Is HONGKONG CARSON safe?

Business

License

Is Hongkong Carson Safe or Scam?

Introduction

Hongkong Carson, a forex broker operating under the name Hong Kong Carson Global Co., Limited, has emerged in the competitive landscape of the foreign exchange market. With the increasing number of brokers available, traders must exercise caution and conduct thorough evaluations before engaging with any broker. The necessity for due diligence stems from the potential risks associated with unregulated or poorly regulated entities, which can lead to significant financial losses. This article aims to investigate the safety and legitimacy of Hongkong Carson by examining its regulatory status, company background, trading conditions, customer experiences, and overall risk profile.

To achieve a comprehensive assessment, we utilized a variety of sources, including regulatory databases, customer reviews, and industry analyses. Our evaluation framework focuses on key areas such as regulatory compliance, company history, trading conditions, customer feedback, and risk assessment. By synthesizing these elements, we aim to provide a clear picture of whether Hongkong Carson is a safe option for traders or if it raises red flags.

Regulation and Legitimacy

The regulatory status of a forex broker is a critical factor in determining its legitimacy. A well-regulated broker is likely to adhere to strict operational standards, ensuring a safer trading environment for its clients. In the case of Hongkong Carson, the broker operates without any valid regulatory licenses. The Securities and Futures Commission (SFC) of Hong Kong has classified it as an unlicensed entity, which is a significant cause for concern.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | Hong Kong | Unlicensed |

The absence of regulatory oversight means that traders have limited recourse in the event of disputes or issues with fund withdrawals. Moreover, the lack of a regulatory framework increases the risk of potential fraud, making it imperative for traders to be cautious. Historical compliance issues and a lack of transparency further exacerbate the situation, leading to concerns about the safety of investing with Hongkong Carson. This lack of regulation raises the question: Is Hongkong Carson safe? Unfortunately, the evidence suggests otherwise.

Company Background Investigation

Hongkong Carson Global Co., Limited claims to operate from a registered address in Hong Kong; however, investigations reveal that this address is linked to a secretarial company, raising suspicions about its legitimacy. The company's history and ownership structure remain opaque, with limited publicly available information. This lack of transparency is a red flag for potential investors, as it indicates that the company may not be forthcoming about its operations or management.

The management teams background is equally unclear, with no verifiable information available regarding their qualifications or professional experience in the financial services sector. A strong management team typically enhances a company's credibility, but in this case, the absence of such information leads to questions about the broker's integrity and operational practices. With limited insight into the company's history and management, one must consider whether Hongkong Carson is safe to engage with.

Trading Conditions Analysis

When evaluating a forex broker, understanding the trading conditions they offer is crucial. Hongkong Carson presents a range of trading instruments and conditions, but a closer examination reveals some concerning elements. The broker‘s fee structure lacks clarity, with reports of hidden fees and unfavorable trading conditions, which can significantly impact a trader’s profitability.

| Fee Type | Hongkong Carson | Industry Average |

|---|---|---|

| Major Currency Pair Spreads | High | Low |

| Commission Structure | Unclear | Transparent |

| Overnight Interest Range | Variable | Standardized |

High spreads on major currency pairs and unclear commission structures are particularly alarming. Traders may find themselves facing unexpected costs that could erode their trading capital. Additionally, the absence of a standard overnight interest range raises questions about the broker's practices. These factors contribute to the perception that Hongkong Carson may not be a safe choice for traders looking for transparent and competitive trading conditions.

Client Funds Security

The security of client funds is paramount when considering a forex broker. Hongkong Carson's approach to fund management raises significant concerns. The broker does not provide clear information regarding its fund segregation practices or investor protection policies. Without proper fund segregation, clients risk losing their investments in the event of the brokers insolvency.

Moreover, there are no indications of negative balance protection, which can leave traders liable for debts exceeding their deposited amounts. This lack of safety measures is a critical factor in assessing whether Hongkong Carson is safe. Historical accounts of clients facing difficulties in withdrawing their funds further exacerbate these concerns, suggesting that the broker may not prioritize the security of its clients investments.

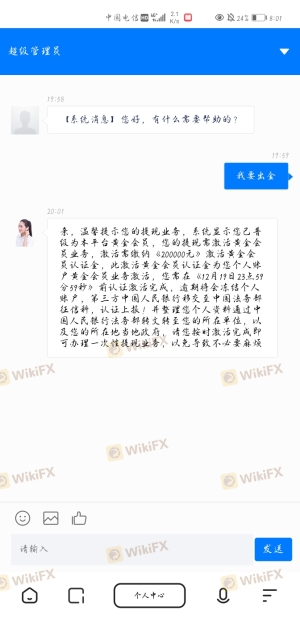

Customer Experience and Complaints

Customer feedback and experiences provide valuable insights into the reliability of a forex broker. Reviews of Hongkong Carson indicate a pattern of complaints related to fund withdrawals, poor customer service, and lack of transparency. Many users have reported being unable to withdraw their funds, which is a significant red flag for any trading entity.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service | Medium | Inadequate |

| Transparency Concerns | High | Nonexistent |

The severity of complaints regarding withdrawal issues is particularly alarming, as it directly affects traders access to their funds. Additionally, the company's inadequate response to customer grievances raises concerns about its commitment to client satisfaction. These patterns lead to the conclusion that Hongkong Carson may not be a safe option for traders who value reliable support and transparency.

Platform and Execution

The trading platform offered by a broker plays a crucial role in the overall trading experience. While Hongkong Carson claims to provide a user-friendly platform, user reviews suggest varying levels of performance and stability. Issues related to order execution quality, slippage, and rejections have been reported, which can severely impact trading outcomes.

Traders have expressed concerns about potential manipulation on the platform, further questioning the broker's integrity. A reliable broker should provide a stable trading environment with minimal interruptions and clear execution policies. Given the reported issues, it is reasonable to ask: Is Hongkong Carson safe for trading? The evidence suggests that traders may face significant challenges that could hinder their success.

Risk Assessment

Engaging with any forex broker involves inherent risks, and Hongkong Carson is no exception. The lack of regulation, transparency issues, and poor customer feedback collectively contribute to a high-risk profile for this broker.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | No valid regulatory oversight |

| Financial Risk | High | Unclear fund management practices |

| Operational Risk | Medium | Reports of platform instability |

To mitigate these risks, potential traders should consider alternatives with stronger regulatory frameworks and better reputations in the industry. It is advisable to conduct thorough research and prioritize brokers that demonstrate transparency, reliability, and a commitment to client security.

Conclusion and Recommendations

In conclusion, the investigation into Hongkong Carson reveals several concerning aspects that suggest it may not be a safe choice for traders. The absence of regulatory oversight, unclear trading conditions, and negative customer experiences raise significant red flags. Therefore, it is crucial for traders to exercise caution and consider alternative options that prioritize safety and transparency.

For those seeking reliable forex brokers, we recommend exploring options that are well-regulated, have a proven track record, and demonstrate a commitment to customer service. Brokers such as [insert reputable broker names here] may provide a safer trading environment and better overall experience.

In summary, the evidence indicates that Hongkong Carson is not a safe broker, and potential clients should be wary of engaging with it.

Is HONGKONG CARSON a scam, or is it legit?

The latest exposure and evaluation content of HONGKONG CARSON brokers.

HONGKONG CARSON Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

HONGKONG CARSON latest industry rating score is 1.60, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.60 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.