Is SENTA safe?

Pros

Cons

Is Senta Safe or Scam?

Introduction

Senta is a forex broker that has emerged in the competitive landscape of online trading, offering services such as forex trading, CFDs, and commodities. As the forex market continues to grow, traders must exercise caution when selecting a broker to ensure their investments are safe. The rise of scams in this sector underscores the importance of thorough due diligence. In this article, we will systematically evaluate Senta's credibility through various lenses, including regulatory status, company background, trading conditions, customer experiences, and risk assessment. Our analysis is based on data gathered from multiple sources, including user reviews and expert evaluations, to provide a well-rounded view of whether Senta is safe or if it poses potential risks to traders.

Regulation and Legitimacy

The regulatory framework governing forex brokers is crucial for protecting traders and ensuring fair practices. Senta, however, is categorized as an unregulated broker, which raises significant concerns regarding its legitimacy. Without oversight from a recognized financial authority, traders may be exposed to higher risks, including potential fraud and loss of funds. Below is a summary of Senta's regulatory status:

| Regulatory Authority | License Number | Regulated Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unverified |

The absence of regulatory oversight means that Senta operates without the necessary checks and balances that protect traders. This lack of regulation is a critical red flag, as it suggests that Senta may not adhere to industry standards for transparency and customer protection. Furthermore, operating without regulation can lead to issues such as mismanagement of client funds and a lack of recourse for traders in case of disputes. In light of this information, it is essential for potential clients to consider the implications of trading with an unregulated broker like Senta.

Company Background Investigation

Senta's history and ownership structure are vital factors in assessing its reliability. Unfortunately, information regarding Senta's establishment, ownership, and operational history is scarce. This lack of transparency can be alarming for potential investors. A reputable broker typically provides detailed information about its founders, management team, and operational milestones.

The management teams background and experience are also essential indicators of a broker's trustworthiness. In Senta's case, there is little publicly available information about its executives or their qualifications. This absence of information contributes to the overall uncertainty surrounding the company's operations. Furthermore, the lack of clear disclosure regarding the company's ownership raises questions about accountability and transparency.

Given these factors, the opacity surrounding Senta's corporate structure and history is a cause for concern. Traders should be wary of engaging with a broker that does not provide adequate information about its management and operational practices, as this could indicate potential risks associated with its legitimacy and reliability.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is essential for evaluating its overall value proposition. Senta's fee structure appears to be complex, with multiple layers that may not be immediately apparent to traders. A clear understanding of costs associated with trading is crucial, as unexpected fees can significantly impact profitability.

| Fee Type | Senta | Industry Average |

|---|---|---|

| Spread on Major Pairs | High (3-5 pips) | 1-2 pips |

| Commission Model | Varies | Fixed/Variable |

| Overnight Interest Range | High | Moderate |

Senta's spreads on major currency pairs are notably higher than the industry average, which could deter traders seeking cost-effective trading solutions. Additionally, the commission model is not clearly defined, leading to potential confusion for users. Traders should be cautious of any unusual fee structures that may not align with industry norms, as they can indicate a lack of transparency and fairness in trading practices.

Moreover, potential hidden fees associated with deposits, withdrawals, or inactivity should be scrutinized. Brokers with unclear fee structures often lead to unexpected costs, which can erode trading capital. Therefore, understanding and evaluating Senta's trading conditions is crucial for any trader considering this broker.

Client Fund Safety

The safety of client funds is paramount when evaluating a broker. Senta's practices regarding fund security are particularly concerning due to its unregulated status. A regulated broker is typically required to maintain segregated accounts and provide investor protection measures, which Senta lacks.

Traders should inquire about the following safety measures when considering a broker:

- Segregated Accounts: Ensure that client funds are kept in separate accounts from the broker's operational funds.

- Investor Protection: Look for any guarantees or compensation schemes in place to protect clients in case of broker insolvency.

- Negative Balance Protection: This feature prevents traders from losing more money than they have deposited.

