients require professional assistance in determining enterprise value and executing transactions. However, due to limited publicly available information about their specific service offerings, operational procedures, and client feedback, this evaluation maintains a neutral stance. More transparency would benefit potential clients in several key areas.

This review is based on publicly available information. It may not reflect the complete scope of HSC's services. Since the available information does not include detailed regulatory oversight, service terms, or comprehensive operational data, readers should conduct independent research and direct consultation with HSC before making any business decisions. The evaluation methodology relies on accessible data sources and general industry standards for business brokerage services. Different jurisdictions may have varying regulatory requirements for business brokers.

| Dimension | Score | Rating Basis |

|---|---|---|

| Account Conditions | N/A | Specific account terms not detailed in available information |

| Tools and Resources | N/A | Business tools and resources not specifically outlined |

| Customer Service | N/A | Customer service capabilities not detailed in public materials |

| Transaction Experience | N/A | Client transaction experiences not documented in available sources |

| Trust and Credibility | N/A | Regulatory information and credentials not specified |

| User Experience | N/A | Client satisfaction data not available in accessible materials |

HSC Business Brokers operates as a specialized business brokerage firm. They focus on helping clients navigate the complex landscape of business acquisitions and sales. According to available information, the company has established itself in Delano, Minnesota. HSC positions itself to serve clients seeking professional guidance in enterprise transactions. The firm emphasizes their experience and network capabilities as key differentiators in the business brokerage market. Specific details about their founding year and comprehensive company history are not readily available in public sources.

The company's business model centers on providing valuation services and transaction facilitation for business sales and purchases. HSC appears to target a diverse clientele. This includes individual entrepreneurs, established business owners, and investors looking to acquire or divest business interests. Their approach emphasizes leveraging industry experience and professional networks to support clients throughout the transaction process. This support spans from initial valuation through final sale completion.

Regarding their operational framework, specific details about transaction platforms, asset categories, and regulatory oversight are not comprehensively detailed in available materials. This hsc review notes that potential clients would benefit from direct consultation. They need to understand the full scope of services, fee structures, and operational procedures that HSC employs in their business brokerage activities.

Regulatory Jurisdiction: Available information does not specify the regulatory bodies overseeing HSC's business brokerage activities. Their Minnesota location suggests compliance with state-level business brokerage regulations.

Payment Methods: Specific payment and fee collection methods for HSC's services are not detailed in accessible public information.

Minimum Requirements: Entry-level requirements for engaging HSC's services are not specified in available materials. This includes minimum business valuations or transaction sizes.

Promotional Offers: Current promotional offerings or special service packages are not mentioned in the accessible information about HSC.

Service Categories: While business brokerage is their primary focus, specific subcategories of businesses or industries they specialize in are not detailed in available sources.

Fee Structure: Comprehensive cost structures, commission rates, and fee schedules are not publicly detailed. Direct consultation is required for accurate information.

Service Leverage: The extent of additional services or partnerships HSC offers to enhance their core brokerage services is not specified in available materials.

Platform Options: Specific technological platforms or systems used for client interaction and transaction management are not detailed in accessible information.

Geographic Limitations: Service area restrictions or geographic focus beyond their Minnesota base are not specified in available sources.

Communication Languages: Supported languages for client communication are not mentioned in accessible materials. English can be assumed given their US location.

This hsc review emphasizes the need for potential clients to engage directly with HSC. They must obtain comprehensive details about these operational aspects.

The evaluation of HSC's account conditions faces significant limitations. This is due to the absence of detailed information about client onboarding requirements, service agreements, and account management procedures in publicly accessible sources. Traditional account types, minimum engagement thresholds, and service tier structures that might be offered by HSC are not specifically outlined in available materials. This lack of transparency makes it challenging to assess how the firm structures client relationships. It also makes it difficult to understand what requirements potential clients must meet to engage their services.

The account opening process remains unclear from available information. This includes documentation requirements, verification procedures, and timeline expectations. Similarly, any special service categories or customized solutions that HSC might offer for different client types are not detailed in accessible sources. Potential clients seeking to understand HSC's account conditions would need to initiate direct contact with the firm. They need to obtain comprehensive information about engagement requirements, service agreements, and ongoing account management procedures.

Without specific user feedback or detailed service descriptions, this hsc review cannot provide definitive assessments. We cannot determine how HSC's account conditions compare to industry standards or meet client expectations. The absence of publicly available terms of service or client agreements further limits the ability to evaluate the reasonableness and competitiveness of their account requirements.

Assessment of HSC's tools and resources proves challenging. This is given the limited information available about their specific business brokerage tools, analytical resources, and client support materials. The firm's emphasis on experience and network suggests they possess industry-specific resources. However, the nature, quality, and accessibility of these tools are not detailed in public materials. Traditional business brokerage tools might include valuation software, market analysis capabilities, and transaction management systems. HSC's specific technological infrastructure is not documented in available sources.

Educational resources, training materials, or informational content that HSC might provide to clients are not mentioned in accessible information. Similarly, any proprietary analytical tools, market research capabilities, or specialized software platforms that could enhance their service delivery are not specified. The extent of their professional network and how clients can leverage these connections remains unclear from available materials.

