Regarding the legitimacy of Guze markets forex brokers, it provides FinCEN and WikiBit, .

Is Guze markets safe?

Risk Control

Regulation

Is Guze markets markets regulated?

The regulatory license is the strongest proof.

FinCEN Currency Exchange License (MSB)

Financial Crimes Enforcement Network

Financial Crimes Enforcement Network

Current Status:

RegulatedLicense Type:

Currency Exchange License (MSB)

Licensed Entity:

Guze Markets Ltd

Effective Date:

2025-05-07Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

Ground Floor, The Sotheby Building Rodney Village, Rodney Bay, Gros-Islet LC01401Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is Guze Markets A Scam?

Introduction

Guze Markets is a relatively new player in the forex market, having been established in 2022. The broker claims to offer a diverse range of trading instruments, including forex, commodities, and cryptocurrencies, with enticing features such as high leverage and low minimum deposits. However, the rapid rise of online trading has also led to an increase in fraudulent activities, making it imperative for traders to exercise caution when selecting a broker. The purpose of this article is to conduct a comprehensive analysis of Guze Markets, assessing its legitimacy and reliability based on various factors, including regulatory status, company background, trading conditions, and customer experiences. Our evaluation is grounded in a thorough review of available online resources, user feedback, and industry standards.

Regulation and Legitimacy

The regulatory status of a broker is a critical factor in determining its trustworthiness. Guze Markets claims to be regulated by the Financial Conduct Authority (FCA) in the UK; however, it is essential to note that the broker's license has been marked as "exceeded," meaning it is no longer valid. This raises significant concerns about the broker's legitimacy and adherence to regulatory standards.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Financial Conduct Authority (FCA) | 15884393 | United Kingdom | Exceeded |

The lack of a valid regulatory license places Guze Markets in a precarious position, as it operates without the oversight that protects traders from potential fraud. Regulatory bodies like the FCA enforce strict compliance measures, including fund segregation and negative balance protection, which are crucial for ensuring the safety of client funds. Without such protections, traders are exposed to considerable risks, including the possibility of losing their entire investment without recourse.

The FCA has a reputation for maintaining high standards in the financial services industry, and being unregulated or having an exceeded license indicates a lack of accountability. This absence of regulatory oversight can lead to questionable practices, such as price manipulation and withdrawal issues, further eroding trust in the broker.

Company Background Investigation

Guze Markets operates under the name Guze Markets Company Limited, claiming to be based in London, UK. However, the legitimacy of this claim is questionable, as a search through the FCA's register reveals no record of the broker. Additionally, the company's registered address appears to be in Saint Vincent and the Grenadines, a jurisdiction often associated with offshore brokers that lack stringent regulatory frameworks.

The management team behind Guze Markets has not been explicitly disclosed, raising concerns about transparency and the broker's operational integrity. A lack of information about the individuals who run the company can be a red flag for potential investors, as it obscures accountability and the level of expertise guiding the broker's operations. Moreover, the absence of detailed information about the company's history and ownership structure contributes to the overall uncertainty surrounding Guze Markets.

Transparency is a fundamental aspect of a trustworthy broker. Clients should have access to information about the company's operations, including its ownership, management team, and regulatory status. The lack of such information in the case of Guze Markets raises significant concerns about its credibility and the potential risks involved in trading with this broker.

Trading Conditions Analysis

Guze Markets advertises competitive trading conditions, including a low minimum deposit requirement and high leverage options. However, the overall fee structure and trading costs must be carefully scrutinized to determine the true cost of trading with this broker.

| Fee Type | Guze Markets | Industry Average |

|---|---|---|

| Major Currency Pair Spread | From 1.2 pips | 0.6 - 1.0 pips |

| Commission Structure | Yes (for certain accounts) | Varies |

| Overnight Interest Range | Not specified | Varies |

While the minimum deposit is set at $10, which is attractive for beginners, the spreads offered are relatively high compared to industry standards. The starting spread of 1.2 pips for major currency pairs is a significant cost that can eat into profits, especially for traders who engage in frequent trading. Furthermore, the lack of clarity surrounding commissions and overnight interest rates may lead to unexpected costs that could deter traders.

In addition to the financial implications of trading costs, the absence of clear information regarding the broker's withdrawal policies and potential fees associated with withdrawing funds raises further concerns. Traders should be cautious of brokers that do not provide transparent information about their fee structures, as hidden fees can significantly impact overall profitability.

