Regarding the legitimacy of Horseforex forex brokers, it provides ASIC and WikiBit, (also has a graphic survey regarding security).

Is Horseforex safe?

Business

License

Is Horseforex markets regulated?

The regulatory license is the strongest proof.

ASIC Forex Execution License (STP)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

UnverifiedLicense Type:

Forex Execution License (STP)

Licensed Entity:

Alpha Securities Pty Ltd

Effective Date:

2008-11-06Email Address of Licensed Institution:

george@alphasecurities.com.auSharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

Level 1, 251 Elizabeth Street, SYDNEY NSW 2000, Alpha Securities Pty Ltd, Suite 301, 10 Bridge St, Sydney NSW 2000Phone Number of Licensed Institution:

02 9299 9270Licensed Institution Certified Documents:

Is Horseforex Safe or a Scam?

Introduction

Horseforex is a forex broker that has emerged in the trading landscape, claiming to offer a range of financial instruments, including forex, CFDs, and cryptocurrencies. Established in 2018, it positions itself as a platform catering to both novice and experienced traders. However, the forex market is fraught with risks, and traders must exercise caution when selecting brokers. The potential for scams and unregulated entities is significant, making it essential for traders to conduct thorough evaluations of any broker before committing their funds. This article investigates the safety and legitimacy of Horseforex by analyzing its regulatory status, company background, trading conditions, customer experiences, and overall risk profile.

Regulation and Legitimacy

The regulatory framework is a critical aspect of any broker's credibility. A well-regulated broker is typically seen as safer, as regulatory bodies enforce standards that protect traders. In the case of Horseforex, the broker claims to be registered under various jurisdictions, including Australia and New Zealand. However, upon closer examination, the regulatory status appears dubious.

| Regulatory Body | License Number | Regulatory Area | Verification Status |

|---|---|---|---|

| ASIC | 330757 | Australia | Unsubscribed |

| FSPR | 672971 | New Zealand | Not Valid |

| FSC | C118023277 | Mauritius | Not Verified |

The Australian Securities and Investments Commission (ASIC) has unsubscribed Horseforex, indicating that it no longer holds a valid license. Furthermore, while the broker claims to be registered in New Zealand, its registration does not equate to being licensed as a forex broker, which raises red flags. The Mauritius Financial Services Commission (FSC) registration is similarly questionable, lacking the necessary oversight typical of regulated brokers. This lack of credible regulation significantly impacts the overall safety of Horseforex and suggests that traders should be cautious.

Company Background Investigation

Horseforex is operated by Horse Group Limited, which claims to have a presence in multiple jurisdictions. However, the company's history and ownership structure lack transparency. Information regarding the management team is scant, and there are no clear details about the qualifications or experience of the individuals behind the broker. Transparency is vital in the financial sector, as it builds trust and credibility. The absence of comprehensive information about the company's leadership raises concerns about its operational integrity.

Moreover, the broker has faced numerous complaints, with reports indicating that users have experienced difficulties in withdrawing their funds. A broker that lacks transparency and has a history of complaints should be approached with extreme caution. The opacity surrounding the company's operations further exacerbates concerns regarding its legitimacy and safety.

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions, including fees and spreads, is crucial. Horseforex offers two types of accounts—ECN and STP—with a minimum deposit requirement of $50 and maximum leverage of 1:400. However, traders must be wary of the broker's fee structure, which may not be as favorable as it appears.

| Fee Type | Horseforex | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.8 pips | 1.0 - 1.5 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | Not disclosed | Varies |

The spreads offered by Horseforex, particularly on major currency pairs, are higher than the industry average, which may lead to increased trading costs. Additionally, the absence of a clear commission model raises questions about hidden fees. Traders should be cautious of brokers that do not transparently disclose their fee structures, as this can lead to unexpected costs and reduce overall profitability.

Client Funds Security

The safety of client funds is paramount when choosing a forex broker. Horseforex claims to implement various security measures; however, the lack of regulatory oversight raises concerns about the effectiveness of these measures. The broker does not provide clear information regarding the segregation of client funds or investor protection policies.

Traders should be particularly vigilant about whether their funds are kept in segregated accounts, which would protect their capital in the event of the broker's insolvency. Furthermore, the absence of negative balance protection means that traders could potentially lose more than their initial investment, highlighting the inherent risks associated with trading on this platform.