Without detailed information about HSC's technological capabilities, research resources, or educational offerings, potential clients cannot adequately assess the comprehensiveness of tools available. These tools would support their business transaction needs. This information gap highlights the importance of direct consultation. Clients need to understand the full scope of resources HSC provides to their clients.

The evaluation of HSC's customer service capabilities encounters significant limitations. This is due to the absence of detailed information about their client support infrastructure, communication channels, and service availability. Available materials do not specify the various methods clients can use to contact HSC. This includes phone, email, or in-person consultation options. Response time expectations, service availability hours, and the overall structure of their client support system are not detailed in accessible sources.

Service quality indicators are not available in public materials. These would include client satisfaction metrics, testimonials, or case studies demonstrating successful problem resolution. The firm's capacity to handle multiple clients simultaneously, their approach to managing complex transactions, and their procedures for addressing client concerns remain unclear from available information. Additionally, any multilingual support capabilities or specialized communication preferences are not mentioned in accessible sources.

The absence of documented client feedback, service level commitments, or detailed descriptions of HSC's customer support philosophy makes it difficult to assess their commitment to client satisfaction. Potential clients would need to engage directly with HSC. They need to understand their customer service standards, communication protocols, and support availability throughout the business transaction process.

Analyzing HSC's transaction experience presents challenges. This is due to limited publicly available information about their transaction management processes, execution capabilities, and client experience outcomes. The firm's approach to managing business sales and acquisitions is not detailed in accessible materials. This includes their methodology for handling complex negotiations, due diligence support, and transaction coordination. Platform stability, in the context of business brokerage, might relate to their ability to consistently manage transactions and maintain reliable client communication. However, specific performance metrics are not available.

The quality of transaction execution cannot be assessed from available information. This includes timeline management, accuracy in business valuations, and successful completion rates. Similarly, the comprehensiveness of their transaction management capabilities and any technological tools used to enhance the client experience are not specified in public sources. Mobile accessibility or remote consultation capabilities that might enhance client convenience are not mentioned in available materials.

Without documented client experiences, transaction success stories, or performance data, this hsc review cannot provide concrete assessments of HSC's transaction execution quality. The absence of technical performance metrics, client testimonials, or case studies limits the ability to evaluate how effectively HSC manages the business brokerage process. It also limits assessment of how they deliver value to their clients.

The assessment of HSC's trustworthiness and credibility faces significant obstacles. This is due to the lack of detailed regulatory information, security measures, and transparency indicators in available public materials. While the firm operates from Minnesota, specific licensing, certifications, or regulatory oversight details are not documented in accessible sources. The absence of clear regulatory credentials makes it difficult to verify their compliance with business brokerage standards and professional requirements.

Fund security measures, confidentiality protocols, and data protection procedures that HSC employs to safeguard client information and transaction details are not specified in available materials. Company transparency indicators are limited in public sources. These would include detailed service descriptions, fee disclosures, or comprehensive operational information. Industry reputation markers, professional associations, or third-party endorsements that could support credibility assessments are not mentioned in accessible information.

The handling of any negative incidents, client disputes, or regulatory issues cannot be evaluated. This is due to the absence of such information in available sources. Without documented regulatory verification, third-party assessments, or comprehensive transparency measures, potential clients must rely on direct consultation and independent verification. They need to assess HSC's trustworthiness and professional credibility.

Evaluating HSC's user experience encounters substantial limitations. This is due to the absence of detailed client satisfaction data, interface descriptions, and process feedback in publicly available sources. Overall client satisfaction levels, service delivery effectiveness, and the general client experience throughout business transactions are not documented in accessible materials. The design and usability of any client-facing systems are not described in available information. This includes whether digital platforms or physical office environments.

Registration and initial consultation processes are not detailed in public sources. This includes ease of engagement, documentation requirements, and timeline expectations. The client experience during financial aspects of transactions remains unclear from available materials. This covers payment processing, escrow handling, or fee collection. Common client concerns, frequently asked questions, or typical challenges that HSC helps address are not mentioned in accessible information.

Client demographic analysis and user satisfaction feedback that could inform potential clients about typical experiences are not available in public materials. Without documented user feedback, satisfaction surveys, or improvement initiatives, this assessment cannot provide concrete insights into HSC's user experience quality. Potential clients would need to seek references, testimonials, or direct consultations. They need to understand the typical client experience with HSC's services.

This hsc review reveals that while HSC Business Brokers operates as a specialized business brokerage firm focused on facilitating enterprise transactions, comprehensive evaluation is hindered by limited publicly available information. The information gaps cover their specific services, operational procedures, and client experiences. The firm appears well-positioned to serve individuals and business owners seeking professional guidance in buying or selling businesses. HSC leverages their experience and network within the industry.

The primary strength identified is HSC's specialization in business brokerage. This suggests focused expertise in this niche market. However, the significant limitation lies in the lack of detailed information about service terms, fee structures, regulatory compliance, and client feedback. This prevents potential clients from making fully informed decisions. Prospective clients should engage in direct consultation with HSC to obtain comprehensive details about their services, costs, and capabilities before proceeding with any business transaction arrangements.

FX Broker Capital Trading Markets Review