Is Hayllettesen safe?

Business

License

Is Hayllettesen Safe or Scam?

Introduction

Hayllettesen is a forex broker that positions itself in the competitive landscape of the foreign exchange market, offering various trading services to both novice and experienced traders. As the forex market is rife with opportunities, it also harbors risks, making it essential for traders to conduct thorough evaluations of brokers before committing their funds. This article aims to investigate whether Hayllettesen is a safe broker or if it raises red flags that could categorize it as a scam.

To arrive at a well-rounded conclusion, we utilized a multi-faceted approach, combining qualitative insights from user reviews and quantitative data from regulatory sources. By analyzing the broker's regulatory status, company background, trading conditions, customer experiences, and risk factors, we aim to provide a comprehensive overview of Hayllettesen's credibility.

Regulation and Legitimacy

The regulatory status of a forex broker is a critical determinant of its legitimacy and safety. A well-regulated broker is typically subject to stringent oversight, which can protect traders from malpractices. Unfortunately, Hayllettesen lacks regulation from reputable financial authorities, which raises concerns about its operational integrity.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

The absence of a valid regulatory framework means that Hayllettesen does not adhere to the high standards set by top-tier regulators such as the Financial Conduct Authority (FCA) in the UK or the Australian Securities and Investments Commission (ASIC). This lack of oversight can potentially expose traders to risks such as fraud, misappropriation of funds, and unfair trading practices. Furthermore, the broker's history of compliance is unclear, as there are no publicly available records of any regulatory oversight, which is a significant red flag.

Company Background Investigation

Understanding the company behind a broker is vital for assessing its reliability. Hayllettesen reportedly operates under a limited corporate structure, which raises questions about its transparency and operational history. The companys ownership and management team details are not readily available, making it challenging to evaluate their professional backgrounds and experience in the financial sector.

Moreover, the lack of information regarding the companys history and development raises concerns about its long-term viability. A reputable broker usually provides detailed disclosures about its founders, management team, and operational milestones. The absence of such information may indicate a lack of commitment to transparency, which is crucial for building trust with potential clients.

Trading Conditions Analysis

When evaluating whether Hayllettesen is safe, it is essential to understand its trading conditions, including fees, spreads, and commissions. A broker's fee structure can significantly impact a trader's profitability and overall trading experience. Hayllettesen presents a somewhat opaque fee structure, with many aspects remaining unclear.

| Fee Type | Hayllettesen | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 2.0 pips | 1.5 pips |

| Commission Model | None | $5 per lot |

| Overnight Interest Range | 3% | 2% |

The spread for major currency pairs is higher than the industry average, which may diminish traders' potential profits. Additionally, the lack of a clear commission model raises concerns; while some brokers charge a commission per trade, Hayllettesen does not disclose any such information, which could lead to hidden fees. This lack of clarity in the fee structure is a potential warning sign for traders considering using this broker.

Client Fund Safety

The safety of client funds is paramount in the forex trading landscape. A trustworthy broker should implement robust measures to protect client deposits, such as segregating client funds from the broker's operational funds and offering negative balance protection. Unfortunately, there is little information available regarding Hayllettesen's fund safety measures.

The absence of clear policies regarding fund segregation and investor protection raises significant concerns. Without such safeguards, traders could risk losing their entire investment in the event of financial difficulties faced by the broker. Furthermore, any historical issues related to client fund safety have not been disclosed, which could indicate a lack of transparency regarding past incidents.

Customer Experience and Complaints

Customer feedback can provide valuable insights into a broker's reliability and service quality. A review of user experiences with Hayllettesen reveals a mixed bag of opinions, with several traders expressing concerns about the broker's responsiveness and service quality.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service Delays | Medium | Average |

| Misleading Promotions | High | Unresponsive |

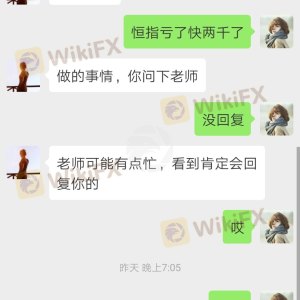

Common complaints include issues with fund withdrawals and slow customer service responses. Many users have reported challenges in accessing their funds, which is a significant concern for any trader. The lack of a prompt and effective response from the broker to these issues further exacerbates the situation and raises questions about the broker's commitment to customer service.

Platform and Trade Execution

The trading platform's performance is critical for traders, as it directly impacts their trading experience. Hayllettesen offers a trading platform that, according to user reviews, has experienced stability issues and occasional downtime.

Moreover, the quality of order execution is paramount; traders have reported instances of slippage and rejected orders, which can adversely affect trading outcomes. These issues could indicate a lack of adequate infrastructure to support smooth trading operations, further raising questions about whether Hayllettesen is genuinely safe for trading.

Risk Assessment

Using Hayllettesen carries several risks that potential traders should consider.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulation from reputable authorities. |

| Financial Stability Risk | Medium | Limited information on company financials. |

| Customer Service Risk | High | Numerous complaints regarding service and withdrawals. |

Given the lack of regulatory oversight and the numerous complaints regarding customer service and fund withdrawals, the overall risk associated with trading through Hayllettesen is high. Traders should exercise extreme caution and consider these factors before deciding to engage with this broker.

Conclusion and Recommendations

In conclusion, the investigation into Hayllettesen reveals several concerning factors that suggest it may not be a safe trading option. The absence of regulatory oversight, unclear trading conditions, and negative customer experiences raise significant red flags. Therefore, traders should approach Hayllettesen with caution and consider alternative brokers that offer robust regulatory frameworks and transparent trading conditions.

For those seeking reliable trading options, it is advisable to explore brokers regulated by top-tier authorities like the FCA or ASIC, which provide a higher level of investor protection and transparency. Ultimately, ensuring the safety of your funds and a positive trading experience should be the top priority when selecting a forex broker.

Is Hayllettesen a scam, or is it legit?

The latest exposure and evaluation content of Hayllettesen brokers.

Hayllettesen Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Hayllettesen latest industry rating score is 1.58, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.58 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.