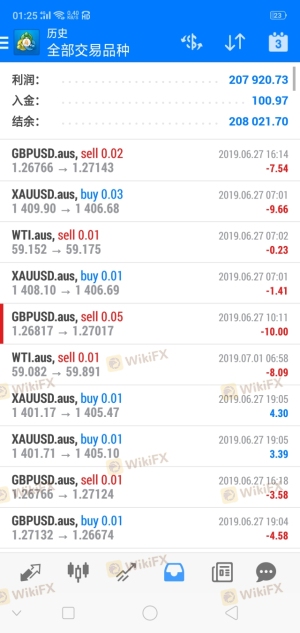

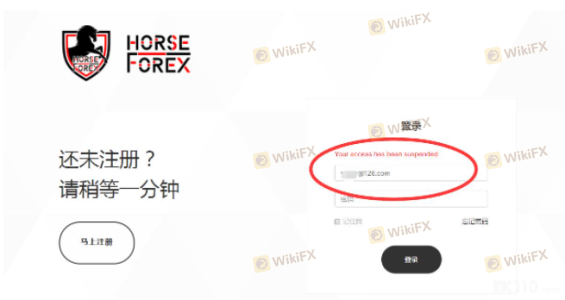

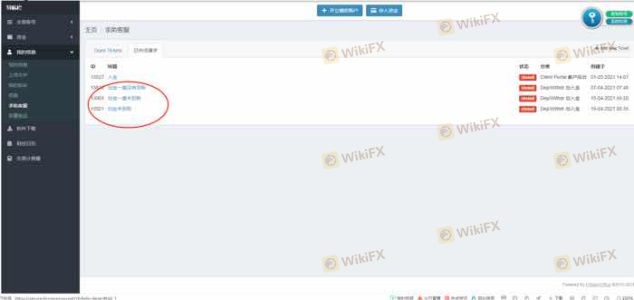

Customer Experience and Complaints

Analyzing customer feedback provides insight into a broker's reliability and service quality. Reviews of Horseforex reveal a pattern of dissatisfaction among users, with many reporting issues related to fund withdrawals and customer support. Common complaints include:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support Delays | Medium | Poor |

| Account Blocking | High | Poor |

For instance, one user reported losing access to their account after attempting to withdraw funds, while another mentioned excessive delays in receiving support. These complaints indicate that Horseforex may not prioritize customer service, which is a significant concern for traders who may require assistance during critical trading situations.

Platform and Trade Execution

The trading platform provided by Horseforex is based on the popular MetaTrader 4 and MetaTrader 5, which are known for their user-friendly interfaces and advanced trading tools. However, the platform's stability and execution quality are essential factors to consider. Reports suggest that users have experienced issues such as slippage and order rejections, which can adversely affect trading outcomes.

Additionally, concerns about potential platform manipulation have been raised, particularly in light of the broker's lack of regulation. Traders must be cautious when using platforms that exhibit irregularities in execution or performance, as these may indicate underlying issues that could jeopardize their trading experience.

Risk Assessment

Using Horseforex comes with several risks that traders should be aware of. The lack of regulation, coupled with a history of customer complaints and issues with fund security, contributes to a high-risk profile for this broker.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated broker with dubious claims. |

| Financial Risk | High | Potential loss of funds due to poor security measures. |

| Operational Risk | Medium | Issues with platform stability and execution quality. |

To mitigate these risks, traders are advised to conduct thorough research before engaging with Horseforex and consider using only well-regulated brokers with a proven track record of customer satisfaction and fund security.

Conclusion and Recommendations

In conclusion, the evidence suggests that Horseforex may not be a safe option for traders. The lack of credible regulation, combined with numerous complaints and concerns about fund security, raises significant red flags. While the broker offers an appealing trading environment with low minimum deposits and high leverage, these advantages are overshadowed by the potential risks involved.

Traders should exercise extreme caution when considering Horseforex and may be better served by looking for alternative brokers that are well-regulated and have a solid reputation in the industry. Reliable options typically include brokers with transparent fee structures, strong customer support, and robust security measures. Ultimately, prioritizing safety and regulatory compliance is essential for successful trading in the forex market.

Is Horseforex a scam, or is it legit?

The latest exposure and evaluation content of Horseforex brokers.

Horseforex Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Horseforex latest industry rating score is 1.57, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.57 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.