Given Senta's lack of regulation, it is likely that these safety measures are not in place. The absence of such protections poses a significant risk to traders, as they may find it challenging to recover their funds in the event of financial difficulties faced by the broker. Therefore, prospective clients should carefully weigh these risks before engaging with Senta.

Customer Experience and Complaints

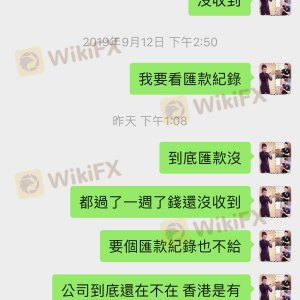

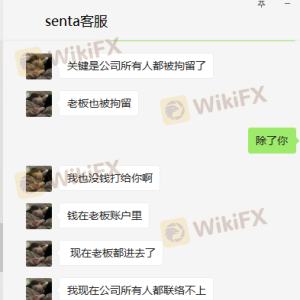

Customer feedback can provide valuable insights into a broker's performance and reliability. A review of user experiences with Senta reveals a pattern of dissatisfaction, particularly concerning withdrawal issues and customer support.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Lack of Customer Support | Medium | Slow |

Common complaints include difficulties in withdrawing funds and inadequate responses from customer support. Traders have reported extended delays in processing withdrawal requests, leading to frustration and financial strain. Additionally, the quality of customer service has been criticized, with users noting slow response times and a lack of effective solutions to their issues.

A couple of representative cases illustrate these concerns. One user reported waiting over three weeks for a withdrawal, only to receive vague responses from Senta's support team. Another trader expressed frustration over being unable to access their account after multiple requests for assistance. Such experiences are significant red flags and indicate that traders may face challenges in resolving issues with Senta.

Platform and Trade Execution

The performance of a trading platform is critical for a seamless trading experience. Senta offers a platform that, according to user reviews, has been described as unstable and prone to technical issues. Traders have reported instances of slippage and order rejections, which can adversely affect trading outcomes.

The quality of order execution is another essential aspect to consider. High slippage rates and frequent rejections can indicate underlying problems with liquidity and platform reliability. Traders should be cautious of any signs of platform manipulation, as this can severely impact their trading strategy.

Overall, the reports of technical difficulties with Senta's trading platform raise concerns about the broker's ability to provide a reliable trading environment. Traders should prioritize brokers with proven track records of stable platforms and efficient order execution to mitigate these risks.

Risk Assessment

Trading with Senta presents several risks that potential clients should consider. The following risk assessment summarizes key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated status poses significant risks. |

| Financial Risk | High | Lack of investor protection and fund segregation. |

| Customer Support Risk | Medium | Poor response times and unresolved complaints. |

| Platform Reliability | High | Reports of slippage and order rejections. |

Given these assessments, traders should be aware of the high risks associated with using Senta. Engaging with an unregulated broker poses inherent dangers, and the lack of robust customer support further exacerbates these concerns. To mitigate these risks, traders should consider alternative, regulated brokers with a proven track record of reliability and customer satisfaction.

Conclusion and Recommendations

In conclusion, the evidence gathered suggests that Senta is not a safe option for traders. The absence of regulation, coupled with a lack of transparency regarding its operations and customer experiences, indicates potential risks that warrant caution. Traders should be particularly wary of the high fees, withdrawal difficulties, and technical issues reported by users.

For traders seeking a safer environment, it is advisable to consider regulated alternatives that provide robust investor protections, transparent fee structures, and reliable customer support. Brokers such as OANDA, IG, or Forex.com offer regulated services and have established reputations in the industry.

Ultimately, the decision to trade with Senta should be made with careful consideration of the inherent risks involved. It is crucial for traders to prioritize their safety and choose brokers that adhere to regulatory standards and demonstrate a commitment to transparency and customer service.

Is SENTA a scam, or is it legit?

The latest exposure and evaluation content of SENTA brokers.

SENTA Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

SENTA latest industry rating score is 1.57, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.57 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.