Client Fund Safety

The safety of client funds is paramount when selecting a forex broker. Guze Markets claims to implement various security measures; however, the absence of regulatory oversight raises questions about the effectiveness of these measures. A reputable broker typically segregates client funds into separate accounts to ensure that they are protected in the event of insolvency.

Unfortunately, Guze Markets does not appear to offer such protections. The lack of guaranteed funds and segregated accounts means that traders' money may not be safe, especially given the broker's unregulated status. Furthermore, there is no indication that Guze Markets provides negative balance protection, which is vital for safeguarding traders from incurring debts greater than their account balance.

Historical incidents of fund misappropriation or withdrawal issues have been reported by users, further highlighting the potential risks associated with trading with Guze Markets. Traders must be aware of these risks and exercise caution when considering whether to trust their funds with this broker.

Customer Experience and Complaints

Customer feedback is a valuable resource for assessing the reliability of a broker. Reviews of Guze Markets reveal a concerning trend of negative experiences among users. Common complaints include withdrawal issues, poor customer support, and misleading trading practices.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | High | Unresponsive |

| Poor Customer Support | Medium | Slow Response |

| Misleading Promotions | High | No Resolution |

One notable case involved a trader who reported difficulties in withdrawing funds after experiencing a profitable trade. The trader claimed that their account was suddenly frozen, and customer support provided no satisfactory resolution. Such incidents contribute to the perception that Guze Markets may not prioritize customer satisfaction or transparency in its operations.

The recurring nature of these complaints raises red flags about the broker's reliability. Traders should approach Guze Markets with caution, as the potential for negative experiences appears to be significant.

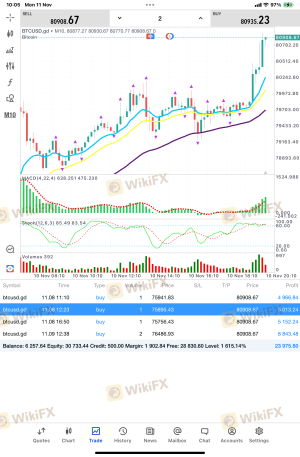

Platform and Trade Execution

The trading platform offered by Guze Markets is MetaTrader 5 (MT5), a widely used and respected platform in the industry. However, the performance and reliability of the platform must be evaluated in the context of user experiences. Reports of platform instability, order execution issues, and slippage have surfaced, which can severely impact trading outcomes.

Traders have expressed concerns about the execution quality, with some alleging that their orders were not executed at the expected prices, leading to unexpected losses. Additionally, there are indications of potential platform manipulation, further eroding trust in the broker's operations.

A reliable broker should provide a seamless trading experience with minimal disruptions. The reported issues with Guze Markets suggest that traders may face challenges in executing their trades effectively, which can lead to frustration and financial losses.

Risk Assessment

Trading with Guze Markets carries a range of risks that potential clients should consider before engaging with the broker. The following risk assessment summarizes key risk areas associated with Guze Markets:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No valid regulatory oversight. |

| Fund Safety Risk | High | Lack of fund segregation and protection measures. |

| Execution Risk | Medium | Reports of slippage and execution issues. |

| Customer Support Risk | Medium | Poor response to complaints and issues. |

Given these risks, it is crucial for traders to approach Guze Markets with caution. Engaging with an unregulated broker poses significant challenges, and traders should consider alternative options that offer better protections and transparency.

Conclusion and Recommendations

In conclusion, Guze Markets raises several red flags that suggest it may not be a trustworthy broker. The absence of valid regulatory oversight, coupled with numerous customer complaints and issues regarding fund safety, creates a concerning picture for potential traders. While the broker may offer attractive features such as low minimum deposits and high leverage, the risks associated with trading here outweigh the potential benefits.

For traders seeking a reliable and secure trading environment, it is advisable to consider regulated alternatives that provide transparency, fund protection, and a solid track record of customer service. Brokers that are regulated by reputable authorities such as the FCA, ASIC, or CySEC should be prioritized to ensure a safer trading experience.

Is Guze markets a scam, or is it legit?

The latest exposure and evaluation content of Guze markets brokers.

Guze markets Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Guze markets latest industry rating score is 6.53, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 6.53 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.